RetailFront2~Nov'99

52 Weeks Ending Sept. 1999

All Commodity $ Growth

Grocery Banners

Drug Stores

Warehouse Clubs

Mass Merchandisers

+5

±0

+6

+1

Retail Services

13 Weeks Ending Sept. 1999

All Commodity $ Growth

Grocery Banners

Drug Stores

Warehouse Clubs

Mass Merchandisers

+7

+4

+9

+8

The Retail Front

What’s in a Card?

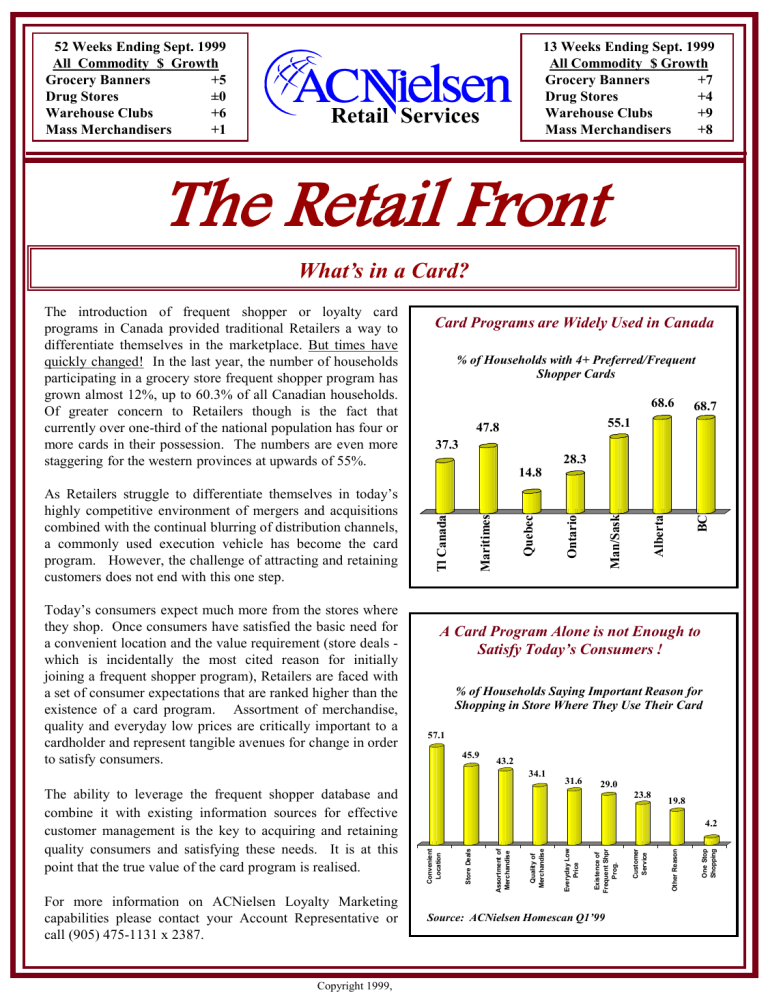

The introduction of frequent shopper or loyalty card programs in Canada provided traditional Retailers a way to differentiate themselves in the marketplace. But times have quickly changed! In the last year, the number of households participating in a grocery store frequent shopper program has grown almost 12%, up to 60.3% of all Canadian households.

Of greater concern to Retailers though is the fact that currently over one-third of the national population has four or more cards in their possession. The numbers are even more staggering for the western provinces at upwards of 55%.

As Retailers struggle to differentiate themselves in today’s highly competitive environment of mergers and acquisitions combined with the continual blurring of distribution channels, a commonly used execution vehicle has become the card program. However, the challenge of attracting and retaining customers does not end with this one step.

Today’s consumers expect much more from the stores where they shop. Once consumers have satisfied the basic need for a convenient location and the value requirement (store deals which is incidentally the most cited reason for initially joining a frequent shopper program), Retailers are faced with a set of consumer expectations that are ranked higher than the existence of a card program.

Assortment of merchandise, quality and everyday low prices are critically important to a cardholder and represent tangible avenues for change in order to satisfy consumers.

The ability to leverage the frequent shopper database and combine it with existing information sources for effective customer management is the key to acquiring and retaining quality consumers and satisfying these needs. It is at this point that the true value of the card program is realised.

For more information on ACNielsen Loyalty Marketing capabilities please contact your Account Representative or call (905) 475-1131 x 2387.

Card Programs are Widely Used in Canada

37.3

% of Households with 4+ Preferred/Frequent

Shopper Cards

68.6

68.7

47.8

55.1

28.3

14.8

57.1

A Card Program Alone is not Enough to

Satisfy Today’s Consumers !

% of Households Saying Important Reason for

Shopping in Store Where They Use Their Card

45.9

43.2

34.1

31.6

29.0

23.8

19.8

Source: ACNielsen Homescan Q1’99

4.2

Copyright 1999,

ACNielsen

Retail Consolidation…Part II: Globalization and the Race for Size!

88 Grocery Retailers operate stores outside their home Country

34

24

17

9

4

>20 10+ 5+ 3 or 4

# of Countries

2

Marks & Spencer

Metro - Makro

Spar

7-Eleven

Carrefour

Ahold

For some Retailers:

"My Market = The World"

23

21

16

17

# of Countries

28

31

In the last issue of the Retail Front, the main article dealt with “Retail Consolidation…the Big are getting

Bigger.” However, the scope of the article was limited to the Canadian market. The effects of the

Loblaws/Provigo and Sobeys/Agora mergers will continue to have a huge impact on the Canadian Retail

Environment, but there may be a larger issue at hand.

