N. Gregory Mankiw

Principles of

Macroeconomics

Sixth Edition

16

The Monetary System

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Premium

PowerPoint

Slides by

Ron Cronovich

In this chapter,

look for the answers to these questions:

• What assets are considered “money”? What are

the functions of money? The types of money?

• What is the Federal Reserve?

• What role do banks play in the monetary

system? How do banks “create money”?

• How does the Federal Reserve control the

money supply?

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

1

What Money Is and Why It’s Important

Without money, trade would require barter,

the exchange of one good or service for another.

Every transaction would require a double

coincidence of wants—the unlikely occurrence

that two people each have a good the other wants.

Most people would have to spend time searching

for others to trade with—a huge waste of

resources.

This searching is unnecessary with money,

the set of assets that people regularly use to buy

g&s from other people.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

2

The 3 Functions of Money

Medium of exchange: an item buyers give to

sellers when they want to purchase g&s

Unit of account: the yardstick people use to

post prices and record debts

Store of value: an item people can use to

transfer purchasing power from the present to

the future

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

3

The 2 Kinds of Money

Commodity money:

takes the form of a commodity

with intrinsic value

Examples: gold coins,

cigarettes in POW camps

Fiat money:

money without intrinsic value,

used as money because of

govt decree

Example: the U.S. dollar

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

4

The Money Supply

The money supply (or money stock):

the quantity of money available in the economy

What assets should be considered part of the

money supply? Two candidates:

Currency: the paper bills and coins in the

hands of the (non-bank) public

Demand deposits: balances in bank accounts

that depositors can access on demand by

writing a check

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

5

Measures of the U.S. Money Supply

M1: currency, demand deposits,

traveler’s checks, and other checkable deposits.

M1 = $1.9 trillion (February 2011)

M2: everything in M1 plus savings deposits,

small time deposits, money market mutual funds,

and a few minor categories.

M2 = $8.9 trillion (February 2011)

The distinction between M1 and M2

will often not matter when we talk about

“the money supply” in this course.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

6

Central Banks & Monetary Policy

Central bank: an institution that oversees the

banking system and regulates the money supply

Monetary policy: the setting of the money

supply by policymakers in the central bank

Federal Reserve (Fed): the central bank of the

U.S.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

7

The Structure of the Fed

The Federal Reserve System

consists of:

Board of Governors

(7 members),

located in Washington, DC

12 regional Fed banks,

located around the U.S.

Ben S. Bernanke

Chair of FOMC,

Feb 2006 – present

Federal Open Market

Committee (FOMC),

includes the Bd of Govs and

presidents of some of the regional Fed banks

The FOMC decides monetary policy.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

8

Clicker question

Ben Bernanke

A. Has a beard.

B. Is greying.

C. Is the Chairman of the Federal Open Market

Committee.

D. Is all of the above.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

9

Bank Reserves

In a fractional reserve banking system,

banks keep a fraction of deposits as reserves

and use the rest to make loans.

The Fed establishes reserve requirements,

regulations on the minimum amount of reserves

that banks must hold against deposits.

Banks may hold more than this minimum amount

if they choose.

The reserve ratio, R

= fraction of deposits that banks hold as reserves

= total reserves as a percentage of total deposits

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

10

Bank T-Account

T-account: a simplified accounting statement

that shows a bank’s assets & liabilities.

Example:

FIRST NATIONAL BANK

Assets

Liabilities

Reserves $ 10 Deposits

$100

Loans

$ 90

Banks’ liabilities include deposits,

assets include loans & reserves.

In this example, notice that R = $10/$100 = 10%.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

11

Banks and the Money Supply: An Example

Suppose $100 of currency is in circulation.

To determine banks’ impact on money supply,

we calculate the money supply in 3 different cases:

1. No banking system

2. 100% reserve banking system:

banks hold 100% of deposits as reserves,

make no loans

3. Fractional reserve banking system

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

12

Banks and the Money Supply: An Example

CASE 1: No banking system

Public holds the $100 as currency.

Money supply = $100.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

13

Banks and the Money Supply: An Example

CASE 2: 100% reserve banking system

Public deposits the $100 at First National Bank (FNB).

