Valuation of Income Properties: Appraisal and the Market for Capital

Valuation of Income Properties:

Appraisal and the Market for Capital

Lesson by:

David Burditt - Ben Kail - Matt Cutter

Market Value

The most probable price which a property should bring in a competitive and open market.

1. Buyer and seller are typically motivated;

2. Both parties are well-informed or well-advised;

3. A reasonable time is allowed for exposure in the open market;

Payment is made in terms of cash in in US dollars or other comparable arrangements;

5. The price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.

Appraisal Process

Physical and legal identification

Identify property rights to be valued

Fee simple or leased fee estate

Specify the purpose of the appraisal

Condemnation of property, insurance losses, property tax

Specify effective date of value estimate

Gather and analyze market data

Apply techniques to estimate value

Sales Comparison Approach

Based on data provided from recent sales of properties highly comparable to the property being appraised.

Comparable properties are adjusted to the subject property.

Positive features that comparables possess relative to the subject property require negative adjustments;

Negative features require positive adjustments.

Valuing properties using this method is a highly subjective process and should be justified with evidence based on recent experience with highly comparable properties.

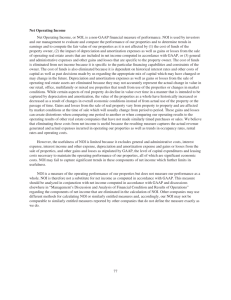

Income Approach

Gross Income Multiplier (GIM)

Sales price / Gross Income

PGI vs. EGI

Capitalization Rate

Used when the comparables have largely differing operating expenses. NOI is used instead.

Define cap rates by looking at comparable properties

Cap Rate = NOI / Sale Price of Comparable

Value = NOI / Cap Rate

DCF Analysis

Forecast NOI

Choose a holding period for the investment

Select a Discount Rate (r)

Also known as: required rate of return

Thought of as a required return for a real estate investment based on its risk when compared with returns earned competing investments and other capital market benchmarks.

A risk premium for real estate ownership and its attendant risks related to operation and disposition should be included within the discount rate.

Estimate Reversion Value

Estimating Reversion Values

(A) Developing Terminal Cap Rates Based on Expected

Long-Term Cash Flows

Use of a Terminal Cap Rate (R

T

)

If reversion is going to take place in year 9, year 10 NOI will be used to calculate the reversion value.

NOI / R

T

= Sales Price

R

T

= (r – g) when avg. long-run growth in NOI is expected to be positive.

R

T

= (r) when long-run growth in NOI is expected to be level or zero.

R

T

= (r + g) when avg. long-run growth in NOI is expected to be negative or decline.

Estimating Reversion Values

(B) Estimating the Terminal Cap Rate Directly from Sales

Transactions Data

Uses a larger cap rate than the “going in” rate.

Assumes that as properties age and depreciate the production of income declines; therefore, the expected growth in NOI for an older property should be less than that of a new property.

Higher caps on older properties reflects economic depreciation.

Estimating Reversion Values

(C) Estimating the Resale Price Based on an Expected

Change in Property Values

Avoids using a terminal cap rate, instead assumes that property values will change at a specified compound rate each year.

The resale price is expressed as a function of the unknown present value. The valuation is based on the premise that the value of the property is equal to the present value of the

NOI.

Highest and Best Use Analysis

PV= NOI

1

/ r-g or NOI

1

/r

PV- BLDG cost= land value

Example

PV=$500,000/(.13-.03)

$500,000/.10=$5,000,000

Assuming building cost=$4,000,000

Land Value=$5,000,000-$4,000,000

Land Value=$1,000,000

Volatility in Land Prices

What causes land price volatility?

Investor Speculation

Fundamental change or expected change in location

Highest and Best Use Analysis

Office Retail Apartment Warehouse

NOI yr 1 $500,000 $600,000 $400,000 $400,000

Return or r 13.00% 12.00% 12.00% 10.00%

Growth or g

3.00%

Building

Costs

4.00% 3.00% 2.00%

4,000,000 4,000,000 4,000,000 4,000,000

Use

Office

Highest and Best Use Analysis

Year 1

NOI

R Implied

Property

Value

Building

Costs

Implied

Land

Value

$500,000 10.00% 5,000,000 4,000,000 1,000,000

Retail 600,000 8.00%

Apartment 400,000 9.00%

Warehous e

400,000 8.00%

7,500,000 4,000,000 3,500,000

4,444,444 4,000,000 444,444

5,000,000 4,000,000 1,000,000

Highest and Best Use Analysis

The retail project would be the highest and best use

A total property value of $7,500,000

Implied land value of $3,500,000

If the asking price of the land is $1,000,000

The can immediately realize value by developing retail site for $1,000,000 and selling for $3,000,000

Highest and Best Use Analysis

Summary

It is the expected use of land and its future income that determines its value.