Our current focus is consolidation, but we may need to change this focus to Globalization! As Retailers around the world compete in a race for size, they concentrate on three distinct strategies: More and Bigger

Stores, Intra-Country Consolidation and Global Expansion. One needs only to look at the trends in Europe to forecast what is to come for Canada. In Europe, Retailers have focussed their attention on all three of these strategies. Firstly, over the last two decades, Hypermarkets and Large Supermarkets have grown from

25.5% of the market to represent 55.5% of all store formats. Secondly, there has been a large number of mergers and acquisitions over the last few years involving some of Europe’s largest Retailers. And finally, as far as Global Expansion goes, Europe is leading the way. Globally, 88 Grocery Retailers operate stores outside their home country. These 88 Retailers have 403 ventures in foreign countries and 292 of these ventures have Europe as their region of origin. Now, many European Retailers have focussed their attention on the U.S. In fact, it could be argued that European Retailers dominate the Eastern Coast of the U.S.

(Ahold, Delhaize, Tengelmann, Ito Yokado, Aldi).

What does all this mean to Canadian Retailers? Essentially, as more and more Retailers expand globally,

Canada will be seen as a very lucrative market. The Hypermarkets will be a format for the future, whether current Retailers adopt these formats or foreign Retailers look to Canada to expand. Canadian Retailers may be forced to make a decision - buy or be bought!

Where and How are Consumers Shopping?

Channel

Grocery Banners

Drug Stores

Warehouse Clubs

Share of Market

Mass Merchandisers

46.3

6.0

6.3

9.9

Shr Chg

+0.3

-0.2

+0.1

-0.3

$/Trip

36.10

21.11

93.25

37.56

Chg Vs Year Ago

+0.99

+1.43

+0.66

+1.73

Trips/Hhld

97.7

22.4

10.3

21.7

Chg Vs Year Ago

1.7

-1.4

0.4

-0.9

Source: ChannelWatch, 52 Weeks to September 1999

Copyright 1999,

ACNielsen

On-line Shopping Receiving Due Diligence

Internet usage is no longer confined only to the niche group it began with.

It is infiltrating a much wider spectrum of the population with the demographics of users being much more in line with the mainstream population. Nine and a half million Canadians over the age of 12, or 37% of the population, are Internet users an increase of 20% over last year.

Compared to two years ago when the gender balance of the Internet population was skewed 60:40 in favour of males, the

Canadian Internet population has achieved a gender balance which is similar to the population at large. The

Canadian Internet population is now 49% female. In the

Percentage of Internet Users that Have Made a

Purchase On-line

11%

13%

17% past, the age distribution of the Internet population was heavily skewed toward younger age groups. The recent

1996 1997 1998 entry of large numbers of people from middle aged and senior aged groups has made significant progress in balancing access to the Internet. While those 55 years of age and older continue to be under-represented relative to the population, their numbers have greatly increased in the past year.

In terms of e-Commerce, the volume conducted from business-to-business is vastly larger than the volume conducted by the consumer, meaning on-line shopping. Focussing on the consumer side of on-line shopping, the percentage of

Internet users having made a purchase on the Internet has increased from 11% in 1996 to 13% in 1997 and to 17% in

1998.

Internet users who have been using the Internet for longer periods of time and who consider themselves to be more skilled users of the Internet are considerably more likely to report having made an on-line purchase. This tends to corroborate the notion that it takes some time for consumers to get comfortable with on-line shopping, but once they do, they are willing to use it to make purchases. We can look at past experience with the introduction of other new channels for conducting commerce as a useful point of comparison such as credit cards, automatic teller machines and debit cards, which are now in widespread use. In the case of all three, upon introduction there was a certain number of people who were interested in these channels immediately and, after a relatively short period of time getting accustomed to the idea, became regular users. The same path will hold true for the Internet.

There certainly has been a great deal of excitement about Internet prospects for the consumer. Some of this enthusiasm might justifiably be categorized as ‘hype,’ hence the hesitation from Retailers to quickly jump in to the heavy investment required for e-Commerce.

However, consumers do have very positive expectations regarding the prospective benefits they believe the Internet will deliver. Sixty nine percent of Internet users feel the Internet will improve the quality of life of the average Canadian Internet user. As we speak, the volume of electronic purchases continues to climb, however, it is not clear when or if there will be a sudden explosive surge.

Would Make Another Purchase Via The Internet

Yes, definitely

Base: Internet Users who used the Internet to make purchases

Total

(761)

%

< 6

Months

(36)*

%

Length of Time Using Internet

6-12

Months

(101)

13-24

Months

(195)

% %

25+

Months

(429)

%

29 11 22 24 35

Yes, probably

Probably not

No

Not sure

55

4

2

9

49

11

10

20

52

10

3

13

57

2

4

12

55

3

1

7

* Caution: S mall Base Source: 1998 ACNielsen Canadian Internet Study

At the end of the day there is no conclusive answer for Retailers. The

Internet research results show many positive trends and, as with any new and exciting opportunity, there is an undetermined business.

potential for your

New on-line shopping websites are slowly beginning to emerge and many other Retailers are doing considerable behind-the-scenes exploration to capitalize on growing phenomenon in the future.

this

Suggestions are welcome! Please contact your ACNielsen Account Team in one of the following offices: Toronto: (905) 475-1131,

Montreal: (514) 333-1416, Vancouver: (604) 270-7444, Halifax: (902) 835-4706. For general inquiries call the Toronto office, Extension 2393.

Copyright 1999,

ACNielsen