Building the Biotechnology Sector in Houston

advertisement

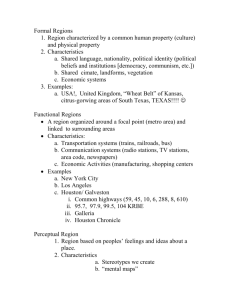

Building the Biotechnology Sector in Houston • Introduction • Houston Biotechnology Atmosphere • Why so few companies? • Possible solutions Building the Biotechnology Sector in Houston • Introduction • Houston Biotechnology Atmosphere • Why so few companies? • Possible solutions Building the Biotechnology Sector in Houston • Introduction • Houston Biotechnology Atmosphere • Why so few companies? • Possible solutions BioHouston Background Non-profit 501(c)3 founded by Houston-area research institutions to develop the Houston region – defined as College Station, to The Woodlands, to Galveston Northcut Gillis Mendelsohn Regional Research Strength from College Station to Galveston • Texas Medical Center – – – – Largest medical center in the world; 42+ member institutions $2.1 billion spent for additions to facilities from 2002-2004 800+ acres; 100+ permanent buildings Ground broken for The University of Texas Research Park • Texas A&M University-College Station – Ranked 11th by NSF for total research and development expenditures – 5,200+ acres, including a 324-acre research park – 2.5M+ square feet of research space • University of Texas Medical Branch-Galveston – Ranked 19th of 121 medical schools in NIH funding – 84 acres; 77 major buildings – 385k+ square feet of research space Massive but under-recognized research and commercialization assets World Class Research Institutions Leading Medical Institutions in the U.S. Baylor College of Medicine Methodist Hospital • • #10 in Neurology and Neurosurgery • #17 in Cardiology and Cardiac Surgery #1 in Pediatric Research funding-NIH (with TCH) • #11 in NIH Awards to Med Schools-NIH • #13 Research Intensive Medical Schools The University of Texas M. D. Anderson Cancer Center Rice University • #1 in Nanotechnology Commercialization • #1 in Oncology The University of Texas Health Science Center School of Public Health • #5 in Gynecology • • #10 in Urology Texas Children’s Hospital • #10 in Ear, Nose and Throat • • #10 in Rehabilitation #1 in Pediatric Research funding-NIH (with BCM) • #4 in Pediatrics The University of Texas Medical Branch #1 in Health Education Texas Heart Institute • 1 of 2 Infectious Disease and Biodefense National Laboratories • 1 of 6 Regional Centers of Excellence for Biodefense University of Houston • #19 in NIH Awards to Med Schools-NIH • Source: U.S. News and World Report, 2004, NIH database, Small Times • #9 in Cardiology and Cardiac Surgery #2 in Health Law Other Selected Centers of Excellence Brown Foundation Institute for Molecular Medicine • Gulf Coast Consortium for Bioinformatics • Gulf Coast Center for Computational Cancer Research • John S. Dunn, Se. GCC for Chemical Genomics • John S. Dunn, Sr. GCC For Magnetic Resonance • Gulf Coast Consortium for Membrane Biology • Gulf Coast Consortium for Protein Crystallography • Gulf Coast Consortium for Theoretical and Computational Neuroscience Research Leadership • Historical firsts: – First multiple organ – – – – – – transplant First identification of C60 First draft of the human genome One of two National Biocontainment Labs First artificial artery First successfully cloned companion animal First total heart transplant • National Recognition: – Three Nobel laureates – 16 members of the National Academy of Sciences – Two Presidential Advisors – Hundreds of members of national academies • Next Generation of Leaders: Source: Battelle Memorial Institute and the State Science and Technology Institute study – #2 in higher education degrees in bioscience – #3 for university expenditures in biosciences – 22,000+ biomedical students in the Texas Medical Center Houston region highlights • Total annual academic research investments exceed $1.5 billion • 140+ life science companies • Number of companies has doubled since 2003 • Approximately 1/3 are therapeutic, 1/3 are device and 1/3 are tools and service providers • Recent VC investment activity in region Best Biotech Fields for Houston to Grow Cardiovascular Medicine Nanotechnology Metabolic Diseases Oncology Biodefense / Infectious Disease Genomics Genetics Neuroscience Texas Emerging Technology Fund • Initiated in 2005. • $175 million in funds available • $52.9 million in total statewide life science grants have been awarded or are currently under final review by State leadership • 9 Houston region life science companies have received grants for $10.1 million since inception • Texas Life Science Committee conducts extensive due diligence (business/science/IP) on technologies and companies before forwarding to leadership for final approvals $3 Billion Cancer Research Initiative Approved in November 2007 • Established Cancer Prevention and Research Institute of Texas • Peer reviewed distribution of up to $300 mm in grants per year over next decade • Every $1 invested will require $0.50 in matching spending by recipient organizations • Public and private educational institutions and medical research facilities will be eligible for grants • First investment expected in 2009 Tanox A 20-year and $919 Million Journey to Success Snapshot of Success • The Houston region is home to the 2 largest IPO’s in biotech history: – Tanox: Acquired by Genentech for $919 million in 2007 – Lexicon Pharmaceuticals: Ten products in clinical pipeline – – – – Also… Agennix: Developing drugs for cancer and diabetic ulcers; in late-stage trials for NSCLC Cyberonics: VNSTherapy for epilepsy and depression Introgen Therapeutics: In late-stage development of ADVEXIN to treat head and neck cancer Repros Therapeutics: Lead drug Proeelex; IND will be submitted to initiate Phase 3 trials for Uterine Fibroid indications Introgen Texas Life Science Conference • Largest investment conference in Southwestern U.S. • 2007 Conference – – – – More than $6 billion in current funds in attendance 50+ company presentations Record attendance Texas Governor Rick Perry addressed meeting • 2008 Conference will be held November 5-7 Why Houston? “Nowhere in the country is there such research infrastructure, scientific leadership, and patient numbers in such close proximity.” Building the Biotechnology Sector in Houston • Introduction • Houston Biotechnology Atmosphere • Why so few companies? • Possible solutions Why so few companies? • Everybody wants to be “the next San Diego”. • Institutions doing more development. • Easier to export ideas and talent. • Lack of experienced management. • No soft landing for failures. • Insufficient informed Venture Capital. • Unfamiliar value proposition. Building the Biotechnology Sector in Houston • Introduction • Houston Biotechnology Atmosphere • Why so few companies? • Possible solutions Possible solutions • Support pump priming efforts • Insist on regional cooperation • Strategic recruiting • Monitor the ETF and CPRIT $ • Philanthropic investments