FNB holds

100% of

deposit

as reserves:

FIRST NATIONAL BANK

Assets

Liabilities

Reserves $100 Deposits

$100

Loans

$

0

Money supply

= currency + deposits = $0 + $100 = $100

In a 100% reserve banking system,

banks do not affect size of money supply.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

14

Banks and the Money Supply: An Example

CASE 3: Fractional reserve banking system

Suppose R = 10%. FNB loans all but 10%

of the deposit:

FIRST NATIONAL BANK

Assets

Liabilities

Reserves $100

$100

10 Deposits

Loans

$ 90

0

Depositors have $100 in deposits,

borrowers have $90 in currency.

Money supply = C + D = $90 + $100 = $190 (!!!)

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

15

Banks and the Money Supply: An Example

CASE 3: Fractional reserve banking system

How did the money supply suddenly grow?

When banks make loans, they create money.

The borrower gets

$90 in currency—an asset counted in the

money supply

$90 in new debt—a liability that does not have

an offsetting effect on the money supply

A fractional reserve banking system

creates money, but not wealth.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

16

Banks and the Money Supply: An Example

CASE 3: Fractional reserve banking system

Borrower deposits the $90 at Second National Bank.

Initially, SNB’s

T-account

looks like this:

SECOND NATIONAL BANK

Assets

Liabilities

Reserves $ 90

$ 90

9 Deposits

Loans

$ 81

0

If R = 10% for SNB, it will loan all but 10% of the

deposit.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

17

Banks and the Money Supply: An Example

CASE 3: Fractional reserve banking system

SNB’s borrower deposits the $81 at Third National

Bank.

THIRD NATIONAL BANK

Initially, TNB’s

Assets

Liabilities

T-account

81 Deposits

$ 81

looks like this: Reserves $ $8.10

$72.90

Loans

$ 0

If R = 10% for TNB, it will loan all but 10% of the

deposit.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

18

Banks and the Money Supply: An Example

CASE 3: Fractional reserve banking system

The process continues, and money is created with

each new loan.

In this

Original deposit = $ 100.00

example,

FNB lending = $ 90.00

$100 of

SNB lending = $ 81.00

reserves

TNB lending = $ 72.90

generates

..

..

$1000 of

.

.

money.

Total money supply = $1000.00

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

19

The Money Multiplier

Money multiplier: the amount of money the

banking system generates with each dollar of

reserves

The money multiplier equals 1/R.

In our example,

R = 10%

money multiplier = 1/R = 10

$100 of reserves creates $1000 of money

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

20

ACTIVE LEARNING

1

Banks and the money supply

While cleaning your apartment, you look under the

sofa cushion and find a $50 bill (and a half-eaten

taco). You deposit the bill in your checking account.

The Fed’s reserve requirement is 20% of deposits.

A. What is the maximum amount that the

money supply could increase?

B. What is the minimum amount that the

money supply could increase?

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

ACTIVE LEARNING

Answers

1

You deposit $50 in your checking account.

A. What is the maximum amount that the

money supply could increase?

If banks hold no excess reserves, then

money multiplier = 1/R = 1/0.2 = 5

The maximum possible increase in deposits is

5 x $50 = $250

But money supply also includes currency,

which falls by $50.

Hence, max increase in money supply = $200.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

ACTIVE LEARNING

Answers

1

You deposit $50 in your checking account.

A. What is the maximum amount that the

money supply could increase?

Answer: $200

B. What is the minimum amount that the

money supply could increase?

Answer: $0

If your bank makes no loans from your deposit,

currency falls by $50, deposits increase by $50,

money supply does not change.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Clicker question

In a 100% reserve banking system, the money

multiplier is

A. 0.

B. 10.

C. 1.

D. 100.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

24

A More Realistic Balance Sheet

Assets: Besides reserves and loans, banks also

hold securities.

Liabilities: Besides deposits, banks also obtain

funds from issuing debt and equity.

Bank capital: the resources a bank obtains by

issuing equity to its owners

Also: bank assets minus bank liabilities

Leverage: the use of borrowed funds to

supplement existing funds for investment

purposes

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

25

A More Realistic Balance Sheet

MORE REALISTIC NATIONAL BANK

Assets

Reserves $ 200

Liabilities

Deposits

$ 800

Loans

$ 700

Debt

$ 150

Securities

$ 100

Capital

$ 50

Leverage ratio: the ratio of assets to bank capital

In this example, the leverage ratio = $1000/$50 = 20

Interpretation: for every $20 in assets,

$ 1 is from the bank’s owners,

$19 is financed with borrowed money.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

26

Leverage Amplifies Profits and Losses

MORE REALISTIC NATIONAL BANK

Assets

Reserves $ 200

Liabilities

Deposits

$ 800

Loans

$ 700

Debt

$ 150

Securities

$ 150

Capital

$ 100

In our example, suppose bank assets

appreciate by 5%, from $1000 to $1050.

