Chapter 23

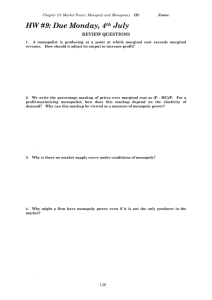

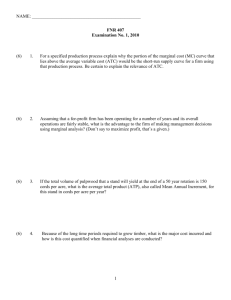

advertisement

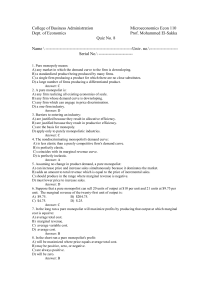

23-1. If a firm can change market prices by altering its output, then it: → Has market power. Faces a flat demand curve. Is a price taker. Engages in marginal cost pricing. 23-2. If the entire output of a market is produced by a single seller, the firm: → Is a monopoly. Faces a perfectly inelastic demand. Can charge any price it wants and not lose customers. Is producing a new product. 23-3. Which of the following is likely to be a monopolist? → A drug firm that has a patent granting it the exclusive right to produce a drug A large firm like GM, which has a substantial portion of the car market The Boeing Company, which is one of the largest producers of airplanes An Indonesian restaurant in a large city 23-4. A monopolist will find that its marginal revenue curve: Is the same as its demand curve. Lies above its demand curve and is flatter than its demand curve. → Lies below its demand curve and is steeper than its demand curve. Lies below its demand curve and has the same slope as its demand curve. 23-5. The marginal revenue of a monopolist falls below price because the firm: Is not limited by market demand. Faces a market demand curve that is inelastic. → Confronts a downward-sloping demand curve. Has an upward-sloping marginal cost curve. 23-6. Suppose a monopoly firm produces bicycles and can sell 10 bicycles per month at a price of $700 per bicycle. In order to increase sales by one bicycle per month, the monopolist must lower the price of its bicycles by $50 to $650 per bicycle. The marginal revenue of the eleventh bicycle is: → $150. $-50. $50. $7,150. 23-7. Monopolists set prices: On the marginal revenue curve. Without constraints since there is no competition. → At the output where marginal revenue equals marginal cost. At the minimum of the long-run average total cost curve. 23-9. Which of the following is true about the output level where marginal revenue equals marginal cost? Economic profits are equal to zero The firm should increase its output → The firm is maximizing profit The firm should reduce its output 23-8. If a monopolist is producing a level of output where MR exceeds MC, then it should: Raise its price. → Increase its output. Lower its output. Shift its marginal cost curve upward. 23-10. The price charged by a profit-maximizing monopolist occurs: At the minimum of the long-run average total cost curve. Where P = MR = MC. → At a price on the demand curve above the intersection where MR = MC. At a price on the long-run average total cost curve below the point where MR = MC. 23-2. A monopoly is a single firm that produces the entire market supply of a good. 23-1. The essence of market power is the ability of a firm to alter the price of a product. 23-4. If a firm must lower its price to sell additional output, marginal revenue is less than price. For example if the price is $5 when quantity is 1 and the price falls to $4 when quantity is 2. The MR of the second unit is $3 ($8 - $5), which is less than the price of $4. 23-3. A firm that has a patent and therefore the exclusive right to produce a good has no competitors and therefore will be the sole firm that produces for the entire market. 23-6. Total revenue is equal to price times quantity. At a quantity of 10 bicycles, total revenue is $7,000 (10 × $700) and at a quantity of 11 bicycles, total revenue is $7,150 (11 × $650). Marginal revenue is the change in revenue divided by the change in quantity which is $150. 23-5. If a firm must lower its price to sell additional output (demand is downward sloping), marginal revenue is less than price. For example, if the price is $5 when quantity is 1 and the price falls to $4 when quantity is 2. The MR of the second unit is $3 ($8 - $5), which is less than the price of $4. 23-8. If an extra unit brings in more revenue than it costs to produce (MR>MC), it is adding to total profit. Hence, a firm will want to expand the rate of production whenever MR exceeds MC. 23-7. A monopoly maximizes total profit at the output rate (price) where MR is equal to MC; the monopolist will charge the price that corresponds to that point. 23-10. A firm maximizes total profit at the output rate where MR is equal to MC. However, the monopoly faces a downward-sloping demand so the price will be greater than MR. 23-9. A firm maximizes total profit at the output rate where MR is equal to MC. If MC is less than MR, the firm can increase profits by producing more. If MC exceeds MR, the firm should reduce output. 23-11. A monopoly: Maximizes profits at the output where P = MC. Is one of many sellers in a given market. → Charges higher prices than competitive firms, ceteris paribus. Maximizes profits at the output where P = MR. 23-13. Which of the following is a barrier to entry into a monopoly market? Economic profits for the monopolist → Economies of scale A large number of firms in the industry Production of a homogeneous product 23-12. Price discrimination is best defined as: Charging an excessive price for a product. The charging of different prices by different companies for the same product. → The selling of an identical good at different prices to different consumers by a single seller. The selling of differentiated goods to consumers at different prices. 23-14. In a contestable market: Product differentiation results in nonprice competition, as well as price competition. There are economies of scale which heighten competition. → Barriers to entry and long-run economic profit are low. Many firms compete in producing a standardized product. 23-15. In Table 23.1, using the profit-maximization rule, a monopolist will produce: 1 unit. → 3 units. 4 units. 5 units. 23-12. Price discrimination occurs when a producer sells a good to different customers at different prices. Examples of price discrimination include student discounts at the movies and senior citizen discounts at restaurants. 23-11. When compared to a competitive market, monopolists tend to charge a higher price and produce a lower level of output. 23-14. A contestable market is an imperfectly competitive industry subject to potential entry if prices or profits increase. Therefore firms will keep prices low which will result in low profits. 23-13. Examples of barriers to entry include control over key inputs, franchise rights and economies of scale. 23-15. Profit is maximized at the output level where the difference between revenue and cost is greatest (where MR is equal to MC). This occurs at 3 units of output and the profit is equal to $250. 23-16. The profit-maximizing rate of output in Figure 23.1 is: I. H. E. → F. 23-17. In Figure 23.1, the profit-maximizing monopolist will charge a price of: J. L. C. → A. 23 23-18. The shaded area in Figure 23.1 represents: Total revenue. Total cost. → Total profit. Total loss. 23-19. In Figure 23.1 total cost is represented by the area: ABFE. → CDFE. ABGHE. ABDC. 23-20. The primary purpose of antitrust policy in the United States is to: Issue patents. Limit foreign competition. → Encourage competition. Regulate monopolies. 23-16. Profit is maximized at the output level where the MR is equal to MC, at output level F. 23-17. At the output level where MR is equal to MC, the price consumers are willing and able to pay according to the demand curve is A. 23-18. Total profit is equal to the difference between price and average total costs times quantity which will be the shaded area. 23-19. Total cost will be the ATC times quantity which is area CDFE. 23-20. Antitrust laws allow the government to intervene in markets to either alter market structure or prevent abuse of market power with the primary purpose of encouraging competition.