File

advertisement

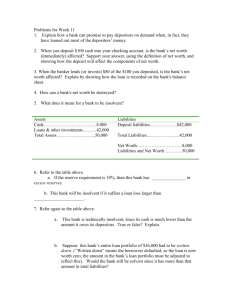

Economics Chapter 4 Bank Credit and Monetary Policy Banks Central bank Special functions in the economy Commercial banks Profit making financial institutes Deposit Loan A B Deposit withdrawal + Interest Loan payment + Interest payment Money Supply M1 = Cash held by the public + Demand deposits in LBs M2 = M1 + Savings and time deposits in LBs + NCD issued by LBs which held by the public M3 = M2 + Deposits & NCD in RBs & DTCs Money Supply Mr. A has $1,000 cash MS = M1 = $1,000 Mr. A saves his $1,000 cash into saving deposit The bank agrees to lend $1,000 to Mr. B (agreement made) Mr. B cash out his loan $1,000 from the bank MS = M2 = $1,000 Mr. B saves his $1,000 into the bank Cash = $0 Mr. A’s deposit = $1,000 MS = M2 = $2,000 (M1 = Cash = $0) (M2 = M1 + Deposit in LB from Mr. A= $1,000) MS = M2 = $1,000 (M1 = Cash = $1,000) Cash = $1,000 Mr. A’s deposit = $1,000 MS = M2 = $2,000 Cash = $0 Mr. A & B’s deposit = $2,000 Deposit creation Through making saving and lending process Bank gains from difference in interest Loan will lead to Deposit Money supply (from $1,000 to $2,000 in above case) The process is know as Deposit creation or Credit creation The reserve system of banks In order to protect depositors, banks Cannot lend out all the deposits Keep enough cash in case of withdrawal Cash held by bank = Reserve (儲備) Reserve ratio = Reserve-to-deposit Reserve ratio = 𝑹𝒆𝒔𝒆𝒓𝒗𝒆𝒔 𝑻𝒐𝒕𝒂𝒍 𝒅𝒆𝒑𝒐𝒔𝒊𝒕 x 100% Calculation of reserve ratio Bank’s balance sheet Cash: Assets held by the bank Deposits: Liabilities that the bank owes the depositors Assets ($) Cash reserves $1,000 Liabilities ($) Deposits $1,000 Case 1 With cash reserves equals total deposits Reserve ratio = ($1000/$1000) x 100% = 100% Calculation of reserve ratio Assets ($) Cash reserves ($1,000-$500) Loans (+$500) Liabilities ($) Deposits $1,000 $500 $500 Case 2 The bank loan out $500 Cash reserves = $1,000-$500 = $500 Reserve ratio = ($500/$1000) x 100% = 50% Calculation of reserve ratio Assets ($) Cash reserves ($1,000-$1,000) $0 Loans (+$1,000) $1,000 Liabilities ($) Deposits $1,000 Case 3 The bank loan out $1,000 Cash reserves = $1,000-$1,000 = $0 Reserve ratio = ($0/$1000) x 100% = 0% Calculation of reserve ratio Assets ($) Cash reserves ($5,000-$3,000) $2,000 Loans (+$3,000) $3,000 Liabilities ($) Deposits $5,000 Try this: Given the deposit = $5,000 The bank loan out $3,000 Cash reserves = $5,000-$3,000 = $2,000 Reserve ratio = ($2,000/$5,000) x 100% = 40% The minimum reserve requirement The Gov’t sets a lowest limit to the reserve ratio To protect public interests Maintain stability of the financial system Required reserve ratio (RRR) or Minimum reserve ratio In US, RRR=10%, i.e. for every $100 saving the bank must keep $10 for cash reserve and the bank can loan out $90 for profit marking The fractional reserve system Fractional reserve system Banks are required to hold only a portion of their deposits as reserves. No need to hold all the deposits as reserve. Can be loaned out for making profit. The fractional reserve system and RRR Country RRR(%) Remarks United Kingdom None Canada None Australia None New Zealand None Japan 0.77 Taiwan 7.00 United States 10.00 No reserve required on savings accounts since 1990 20.00 Up from 15%, effective from 2010-12-06 - Ratio is for requirement on term deposits. RRR for foreign currency positions increased to 43.00 on 15/6/2010 China 20.00 Ratio is for major Chinese Banks on 2012-05-12;[18] down from a 21.5% high in June 2011. Small and medium-size banks have a lower rate of 18.50%. Hong Kong None Liquidity ratio ≥ 25% (Banking Ordinance – Sect.102) Brazil Member of EU (e.g. Greece, Germany, etc.) Subject to minimum reserve framework of the Eurosystem (http://www.ecb.int/mopo/implement/mr/html/calc.en.html) Excess reserve Additional reserve apart from the required or Reserve hold by banks which is in excess of the required reserve. Excess reserve = Actual reserve – Required reserve Example Given RRR = 20% and deposit = $1,000 Required reserve = $1,000 x 20% = $200 If the bank hold reserve = $500 Excess reserve = $500 - $200 = $300 This $300 excess reserve is not required to hold by the gov’t The bank decides to hold more in case of risk of cash withdrawal However, maximum loan drops from $800 to $500 Excess reserve Pros More protection to depositor More confidence Low reserve ratio If any rumours, easy to have bank run Cons Cash reserve makes no interest Unable to earn from making loans Less ability to earn If bad debt, the bank cannot get back the loan Unfavourable to attract investors Whether holding excess reserve or not? Risk vs. Return Money supply with 100% reserve ratio In an economy without bank MS = Cash only If gov’t issues $1,000 cash, MS = $1,000 Money Supply $1,000 Deposit $0 Having a bank with 100% reserve $1,000 cash can be saved as deposits MS = $1,000 Money Supply $1,000 Cash $1,000 Cash $0 Deposit $1,000 No loans can be made No additional deposit MS remains unchanged Money supply with 100% reserve ratio Conclusion With 100% reserve ratio Deposit is kept totally as cash reserve in bank Bank has no further money to make loan No loan No additional deposit With 100%-reserve banking, MS remains unchanged the existence of banks does not affect the money supply. It only changes its composition. In other words with reserve ratio < 100% MS A model of deposit creation under a fractional reserve system Assumptions ** Minimum reserve ratio < 100% No excess cash reserve, Sufficient demand of loan bank loan out all the reserves in excess of the legal requirement the public is willing to borrow money from the bank Public doesn’t hold cash people deposit their loan into the bank No cash drain or leakage A model of deposit creation under a fractional reserve system Illustration Given required reserve ratio = 20% Assume Mr. A deposits $1,000 cash in a bank Balance sheet of the bank after the initial deposit : Assets ($) Reserves Liabilities ($) 1000 Deposits 1,000 A model of deposit creation under a fractional reserve system Illustration 20% of deposit is reserved = $200 80% of deposit can be loan out = $800 Balance sheet of the bank after the initial deposit (w/ loan): Assets ($) Reserves Loan Liabilities ($) 200 Deposits 800 Money supply = $1,000 1,000 A model of deposit creation under a fractional reserve system Illustration Suppose Mr. B apply $800 loan from the bank Then he deposit the $800 into the bank Balance sheet of the bank after the second deposit: Assets ($) Reserves (+800) Loan Liabilities ($) $1000 Deposit (+800) $800 $1,800 A model of deposit creation under a fractional reserve system Illustration 20% of deposit is reserved = $200 + $160 = $360 80% of deposit can be loan out = $800 + $640 = $1440 Balance sheet of the bank after the second deposit (w/ loan): Assets ($) Reserves Loan Liabilities ($) 360 Deposits 1,440 Money supply = $1,800 1,800 A model of deposit creation under a fractional reserve system Illustration Suppose Mr. C apply $640 loan from the bank Then he deposit the $640 into the bank Balance sheet of the bank after the third deposit: Assets ($) Reserves (+640) Loan Liabilities ($) 1,000 Deposit (+640) 1,440 2,440 A model of deposit creation under a fractional reserve system Illustration 20% of deposit is reserved = $200 + $160 + $128 = $488 80% of deposit