Stock Market Project

advertisement

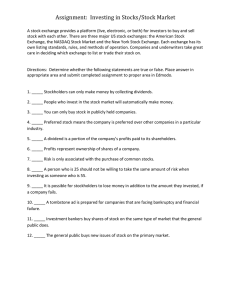

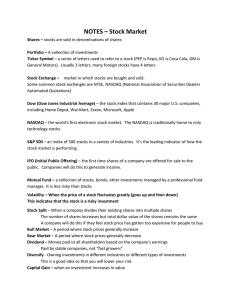

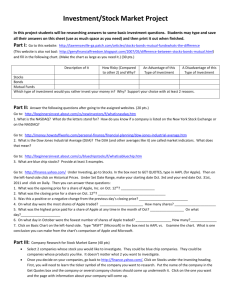

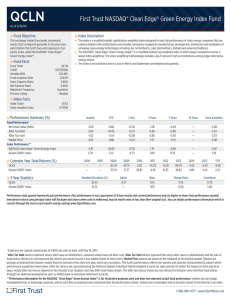

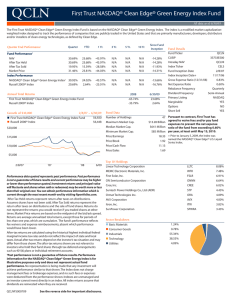

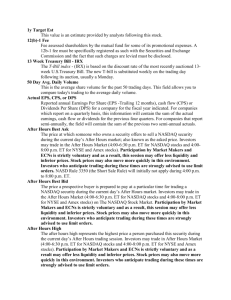

STOCK MARKET PROJECT The purpose of the project is to teach high school students the value of investing in and understanding the stock market. The project also teaches important lessons about the economy, mathematics, and financial responsibility. Using a hypothetical investment of $50,000 in the stock market, students will choose three publicly traded companies to invest in; record the closing price of all three stocks on a worksheet every day for six weeks; research the companies selected and summarize their primary business and financial results; and prepare a final report showing how much their initial investment is worth on the final day; the gain and loss on each stock and price of each stock at the end of the six weeks. Stock quotes can be found online or in many local newspapers. Students should keep a daily journal, notebook, or use Microsoft Excel to keep up with their stocks. Students will learn to: read stock tables, explain the meaning of stock symbols, and how to read percentage points. Each student should invest in multiple stocks at once to prevent from losing all their money in one stock. Throughout the project, students will be asked for updates in how their stocks are trending and have they been affected by the economy. Definitions you may need to know before you start: NASDAQ—National Association of Securities Dealers Automated Quotations WWW.nasdaq.com/screening NASDAQ website provides stock quotes and upto-date stock market summaries that students can use to keep track of their stock. They may also use Yahoo Finance, The U.S. Securities and Exchange Commission, Financial Sense, and Forbes. The figures under VOL. (volume) are the amounts of shared in the company that are bought and sold on that day. The figures under CLOSE are the prices of the stocks at the end of the day. Those are the amounts you will pay for shares. (To change the fractional amounts to a decimal, divide the numerator by the denominator and write the answer as a decimal. The figures under CHG. are the amounts that the stock prices went up (+) or down (-) since the beginning of the trading day. Common stock is, well, common. When people are talking about stocks they are usually referring to this type. In fact, the majority of stock issued is in this form. Common shares represent ownership in a company and a claim (dividends) on a portion of profits. Investors get one vote per share to elect the board members, who oversee the major decisions made by management. Over the long term, common stock, by means of capital growth, yields higher returns than almost every other investment. This higher return comes at a cost since common stocks entail the most risk. If a company goes bankrupt and liquidates, the common shareholders will not receive money until the creditors, bondholders and preferred shareholders are paid. Preferred stock represents some degree of ownership in a company but usually doesn’t come with the same voting rights. (This may vary depending on the company.) With preferred shares, investors are usually guaranteed a fixed dividend forever. This is different than common stock, which has variable dividends that are never guaranteed. Another advantage is that in the event of liquidation, preferred shareholders are paid off before the common shareholder (but still after debt holders). Some people consider preferred stock to be more like debt than equity. A good way to think kinds of shares is to see them as being between bonds and common share DEFINITIONS YOU MAY NEED TO KNOW BEFORE YOU START. NASDAQ –NATIONAL ASSOICIATION OF SECURTIES DEALERS AUTOMATED QUOTATIONS WWW.nasdaq.com/screening www.finance .com The figurers under VOL. (volume) are the amounts of shares in the company that were brought and sold on that day. The figures under CLOSE are the prices of the stocks at the end of the day. Those are the amounts you will pay for shares. (To change the fractional amounts to a decimal, divide the numerator by the denominator and write the answer as a decimal.) The figures under Chg. are the amounts that the stock prices went up (+) or down (-) since the beginning of the trading day. STOCK MARKET PROJECT You will need to research the background of each company you decide to invest in. You will want to keep a journal of your stock transactions. You will write the date from the NASDAQ quotation at the start of your entry. Then you record the name of each stock that you bought, the number of shares, the price per share, the reasons you chose the stock, and how much of your $50,000 you spent. STOCK NUMBER ONE NAME_____________________________________________________ TICKER SYMBOL______________________________________________ CHART ANALYSIS LAST TRADE (amount that one share of stock will cost)_____________ How much of the $50,000 will you spend on this one stock?_____________ Number of shares you will buy _____________ COMPANY PROFILE: Headquarters________________________________________________ Sector _____________________________________________________ Industry____________________________________________________ Description of Company_______________________________________ ___________________________________________________________ Company Website Address_____________________________________ Logo of your company_________________________________________ (slogan, jingo, pictures of what the company makes, ETC.) Three Interesting Facts from Website _________________________________________________________________