A. de Panizza and M. Visaggio

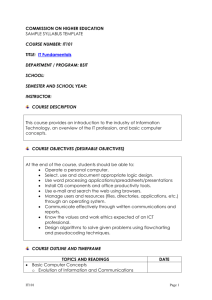

advertisement

The Dynamics of Productivity and Competitiveness in Major Advanced Economies: ICT and Other Determinants Andrea de Panizza ISTAT Mauro Visaggio University of Perugia Productivity, Competitiveness and the New Information Economy Business, Systemic and Measurement Issues ISTAT – Statistics Finland Joint Workshop Rome, June 26-27, 2003 Decomposition of labour Productivity Acceleration A) Macro Decomposition I. Capital deepening The increase in investment provides more capital per worker II. Labour quality growth Change in the composition of labour force with respect to workers’ productivity III. Total factor productivity (TFP) growth\ Change in output that cannot be attributed to both capital and labour (technological 2 and business organization effects) Decomposition of labour Productivity Acceleration B) Sectoral Decomposition d (ln yt ) dt O K ICT d (ln( k ICT t )) K O d (ln( k t )) t t dt dt ICT labour Productivity NON-ICT Capital deepening ICT O d (ln( A )) d (ln( A ICT O t t )) d (ln( H )) L d (ln( L )) t dt dt dt dt ICT NON-ICT labour quality Total Factor Productivity 3 Three channels through which ICT affects labour productivity Innovations in ICT according to Moore’s Law implies drastic decrease in price in ICT sector 3 1 Increase in TFP in ICT sector (production of ICT) 2 Increase in capital deepening in ICT (adoption of ICT) Increase in TFP in non-ICT sectors that adopt ICT due to business reorganization 4 Components of US labour productivity acceleration (1996-00 relative to 1974-1995) Gordon Olin-Sic. Jor-Ho-Stir CEA Lab. Prod. Accel. 1.04 1.03 0.93 1.58 I. Capital deepe. 0.37 0.48 0.52 0.39 - ICT 0.60 0.60 0.44 0.62 - non-ICT -0.23 -0.13 0.08 -0.23 0.01 -0.02 -0.1 0.0 0.52 0.57 0.51 1.18 0.30 0.22 0.14 0.46 0.11 0.00 0.27 0.25 0.00 0.18 1.00 0.00 II. labour quality III. TFP - ICT - non-ICT IV. Other 5 Sources of Labour Productivity Acceleration in the US 2 1.6 1.2 0.8 0.4 0 -0.4 100% 80% 60% 40% 20% 0% -20% Gordon Other TFP in ICT sector Total (R.h.s.) Olin-Sich Jorg-HoStir Labor quality Cap. Deep. non-ICT CEA Cap. Deep. ICT TFP in non-ICT sector 6 Summary of decomposition exercise results I. Capital Deepening increased - Adoption in ICT capital input accelerated - Investment in non-ICT capital input decelerated or stalled II. Labour quality stalled III. TFP growth accelerated - Increase in ICT sectors productivity - And, to a lower extent, in non-ICT sectors 7 The First Determinant of Acceleration: Increase in ITC Investment (change of ITC investment components in percent of private fixed investements) 30 20 10 0 1960 1970 Computer 1980 Software 1990 Comm. Equip. 2000 8 Labour Productivity in the US: Stylized facts Data and further decomposition define a clear and uncontroversial set of “stylized facts” I. The first determinant (for relevance) of productivity acceleration is the strong increase in ICT investment (ICT capital deepening) II. The second determinant of productivity acceleration is the significant increase in TFP in ICT production sector III. The third and last determinant of productivity acceleration is the weak increase in TFP in the non-ICT sector 9 International Comparison of Labour Productivity International comparison on the 1995-2000 period with respect to labour productivity points out the following elements: Increasing divergence in GDP growth rates 10 8 6 4 2 0 -2 -4 1971 1976 1981 JAP 1986 1991 USA EU15 1996 2001 10 International Comparison of Labour Productivity Differences in labour productivity have remained almost stable or slightly increased. Labour productivity can be measured in two different ways In terms of output per employed person In terms of output per hour worked 11 Labour Productivity output per person employed output per hour worked 6 6 4 4 2 2 0 0 -2 -2 -4 1980 1990 USA EU 2000 JAPAN -4 