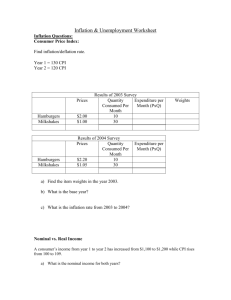

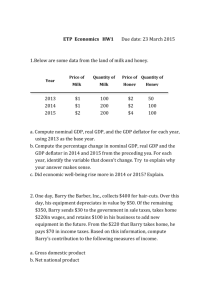

inflation rate

advertisement

Warm Up: Get out the Unemployment Handout from Monday. Have you completed it? Warm Up In the following scenarios, has inflation created: (a) winners and losers at no net cost to the economy, or (b) a net cost to the economy? If you have chosen (b), which type of cost is the inflation generating? 1. During a period of rapid unexpected inflation, Sam’s Meat Market must change the price of his products on a weekly basis. 2. The First Bank of Reffville has made many long-term loans with fixed interest rates assuming a stable inflation of 3% every year. For the last two years inflation has been even lower at 1.5%. Inflation: Module 14 & 15 WHAT IS INFLATION AND? Inflation is a general rising level of prices It reduces the “purchasing power” of money Examples: •It takes $2 to buy today what $1 bought in 1982 •It takes $6 to buy today what $1 bought in 1961 •When inflation occurs, each dollar of income will buy fewer goods than before. The Natural Rate • The real wage is the wage rate divided by the price level. • Real income is income divided by the price level. • The inflation rate is the percent increase in the overall level of prices per year. year 2 – Price level in year 1 x 100 Inflation rate = Price level inPrice level in year 1 5 of 11 Inflation and Deflation 6 of 11 Inflation and Deflation • High rates of inflation impose significant economic costs. • Shoe-leather costs are the increased costs of transactions caused by inflation. • Menu cost is the real cost of changing a listed price. • Unit-of-account costs arise from the way inflation makes money a less reliable unit of measurement. 7 of 11 Winners and Losers from Inflation • Inflation changes the dollar repayment of a loan will be because the loan contract is stated in nominal terms. • The nominal interest rate is the interest rate expressed in dollar terms. • The real interest rate is the nominal interest rate minus the rate of inflation. • If inflation is higher than expected, borrowers gain at the expense of lenders. • If inflation is lower than expected, lenders gain at the expense of borrowers. 8 of 11 Hurt by Inflation Helped by Inflation • Lenders-People who lend money (at fixed interest rates) • People with fixed incomes • Savers • Borrowers-People who borrow money • A business where the price of the product increases faster than the price of resources Cost-of-Living-Adjustment (COLA) Some works have salaries that mirror inflation. They negotiated wages that rise with inflation What are interest rates? Why do lenders charge them? Who is willing to lend me $100 if I will pay a total interest rate of 100%? (I plan to pay you back in 2050) If the nominal interest rate is 10% and the inflation rate is 15%, how much is the REAL interest rate? Real Interest RatesThe percentage increase in purchasing power that a borrower pays. (adjusted for inflation) Real = nominal interest rate - expected inflation Nominal Interest Ratesthe percentage increase in money that the borrower pays not adjusting for inflation. Nominal = Real interest rate + expected inflation Nominal vs. Real Interest Rates Example #1: You lend out $100 with 20% interest. Inflation is 15%. A year later you get paid back $120. What is the nominal and what is the real interest rate? Nominal interest rate is 20%. Real interest rate was 5% In reality, you get paid back an amount with less purchasing power. Example #2: You lend out $100 with 10% interest. Prices are expected to increased 20%. In a year you get paid back $110. What is the nominal and what is the real interest rate? Nominal interest rate is 10%. Real rate was –10% In reality, you get paid back an amount with less purchasing power. Inflation is Easy; Disinflation is Hard •Disinflation is the process of bringing the inflation rate down. 12 of 11 Inflation and Deflation 13 of 11 Israel’s Experience with Inflation • In the mid-1980s, Israel experienced a “clean” inflation. • But policy errors led to very high inflation. • The shoe-leather costs of inflation were substantial. Israelis spent a lot of time moving money in and out of bank accounts that provided high enough interest rates to offset inflation. • Businesses made efforts to minimize menu costs. For example, restaurant menus often didn’t list prices. • It was hard for Israelis to make decisions because prices changed so much and so often. 14 of 11 1. The rate of change of prices is important in the economy. 2. A high inflation rate imposes overall costs on the economy: shoe-leather costs, menu costs, and unit-of-account costs. 3. Inflation does not, as many assume, make everyone poorer by raising the level of prices because wages and incomes are adjusted to take into account a rising price level, leaving real wages and real income unaffected. 4. A higher-than-expected inflation rate is good for borrowers and bad for lenders. A lower-than expected inflation rate is good for lenders and bad for borrowers. 