Tax Savings. Delivered. Cost Segregation

advertisement

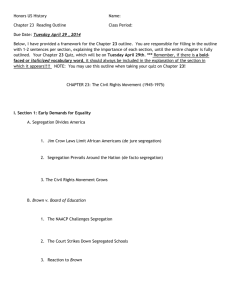

The Implementation of the Tangible Property Regulations Cost Segregation Services, Inc. Copyright © 2014 ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation When was the last time you did something for the 1st time? Research Implementation Contact Trusted Advisor Analysis Experienced Recommend Advisor ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation TPR Implementation Cycle CSSI Resource Guide Implementation Preliminary Analysis Recommend Process Friend Trusted Advisor Cost Segregation Professional Advisor ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Bio ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Capitalize or Expense? Welcome to the Tangible Property Regs General framework for distinguishing Capital Expenditures from: • Supplies • Repairs • Maintenance ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Capitalize or Expense? Welcome to the Tangible Property Regs • 10 yrs. 300+ Pages • Acquire, Produce, Improve Tangible Property • Not Many Bright Lines • Lots of Examples ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation You Need to: Make Your Clients Aware… Before it’s TOO LATE • Advantage to write off Late Partial Dispositions. • “Use It or Lose it” Deadlines in tax year 2014? • Need a Capitalization Policy for tangible property less than $500 per invoice by … January 1, 2014 ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Today’s Agenda Actions to Take • Overview of the Regulations- Resource Documents. • Greatest Impact to Tax Professionals. • How to: Applying Partial Disposition. • Cost Segregation and how it helps in applying TPR. • Improvement Standards Basics for UOP. • Safe Harbors for your clients. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Research How to Implement the TPRs ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Request These Resource Docs AICPA 6 Page Bullet Summary Questions and Answers CCH - Executive Summaries Index of Examples in Fed Register ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation AICPA Resources: Summary Chart Written Policy Template - Webcast Quick Summary Chart of Final TPR Implementing the new TPR – Journal of Accountancy • This is the most concise summary of the regulations in the industry. Six pages in bullet form. You will want to print this and keep it as a document to refer to when reading other articles. • If you only look at one, this is the one to look at. “5 Stars” ***** • Great Overview of the TPR that discusses the difficulties of implementation. • Circular 230 Implications for Tax Professionals - discusses compliance risks. Written Policy Template from AICPA • OMG! You just found out that your client needs a Capitalization Policy in Place starting January 1 to be eligible for the De minimis Rule Safe Harbor. • This document is priceless if your client does not have this in place already. Look under “Sample Written Book Capitalization Policy”. 5 stars***** Final Repair Regulations Dissected • AICPA Webcast • A two hour presentation that provides insight on the new rules • Aired Oct. 23, 2013 • Webinar at “Final Repair Regulations Dissected” Link ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Journal of Accountancy Implementing the New Tangible Property Regulations ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Journal of Accountancy Implementing the New Tangible Property Regulations • “These rules will affect every TP that uses Tangible Property in its business…” • “The rules are all-encompassing and complex…” • “TP may need to devise new collection procedures to capture the necessary data to implement these regulations.” ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Journal of Accountancy Implementing the New Tangible Property Regulations • “Circular 230 may present challenges to practitioners in signing tax returns of clients that have not implemented the final regulations.” • “Due to the challenges of the regulations, waiting to address these issues until completing the 2014 tax return is ill-advised.” ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Tangible Property Regulations Resource Guidance on Deductions & Capitalization Table of Contents Small Taxpayer Safe Harbor Examples Materials and Supplies Examples Betterment Examples De minimis Rule Safe Harbor Examples Adaptation Examples Routine Maintenance Safe Harbor Examples Restoration Examples ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Tangible Property Regulations Resource Guidance on Deductions & Capitalization ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Tangible Property Regulations Resource Guidance on Deductions & Capitalization ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Tangible Property Regulations General Framework Dispositions Cost to Improve Tangible Property Materials and Supplies Cost to Acquire Tangible Property ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Benefit to your Client • Includes: – Sale or Exchange – Retirement – Physical Abandonment – Destruction – Transfer to supplies or scrap – Involuntary conversion – Retirement of a structural component of (or improvement to) a building. Section 168 ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Benefit to your Client Ability to write off assets that are no longer in use with Partial Disposition Election • Renovations • Remodels • Replacements • Abandoned in Place • Common Items – Roofs, HVAC, Electrical ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Catch Up Provision • Know the Value of what went into the Dumpster. • Relative to the value that your client paid for the building. • Disposed of as a Partial Disposition. • Write down to the basis of the property in year 2014. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Benefit to your Client Partial Disposition Election 1.168(i)-8(d)(2) • PAST YEARS: Requires Change in Accounting Method Form 3115 and 481(a) adjustment to “catch up” (196). • CURRENT & FUTURE YEARS: The election is made in the taxable year that the disposition occurs starting in 2014 and for new properties purchased. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Example: A business owner buys 20 year old building and replaces the Roof after 5 years of ownership. Old Regs: 5 years 39 years Cost of Roof Hidden in Building Asset Basis Roof 2 added asset ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Example: A business owner buys 20 year old building and replaces the Roof after 5 years of ownership. New Regs: 5 years 39 years Original Building Asset New Roof Asset ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Example: • $1.5 m Nursing Home with major renovations • $91k in assets removed = Asset Valuation Study • $31k in cash flow • Basis Write Down • Tax Savings at Sale 5 yr. property (35-41%) recaptured at Capital Gains Rate (20%) ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Role of Cost Segregation ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Role of Cost Segregation Example: • Asset Valuation - $53k • Cost Segregation on Renovation - $126k Year of “Opt In” Matters • 2013, 2014 Get Both • 2015 No Past Disposition: Lose $53K ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Tax Professionals Ask #1 Question How do I get “The Number”? IRS says to use: • Reasonable Method • Cost Segregation is a Certain Method ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Reasonable Methods Discounting the cost of the replacement asset to its placed-in-service year cost using the Consumer Price Index. Appropriate for small projects, new equipment. Pro rata Allocation. Both Methods need a valuation of the Unit of Property affected. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Reasonable Methods A Study allocating the cost of the asset to its individual components. This provides the proper valuation of the affected building assets. “Cost Segregation is a certain method.” ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Cost Segregation Method • • • • • • • Labor to Remove Materials Disposal Fees Identify Items Removed Quantify Items Value Items Determine the remaining basis Write Down of Basis is a permanent tax reduction at the time of sale. • • • Personal Property Sec 1245 35-40% Real Property Section 1250 25% Capital Gains 20% ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Cost Segregation Method • Building Plans – Cost Detail Review • IRS accepted Cost Allocation Methods • Defined Engineering-based Methodology • The Study: Report Form meets IRS Report Criteria • Defendable ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Dispositions Asset Valuation Study Works for all applications: • Large Renovations • Complicated Remodels • Retired Components and Partial Disposition ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Explaining Cost Segregation The process of analyzing and identifying commercial building components that are eligible for accelerated depreciation providing a significant tax benefit for the taxpayer. Personal Property is Segregated from Real Property $50k to $80k per $1 Million in Cost Works on $250k buildings ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Explaining Cost Segregation Straight-Line • Hamburger Cost Segregation • • • • • • • 2 All Beef Patties Special Sauce Lettuce Cheese Pickles Onions on a Sesame Seed Bun ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Explaining Cost Segregation Straight-Line Cost Segregation • Looks at the building as a Whole • Identifies Parts and Pieces of the building • Structural Building Components • Non-Structural Building Components • Depreciated over 39yrs (27.5yrs) • Depreciated over 5, 7 & 15 years • Real Property Only • Personal Property & Real Property ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Explaining Cost Segregation Upgrade your Depreciation Strategy Straight Line Cost Segregation in HD ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Explaining Cost Segregation 5 & 7 Year Property Decorative building elements, wallpaper Specialty electrical, plumbing, mechanical Carpet, flooring, crown moldings, Built In cabinets, counter tops, millwork Security, special lighting, window treatments Communications, cable Kitchen fixtures, refrigeration equipment 15 Year Property Landscaping, paving, fencing, site utilities, parking lot, signage, sidewalks, sprinklers, walkways ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Explaining Cost Segregation • An Engineering-Based Study of the building for tax purposes. • Produce a Report that the Tax Professional submits with the return. • Automatically accepted by IRS. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Explaining Cost Segregation The Applications Current Buildings Acquired after 1986 New Construction New Acquisitions Renovations / Leasehold Improvements ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Explaining Cost Segregation Types of Commercial Buildings • • • • • • • • • • • Apartment complex, Condominium Auto Dealership Shopping Mall, Strip Center Restaurant Hotel/Motel Medical/Dental/Veterinary Facilities/Surgical Nursing Homes/Assisted Living Office Buildings, Banks Retail Chains/Franchises/Leasehold Space Self Storage, Mini Warehouses Supermarkets, Furniture Stores Etc… ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Information Needed To Run Preliminary Analysis • Depreciation Schedule is best • • • • What type of Building? What did they pay for the building? (without the land) When did they purchase it? Have there been any major renovations or remodels? ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost Segregation Process of Application • Gather Documents for Engineers • Completed in 4-6 weeks • CPA will apply to return • No need to Amend Past Tax Years • Benefits start in next Quarter ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost Segregation vs. Straight-Line Depreciation ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost Segregation vs. Straight-Line Depreciation Eighth Wonder of the World ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost Segregation vs. Straight-Line Depreciation Eighth Wonder of the World ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost Segregation vs. Straight-Line Depreciation ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Financial Results of Cost Segregation Project #9501 Building Cost $ 250,176 (with-out land) Tax Savings Benefit: $32,845 Study Fee Before Tax: Study Fee After Tax: $2,420 $1,549 ROI: 21:1 ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Financial Results of Cost Segregation Building Cost $324,000 (with-out land) Tax Savings Benefit: Study Fee Before Tax: Study Fee After Tax: ROI: $52,856 $3,400 $2,176 24:1 ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Financial Results of Cost Segregation Project # 9503 Building Cost $5,246,908 (with-out land) Tax Savings Benefit: $312,687 Study Fee Before Tax: Study Fee After Tax: $14,900 $9,536 ROI: 33:1 ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Tangible Property Regulations Opportunity & Issues Late Partial Disposition 2014 2014 Final only Scope Limitations: Temp and Final Allows for multiple 3115 Correct Past Capitalization – Expense Issues / Disposition 2014,Future: Automatic Partial Disposition is an Annual Election In the tax year item removed…Allows for duplicate assets in depreciation if no disposition taken Final Tangible Regulations Automatic Enrollment ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Solution: It’s the Process • Find all clients with depreciation on building assets. • Qualify clients with estimated Disposition and Cost Segregation economic needs. • Get an Engineering-based Study that meets the IRS’s guideline. • Apply the Change in Accounting Method Form 3115 & 481(a) with study results to the client’s return. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Improvement Standards Improvement Standards • Deductible Repair • Capitalized Improvement BAR TEST ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Improvement Standards BAR TEST Betterments Adaptations Restorations Capitalize Improvements ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Improvement Standards Capitalize…Amounts paid for new building or improvements 1.263(a)-3. - that increase value of property - bring property to new or different use - return of original condition Expense... Amounts paid for incidental repairs and maintenance of property 1.263 (a)-1. Refresh - keeps in ordinary operating condition ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Unit of Property - UOP For Real and Personal Property (except buildings) • A Unit of Property is comprised of all components that are functionally interdependent (i.e., the placing in service of one component is dependent on the placing in service of the other component). For Buildings - Each Building is a UOP • Straight Line Each Building is a UOP • Cost Segregation - Each Building’s 5,7,15 & 39 (27.5) yr. depreciable lives property groups are UOPs ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Capitalize or Expense? Can I expense this invoice? Betterment- Adaptation- Renovation? What do I compare it to? The Building? ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Compare Invoice to Building Systems Building Structural Components ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Building Structural Components* Building Systems Building & Structural Components, HVAC Fire Protection Sys. Elevators/Escalators Electrical, Plumbing Gas Distribution Security Sys. Other • • • • • • • Roof Windows Exterior Framing Insulation Doors Foundation * - Discreet and Critical Function ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost Segregation Expertise HD Study Building Elements/Units of Property Building Components $ 6.00 Cabinets / Millwork Moldings Wood Paneling Flooring - Vinyl Tile Flooring - Carpet Window Treatments Air Curtain Building Signage Specialty Electrical - Kitchen Equip. Communication / Data $ $ $ $ $ $ $ $ $ $ 20,085.41 8,286.30 2,062.22 519.68 9,084.00 187.90 1,709.08 122.56 15,216.78 32,356.35 Specialty Plumbing - Cooler Equip. / Kitchen Sinks Security / Exterior Lighting FRP Wall Panels Rear Entry Canopy Interior Overhead Doors - Security Slatwall / Pegboard Paneling Surveillance System Interior Wood Trellis Systems Liner Panels Paging System Windmill Exhaust Hood Fire Extinguishers Cooler Movable Storage Units $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 10,181.63 9,827.88 1,003.24 20,084.92 21,931.82 9,657.00 4,375.25 6,046.21 109,271.70 1,688.23 17,244.53 11,258.61 1,833.25 10,635.63 30,431.69 Site Work / Improvements Water Well $ 5,464,546.00 $ 19,318.45 Site Drainage $ 48,990.57 Parking Lot $ 138,639.38 Exterior Signage Structure $ 17,790.84 Parking Lot Striping / Barriers $ 23,325.00 Sidewalks $ 711.12 Landscaping $ 68,635.17 Security Lighting Poles $ 6,374.77 Aggregate Base Paved Area $ 192,436.06 Exterior Fencing / Decking $ 31,986.93 Retaining Walls $ 16,024.07 Fabricated Steel - Bollards $ 2,926.12 Patio Concrete $ 10,848.65 Exterior Wood Trellis Systems $ 2,783.73 Gazebo $ 4,605.26 Building Structure Structural Components Roofing Systems Foundations HVAC Electrical Plumbing Masonry Doors & Windows Insulation Gas Distribution Drywall Painting Fire Protection & Alarm Gutters & Downspouts $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 8.00 559,508.38 66,975.93 234,535.89 179,747.78 242,472.40 68,844.81 40,657.35 17,063.50 43,168.87 4,989.84 13,092.14 23,796.64 15,192.82 12,335.58 Cost to Improve Tangible Property Depreciation of UOP Improvement Standards Each Building is a Unit of Property Or Each Building’s Property by Class Life • 5 yr. Property • 7 yr. Property • 15 yr. Property • 39 (27.5) yr. Property BAR Test ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Request These Resource Docs AICPA 6 Page Bullet Summary Questions and Answers CCH - Executive Summaries Index of Examples in Fed Register ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Safe Harbor Issues ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Acquire Tangible Property De minimis Safe Harbor • With AFS - $5,000 per invoice (or per item as substantiated by invoice) • Written policy in place at beginning of year. • Policy to expense for amounts under a certain dollar amount or property with an economic useful life of 12 months or less. • Treats the amounts as expenses on the AFS as well. • Without AFS: - $500 per invoice (or per item as substantiated by invoice) • Policy in place at beginning of year (written policy not required) for amounts under certain dollar amounts or property with an economic useful life of 12 months or less. **Action Item: $5000 with AFS - Must have written expensing policies in place at the beginning of the tax year. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Materials and Supplies • UOP with a useful life of < or = 12 months; • Fuel, lubricants, water, & similar items expected to be consumed < or =12 months from beginning of use; • Costing $200 or less (up from $100 in temp regs). Defined as tangible property used in taxpayer's business that is not inventory and A component acquired to maintain, repair, or improve a UOP that is not acquired as part of any single UOP. Reg Sec 1.162.-3 Requires a Form 3115 ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Routine Maintenance Safe Harbor Expenses • Deductible if you reasonably expect (at time UOP is placed in service) to perform more than once during the 10 year period from when the building system was placed in service. • Safe Harbor does not apply to Betterments, Adaptations, or some Restorations (see Reg. § 1.263(a)-3(i)(3)) • Requires submission of Form 3115 to adopt ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost to Improve Tangible Property Small Taxpayer Safe Harbor for Buildings • Can elect “not to apply” improvement rules to eligible buildings if the annual amount spent is less than $10,000 or 2% of unadjusted basis on a building-by- building basis. • May be written off as repairs. • Example: $300k building = $6,000 limit • If limit is exceeded, does not apply to any amounts ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Journal of Accountancy Article “Clearly, the new repair regulations pose considerable compliance risks both for CPAs and the businesses they advise.” Journal of Accountancy Feb 2014 Implementing the New Tangible Property Regulations Christian Wood. J.D. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Recommendations: Take Action • Acquisition Cost • Prepare to make De minimis Safe Harbor election. (AICPA Form Provided) • Check adequacy of written procedures for the De minimis Safe Harbor before beginning of the year. • Educate Clients to change policies, track expenses per UOP - (Dear Client Letter). • Repair and Maintenance Cost • Apply Routine Maintenance Safe Harbor to cyclical maintenance on buildings and other property (3115 req.). • File book conformity election for capitalized improvements. • Resources and Enhanced Capabilities • Determine Implementation Work Load (3115’s, UOP revisions) • Identify & Qualify Late Partial Disposition / Cost Seg candidates. • Partner with a Cost Segregation Firm. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Solution: It’s the Process • Find all clients with depreciation on building assets. • Qualify clients with estimated Disposition and Cost Segregation economic needs. • Get an Engineering-based Study that meets the IRS’s guideline. • Apply the Change in Accounting Method Form 3115 & 481(a) with study results to the client’s return. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation CPA Implementation Process Partnering Qualification & Analysis Client Contact & Execution Proposal ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Cost Segregation & Asset Valuations Expected Results of the CSSI Process Ease of Compliance CPA: 1-2 hrs per client Timely completion Additional Revenue $1,000-$3,000 per client Client Satisfaction 100%: Grateful for effort to save taxes ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Recommendations: Take Action List • • • • • • • • • • • Late Partial Disposition study for 2014 tax year deadline. Cost Segregation Preliminary Analysis. Capitalization Policy in Place – AICPA Template. De minimis Safe Harbor or Materials and Supply. Routine Maintenance Safe Harbor Form 3115. Units of Properties Defined on Dep. Schedule. Track Expenses per Building and per Building Sys. Book Conformity. Dear Client Letter – Start selling difficulty. Resources to file CAM Form 3115 & 481(a) Partner with Cost Segregation Firm (CSSI) ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Use the CSSI Experience Tax Savings. Delivered. Performing Engineering-based Studies for over 13 years, National capability, 9,500 Studies completed across the U.S., always on-time. Qualify the tax savings estimates within 48 hrs. for your client. Full Engineering-based Studies completed in 4-8 weeks. Perform Change in Accounting Method Form 3115 and 481(a) adjustments. Use CSSI as your engineering-based service provider for your clients. ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation Thank You Looking forward to your call Bill McCormick Cost Segregation Services, Inc. (CSSI) 802-728-2044 wfm@costsegserve.com David Deshotels David@CostSegregationServices.com www.CostSegregationServices.com ©2014 Tax Savings. Delivered. Cost Segregation - TPR Implementation