can be loan out = $800 + $640 + $512 = $1,952 Balance sheet of the bank after the third deposit (w/ loan): Assets ($) Reserves Loan Liabilities ($) 488 Deposit 1,952 Money supply = $2,440 2,440 A model of deposit creation under a fractional reserve system Illustration Suppose Mr. D apply $512 loan from the bank Then he deposit the $512 into the bank Balance sheet of the bank after the fourth deposit: Assets ($) Reserves (+512) Loan Liabilities ($) 1,000 Deposit (+512) 1,952 Money supply = $2,952 2,952 A model of deposit creation under a fractional reserve system The public Change in deposits Change in loans [Deposit x (1-20%)] 1st $1000 $800 2nd $800 [$1000 x 0.8] $640 3rd $640 [$1000 x 0.82] $512 4th $512 [$1000 x 0.83] $409.6 5th $409.6 [$1000 x 0.84] $327.68 6th $327.68 [$1000 x 0.85] $262.144 . . . . . . . . . A model of deposit creation under a fractional reserve system Total deposits: The public Change in deposits Total deposits 1st $1,000 $1,000 2nd $1000 x 0.8 = $800 $1,800 3rd 4th 5th 6th $1000 x 0.82 = $640 $1000 x 0.83 = $512 $1000 x 0.84 = $409.6 $1000 x 0.85 = $327.86 $2,440 $2,952 $3,361.6 $3,689.46 . . . . . . A model of deposit creation under a fractional reserve system Total deposits = $1,000 + $1,000(0.8) + $1,000(0.82) + $1,000(0.83) +… By geometric progression 1 = $1,000 x 1 −0.8 = $1,000 = $5,000 1 1 x [ i.e. Initial deposit x ] 𝑅𝑅𝑅 0.2 A model of deposit creation under a fractional reserve system Given that reserve ratio = 20% meaning that 80% of deposits can be loaned out Total loans = Total deposits – required reserve = $5,000 - $5,000 x 20% = $5,000 x (1 – 20%) = $5,000 x 80% = $4,000 A model of deposit creation under a fractional reserve system Illustration After many deposits and loans The final status of the bank’s balance sheet: Assets ($) Reserves Loan Liabilities ($) 1,000 Deposit 4,000 Money supply increase from $1,000 to $5,000 i.e. MS = $4,000 5,000 Deposit creation and the banking multiplier Given reserve ratio = 20% Assets ($) Reserves Loan $1,000 $5,000 Liabilities ($) 1,000 Deposit 4,000 Reserves = Deposits x Reserve ratio Deposits = Reserves x 1 Reserve ratio 5,000 $5,000 x 20% 1 $1,000 x 0.2 = Reserves x Banking multiplier $1,000 x 5 = Initial deposit x Banking multiplier Deposit creation and the bank multiplier The banking multiplier Banking multiplier = 1 Reserve ratio Minimum reserve ratio (RRR) is the lowest reserve ratio Max banking multiplier = = 1 Minimum reserve ratio 1 RRR Deposit-creation ability and the banking multiplier Deposits = Reserve x 1 Reserve ratio Max. Deposits = Reserve x 1 Minimum reserve ratio Example 1: Given the RRR is 20%. If a person saves $1,000 into the bank and the bank keeps the required reserves and loans out the remaining part, what is the maximum increase in deposits? Solution: Max. Deposits = Reserve x = $1,000 x 1 0.2 1 Required reserve ratio = $5,000 Example 2 Below shows the balance sheet of a bank Assets ($) Reserves Loan 1,000 Deposit 4,000 Suppose there is no excess reserves, calculate a. i. ii. b. Liabilities ($) the required reserve ratio and The maximum banking multiplier. Suppose $500 cash is deposited into the bank, calculate the change in deposit. 