Cost Segregation

advertisement

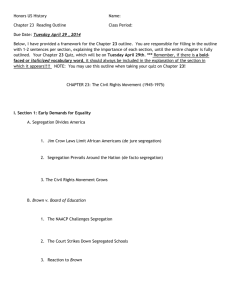

Cost Segregation and Fixed Assets Cost Segregation Services Idea Description • Accelerating Depreciation Deductions and increasing Cash Flow on Real Estate and Leasehold Improvements • Most Taxpayers Overstate 39-Year Real Property • A Cost Segregation Study Optimizes Depreciation Deductions while Documenting and Supporting Asset Reclassifications • Maximizing Personal Property Results in Substantial Cash Flow Benefits Cost Segregation Services Cash Flow Model 100,000.00 90,000.00 80,000.00 70,000.00 60,000.00 5 50,000.00 40,000.00 15 30,000.00 25 20,000.00 35 10,000.00 0.00 Types of Cost Segregation Studies • New Construction • “Ground Up” • “Improvements” • Purchased Property • Retroactive • “Fixed Asset Review” Audit Techniques Guide Cost Segregation Methodologies • Detailed engineering approach from actual cost records • Detailed engineering cost estimate approach • Survey or letter approach • Residual estimation approach • Sampling or modeling approach • “Rule of thumb” approach Cost Segregation Example: Manufacturing Property Study Details: A manufacturing client purchased and renovated a 100,000 square foot manufacturing facility at a cost of $11 million. McGuire Sponsel was hired to complete a cost segregation study as well as a 179D Energy Efficient Building Study. Cost Segregation Example: Manufacturing Property (cont’d) Study Results: Our Team classified approximately 28% of the facility to shorter lives, helped the client realize $180,000 in 179D deductions, and secured 30% tax credits on more than $350,000 in photovoltaic cells. These deductions and credits saved the client over $800,000. Complex Issues/Updates 263(a) • New Temporary Regulations issued 12/23/11 • Allows for the disposal of part of a larger asset • Roofs or lighting can be written off when replaced • Clarifies when a project is Capital v. Repair • Tests for “Betterment” • Review by “Unit of Property” Forgiveness of Debt • Can Trigger Tax Payment, Cost Segregation may offset this penalty New 263(a) Regulations Temporary Regulations to expand and clarify the treatment of tangible property under 263(a) and 162(a) • Defines “Unit of Property” under §1.263(a)-3T • Separate building and specific “building systems” • “Building Systems” include HVAC, plumbing, electrical, etc. • A betterment to a “Unit of Property” is a betterment to the system • Provides examples and rules for when a project is Capital v. Expense • Allows for the retirement of a structural component under Section 168 • A replacement of a roof allows for the retirement of the original roof • Requires that the new project be capital and not repair and maintenance • Underscores the importance of a detailed cost segregation to show values of assets that may someday be written off Forgiveness of Debt • Forgiveness of Debt may trigger taxable income • A cost segregation study may be able to offset this income • Where a Section 108 Analysis is completed, Insolvency and FMV of assets are not based on tax depreciation • • Can be used in conjunction with cost segregation study Cost segregation will accelerate deductions as of 12/31 of the prior year. Section 108 reduction in basis occurs at the time of the transaction so they can be used together to eliminate tax liability. Recent Court Cases • Ronald and Daryl Pearce v. Department of Revenue, State of Oregon • Deals with a cost segregation study being done by a unqualified preparer • Peco Foods v. Commissioner • Effect of a detailed Section 1060 Allocation on a cost segregation study completed in the future • AmeriSouth XXXII v. Commissioner • Cost segregation studies on apartments “Oregon Case” • Ronald and Daryl Pearce v. Department of Revenue, State of Oregon • • • • Deals with a cost segregation study being done by a unqualified preparer Did not want to pay for a full cost segregation study Used their own assumptions/estimates Court allowed for the depreciation study to be reviewed even though it was from a closed year (2004) • Calculations from closed years can be reviewed to determine the affect on open years • Closed years can’t be adjusted but open years can be adjusted based on errors Peco Foods • Peco Foods, Inc & Subsidiaries v. Commissioner of Internal Revenue • • • • Cost segregation completed after an asset based purchased Section 1060 allocation agreed to for “all purposes” Cost segregation attempted to change allocation on a 3115 Court ruled Section 1060 allocations permanent • “Whipsaw” effect • Conclusions • Get provider involved early in asset based transactions • Be careful with filing of 8594 (only agree to totals of Category V property) AmeriSouth • AmeriSouth XXXII, Ltd. v. Commissioner • Deals with apartments • Court ruled against traditional items of 1245 property, but only for apartments • Kitchen Cabinetry • Kitchen Hoods • Decorative Millwork • Poorly prepared and defended study • Study very aggressive • Not defended well on audit (owner stopped responding) • Still sets legal authority What these Cases have in Common • Under qualified Practitioners • Poor Defense and Council under audit • Create Legal Authority These cases are not isolated. McGuire Sponsel sees other situations where users are getting into trouble under audit due to the use of less qualified preparers. These three examples are the only ones published since they went to tax court. Federal Tax Incentives for Green Building Design and Construction • Alternative Energy Tax Credits • Solar • Wind • Geothermal • Energy Efficient Building Deductions (179D) • Owner • Designer • Other Misc. Credits/Incentives Alternative Energy Tax Credits • Under Section 45 and 48 of the Tax Code • Section 45 “Production Tax Credit” • Section 48 “Investment Tax Credit” • Section 48 Tax Credit • 30% in Most Situations • 10% for Geothermal • Remaining Basis Depreciated over 5-years • 1603 Grant in Lieu of Tax Credit • Currently Expired as of 12/31/2011 Energy-Efficient Building Deduction • The Energy Policy Act of 2005 allows a deduction for the cost of major energy-saving improvements or new construction • Pursuant to a certified plan to reduce energy costs • Reduces energy cost by at least 50% in comparison to reference building (Standard 90.1-2001) • Maximum deduction of $1.80 per square foot • New Energy Savings Percentages (Notice 2012-22) make it easier to get partial deduction on HVAC Energy-Efficient Building Deduction • Partial deduction of up to $0.60 per square foot for each eligible building component • Interior lighting system • Heating, cooling, ventilation, and hot water systems • Building envelope (windows, walls, foundations, slabs, ceiling, roof system, and insulation) • Combine with new expensing regulations – Write off remaining basis of original asset – Take 179D on new capital asset Repair and Maint. Regulations • New Regulations cover both 263(a) and 162(a) • New Regulations “Biggest Change to Capitalization Regulations in 20 years” • Regulations are effective and need to be followed for years beginning on or after 1/1/14 New Regulations Key Issues • Repair vs. Capital – Less Liberal than 2008 Proposed Regulations – Based on “Highly Factual” information • Retirement of Structural Component – Allows for retirement of a portion of a larger capital asset • Remove Plan of Rehabilitation Doctrine Opportunities - Types • Ability to “write off” existing capital assets – Structural Assets when removed can now be expensed – Items that may have previously been considered “capital” may now be “Repair” • Review Existing Cap Ex Policies • 3115 – Change in Accounting Method • Cost Segregation Now More Valuable – Requires full engineering approach QUESTIONS & ANSWERS Presenter Mike D’Alessandro, Principal 610-395-1166 (office) 610-730-6302 (cell) miked@mcguiresponsel.com