Worlds Collide

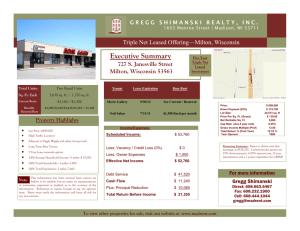

advertisement

Leased Fee vs. Fee Simple PART 1 LEASED FEE – THE SALE DEMAND GENERATOR THE DEVELOPER THE SITE – 7.0 ACRES Land Costs $4,300,000 Per Bldg. Area $71.66/SF The - Improvements Net Rentable Area 40,000 SF Anchor 20,000 SF In-Line 60,000 SF Total Bldg. Costs $12,000,000 Per Bldg. Area $200/SF Total Development Costs $16,300,000 $272 per square foot Rent Roll LEASE TERMS Triple Net – Pro Rata Share Real Estate Tax Clause The Investment Sale Developer engages a national brokerage firm Marketed at a list amount of $21,200,000 Exposed to the investment market for 90 days Eight offers considered Top Four offers from: 10 31 Tax Exchange Buyer - $20,500,000 Institutional Investor - $20,400,000 Public REIT - $20,200,000 Private REIT - $20,000,000 The Lucky Winner – 1031 Exchange Sale Amount $20,500,000 NOI = $1,295,940 Cap Rate = 6.32% The True Winner Sale Amount $20,500,000 Total Costs $16,300,000 Total Profit $4,200,000 Implied Profit 25.7 % 2 Year Process PERMANENT DEBT FINANCING The Sponsor Mortgage Brokers Sponsor & Mortgage Brokers The sponsor also known as the owner, wants to free up as much of the capital possible that was used to buy the shopping center. The sponsor engages a middle-man or mortgage broker to represent the sponsors interests. The mortgage broker represents the interests of the sponsor and at the same time holds the relationship with the lenders, financial institutions and life companies. A mortgage broker may charge the sponsor one mortgage point upfront for origination, meaning they’ll be paid one percent of the loan amount for getting the sponsor the loan, while also tacking on loan processing fees. THE LENDERS LOAN TERMS – CONDUIT LENDING COMMERCIAL MORTGAGE BACKED SECURITY (CMBS) NON-RECOURSE 30 YEAR AMORTIZATION INTEREST ONLY YEARS 1 THROUGH 4 INTEREST RATE 4.5% 10 YEAR LOAN TERM LOAN TO VALUE (LTV) AT 75% LOAN AMOUNT - $15,375,000 SPONSOR EQUITY CONTRIBUTION - $5,125,000 ANNUAL DEBT SERVICE PAYMENT - $933,314 DEBT COVERAGE RATIO - 1.38 (NOI/Debt Payment) INTEREST ONLY PAYMENT YEAR 1 - $690,750 YEAR 1 – CASH ON CASH = 13.5% UNDERWRITING REQUIREMENTS “Mark to Market” – CMBS lenders are required to “mark to market” any contract rents that are above the appraiser’s opinion of market rent. This can dramatically impact the loan proceeds and terms for the borrower. Market Rent - The most probable rent that a property should bring in a competitive and open market reflecting all conditions and restrictions of the lease agreement, including permitted uses, use restrictions, expense obligations, term, concessions, renewal and purchase options, and tenant improvements (TIs). THE APPRAISAL Loan terms agreed upon Lender orders appraisal Appraiser typically has two to three weeks to perform the valuation. Appraiser relies heavily on Income Approach methodology. Appraiser concludes that the contract rents within the subject development are market supported having compared the subject’s rents with other first generation contract rents in the market, also known as build to suit contract rents. CONTRACT RENT VS. MARKET RENT ATTAINED RENT LEVELS Contract Rent Area Equiv. Tenant Name ( SF ) Rent/SF > 40,000 SF Grocery Store > 3,000 SF Pet Store Restaurant < 3,000 SF Nail Salon Beauty Massage Asian Restaurant Hair Salon Beauty Salon Soup & Salads GRAND-TOTALS MARKET RENT Market Rent Rent/SF COMPARISON Comparison Contract Rent Versus Market Rent 40,000 40,000 $19.25 $19.25 $20.00 $20.00 3.75% below market 3.75% below market 4,600 4,300 8,900 $21.52 $27.35 $24.34 $25.00 $25.00 $25.00 13.91% below market 9.40% above market 2.65% below market 1,900 2,100 1,900 1,300 1,600 2,300 11,100 $30.82 $24.79 $29.37 $25.85 $26.25 $29.25 $27.86 $28.00 $28.00 $28.00 $28.00 $28.00 $28.00 $28.00 10.08% 11.47% 4.89% 7.69% 6.25% 4.48% 0.48% 60,000 $21.60 $22.22 above market below market above market below market below market above market below market 2.80% below market THE APPRAISAL - CONCLUSION Appraiser analyzes the terms of the initial sale from developer to 1031 buyer and concludes the implied going in cap rate of 6.32% is market supported. This opinion is