5,000 Example 2 Below shows the balance sheet of a bank. Assets ($) Reserves Loan 1,000 Deposit 4,000 5,000 Suppose there is no excess reserves, calculate a. b. Liabilities ($) $1000 $5000 i. The required reserve ratio = x 100% = 20% ii. The maximum banking multiplier = 1 20% =5 Suppose $500 cash is deposited into the bank, calculate the change in deposit. The change in deposit = Reserve x = $500 x = $2500 1 0.2 1 Minimum reserve ratio Example 3 Below shows the balance sheet of a banking system. Assets ($) Reserves Loan Liabilities ($) 700 Deposit 1,800 2,500 Suppose the required reserve ratio is 20% and the public do not hold cash. Determine whether the following statements are true or false. a. The bank reserve ratio is 20%. b. The maximum amount of deposits is $12,500. c. The bank hold excess reserves of $100 d. The bank can increase its loans by at most $1,000. Example 3 a. $700 The bank reserve ratio = $2500 x 100% = 28% (The bank reserve ratio is 20%” is false.) b. The maximum amount of deposits = Reserve x 1 Minimum reserve ratio = $700 x 1 0.2 = $3500 ( The maximum amount of deposits is $12,500” is false) c. Excess reserves held by the banks = Actual reserve - Required reserve = $700 – ($2,500 x 20%) = $700 - $500 = $200 ( “The bank hold excess reserves of $100” is false.) Example 3 d. Since excess reserve = $200 The banks can loan out the excess reserve. The max. increase in loan = Additional loan x banking multiplier = $200 x 1 0.2 = $1000 (‘ The bank can increase its loans by at most $1,000’ is correct.) Example 4 Fill in the balance sheet below to show the final situation if $1,000 cash in deposited into the banking system with required reserve ratio 25% without excess reserve. Think about: 1 25% i. What is the banking multiplier? ii. The initial $1,000 deposit dollars is kept and used to support the final deposit. Then what is the meaning of this $1,000 in the balance sheet? Reserves How much is the max deposit can be supported by this $1,000 in the banking system? $1,000 x 4 = $4,000 iii. =4 Assets ($) Reserves Loan Liabilities ($) 1,000 Deposit 3,000 4,000 Deposit-creation and money supply MS = Cash held by the public (C) + Deposit (D) MS = C + D Given RRR = 20% If the public save $1,000 cash into the bank Currency in circulation: $1,000 [i.e. C = - $1,000] 1 Deposits: $5,000 [i.e. D = $1,000 x 0.2 = $5,000] MS = C + D = -$1,000 + $5,000 = $4,000 HKCEE 2009/Paper 1/Q.6 Study the following balance sheet of a banking system. Assets ($) Liabilities ($) Reserves Loan 300 Deposit 700 1,000 Suppose the legal reserve ratio is 20%. a. Calculate the excess reserve of the banking system. (2 marks) Excess reserve = $300 – ($1000 x 20%) = $100 b. Suppose all excess reserve is loaned out. Calculate the maximum possible amount of total deposits in the banking system. (2 marks) Max. deposits 1 = $300 x 20% = $1500 c. Hence, calculate the change in money supply. (2 marks) Change in money supply = Change in cash (held by the public) + Change in deposit = $0 + ($1500 - $1000) = $500 Monetary base ( 貨幣基礎 / 銀根 ) MS = Cash held by the public + Total Deposit Total Deposit = Initial deposit x Banking multiplier = Reserves x Banking multiplier = Reserves x MS 1 RRR = Cash held by the public + Initial deposits x Monetary base 1 RRR Example Given RRR = 20%, Cash held by the public = $500 and Initial deposit = $1000. Find i. Monetary base & ii. Money supply Solution: i. Monetary base ii. Money supply = Cash held by the public + Initial deposits = $500 + $1000 = $1500 = Cash held by the public + Deposits = Cash held by the public + Reserves x = $500 + $1000 x 1/0.2 = $5,500 1 RRR HKDSE Practice Paper 2/Q.14 The following table shows the balance sheet of the banking system of an economy: Assets ($million) Reserves Loan Liabilities ($million) 1000 Deposit 3000 4000 Suppose the public in this economy always holds $500 million cash and the banking system never holds excess reserves. a. Calculate the monetary base and money supply of the economy. (2 marks) b. Suppose the central bank lowers the minimum reserve ratio of the banking system by 5%. i. Explain whether the monetary base of the economy changes. (2 marks) ii. Calculate