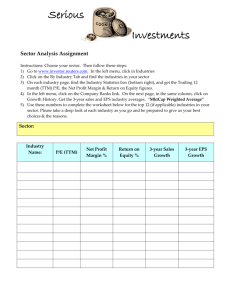

presentation - Smart Woman Securities

smart woman securities

October 31, 2007

Financial Metrics: Part 1

MORGEN PECK

EQUITY RESEARCH ANALYST

FIDELITY INVESTMENTS

These materials are made for educational purposes and should not be distributed. All materials are for SWS members’ use only

Announcements

• Investment Project teams!

– Mini-Project deadlines:

• Business Overview (11/7/07)

• Competition (11/14/07)

• Financials (11/28/07)

• Valuation (11/28/07)

• Investment Opportunities/Risks (Pro/Con) (12/5/07)

• Investment Project Mentors

What Happened in the Market Last Week

• S&P200 gained 2.3% on the week; DJIA was up 2.1% while the NASDAQ was up 2.9% as investors seemed less concerned about risks in the credit markets

• There were mixed technology results as Apple &

Microsoft posted solid positive Q3 earnings; rising concerns about semiconductor valuations

• Merrill Lynch wrote down $7.9b in losses from subprime losses, although the stock rallied on reports that CEO Stan O’Neal would be ousted

• Bank of America announced 3,000 job cuts in the corporate & investment banking division

• Crude oil futures climbed above $92; some analysts expect it to surpass $100

Review: Stock Picking

• #1: Finding ideas through trends

– Newspapers, TV, roommates, internet, everyday life

– Wall Street Journal, New York Times

– Come up with preliminary list of companies

• #2: Research the company

– What industry does it belong in? What trends impact that industry?

– Company website, financial filings (MD&A section), talk to company mgmt, listen to conference calls

– Porter’s 5 forces tell you if it’s a good business (customer power, supplier power, barriers to entry, threat of substitutes, rivalry)

• #3: Determine how sustainable trends are (this is subjective, no easy answer)

– Talk to company mgmt, think independently (what makes sense?)

– Remember trends drive revenues, and revenues drive earnings (aka EPS)!

Review: Stock Picking

• #4: Use valuation to determine if a trends are priced into the stock

– P/E = Price/EPS

– P/E = what the market is willing to pay for $1 of EPS.

Depends primarily on growth rate of the company.

– Solve for P/E by dividing current stock price by current EPS

(EPS = earnings per share). Compare P/E to EPS growth

– Examples:

• GOOG EPS = $16, stock price = $675 so P/E = $675/$16 = 42x

• Anything > 25x is expensive and means the market is assuming a lot of future growth.

Review: Stock Picking

• #5: Use valuation to determine future stock price

– Price = EPS x P/E

– To determine future stock price, investors use 2 things:

• They make an assumption about the future P/E of a stock

• They then use their forecasted EPS

– For example:

• Forecasted 2008 GOOG EPS assuming 30% growth from

2007 EPS of $16 = $21 = 2008 EPS

• Estimated P/E is 40x

• Estimated future stock price = 40 x $21 = $832

• Stock price is $675 today, I estimate it will go to $832 over the next 12 months, so I see upside of 23%

One helpful valuation trick

• The P/E for a stock is a function of EPS growth

• Valuation is an art (there are no hard & fast rules), but here is one useful tool

• The market will often pay 1.5 to 2x

EPS growth

– If Kellogg (K) growing EPS 10% consistently, its

P/E can be as high as 2 x 10 = a P/E of 20x.

Example: Figuring out what trends priced into stock using P/E

• GIVEN: Colgate (CL) EPS in 2007 =

$3.34 (yahoo finance)

• GIVEN: CL’s current stock price =

$73.95 (yahoo finance)

• SOLVE: CL’s current P/E = Price/EPS =

$73.95/$3.34 = 22x

• Remembering rule of 1.5-2x growth:

CL’s EPS growth for the past 5 years has been ~12%

Example: Using P/E to determine the future stock price

• After researching CL, I think new toothpaste products will allow them to grow EPS 17% in

2008

• 2008 EPS estimate = $3.91 ($3.34 x 1.17)

• I think that CL will continue to have a P/E of

25x

• I estimate the future stock price will be

25 x $3.91 = $98

• I therefore think CL’s stock will rise 33% over the next 12 months (=$98/$73.95 -1)

Valuation cont’d

• P/E allows investors to value companies w/ different stock prices & EPS

– VLO: Stock price = $90, EPS = $8.10

– SBUX: Stock price = $26, EPS = $1.00

– Based on just the stock price & EPS, we cannot conclude which stock is more expensive

– Need to use P/E!