based on analyzing sale comparables (cap rate extraction), broker interviews and institutional investment surveys. Since the appraisal report concludes contract rents are at “market levels” and the cap rate for these type of investments is bracketed between 6.0 and 6.5 percent, the lender and sponsor proceed with the closing of the loan. ALL’S WELL THAT ENDS WELL PART 2 FEE SIMPLE – THE TAX APPEAL EXTRA EXTRA - READ ALL ABOUT IT SHOPPING CENTER SELLS FOR $20,500,000 THE TAX MAN COMETH SCHOOL BOARD We’ve Got a Live One ! SCHOOL BOARD ATTORNEY $20.5 What? TALE OF TWO CITIES A recent arms-length sale of a property will typically invoke a reassessment of value to the sale amount. This holds especially true if the reassessment results in an increase in value, generating more tax dollars for the local schools, municipality and county. RE Taxes Pre-Sale $3.00/SF $180,000/yr RE Taxes Post-Sale $10.00/SF $600,000/yr 333% Increase THE TENANT RESPONSE ACTION DEMANDED We were told $3.00/SF not $10/SF How can we resolve this problem? I collect rent checks……this is not my problem ACTION TAKEN Tenant Response Ownership is far less likely to file a tax complaint when the tax expense is the tenant’s responsibility. Anchor tenant lease contracts (National Chain Tenancy) will often allow the tenant the right to contest the real estate tax assessment on behalf of the ownership entity. Smaller storeroom tenancy lease contracts will not typically include this provision. Tenant, through legal representation, engages an appraiser to estimate the market value of the property. THE APPEAL PROCESS While tax law may be different state to state, reassessment based on a recent sale of a property is common practice in many states. Relative to properties such as this case study, we find it common for the Respondent (tenant or owner) to engage an appraiser in defense of a significant increase in real estate taxes even at the lowest level of the appeal process. At the lower level of the appeal process the Petitioner (local school board) will almost exclusively rely on the most recent sale as the best evidence of market value. If appealed to a higher level an appraiser is likely to be engaged as a means to defend the reassessment value. THE ROAD TO THE APPEAL PROCESS It is likely the sale of the subject will not result in a amenable resolution between the Respondent and Petitioner at a low level of the appeal process. Even if the Respondent provides an appraisal as evidence of value, most lower level hearing decisions have been reluctant to ignore the most recent sale premise. The appraisal process moves forward and both parties engage an appraiser to estimate the FEE SIMPLE market value of the subject. LEASED FEE - FEE SIMPLE WORLD’S COLLIDE - Appraising the fee simple interest of what is typically a leased fee interest property type is often complicated by decisions handed down from hearing examiners at higher levels of the appeal process. WORLD’S COLLIDE - The acceptance of leased fee practice within a fee simple valuation has become beneficial to the tax authority yet burdensome to the tenant/owner and an appraiser that full understands fee simple valuation. WORLDS COLLIDE - Unfortunately the appraisal practice techniques of licensed appraisers can often be at odds. Both sides of the appeal believe the other is agenda driven. THE ISSUES AT HAND Leased fee valuation rests heavily on tenancy credit strength, lease term longevity, capitalization of contract rents that may be above or below market. In a fee simple appraisal a tenant’s CREDIT STRENGTH is not suppose to be on trial; however, it is often the core economic component driving value leased fee ownership interest. In a fee simple appraisal MARKET RENT is to be applied to the tenancy storerooms and the appraiser should adhere the Appraisal of Real Estate definition of MARKET RENT. THE ISSUES AT HAND CONTRARY to fee simple valuation practice, the decisions handed down by hearing examiners relative to leased fee infusion into fee simple valuation has caused for additional adverse decisions relative to market rent application in fee simple appraisal practice. FIRST GENERATION and/or BUILD