5. Disinflation is very costly, so policy makers try to prevent inflation from becoming excessive in the first place. 15 of 11 Price Level versus the Inflation Rate, 1969–2009….Notice how by 2009 costs of items are much higher than the actual inflation rate thus reducing the purchasing power of the consumer. Notice the “Stagflation Era” of the early 1980s. How is Inflation measured? (Module 15) The government tracks the prices of the same goods and services each year. • This “market basket” is made up of about 300 commonly purchased goods • The Inflation Rate-% change in prices in 1 year • Then compare changes in prices to a given base year (usually 1982) • Prices of subsequent years are then expressed as a percentage of the base year • Examples: •2005 inflation rate was 3.4% •U.S. prices have increase 98.3% since 1982 (base year). World Inflation Rates Historic Inflation Rates Price Indexes and the Aggregate Price Level • To determine the aggregate price level, we use a Market Basket. • A price index is the ratio of the current cost of that market basket to the cost in a base year, multiplied by 100. 24 of 12 The most commonly used method to determine inflation for consumers is the Consumer Price Index Here is how it works: • The base year is given an index of 100 • To compare, each year is given an index # as well CPI = Price of market basket Price of market basket in base year x 100 1997 Market Basket: Movie is $6 & Pizza is $14 Total = $20 (Index of Base Year = 100) 2009 Market Basket: Movie is $8 & Pizza is $17 Total = $25 (Index of 125) •This means inflation increased 25% b/w ’97 & ‘09 •Items that cost $100 in ’97 cost $125 in ‘09 The CPI, 1913–2009 The Market Basket of Goods used to compute the Consumer Price Index in 2008. Inflation Rate, CPI, and other• Indexes The inflation rate is the yearly percentage change in a price index, typically based upon Consumer Price Index, or CPI, the most common measure of the aggregate price level. • The CPI measures the cost of the market basket of a typical urban American family. 28 of 12 Table 15.1 Calculating the Cost of a Market Basket Krugman and Wells: Macroeconomics, Second Edition in Modules Copyright © 2012 by Worth Publishers Example on the board Figure 15.3 The CPI, the PPI, and the GDP Deflator Krugman and Wells: Macroeconomics, Second Edition in Modules Copyright © 2012 by Worth Publishers Market Baskets and Price Indexes Calculating GDP and Real GDP in a Simple Economy Pre-frost Post-frost Price of orange $0.20 $0.40 Price of grapefruit 0.60 1.00 Price of lemon 0.25 0.45 Cost of market basket (200 × $0.20) + (200 × $0.40) + (200 oranges, 50 grapefruit, (50 × $0.60) + (50 × $1.00) + 100 lemons) (100 × $0.25) = $95.00 (100 × $0.45) = $175.00 32 of 12 Other Price Measures • A similar index to CPI for goods purchased by firms is the producer price index. • Economists also use the GDP deflator, which measures the price level by calculating the ratio of nominal to real GDP. • The GDP deflator for a given year is 100 times the ratio of nominal GDP to real GDP in that year. 33 of 12 CPI vs. GDP Deflator The GDP deflator measures the prices of all goods produced, whereas the CPI measures prices of only the goods and services bought by consumers. An increase in the price of goods bought by firms or the government will show up in the GDP deflator but not in the CPI. The GDP deflator includes only those goods and services produced domestically. Imported goods are not a part of GDP and therefore don’t show up in the GDP deflator. GDP Deflator = Nominal GDP Real GDP x 100 If the nominal GDP in ’09 was 25 and the real GDP (compared to a base year) was 20 how much is the GDP Deflator? Calculating GDP Deflator GDP Deflator Nominal GDP = = Nominal GDP Real GDP x 100 (Deflator) x (Real GDP) 100 The CPI, the PPI, and the GDP Deflator 36 of 12 Indexing to the CPI • The CPI has a direct and immediate impact on millions of Americans. • Many payments are tied, or “indexed,” to the CPI. • Today, 48 million people receive checks from Social Security. In addition, all Social Security payments are adjusted each year to offset any increase in consumer prices over the previous year. • The CPI is used to calculate the official estimate of the inflation rate used to adjust these payments yearly. 37 of 12 1. To measure the aggregate price level, economists calculate the cost of purchasing a market basket. 2. A price index is the ratio of the current cost of that market basket to the cost in a selected base year, multiplied by 100. 3. The inflation rate is the yearly percent change in a price index, typically based on the consumer price index the most common measure of the aggregate price level. 4. A similar index for goods and services purchased by firms is the producer price index. Finally, economists also use the GDP deflator, which measures the price level by calculating the ratio of nominal to real GDP times 100. 