This increases bank capital from $50 to

$100, doubling owners’ equity.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

27

Leverage Amplifies Profits and Losses

MORE REALISTIC NATIONAL BANK

Assets

Reserves $ 200

Liabilities

Deposits

$ 800

Loans

$ 700

Debt

$ 150

Securities

$ 50

Capital

$

0

• Instead, if bank assets decrease by 5%,

bank capital falls from $50 to $0.

• If bank assets decrease more than 5%, bank

capital is negative and bank is insolvent.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

28

Leverage Amplifies Profits and Losses

Capital requirement: a govt regulation that

specifies a minimum amount of capital, intended to

ensure banks will be able to pay off depositors and

debts.

The capital requirement essentially specifies a

minimum leverage ratio that banks must maintain

Capital requirements have been increased around

the world in response to the financial crisis of the

Great Recession.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

29

Leverage and the Financial Crisis

In the financial crisis of 2008–2009, banks suffered

losses on mortgage loans and mortgage-backed

securities due to widespread defaults.

Many banks became insolvent:

In the U.S., 27 banks failed during 2000–2007,

166 during 2008–2009.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

30

Leverage and the Financial Crisis

Many other banks found themselves with too little

capital, because the market began to expect that

their profits would be poor. Consequently, the

value of their stock was bid down.

In order to reconcile their balance sheets, banks

responded by reducing lending. This caused a

credit crunch.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

31

The beginning of a credit crunch

MORE REALISTIC NATIONAL BANK

Assets

Reserves $ 200

Liabilities

Deposits

$ 760

Loans

$ 500

Debt

$

Securities

$ 100

Capital

$ 40

0

• Capital declines.

• Assets must shrink so that the bank maintains the

minimum leverage ratio.

• Banks can accomplish this by calling in loans (and

perhaps selling securities).

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

32

The Government’s Response

To ease the credit crunch, the Federal Reserve

and U.S. Treasury injected hundreds of billions of

dollars’ worth of capital into the banking system.

This unusual policy temporarily made U.S.

taxpayers part-owners of many banks.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

33

The Government’s Response

The policy succeeded in “recapitalizing” the

banking system.

In other words, the government increased the

amount of capital in the banks balance sheets.

The precise procedure by which it accomplished

this will … be left for later courses.

In order to reconcile their balance sheets, banks

increased the amount of loans that they made.

This policy helped restore lending to normal levels

in 2009.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

34

The Fed’s Tools of Monetary Control

Earlier, we learned

money supply = money multiplier × bank reserves

The Fed can change the money supply by

changing bank reserves or

changing the money multiplier.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

35

How the Fed Influences Reserves

Open-Market Operations (OMOs):

the purchase and sale of U.S. government

bonds by the Fed.

If the Fed buys a government bond from a

bank, it pays by depositing new reserves in that

bank’s reserve account.

With more reserves, the bank can make more

loans, increasing the money supply.

To decrease bank reserves and the money

supply, the Fed sells government bonds.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

36

How the Fed Influences Reserves

If the Fed buys a bond, the bank swaps its bond

for an equivalent amount in currency.

The bond can’t be broken up and loaned out, but

the equivalent amount in currency can.

Some of the currency is retained as reserves,

the rest is loaned out and expands according to

the money multiplier.

This is how the Fed can increase the money

supply by swapping its cash for a bond held by a

bank.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

37

How the Fed Influences Reserves

The Fed makes loans to banks, increasing their

reserves.

Traditional method: adjusting the discount

rate—the interest rate on loans the Fed makes to

banks—to influence the amount of reserves

banks borrow

New method: Term Auction Facility—the Fed

chooses the quantity of reserves it will loan, then

banks bid against each other for these loans.

The more banks borrow, the more reserves they

have for funding new loans and increasing the

money supply.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

38

How the Fed Influences the Reserve Ratio

Recall: reserve ratio = reserves/deposits,

which inversely affects the money multiplier.