1980 1990 USA JAPAN 2000 EU 12 Different statistical sources in measuring labor productivity lead to different pictures US Labour productivity relative to EU 15 (=100) OECD EUROSTAT 130 130 120 120 110 110 100 1990 100 1990 1995 2000 GDP per hour GDP per person 1995 2000 GDP per person GDP per hour 13 Open Issues I. Contradictory pattern of labour productivity How is it possible that the US leadership relative to EU both in GDP growth and ICT investment is not mirrored in the dynamics of labour productivity? II. Determinants of labour productivity acceleration. Is the weak increase in TFP in the non-ICT sector due to the narrow industrial reorganization in this sector or is it due to the presence of other factors? 14 GDP growth unpacked 1992-1995 1996-2001 3 2 1 0 -1 EU15 Employment GDP per hour USA EU15 USA Hours per person Avg GDP% growth 15 Structural change: an explanation of the weird productivity dynamics … In all advanced economies – employment has moved towards lower productivity sectors (personal services - Denison effect reversed); – productivity % growth in low productivity sectors tends to be smaller (Baumol effect) In the US, faster GDP growth and exchange rate induced shifts in terms of trade (from tradables to non-tradables), might have been associated with a wider shift towards low productivity sectors, thus offsetting productivity gains in ICT intensive manufacturing and professional services. 16 Sectoral dynamics in the US THE CASE OF Community, Social and Personal Services (excluding P.A.-Defence-Compulsory soc. Security & housework) •Relative weight in employment (1995-hours) : approx. 15% •Employment growth (1996-2001) 18% : 73% higher than whole economy avg. •Relative productivity (1995; $/Hour) : 35% lower than whole economy avg. •Dynamics of productivity (1996-2001) : 20% lower than whole economy avg. Resulting yearly percentage reduction in productivity growth: -4.5% US VS. EU EMPLOYMENT SHARES (PERSONS) & DYNAMICS US share 2000 2000-1991 Euro-3 2000-1995 share 2000 2000-1991 2000-1995 Manufacturing 12.6 -0.2% -0.6% 19.8 -16.6% -2.3% Services 78.3 21.2% 12.0% 69.1 13.8% 10.3% - Comm.soc. & pers. Serv. 31.8 15.6% 8.6% 29.7 11.3% 5.9% - Wholes. & ret. Tr; Repairs 23.3 16.9% 8.4% 15.1 4.9% 6.2% Data availability and quality do not allow a robust comparison 17 … that calls for a choice on indicators and improvements in data production … Productivity (GDP growth) • Divided by Hours worked vs. employment Hours worked are the effective labour input need for reliable data on hours worked • PPP adjusted vs. real terms ? This choice is more controversial; exchange rate movements impact both on relative Gdp levels and, in each country, on terms of trade between tradables and non tradables; More attention to sectoral patterns these would allow a more clear view on the impact of ICT on the dynamics of productivity Need for sectoral measures 18 … while posing other questions GROWTH differentials remain to a large extent unexplained we have to look at additional channels by which ICT and other factors might have influenced competitiveness and relative performance ICT direct and indirect impacts Other (Political & Economic) country specific determinants 19 ONE STEP BACK The G7 as a group: a falling performance 6 GDP Growth 1970-2002 5 G7 3y MA G7 BC AVG World (PPA) 3y MA World (PPA) BC AVG 4 3 2 1 and vs. the others over time 0 1970 1974 1978 1982 1986 1990 1994 1998 2002 20 ADVANCED AND ESPECIALLY TRANSITION ECONOMIES LOST SHARES IN WORLD GDP The emergence of China as a NEW ACTOR IN THE GLOBALISING ECONOMY 13 51 Shares in World GDP (PPP weigthed) 12 50 11 49 10 48 9 47 8 46 7 45 6 44 5 43 CHINA (Mainland) Other emerging Asia 4 42 Ex-Comecon G7 (rhs) 3 41 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 21 Large performance differentials in the G7 4.5 1971-80 1981-90 1991-2000 2001-2002 US takes the lead, Japan