38 of 12 So What Do You Actually Understand? • Modules 10-15 Review Questions 51. GDP is: A) the monetary value of all goods and services (final, intermediate, and non-market) produced in a given year. B) total resource income less taxes, saving, and spending on exports. C) the economic value of all economic resources used in the production of a year's output. D) the market value of all final goods and services produced within a nation in a specific year. 52. GDP can be calculated by summing: A) consumption, investment, government purchases, exports, and imports. B) consumption, investment, government purchases, and imports. C) investment, government purchases, consumption, and net exports. D) consumption, investment, wages, and rents. 53. Net exports are negative when: A) a nation's imports exceed its exports. B) the economy's stock of capital goods is declining. C) depreciation exceeds domestic investment. D) a nation's exports exceed its imports. E) the government increases trade barriers 54. Historically, real GDP has increased less rapidly than nominal GDP because: A) price indices have not reflected improvements in product quality. B) the general prices have increased. C) technological progress has resulted in more efficient production. D) the general prices have declined. E) nominal GDP is adjusted for inflation 55. Which of the following best measures a nation’s standard of living: A) unemployment rate. B) nominal GDP. C) total consumption and government spending D) real GDP per capita. E) inflation rate 56. The phase of the business cycle in which real GDP declines for at least 2 quarters is called: A) the peak. B) a recovery. C) a recession. D) the trough. E) a depression 57. Assuming the total population is 100 million, the civilian labor force is 50 million, and 47 million workers are employed, the unemployment rate: A) is 3 percent. B) is 6 percent. C) is 7 percent. D) is 9 percent. E) cannot be determined because we do not know how many workers are retired. 58. Which of the following is correct? A) The unemployment rates of men and women workers are roughly the same. B) Unemployment rates for black and white workers are approximately the same. C) Teenagers experience approximately the same unemployment rates as do adults. D) Laborers are less vulnerable to unemployment than are professional workers. 59. Kim quit her job as an insurance agent to return to school full-time to earn an MBA degree. She is now done with school and is searching for a position in management. Kim is: A) cyclically unemployed. C) frictionally unemployed. B) The presence structurally D) not in the labor 60. of unemployed. “discouraged workers”: force. A) increases the size of the labor force, but does not affect the unemployment rate. B) reduces the size of the labor force, but does not affect the unemployment rate. C) may cause the official unemployment rate to understate the amount of unemployment. D) may cause the official unemployment rate to overstate the amount of unemployment. Answers 51.D 52.C 53.A 54.B 55.D 56.C 57.B 58.A 59.C 60.C Sample Calculations 1. In an economy, Real GDP (base year = 1996) is $100 billion and the Nominal GDP is $150 billion. Calculate the GDP deflator. 2. In an economy, Real GDP (base year = 1996) is $125 billion and the Nominal GDP is $150 billion. Calculate the GDP deflator. 3. In an economy, Real GDP for year 2002 (base year = 1996) is $200 billion and the GDP deflator 2002 (base year = 1996) is 120. Calculate the Nominal GDP for 2002. 4. In an economy, Nominal GDP for year 2005 (base year = 1996) is $60 billion and the GDP deflator 2005 (base year = 1996) is 120. Calculate the Real GDP for 2005. Calculating CPI Year 1 2 3 4 5 Units of Price Output Per Unit 10 10 15 20 25 Nominal, GDP Real, GDP CPI/ GDP Deflator (Year 1 as Base Year) $4 5 6 8 4 Make year one the base year CPI = Price of market basket in the particular year x 100 Price of the same market basket in base year Inflation Rate Calculating CPI Year 1 2 3 4 5 Units of Price Output Per Unit 10 10 15 20 25 $4 5 6 8 4 Nominal, GDP Real, GDP CPI/ GDP Deflator (Year 1 as Base Year) $40 50 90 160 100 $40 40 60 80 100 100 125 150 200 100 Inflation Rate N/A 25% 20% 33.33% -50% Inflation Rate % Change in Prices = Year 2 - Year 1 Year 1 X 100 Practice Year 1 2 3 4 5 Units of Price Output Per Unit 5 10 20 40 50 $6 8 10 12 14 Nominal, GDP Real, GDP $30 80 200 480 700 $50 100 200 400 500 Consumer Price Index (Year 3 as Base Year) 60 80 100 120 140 Make year three the base year CPI = Price of market basket in the particular year Price of the same market basket in base year x 100 Problems with using CPI as a Measurement 1. Substitution Bias- As prices increase for the fixed market basket, consumers buy less of these products and more substitutes that may not be part of the market basket. (Result: CPI may be higher than what consumers are really paying) 2. New Products- The CPI market basket may not include the newest consumer products. (Result: CPI measures prices but not the increase in choices) 3. Product Quality- The CPI ignores both improvements and decline in product quality. (Result: CPI may suggest that prices stay the same though the economic well being has improved significantly)