The Fed sets reserve requirements: regulations

on the minimum amount of reserves banks must

hold against deposits.

Reducing reserve requirements would lower the

reserve ratio and increase the money multiplier.

Since 10/2008, the Fed has paid interest on

reserves banks keep in accounts at the Fed.

Raising this interest rate would increase the

reserve ratio and lower the money multiplier.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

39

Problems Controlling the Money Supply

If households hold more of their money as

currency, banks have fewer reserves,

make fewer loans, and money supply falls.

If banks hold more reserves than required,

they make fewer loans, and money supply falls.

Yet, Fed can compensate for household

and bank behavior to retain fairly precise control

over the money supply.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

40

Bank Runs and the Money Supply

A run on banks:

When people suspect their banks are in trouble,

they may “run” to the bank to withdraw their funds,

holding more currency and less deposits.

Under fractional-reserve banking, banks don’t

have enough reserves to pay off ALL depositors all

at once, hence banks may have to close.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

41

Bank Runs and the Money Supply

This can happen even if the bank is not bankrupt,

meaning that the assets are equal in value to the

liabilities. The problem is that many of the assets

are in illiquid form, such as loans that can’t be

called in instantaneously. These assets can’t be

converted to cash quickly enough to satisfy the

demand for withdrawals.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

42

Bank Runs and the Money Supply

Banks that fear runs may make fewer loans and

hold more reserves to satisfy depositors.

These events increase R, reverse the process of

money creation, cause money supply to fall.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

43

Bank Runs and the Money Supply

During 1929–1933, a wave of bank runs and

bank closings caused money supply to fall 28%.

Many economists believe this contributed to the

severity of the Great Depression.

Since then, federal deposit insurance has

helped prevent bank runs in the U.S.

In the U.K., though, Northern Rock bank

experienced a classic bank run in 2007 and was

eventually taken over by the British government.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

44

Clicker question

Reducing R, the reserve requirement

A. Makes monetary policy more powerful and

reduces the likelihood of a bank run.

B. Makes monetary policy less powerful and

reduces the likelihood of a bank run.

C. Makes monetary policy less powerful and

increases the likelihood of a bank run.

D. Makes monetary policy more powerful and

increases the likelihood of a bank run.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

45

The Federal Funds Rate

On any given day, banks with insufficient reserves

can borrow from banks with excess reserves.

The interest rate on these loans is the federal

funds rate.

The FOMC uses OMOs to target the fed funds

rate.

Changes in the fed funds rate cause changes in

other rates and have a big impact on the economy.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

46

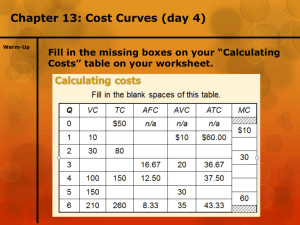

The Fed Funds rate and other rates, 1970–2011

Fed Funds

20

Prime

3 Month T-Bill

15

(%)

Mortgage

10

5

0

1970

1975

1980

1985

1990

1995

2000

2005

2010

Monetary Policy and the Fed Funds Rate

To raise fed funds

rate, Fed sellsFederal

funds rate

govt bonds (OMO).

This removes

reserves from the

banking system,

reduces supply of

federal funds,

rf

The Federal

Funds market

S2

S1

3.75%

3.50%

causes rf to rise.

D1

F2 F1

Quantity of

federal funds

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

F

48

S U MMA RY

• Money serves three functions: medium of

exchange, unit of account, and store of value.

• There are two types of money: commodity

money has intrinsic value; fiat money does not.

• The U.S. uses fiat money, which includes

currency and various types of bank deposits.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

S U MMA RY

• In a fractional reserve banking system, banks

create money when they make loans. Bank

reserves have a multiplier effect on the money

supply.

• Because banks are highly leveraged, a small

change in the value of a bank’s assets causes a

large change in bank capital. To protect

depositors from bank insolvency, regulators

impose minimum capital requirements.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

S U MMA RY

• The Federal Reserve is the central bank of the

U.S., is responsible for regulating the monetary

system.

• The Fed controls the money supply mainly

through open-market operations. Purchasing

govt bonds increases the money supply, selling

govt bonds decreases it.

• In recent years, the Fed has set monetary policy

by choosing a target for the federal funds rate.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.