CONSUMPTION FUNCTION

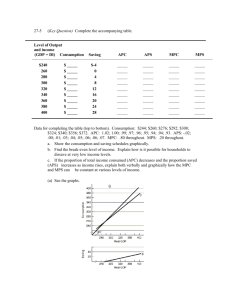

advertisement

QUICK REVIEW LRAS PRICE LEVEL SRAS AD Q1 Qn REAL GDP PRICE LEVEL LRAS SRAS AD Qn REAL GDP Price Level LRAS SRAS Short-run equilibrium Long-run equilibrium AD 0 QN Natural Real GDP Answer the following: What is Say’s law? What three things must be flexible in the Classical model? What is the Classical solution for too much unemployment? How does the self-regulating economy get out of a recessionary gap? Self-Regulating Economy KEYNESIAN ECONOMICS J. M. Keynes wrote during the Great Depression Keynes focused on the demand side of the economy Keynes did not believe that the economy was necessarily self-correcting KEYNES ON WAGES AND PRICES Keynes believed that wages and prices were STICKY DOWNWARD The lack of wage and price flexibility suggested that the economy might get STUCK in a recessionary gap. Keynes tended to focus on the short run because “IN THE LONG RUN WE ARE ALL DEAD” KEYNES AND INCOME Keynes focused his analysis on Total Expenditures in the economy In particular, he focused on Consumption CONSUMPTION is a function of DISPOSABLE INCOME SAVING is also determined by DISPOSABLE INCOME CONSUMPTION AND SAVING TERMS Autonomous Consumption - the portion of consumption that is not related to income (it is the amount of Cons. when income is 0). MPC - marginal propensity to consume (it is change in C / change in Y) MPS - marginal propensity to save (it is the change in saving / change in Y) CONSUMPTION AND SAVING TERMS Break-even income - the level of disposable income where consumption spending is just equal to disposable income. C = Yd S must be zero EQUATION FOR C AND S C = a + b(Yd) Consumption = autonomous consumption + the MPC * (disposable income) S = -a + (1-b)(Yd) Saving = negative autonomous consumption + MPS * ( disposable income) EXAMPLE C = 100 + .75 (Yd) Find Aut. Cons., MPC, MPS, and C and S when Yd=1000. Aut. Cons. = 100 MPC = .75 MPS = .25 C = 100 + .75 (1000) = 100 + 750 = 850 CONSUMPTION FUNCTION INCOME 0 100 200 300 500 600 CONS. 100 180 260 340 500 580 SAVING -100 -80 -60 -40 0 20 Find MPC Find MPS Find Autonomous Consumption Give the equation for consumption Give the equation for saving Find breakeven income Find C and S when income is 700 CONSUMPTION FUNCTION A change in Disposable Income causes a MOVEMENT ALONG the Consumption Function A change in Autonomous Consumption causes a SHIFT of the Consumption Function SAVING SAVING is the unspent portion of a consumer’s income. SAVING = Income - Consumption Exp. INVESTMENT 2 components Capital goods (producer durables) - goods used by businesses to produce other goods and services. They have an expected service life of more than one year. Inventory investment - changes in the stocks of finished goods, goods in process, and in raw materials a firm keeps on hand. TOTAL EXPENDITURES Total Expenditures = C + I + G + (X-M) C depends on Disp. Y S depends on Disp. Y Disp. Y = C + S I depends on the interest rate ( not Y ) G is assumed to be autonomous EQUILIBRIUM TOTAL EXPENDITURES are equal to TOTAL PRODUCTION is equal to INCOME DISEQUILIBRIUM TOTAL OUTPUT < TOTAL EXPENDITURES unplanned inventories production employment Real GDP income DISEQUILIBRIUM TOTAL OUTPUT > TOTAL EXPENDITURES unplanned inventories production employment Real GDP income C = 200 + .80(Yd) I = 300 Find Autonomous Cons., MPC, and MPS Find breakeven income Find equilibrium income In Qn=3000, identify the following: type of gap, size. THE MULTIPLIER A dollar injected into the economy (i.e. investment) has an impact beyond the initial expenditures. The dollar continues to be spent multiplying its impact on the economy. The number of times it circulates through the economy is known as THE MULTIPLIER. THE MULTIPLIER cont. The rate of circulation is related to the MPC and MPS. The larger the MPC, the more consumption rises as a result of an increase in income. This will result in a larger MULTIPLIER. Autonomous Government Spending & the Multiplier (1) EXPENDITURE ROUND (2) CHANGE IN AUTONOMOUS GOVERNMENT SPENDING (3) CHANGE IN REAL NATIONAL INCOME OR REAL GDP ($ millions) (4) MPC (5) CHANGE IN CONSUMPTION ($ millions) Round 1 $60.00 $ 60.00 .80 $ 48.00 Round 2 48.00 .80 38.40 Round 3 38.40 .80 30.72 Round 4 . . . . . . . . All other 30.72 . . . . .. . . .80 .. . . . . . . .80 24.57 . . . . .. . . TOTAL Exhibit 12 122.88 $300.00 98.88 $240.00 (Approx. THE FORMULA MULTIPLIER = 1 1 - MPC or 1 MPS EXPANSIONARY FISCAL POLICY TO ADDRESS A RECESSIONARY GAP policy aimed at increasing economic activity through increasing G &/or decreasing T to increase AD or increase SRAS CONTRACTIONARY FISCAL POLICY TO ADDRESS AN INFLATIONARY GAP policy aimed at decreasing economic activity through decreasing G &/or increasing T to decrease AD or decrease SRAS Fiscal Policy in Keynesian Theory: Ridding the Economy of Recessionary Gaps Fiscal Policy in Keynesian Theory: Ridding the Economy of Inflationary Gaps Exhibit 2 (2 of 2) THE MULTIPLIER EFFECT both G and T are subject to the multiplier effect SO a change in either will lead to an even greater change in equilibrium real output (which is equilibrium Y) THE EXPENDITURE MULTIPLIER 1 / 1- MPC or 1 / MPS Change in Real GDP = multiplier x (change in G) COMMON MULTIPLIERS MPC .9 .8 .75 .66 .5 EXP MULT 5 4 3 2 10 