• VLO P/E = Price/ EPS = $73/$8.10 = 11x

• SBUX P/E = $26/$0.87 = 30x

– SBUX is MORE expensive but is growing much faster than VLO

Financial statements critical to investing

• Helps investors determine the financial health of the company. This is REALLY important.

– How fast have revenues grown?

– How profitable is the company?

– How efficiently are they growing EPS?

– How are they financing that growth (debt & equity)?

– Do they have adequate liquidity?

• Once we learn about the financial statements, you can calculate ratios and compare them across different companies

In This Seminar:

• Read financial statements and understand what they mean

– Balance Sheet

– Income Statement

– Cash Flows (next week)

• Learn important ratios

• Be able to compare similar stocks on the basis of financial strength

• Pare down your list of stocks even more, based on financial metrics

intro to financial statements

Financial Accounting

– Translates activities into objective numbers

• Allows comparability across time, firms and industries

– Helps us evaluate:

• Historical financial performance

• Future prospects

• Potential problems

Every public company has to disclose financial statements.

Thus, understanding financial statements offer us a good point of comparison, as well as an indication of a company’s relative financial strength

©2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton

Accessing Financial Statements

• How do investors get access to financial statements?

– Public company’s financial statements MUST be available to the public

– Look at your company’s website and find their 10K

(annual report) or 10-Q (quarterly report) – this is usually found under “SEC Filings” or something similar

Accessing Financial Statements

• Public Companies: www.sec.gov/edgar

Financial Statements

• Annual Reports (10-K)

– Company overview & business description

– Accounting policies (GAAP)

– Financial statements (and footnotes!)

– Management discussion and analysis (MD&A)

– Directors and executive officers’ bios

– Executive compensation

– Update on recent merger/acquisition activity

• Quarterly Reports (10-Q)

– Financial statements

– MD&A

Financial Statements

• What do investors look at?

– Balance Sheet

– Income Statement

– Statement of Cash Flows

– Footnotes (they explain changes in these statements)

A Note on Ratios

• Most of the financial metrics investors use are ratios calculated from financial statements

– Operating profit/revenues, net income/total equity, current ratio

• Compare these ratios across two different stocks comparing ratios

It is important to note that ratios tell you nothing by themselves; we can only judge something in comparison to others. Oftentimes we compare companies that are in the same industry or have similar business models (ie. Pepsi vs. Coke), or we compare a company to its industry as a whole (ie. Coke to the beverage industry).

These are still imperfect comparisons, but it is important to note that because industries are so different, it does not make sense to compare a Coke to Microsoft, or compare a single stock to another industry.

Balance Sheet

Balance Sheet

• Financial snapshot at a single point in time

• Assets (what the company owns )

– economic resources that are expected to benefit future activities of the company

• Liabilities (what the company owes)

– the company’s economic obligations

• Shareholders’ equity (whatever is left)

– the excess of the assets over the liabilities (also called

“stockholders’ equity”)

• Assets = Liabilities + Shareholders’ Equity

©2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton

Balance Sheet: Its Components

Assets: A company’s resources

Liabilities: Claims against the company’s resources

Shareholders’ Equity:

Remaining Claims accruing to owners

Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001

Balance Sheet Example

• You & your roommates decide after graduating you want to start a bread company.

• You need money to start up the company

– Borrow money from your parents?

– Go to the bank to borrow money?

– Go to mutual fund company like Fidelity to borrow money?