TO SUIT rent contracts are now being construed as evidence of MARKET RENT even though these types of rents do not adhere to the definition of MARKET RENT. TYPES OF RENT Rent, relative to the subject’s use type, requires a basic understanding and recognition that the term “rent” can often take on several different interpretations, especially in the tax appeal process. Within the commercial real estate industry, rent is often identified as being one of the following: Build-to-Suit Rent – First Generation Market Rent – First & Second Generation Sale-Leaseback Rent BUILD TO SUIT RENT In a build-to-suit contract lease arrangement, the rent paid is specifically tied to the tenant’s development specifications both in location, site and vertical improvements. These specifications result in a contract rent born out of the developer’s land cost basis, all soft/hard costs of construction, and developer profit. The sum of these basic components results in a build-to-suit contract rent; however, it does not necessarily conform to the definition of market rent. Build to suit rent is not exclusively tied to single-tenant properties. The subject, as a multi-tenant shopping center, involved build to suit contractual terms for the anchor and while the in-line space was developed as generic white box or shell space, the inclusion of tenant allowances paid by the developer to the tenants to complete build-out also can be considered build to suit or in some instances modified build to suit (white box or shell delivery with no allowances). MARKET RENT The most probable rent that a property should bring in a COMPETITIVE and OPEN MARKET reflecting all conditions and restrictions of the lease agreement, including permitted uses, use restrictions, expense obligations, term, concessions, renewal and purchase options, and tenant improvements (TIs). The words competitive and open market are integral to the selection of rent comparables in fee simple valuation. MARKET RENT In the appraisal process, collection of rent comparables requires equivalency adjustment analysis. Many contract rent comparables involve tenant specific allowances relative to their use type or there may be up front rent concessions with stepped up rent increases at the back-end of a lease term. Allowances and concessions can significantly cause for a contract rent to be above other market participant expectations for like kind space. It has been our experience that most market participants interpret market rent as being the probable rent a storeroom could achieve in a competitive environment assuming competent marketing and adequate exposure time to the open market. MARKET RENT Relative to newly developed, first generation shopping center and/or freestanding retail development, it has also been our experience that some market participants believe market rent should closely mirror the contract rents already being paid by the inplace tenancy. MARKET RENT It has become common practice within the appeal process to identify rent comparables as being first generation (typically build to suit) or second generation (initial tenant vacates and the space is subsequently re-leased to another use). With consideration for the definition of Market Rent, most second generation rent comparables are the best evidence of market rent, recognizing the storeroom or freestanding building was exposed to a competitive and open market prior to being re-leased. TAX APPEAL SELECTION OF RENTS Rent = $15.00/SF Net Second Gen Tenant $30/SF allowance Respondent’s Appraiser Rent = $20.00/SF Net First Gen Tenant Build To Suit Petitioner’s Appraiser TAX APPEAL SELECTION OF RENTS Rent = $25.00/SF Net Second Gen Tenant $20/SF allowance Respondent’s Appraiser Rent = $30.00/SF Net First Gen Tenant White Box + $15/SF in TI Petitioner’s Appraiser MARKET RENT CONCLUSIONS $1,073,000 - Annual Rent Respondent’s Appraiser $1,333,300 - Annual Rent Petitioner’s Appraiser CAP RATE SUPPORT Q3 2015 Average Cap Rate = 6.81% CAP RATE & VALUE CONCLUSION $1,073,300 - NOI 7.0% - Cap Rate $15,350,000 - Value Respondent’s Appraiser $1,333,300 – NOI 6.5% - Cap Rate $20,500,000 – Value Petitioner’s Appraiser WORLDS COLLIDE