the new money supply. Show your working. (4 marks) HKDSE Practice Paper 2/Q.14 The following table shows the balance sheet of the banking system of an economy: Assets ($million) Reserves Loan Liabilities ($million) 1000 Deposit 3000 a. Monetary base = $1 000 million + $500 million = $1 500 million (1) Money supply = $4 000 million + $500 million = $4 500 million (1) b. (i) No, because (1) the policy affects neither the amount of reserves nor the cash held by the general public. (1) (ii) Before the policy change, the minimum reserve ratio = $4 000million / $1 000million = 0.25 (1) The new minimum reserve ratio = 0.25 – 0.05 = 0.2 (1) The banks will lend out the excess reserves. New deposits = $1 000 million x 1 0.2 = $5 000 million (1) New money supply = $500 million + $5 000 million = $5 500 million (1) 4000 No. of banks and the form of loans do not affect deposit creation In reality, many banks Do not affect deposit creation Loan from Bank A Deposit to Bank B Loan from Bank B Deposit to Bank C … The Change in deposits Change in loans public [Deposit x (1-20%)] 1st $1000 $800 2nd $800 $640 3rd $640 $512 4th $512 $409.6 5th $409.6 $327.68 6th $327.86 $262.144 . . . For details, read p.110 Deposit as a whole is not affected Realistic assumption Assumptions of maximum deposit creation 1. 2. 3. 4. Banks adopts fractional reserve system No excess reserves held by banks Sufficient demand of loans No cash drain / leakage In real world: Only assumption 1 is true. Assumption 2. Reason: for risk management Assumption 3. Reason: interest rate loans Assumption 4. Reason: the public need cash Violations of assumption Violation of assumption 2: Excess reserve Banks usually hold excess reserve to reduce risk Actual reserve ratio Banking multiplier Violation of assumption 3: Insufficient demand of loan High reserves Less amount for loan Banks’ profit interest rate Demand of loan Violation of assumption 4: Cash leakage The public holds cash less loan get back to the banks as deposit Deposit Loan Deposit creation can’t be maximized Conclusion: Model of deposit creation Assumption Able to have deposit creation? Able to maximize deposit? Fractional reserve system - No excess reserves - Sufficient loans - No cash leakage - Necessary condition for deposit creation Necessary conditions for maximizing deposit Reserve shortage What happen if Mr. A withdraws $100 from the bank? Assets ($) Reserves Loan Liabilities ($) 1,000 Deposit 4,000 5,000 Total deposit = $5,000 - $100 = $4,900 Assets ($) Reserves (-100) Loan Liabilities ($) 900 Deposit (-100) 4,000 4,900 Reserve shortage Assets ($) Reserves (-100) Loan Liabilities ($) 900 Deposit (-100) 4,000 After withdrawal, Reserve ratio = 4,900 $900 $4900 x 100% = 18.37% However, required reserve ratio (RRR) = 20% Not accepted by the law: Actual reserve ratio < RRR necessary to increase reserves to fulfill the minimum reserve requirement Reserve shortage Assets ($) Reserves (-100) Loan Liabilities ($) 900 Deposit (-100) 4,000 4,900 If deposit = $4,900 & RRR = 20% Required reserves = $4,900 x 20% = $980 However, after $100 withdrawal Actual reserves = $900 Reserve shortage: Actual reserves < Required reserves Amount of reserve shortage = $980 - $900 = $80 Deposit contraction(存款收縮) Reserve shortage = $80, what can the banks do? Recall loans The bank recalls loans from Mr. B = $80 Since bank holds 20% reserves & loans out 80% of deposit For every $1 withdrawal, the bank has to recall $0.8 of loans to maintain sufficient reserves Effect Mr. B doesn’t have cash When a bank recalls loans, he needs to withdraw $80 from his deposit Another round of reserve shortage occurs Deposit contraction(存款收縮) Reserve shortage: Reserves Loan Assets ($) Liabilities ($) 900 Deposit 4,000 Recall loans from Mr. B Assets ($) Reserves (+80) Loan (-80) 4,900 Liabilities ($) 980 Deposit 4,900 3,920 Mr. B’s withdrawal Assets ($) Reserves (-80) Loan Liabilities ($) 900 Deposit (-80) 3,920 4,820 Deposit contraction(存款收縮) Withdrawal Change in deposits Change in loans 1st - $100 - $80 2nd - $80 - $64 3rd - $64 - $51.2 4th - $51.2 - $40.96 5th - $40.96 - $32.768 6th - $32.768 - $26.2144 . . . . . . . . . Deposit contraction Initial withdrawal 2nd round withdrawal Mr. A withdraws $100 from a bank To keep enough reserves, the bank recalls $80 from Mr. B Mr. B withdraws $80 from a bank to repay his debt To keep enough reserves, the bank recalls $64 from Mr. C 3rd round withdrawal Mr. C withdraws $64 from a bank to repay his debt To keep enough reserves, the bank recalls $51.2 from Mr. D Deposit contraction and the banking multiplier Deposits = Reserve x 1 Reserve ratio Max. Deposits = Reserve x Deposits = Reserve x = - $100 x = - $500 1 20% 1 Minimum reserve ratio 1 Reserve ratio Deposit contraction Before withdrawal: Assets ($) Reserves Loan Liabilities ($) 1,000 Deposit 4,000 5,000 After withdrawal: Max. change of loans = Change in deposits – Change in reserves = - $500 – [-$500 x 20%] = - $500 x (1 – RRR) = - $500 x (1 – 20%) = - $400 Assets ($) Reserves (-100) Loan (-400) Liabilities ($) 900 Deposit (-500) 3,600 4,500 Example Below is the balance sheet of the banking system. Suppose the bank has no excess reserves: Assets ($) Reserves Loan Liabilities ($) 400 Deposit 1,600 2,000 If a depositor withdraws $100 cash from the bank, what is the maximum change in the deposits? Answers: Reserve ratio = $400 $2000 x 100% = 20% Change in deposits = Reserve x = - $100 x = - $500 1 20% 1 Reserve ratio Assets ($) Reserves Loan Liabilities ($) 300 Deposit 1,200 1,500 Monetary policy Borrow $$ to buy car now? ( Yes / No ) Consumption Apply mortgage to buy a house now? ( Yes / No ) Investment Interest rate Borrow $$ from the bank to expand production? ( Yes / No ) Production Monetary policy ( 貨幣政策 ) The central bank’s control of 1. the money supply or 2. the interest rate to achieve certain economic objectives MS = Cash held by the public + Deposits How to control the amount of cash in public? How to influence deposits? I. Monetary policy tools 1. Issuing banknotes Cash held by the public Money supply Cash Deposit Reserves Loans Deposit creation Money supply Most likely for MS increasing I. Monetary policy tools 2. Minimum reserve requirement RRR Cash reserves in banks Ability to make loans Deposits creation Money supply RRR Cash reserves in banks Ability to make loans Deposits creation Money supply I. Monetary policy tools 3. Open market operation Controlled by central banks Reserves and deposits at the central bank Operation with commercial banks Buying and selling gov’t bonds I. Monetary policy tools 3. Open market operation Open market purchase a. Assume ABC Company (the public) holds gov’t bond Central bank buys bonds (worth $1million) by paying cheque to ABC Co. ABC Co. deposits the cheque into commercial bank Central bank pays Bank A $1million for cheque clearing Deposit: Increase by $1 million Through deposit creation, MS $1million Central bank Bank A Cheque Deposit ABC Co. [holding Gov’t bonds] Illustration After the open market purchase: Assets ($) Reserves Liabilities ($) +1,000,000 Deposits +1,000,000 In short, both reserves and deposits increase by $1 million. Given the RRR=20% Total Deposits = Initial deposits x Banking multiplier = $1,000,000 x = $5,000,000 Ms = Cash + Deposits = $0 + $5,000,000 = $5,000,000 1 20% I. Monetary policy tools 3. Open market