Balance sheet example cont’d

• You borrow $500M from the bank and sell shares to Fidelity & other mutual funds for another $500M

ASSETS LIABILITIES & EQUITY

Cash: $1B Debt: $500M

Shareholders’ Equity: $500M

Total Assets: $1B Total Liabilities & Equity: $1B

Balance Sheet Example Cont’d

• Use cash to buy stuff to help you make bread: a bread plant, ingredients

(flour, eggs), an office, etc

ASSETS LIABILITIES & EQUITY

Current Assets:

Cash: $100M

Inventory: $200M

Debt: $500M

Shareholders’ Equity: $500M

Long Term Assets:

Property Plant & Equipment: $700M

Total Assets: $1B Total Liabilities & Equity: $1B

Assets

Assets generate future value for the company

• Examples:

– Cash = money company has today

– Accounts Receivables = money owed to the company by its customers

– Inventory = assets that will be turned into products that the company will sell for money in future

– Property Plant & Equipment = assets that are used to produce products

• Current Assets: Assets that can be converted to cash within one year

• Non-Current Assets: Assets that are not expected to be converted to cash within that time period: property, plants, equipment, patents, goodwill

Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001

Liabilities

Liabilities are the company’s obligations to deliver something of value (usually cash or services) in the future

• Examples:

– Accounts Payable = money the company owes its suppliers

– Salaries Payable = money the company owes its workers

– Short term debt = money the company owes the bank

• Current Liabilities: Obligations that are expected to be paid within one year (ie. Short term debt, accounts payable, etc)

• Non-Current Liabilities: Obligations that are not expected to be paid within one year or the operating cycle, whichever is longer (ie. Long term debt, capital leases)

Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001

Shareholders’ Equity

Equity is the difference between assets and liabilities

• Stock and Paid-in Capital

• Retained Earnings

• Treasury Stock

• Other

Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001

Example: Balance Sheet (CL)

Relevant Balance Sheet Ratios

• Common size balance sheet: Divide every line of the B/S by Total Assets and compare it to other companies

• Current Ratio: a measure of short-term liquidity risk

= Current Assets/Current Liabilities

• Return on Equity: Measure of the efficiency with which a company utilizes its owners’ capital

= Net Income / Owners’ Equity

• Return on Assets: Measure of the efficiency with which a company utilizes its assets to generate profits

= Net Income / Assets

• Debt-to-Equity: This ratio measures the amount of long-term debt financing relative to equity in a firm’s capital structure

= Long-term Debt / Shareholders’ Equity

Sources: What is a “Strong” Balance Sheet, Chris Cather, Motley Fool, fool.com, February 2, 2005

Comparing B/S of 2 Companies

ROA

(Net income/Total Assets)

ROE

(Net income/ Shareholders’

Equity)

Debt/Equity

Pfizer (PFE) Tyson (TSN)

13% 3%

22%

11%

6%

67%

Current Ratio

(current assets/current liabilities)

2.2x

1.9x

How We Can Read Balance Sheets

• Its usefulness

– Gives information about the liquidity of a company

– Tells us how “asset intensive” a company is

– Tells us about the ability of a company to meet its long-term fixed expenses and to accomplish long-term growth

• Its limitations

– Assets are recorded at historical cost rather than at market value (what you paid, not what it’s “worth” or the price at which you could sell the asset)

– Resources such as employee skills and reputation are NOT recorded on balance sheet

Sources: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001; Investopedia.com

Income Statement

Income Statement

• Tells us about the profitability of a company over a 3-month or 1-year period vs. point in time (balance sheet)

• Basic equation:

Revenues – expenses = net income

– Revenues: what the firm gets paid for selling goods

– Expenses: costs firm incurs to create those goods

– Analysis of net income (& other measures of profitability) tell us how profitable the firm is

• Net Income = “earnings” divided among the firm’s shareholders (EPS)

• EPS = Net Income/Shares Outstanding

Revenues and Expenses

• Revenues are typically = price x volume.