As developers and investors envision what will bring the highest property value, competition for site and prices paid based on expected site developments will ultimately determine land values.

Mortgage Equity Capitalization

The previous discount rate was the free and clear discount rate, it does not consider if the property will be financed

Mortgage Equity Capitalization considers financing affects

V= M+E

(V)Value = present value of expected (M) mortgage financing + (E) equity investment made by investors

Mortgage Equity Capitalization

DS= NOI

1

/ DCR

DS= $50,000/ 1.20 = $41,667

Calculate M- The monthly mortgage is

$41,667/12 = $3,472.22l assuming a 20 yr term and an 11% rate

Calculate E (PVA+CF)

PV= M+ E

NOI

Mortgage Equity Capitalization

1 2 3 4 5 6

$50,000 $51,500 $53,045 $54,636 $56,275 $57,964

DS 41,667

Cash flow $8,333

Resale:

Resale in year 5

Less mortgage balance

Cash flow

Total cash flow

$8,333

41,667

$9,833

$9,833

41,667 41,667 41,667

$11,378 $12,969 $14,608

N/A

$526,945

$305,495

$221,450

$11,378 $12,969 $236,058

Mortgage Equity Capitalization

PV= M+ E

PV at a 12% discount rate is $167,566

PV = $336,394 + $165,566

PV = $501,960

You can calculate the LTV: $336,394/$501,960 =

67%

Cap Rates and Market

Conditions

Lower cap rates (higher property values) tend to be brought about by:

Unanticipated increases in demand relative to supply

Unanticipated decreases in interest rates

Both of the above

Cap Rates and Market

Conditions

Higher cap rates (lower property values) tend to be brought about by:

Unanticipated increases in supply relative to demand

Unanticipated increases in interest rates

Both of the above

Word of Caution

The above illustrations were developed under strict assumptions regarding timing and duration of conditions of excess supply and demand

To demonstrate the effects of market conditions on property values and cap rates

No consideration was given to the possible interaction between changes in any one of these market forces on other market influences

In Practice

The investor must know how to incorporate these relationships into forecasts

Consider:

Current market supply and demand conditions and how long such conditions will last

The effects of such conditions on rents and NOI

The future course of interest rates that may be affected by more global, non-real estate specific influences such as global economic growth and inflationary pressures

The contents of leases that have been executed on the property being evaluated and whether conditions in any of the above will materially affect rents, expenses, and tenant default rates

Valuation of a Leased Fee

Estate

Simple Estates

Properties that can be leased at current market rents

Leased Fee Estates

Properties that have existing leases in place that have leases at below or above market rents

When considering a property, it is important to investigate whether or not existing leases are present and the contents of such leases

Failure to investigate such cases may result in serious errors when estimating value

The Cost Approach

Rational of the Cost Approach: Any informed investor would not pay more for a property than it would cost buy the land and build the structure.

The Cost Approach

For new property: The cost approach involves determining the construction cost of the building an improvement and adding the market value of the land.

In the case of an existing building, the appraiser estimates the cost of replacing the building.

The Cost Approach

To use the cost approach to value, an appraiser uses today’s replacement cost of equivalent or identical property as a basis for evaluation. This is the cost to replace the asset with another of similar age, quality, origin, appearance, provenance, and condition, within a reasonable length of time in an appropriate market.

In using this approach, the appraiser reasons that the value of an asset is equal to the amount required to produce another desirable asset of at least equal amount and quality. This approach involves the cost of reproduction, independent of the benefit of having the original asset at hand.

The Cost Approach

• See Excel Spreadsheet

The Cost Approach: Adjustment of

Replacement Cost Estimate

Replacement Costs at current prices

Less Repairable Depreciation

Less Incurable Depreciation

Less Functional & Economic –Locational

Obsolescence

Add in Site Value

=Value per Cost Approach

The Cost Approach

1.

2.

Cost Approach is most effective when:

An improvement is new and depreciation does not present serious complications (effective age compensation).

It is hard to find comparables among unique property types.

Oakwood Apartments: Income

Approach

Inputs:

Units:

Rent:

Rent Escalator:

95 Two-bed

$1210/month

3%

See Comparables on Page

284 & Excel Spreadsheet

Chapter 10 Conclusion

1.

2.

3.

4.

Three Approaches to Valuing Real

Estate:

Sales/Market Approach

Income Capitalization Approach

Cost Approach

The three approaches are somewhat intertwined.

Chapter 10 Conclusion

The availability and quality of data should always dictate the methods and approaches chosen for valuation.

Perfect data = perfect results; this is never the case, appraisals are always somewhat subjective due to the human factor and imperfect data.

Chapter 10 Conclusion

Appraisals are estimates of market value based on market conditions and information available at the time of the appraisal.

The appraisal should be used as complement, not a substitute for sound underwriting or investment analysis.