Ch 2

advertisement

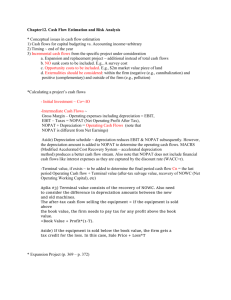

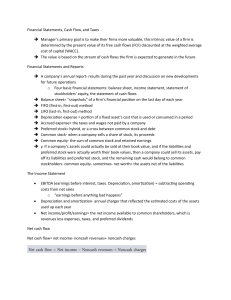

Ch. 2 Financial Statements, Cash Flows and Taxes Goals • To understand financial Statements • To understand how to calculate cash flows • To understand how to measure the performance • To understand taxes 1. Financial Statement & Reports • Two types of information in annual reports • 1) Letter describing the operating results during the past years • 2) 4 Financial Statements: balance sheet, income statement, statement of retained earnings and statement of cash flows 2. Balance sheet: • A statement of the firm’s financial position at a specific point in time • It measures asset (what a company own) and claims on assets ( what it owes) • Items is listed in order of liquidity or the length of time • Ex) Table 2-1 Asset Liability and Equity Cash and equivalents Accounts payable Short term investments Notes payable Accounts receivable Accruals Inventory Total current assets Net plants and equipment Total assets Total current liabilities Long term bonds Total liabilities Preferred stock Common stock Retained earnings Total common equity Total liabilities and equity Something in B/S: - Liquidity - Debt versus Equity (Source of Financing): Claims in Bankruptcy Financial Distress - Common equity = common stock + retained earnings - Market Value versus Book Value Book value explain the current market value? Ex) Good Management or reputation Market value is more concern - Accounting Rules: Inventory (FIFO & LIFO) – cost of goods sold Depreciation Methods (Accelerated or straight line) - Net worth = asset - liabilities 3. Income Statement: A statement summarizing the firm’s revenue and expenses over a period Ex) Something in I/S - Matching with GAAP: not matching with the actual cash flows - Depreciation and amortization are not actual cash outlay Sales Operating Cost except depreciation & amortization EBITDA Depreciation & Amortuization other operating expenses EBIT Less interest EBT Taxes (40%) Net Income before preferred dividends Preferred dividends Net Income Dividends to common Addition to retained earnings - EBITDA is commonly used among managers, analysts and bank loan officers - Net cash flow = Net income – noncash revenues+ noncash charge = Net income +depreciation and amortization 3. Statement of retained earnings: A statement reporting how much of the firm’s earnings were retained in the business rather than paid out in dividends 4. Statement of Cash Flows: A statement reporting the impact of a firm’s operating, investing and financing activities on cash flows over a period 5. Modifying Accounting data for investors and managerial decisions The cash flow generated through operations determines the firm’s value. 1) Operating Cash Flow = EBIT (1- tax rate) +Depreciation and Amortization 2) Here, EBIT(1- tax rate) is called NOPAT (net operating profit after taxes). It is a profit that a firm would generate if it has no debt and held only operating assets. • NOPAT is better performance measurement due to different debts and interest charges • Comparing changes of NOPAT to those of EPS reveals impact of interests 3) Net operating working capital = operating current asset – operating current liabilities = (cash + A/R + Inventories) – (A/P + Accruals) • It indicates the level of liquidity in business. • (here, AP and accrued taxes and wages are free due to no fees. They are not provided by investors) 4) Total net operating capital = net operating working capital + operating long term asset (net plant and equipment) •Change of total net operating capital = net investment in operating capital •Ex) relationship among working capitals and net income or sales • - lower increase of sales/net income, compared to higher increase total net operating capital indicates something wrong. Cash management problem? Inventory problem? Why? 5) Free cash flow (FCF): • cash flow actually available for distribution to all investors after investments in fixed assets, new products and working capital necessary to sustain ongoing operations • It will determine the value of a company’s operations FCF (free cash flow) =NOPAT – net investment in operating capital =(NOPAT + Depreciation) – (Net investment in operating capital +Depreciation) = Operating cash flow – Gross investment in operating capital How to use FCF? • Pay interest • Repay debt-holders • Pay dividends • Repurchase stock • Buy short term investments or non-operating assets 6. Performance Evaluation Negative FCF is Bad? • High growth firms with positive NOPAT tend to have negative FCF • However it is a bad sign if both NOPAT and FCF were negative. • One way to measure this issue is ROIC (return on invested capital). 1) ROIC = NOPAT / Total net operating capital. If ROIC is greater than WACC, firm is adding value. 2) Market value added (MVA): Performance Measurement with stock price information MVA = market value of stock – equity capital supplied by shareholders = (shares outstanding × stock price) – total common equity • The difference between the market value of the firm’s stock and the amount of equity capital investors have supplied • Based on the belief that maximizing the difference will maximize the stock price • But it measures the management’s performance during the whole period • Another MVA = (market value + market value of debt and preferred stock) – Total investorsupplied capital. Here total investor-supplied capital is summation of equity, debt and preferred stock. 3) Economic value added (EVA): • Value added to shareholders by management during the given year. It is a measurement typically used for an incentive compensation program. • EVA • = NOPAT – after-tax dollar cost of capital used to support operations • = EBIT(1-tax rate)-(Total net operating capital)(after tax cost of capital) • = (Total net operating capital) × (ROIC – WACC) 6. Federal Income Tax System • Corporate income is generally taxed by the federal government at the rate of 15% to 35%, depending taxable incomes. Also most state governments impose income tax on corporations ( typically around 5%). Thus a large firm usually pay around 40%. • Individuals are taxed by the federal government at the rate of 10% to 35%. Also some states impose state taxes. Pension accounts are not taxed until the money is withdrawn. • • • • • • Page 77 Taxable income of $65,000. Tax amount = 7500 + 0.25*(65000-50000) =11250 Here 25% is a marginal tax rate. 11250/65000 is an average tax rate. • For a business, interest payment is considered as expense and reduce taxable incomes. But for individuals, it is not (exception: home loans). • Interests earned from state and local government debts are exempt from federal taxes. • Dividends paid is not tax deductible. • Dividend received by the individuals are taxed as capital gains. But 70% of dividends received by corporations from others could be deducted in order to minimize triple taxation – dividend paying corporation, dividend receiving corporation, and shareholders of dividend receiving corporation. • Due to this character (70% deduction), investment on stocks rather than on bonds is preferred by corporations. • Before 1987, corporate long term capital gains were taxed at lower rates than corporate ordinary income. But under current law, corporations’ capital gains are taxed at the same rates as their operating income. • Tax loss carry-back and carry-forward: Ordinary corporate operating losses can be carried back to prior 2 years and forward for the next 20 years if necessary. The loss is applied first to the earliest year, then to the next earliest year, and so on, until losses have been used up. • If a corporation intentionally does not pay dividend in order to help shareholders not to pay tax on dividend, it is a violation. Improper accumulation to avoid payment of dividends. It is subject to penalty rate. • Consolidated corporate tax return: if a corporation owns 80% or more of another corporation’ stock, then it can aggregate income and file one consolidated tax return. The losses of one company cane be used to offset the profits of other company. • Taxes on Oversea Income: As long as foreign earnings are reinvested oversea, no tax is due and infinite. • But when repatriated, it is subject for taxation – difference between what is paid in foreign countries and in US. • S corporation is taxed like a personal taxation. • About personal tax: - Tax rate is progressive. That is, depending on incomes, tax rate increases. - Capital gain resulting from holding investment more than 1 year, this capital gain is called long term capital gains and taxed at a lower rate (around 15%).