falls behind 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 USA EU15 UK France Italy Ge rm any Jap an WINNERS: US & Canada, UK, France LOSERS: Japan, Germany, Italy 22 THE US ECONOMY HAS SHOWN TO BE MORE COMPETITIVE Export dynamics (1992 =100) 180 NATIONAL CURR. 1995 Prices 260 170 ECU/EURO Crurrent Prices 240 160 220 150 200 140 130 180 120 160 110 140 100 Germany Italy USA 90 80 1992 1994 1996 France UK Japan 1998 2000 2002 120 100 1992 1994 1996 1998 2000 2002 23 THE US ECONOMY HAS SHOWN TO BE MORE COMPETITIVE 12.5 Shares in world merchandise exports 11.0 US D 9.5 JP 8.0 F UK 6.5 IT 5.0 CA 3.5 1990 1995 2000 24 This is largely explained by ICT direct effects… • Market share of ICT products from 1992 to 2000 has passed from 11 to 17.5% of world exports • The US has maintained a first rank share on world ICT exports: • Slight decline. from about 14 to 12% • Summing up US & Mexico (where most exports origin from subsidiaries of US companies), this percentage grows from 14.4 to 17.2% • The weight of ICT products on US export has increased 6.3 percentage points, from 11.4 to 17.7% • France and UK have also performed well, while Germany, Italy and, especially Japan, have lost shares 25 ICT shares in world exports and countries shares 100% 18 Other Countries MEX 80% 16 US UK 60% 14 Nordic (FINS) E-3 40% 12 20% 10 0% 8 1987 1992 1996 2000 JAPAN NEW TIGERS (ML+IN+TH+PH+SI) OLD TIGERS (TW+KO+HK) CHINA ICT in % of world X 26 … but we can also imagine indirect (spill-over) effects on other sectors.. an INCREASE in market shares for ICT intensive products could be a proxy for ICT induced process and product innovations That could be the case of Machinery and equipment (World export shares) JP US 2000 E-4 1996 1992 10 12 14 16 1830 32 34 36 38 40 42 THE US HAVE INCREASED THEIR SHARE NOTWITHSTANDING LOWER THAN AVERAGE PRODUCTIVITY GAINS 27 …and also other elements related to performance, though not explicitly to productivity and competitiveness Cons. coll eu15 0.7 Cons. coll us The US vs. EU: Key differences in the demand components of GDP 0.6 0.5 0.4 0.3 0.2 0.1 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 -0.1 3.5 Cons.priv. eu15 3.0 Cons.priv. us 2.5 2.0 1.5 1.0 0.5 0.0 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 -0.5 1992 2.5 Invest.F.L. eu15 2.0 Invest.F.L. us 1.5 1.0 0.5 0.0 -0.5 -1.0 2002 2001 2000 1999 1998 1997 1996 1995 1994 -1.5 1993 These last two were possible ‘burning’ some resources thanks to the accumulated factors surplus 0.0 1992 • Earlier and fast fiscal adjustment • stronger (and compensatory) private consumption • A sustained investment cycle 28 …and also other elements related to performance, though not explicitly to productivity and competitiveness Amongst EU losers, instead... – Italy: Public debt constraints reduced contribution of Collective Consumption to GDP growth – Germany: Unification costs low growth content of public expenditure + many other features common to EU, from market conditions, to high sub-regional disparities, and to integration of CCs. we ought to consider the role of cyclical and other aspects, also on ICT diffusion profile and, subsequently, on performance 29 Summing up • ICT have had a positive but manifold impact on recent performance differentials • These do not (yet) appear clearly in productivity, when we consider it in aggregate terms • Instead, a clearcut competitive advantage can be elicited for ICT producers vs. users • Other (temporary?) factors have influenced performance • DATA REQUIREMENTS & INDICATORS: – Sound, harmonised worked hours statistics (in the pipeline) for relevant sectors -->[productivity] – small areas estimates for ICT usage (survey design improvements) --> [networking cum sectoral dimensions] – Impact measures and indicators (that is partly w/in Nesis) – accompanying sets of indicators that integrate ICT with competitiveness patterns 30