operation Open market sale b. Gov’t sell bonds to the public ABC Company bank buys bonds (worth $1million) by paying cheque to the central bank Central bank withdraws $1million for ABC’s account Deposit: decrease by $1 million Through deposit contraction, MS $1million $1million Central bank Bank A Deposit ABC Co. [holding Gov’t bonds] I. Monetary policy tools 4. Discount rate Interest rate (Cost) of loan from the central bank to commercial banks If discount rate Cost of loan Commercial banks: less incentive to borrow Loan out Deposit Reserve Ability of deposit creation Ms Conclusion: Discount rate Reserves and Ms I. Monetary policy tools 4. Discount rate If discount rate Cost of loan Commercial banks: more incentive to borrow Loan out Deposit Reserve Ability of deposit creation Ms Conclusion: Discount rate Reserves and Ms Conclusion: Monetary policy tools Open market operations Discount rate Monetary policy tools Minimum reserve ratio Issuance of banknotes Commercial banks’ deposits at the central bank Reserves Deposits Money Supply Cash held by the public II. Controlling of interest rate Effects on interest rate If Gov’t sell bonds, Ms (i.e. capital in the market flow towards the central bank) Deposit Reserve Interest rate (%) MS2 Loanable fund in the market MS1 Interest rate r2 r1 Md 0 Q2 Q1 Quantity of money II. Controlling of interest rate By controlling Ms, the gov’t indirectly controls interest rate affect the incentive of loan making Relationship: Ms interest rate Ms interest rate Types of monetary policy Carry out by the central bank Expansionary monetary policy Contractionary monetary policy Monetary policy Types Expansionary Contractionary Central bank controls Money supply Interest rate Money supply Interest rate Open market operation Buy bonds Sell bonds Discount rate Minimum reserve ratio Issuance of banknotes Tools Effects of monetary policy Expansionary monetary policy ( Ms , r ) Banks have more to loan out More people are willing to borrow Consumption Investment GDP Gov’t uses expansionary monetary policy to booth the economic growth E.g. the US Gov’t adopted QE (Quantitative ease) in 2008 & QE2 policies in 2010 Effects of monetary policy Expansionary monetary policy ( Ms , r ) Pros GDP Employment Consumption Investment Investment Firms will hire more labour Cons Inflation Consumption Demand of goods Price Effects of monetary policy Contractionary monetary policy ( Ms , r ) Banks have less to loan out With high interest rate, less people make loan Consumption Investment GDP Gov’t uses contractionary monetary policy to prevent overheated economy Effects of monetary policy Contractionary monetary policy ( Ms , r ) Pros Avoid economic overheat Avoid inflation Investment Production Consumption Demand of goods Price Cons Unemployment Investment Firms will not hire or even lay off excess labour Monetary policy in Hong Kong Easy to be affected by foreign economies No HK bonds buying or selling Linked exchange rate system Aim at keeping exchange rate: HKD7.8 = USD 1 Operation: Linked exchange rate [ HKD7.8 = USD1 ] Exchange rate HKMA’s action Result - HKD exchange rate [ HKD7.5 = USD1 ] HKD exchange rate [ HKD8 = USD1 ] Sell HK Dollar Buy HK Dollar to lower the price of HKD Maintain HKD7.8 = USD1 Ms - to raise the price of HKD Maintain HKD7.8 = USD1 Ms Monetary policy in Hong Kong Conclusion Issuance of banknotes - usually around Chinese New Year Minimum reserve ratio - Liquidity ratio ≥ 25% Discount rate - Replaced by HIBOR (Hong Kong Inter-bank offered rate) Open market operation - Replaced by the “Linked Exchange Rate System” Chance to be attacked by global speculators, lost the function of controlling money supply