– Price per widget x # of widgets

• Expenses are the costs incurred in generating revenues

– Cost of goods sold, selling expenses, general and administrative expenditures, depreciation, interest, income taxes

Source: Intermediate Accounting; Spiceland., Sepe, Tomassini; 3rd edition; Irwin/McGraw-Hill Publishing Company, 2001

Income Statement Example

• Revenues = # of loaves of bread sold x price per loaf

• Cost of Good Sold = cost of ingredients & cost of using the plant to produce the bread, cost of labor

• Selling General &

Administrative Costs = costs to run your headquarters, your salaries

• Interest expense = cost of taking on debt

INCOME STATEMENT (in Millions $)

Revenues

- Cost of Goods Sold

Gross Profit

- Selling General & Administrative Expenses

Operating Profit

-Interest

- Taxes

Net Income

EPS

Diluted Shares Outstanding

$ 250

$ 175

$ 75

$ 25

$ 50

$ 6

$ 15

$ 29

$ 1.43

20

• Taxes = what you owe the government

An Investor’s Look at Income Statements

• Gross Profit = Revenue – Cost of Goods Sold (“COGS”)

– Gross Profit = $250-175 = $75M

• Gross Margin = Gross Profit/Revenue

– Gross Margin = $75/250 = 30%

• Operating Profit = Revenues – COGS – operating costs

– Operating Profit = $250 – 175 – 25 = $50M

• Operating Margin = Operating Profit/Revenue

– Operating Margin= $50/250 = 20%

• The higher the gross & operating margins the better!

Note: Margins vary widely by industry. For example, software companies (ie, Microsoft) tend to have high margins, whereas retailers (ie, Wal-Mart) tend to have low margins

- Why? Think about Porter’s 5 Forces and the “value proposition” of each company

Lower-margin companies like Wal-Mart can still be very profitable because they make up for their margins through selling large volumes of products

Sources: Foolish Fundamentals: The Income Statement, Motley Fool, fool.com, August 25, 2006; Investopedia

Earnings

• From the income statement, we can determine the company’s earnings

– The company can do two things with earnings: return it to shareholders through paying dividends or repurchasing shares, or re-invest in the company (known as “retained earnings”)

• Earnings per share (EPS)

– How much a stock earned per share (or, net income divided by number of shares outstanding)

• During “earnings” season (4x a year), companies have to report how well they did in the previous quarter. Oftentimes you might hear about a company “missing earnings”… this means that the company reported EPS below consensus

Income Statement (CL)

Income Statement Detail (CL)

How We Can Read Income Statements

• Its usefulness

– Summarizes sales and profits and losses over a period of time – hence why it is often called a P&L statement!

– Lets us look at changes in key line items and ratios across time to see whether operations have been changing and in what direction

• Its limitations

– Difficult to compare some ratios for companies in different industries

– Management teams have lots of options for accounting practices

– Revenues reported don’t always equal cash collected, and expenses reported aren’t always equal to cash paid, so income usually IS NOT

EQUAL to the change in cash for the period

– There are many components in income statements; make sure you read the footnotes so that you’re getting the whole story!

Source: ©2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton

Comparing I/S of 2 companies:

Revenue Growth

PFIZER (PFE)

-3%

STARBUX (SBUX)

20%

Gross Margin

Gross Profit/Revenues

Operating

Margin

Operating Profit/Revenues

EPS Growth

85%

40%

6%

57%

10%

21%

P/E Ratio

• Look at the EPS from the Income Statement

& think about:

– Factors that will drive continued growth (trends)

– What future EPS growth will be

• Look at the current P/E ratio

– Current price/current EPS

• Decide if you think the P/E will stay the same, increase, or decrease

• Use estimated EPS & P/E to determine if stock is a buy or a sell

Key Takeaways

Key Points

• Use balance sheets to assess a company’s financial position at a point in time

– Look at key ratios to analyze a company’s business

• Income statements measure profitability over a certain time period

– Look at the company’s sales growth, operating profit growth, gross & operating margins, etc.

Key Ratios

• Important ratios vary from industry to industry, depending on the type of business

– For example, pharmaceutical companies put a big focus on profitability margins vs. retail companies which care about sales per square foot

• Some generally important ratios across the board:

– Return on Equity, Return on Assets

– Debt/Equity

– Current Ratio

• Ratios only tell us something about potential investments when compared to other similar companies

Next Seminar

• Week 6: More on financial statements

– Cash Flows

– Case study

– Actually applying these ratios and looking more indepth to balance sheet, income statement, etc.