EXAMPLE Qe = 800 while Qn = 1000 MPC = .75 find the G necessary to bring the economy to natural real GDP THE TAX MULTIPLIER - MPC / MPS or ( 1 - exp. mult.) Change in Real GDP = tax multiplier x (change in T) EXAMPLE Qe = 1200 while Qn = 800 MPC = .66 find the T necessary to bring the economy to full employment GDP BALANCED BUDGET MULTIPLIER if both G & T increase (or decrease) by the same amount, then equilibrium real GDP will increase by the amount of the increase (or decrease) in G C = 200 + .80(Yd) I = 300 Find equilibrium income In Qn=3000, identify the following: type of gap, size, fiscal policy options to close it. Should Fiscal Policy be Used? NOT NECESSARILY Crowding Out Lags CROWDING OUT increases in G may lead to decreases in private sector spending ( C or I ) CROWDING OUT may occur due to: direct substitution more on public libraries fewer books at bookstores interest rate effects more on social programs and defense budget deficit increases government’s demand for credit rises interest rate rises investment drops Lags and Discretionary Fiscal Policy The data lag: not aware of changes in the economy as soon as they happened The wait-and-see lag: adopt a more cautious attitude The legislative lag The transmission lag: take time to be put into effect The effectiveness lag: take time to affect the economy KEYNESIAN PERSPECTIVE fiscal policy is effective crowding out is relatively small lags are short CLASSICAL PERSPECTIVE fiscal policy is ineffective crowding out is significant lags are long FISCAL POLICY Discretionary Fiscal Policy DISCRETIONARY FISCAL POLICY deliberate changes in G and/or T to achieve particular objectives requires new action by Congress FISCAL POLICY Discretionary Fiscal Policy Automatic Stabilizers AUTOMATIC STABILIZERS changes in G and/or T that occur automatically as economic conditions change these changes do not require new action by Congress Four Types of Fiscal Policy Expansionary Discretionary Automatic Contractionary Policy Makers G or T or both Policy Makers G or T or both (1) (2) Unemployment Compensation Welfare Payments Unemployment Compensation Welfare Payments (3) (4) The New Classical View Of Fiscal Policy crowding out does occur as people save more in anticipation of higher taxes these adjustments cause expansionary fiscal policy to be ineffective. SUPPLY SIDE POLICY dislike demand side policies because increases in AD means growth comes with higher prices prefer to focus on tax issues which alter incentives to work, save, and invest What Are the Major Federal Taxes? Personal income tax Corporate income tax Social security tax Exhibit 1 Major Federal Taxes SOURCE: Council of Economic Advisers, Economic Report of the President, 1999. MARGINAL TAX RATE tax rate applied to additional income change in tax payment divided by the change in taxable income Three Income Tax Structures MARGINAL TAX RATES AND FISCAL POLICY decreasing marginal tax rates leads to an increase in SRAS b/c increases the incentive to work if the tax change is permanent, then the change in AS is too the LRAS will shift to the right Laffer Curve Tax Rate (percent) 100 C B to C: Tax rate and tax revenues inversely related. Laffer Curve Z B Y A to B: Tax rate and tax revenues directly related. X A 0 TX TZ TY Tax Revenues What are the Major Federal Government Spending Programs? National defense Income security Health Medicare Social security Net interest on the National Debt Exhibit 3 Major Federal Spending Programs SOURCE: Council of Economic Advisers, Economic Report of the President, 1999. DEBT AND DEFICITS BUDGET DEFICITS occur when government expenditures exceed tax receipts A BUDGET SURPLUS occurs when tax receipts exceed government expenditures CYCLICAL DEFICITS The portion of the deficit that is a result of an economic downturn many economists (Keynes) believe that deficits are natural and necessary during recessions because tax revenues fall and benefit payments rise Our problem is that we have continued to run deficits in expansionary periods STRUCTURAL DEFICITS The structural deficit is the portion of a budget deficit which exists when the economy is operating at full employment Total Budget Deficit = structural deficit + cyclical deficit National Debt NATIONAL DEBT is the total sum of what the federal government owes its creditors (the sum of past deficits) Exhibit 5 Public Debt for 1987–1999 The 1999 amount is for November 1999. SOURCE: Bureau of the Public Debt. NATIONAL DEBT As the debt grows, interest on the debt grows in its share of the budget. The portion of the budget that can be cut in order to balance the budget is SHRINKING PORTION OF THE BUDGET THAT IS CONSIDERED UNTOUCHABLE Interest on the Debt Social Security untouchable total National Defense Total 14% 22% 36% 20% 56% WHO BEARS THE BURDEN OF THE DEBT? CURRENT GENERATION - if crowding out occurs then households are giving up consumption to pay for increases government spending FUTURE GENERATIONS - will have to pay higher taxes to pay off the bonds when they come due. They bear the cost while the bondholders receive the payoffs. COUNTERPOINT WE-OWE-IT-TO -OURSELVES - if American taxpayers make payments to American bondholders, money is simply shifted from one pocket to another. Only works if debt is held domestically (currently 14-18% is held by foreigners)