Practice Exam 1 - Iowa State University

advertisement

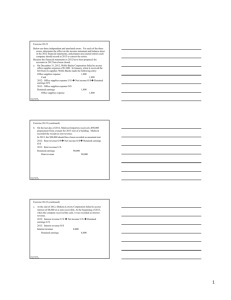

Leader: Jacob K. Course: ACCT 284 – AC Instructor: Clem Practice Exam 1 September 18, 2012 Supplemental Instruction Iowa State University Disclaimer: This practice exam was formulated using the exam 1 study guide published on Blackboard. While it is not intended to be a comprehensive review of all topics that might be covered on the first exam, it will serve as a helpful study tool when used in combination with other available exams, class notes, and your textbook. 1) Which of the following is not part of financial accounting? a. Processes information about an organization b. It is a system that collects and processes financial information c. It makes decisions for you d. Reports information to decision makers 2) The financial statement that shows the financial position of a company at a point in time: a. Income statement b. Statement of cash flows c. Statement of retained earnings d. Balance sheet 3) This financial statement shows how net income and the distribution of dividends affected the financial position of the company for the accounting period: a. Statement of cash flows b. Balance sheet c. Statement of retained earnings d. Income statement Use this table to answer the following three questions (4-6). Liabilities, 12/31/2010 $350,000 Contributed Capital, 12/31/2010 Beginning Retained Earnings, 1/1/2010 $125,000 $175,000 Revenues for 2010 Expenses for 2010 Dividends for 2010 $650,000 $200,000 $20,000 4) How much are assets on 12/31/2010? a. $650,000 b. $1,080,000 c. $1,300,000 d. $1,475,000 Supplemental Instruction 1060 Hixson-Lied Student Success Center 294-6624 www.si.iastate.edu 5) How much is ending retained earnings on 12/31/2010? a. $175,000 b. $605,000 c. $625,000 d. $825,000 6) What amount of dividend expense would the company report on its Income Statement for 2010? a. $20,000 b. $180,000 c. $220,000 d. Would not be reported on income statement 7) The private body that actually writes the accounting rules: a. PCAOB b. SEC c. FASB d. SOX 8) Who is primarily responsible for the information contained in the financial statements? a. Auditors b. Management c. Investors d. SEC 9) What is an disadvantage of incorporation a. Limited liability of stockholder b. Ability to raise capital c. Ease of ownership transfer d. None of the above 10) The statement of cash flows shows a change in cash from which three activities? a. Operating, investing, and financing b. Investing, assets, contributed capital c. Financing, net income, debt d. Credits, debits, operating 11) Which of the following is NOT part of PP&E? a. Plant b. Equipment c. Expenses d. Property 12) An example of a non-current asset would be: a. Cash b. Land c. Supplies d. Prepaid Rent 13) The idea of conservatism relates to which Principle/Assumption? a. Revenue Principle b. Time Period Assumption c. Cost Principle d. Matching Principle 14) A classified balance sheet is placed in order by: a. The first letter of the account b. Liquidity c. The amount in the account d. The date the account began 15) A company’s balance sheet shows total assets of $400,000, including $135,000 of current assets. The company also has long-term liabilities of $207,000, and total stockholders’ equity of $100,000. What is the company’s current ratio? a. 0.69 b. 1.45 c. 1.93 d. Cannot be determined from information given 16) On August 1, a company paid six months worth of rent in advance, at a cost of $7,200. How should the company record the transaction? a. With a debit to rent expense, $7,200 b. With a debit to prepaid rent, $7,200 c. With a credit to rent expense, $7,200 d. With a credit to prepaid rent, $7,200 17) On August 1st, Accounts Payable had a normal balance of $88,000, and at the end of August had a normal balance of $61,000. If payments on the account were $43,000 during the month, how much were purchases using the account? a. $16,000 b. $27,000 c. $70,000 d. $106,000 18) When a company purchases equipment on account, the effect would be? a. Assets increase and stockholders’ equity would increase b. Liabilities decrease and stockholders’ equity would increase c. Assets increase and liabilities increase d. Assets increase and liabilities decrease 19) On September 1, a company recorded a transaction with a debit to Cash and a credit to Notes Payable. Which of the following describes the transaction? a. The company received money from a customer as payment on his or account. b. The company borrowed money by signing a promissory note. c. The company made a payment on a previously signed note payable. d. The company allowed a customer to borrow money in exchange for the customer signing a promissory note. 20) A company receives rent from a tenant on March 31st. The tenant paid in advance for an entire year, starting April 1st. Rent is at a rate of $750 a month. On December 31st, what will be the necessary adjusting entry? a. A debit to unearned rent revenue and a credit to rent revenue, $6,750 b. A debit to cash and a credit to unearned rent revenue, $9,000 c. A debit to unearned rent revenue and a credit to rent revenue, $2,250 d. A debit to cash and a credit to rent revenue, $6,750 21) Which of the following would never happen based on our basic accounting equation? a. Increase stockholders’ equity and increase an asset b. Decrease a liability and increase an asset c. Decrease stockholders’ equity and increase a liability d. All of the above would never happen 22) A lawn care company charged a customer for services completed this month for $300, the transaction would look like: a. Accounts receivable increases by $300 b. Cash increases by $300 c. Service revenue decreases by $300 d. Accounts receivable decreases by $300 23) For transaction analysis to be done correctly what must occur? a. Have two or more accounts affected b. Identify the effect on the all the accounts c. Make sure the transaction is in balance d. All of the above 24) Limitations of the income statement do not include: a. Uses estimates to measure income b. Cash flows equal net income c. Does not directly measure the change in value of a company d. All of the above are limitations of the income statement 25) All of the following are involved in closing entries, except: a. Cost of goods sold b. Sales revenue c. Dividends d. Inventory 26) A company earns interest revenue on its investments every month, but interest is paid out annually on July 1. If the company issues financial statements every December 31, what type of adjusting entry is required to record interest earned? a. Accrued expense b. Accrued revenue c. Deferred expense d. Deferred revenue 27) Under the accrual basis, which of the following is false: a. It is required by GAAP for external reporting b. Revenues are recognized when cash is collected c. Revenues and expenses are recognized when they are earned/incurred regardless of when cash is received d. All of the above are true under the accrual basis 28) Which two financial statements do adjusting entries always affect? a. Balance sheet and income statement b. Statement of cash flows and the balance sheet c. Income statement and statement of retained earnings d. Statement of retained earnings and the balance sheet 29) A company receives $18,000 cash on June 1, 2011 for one-year club memberships. The company sends out club materials at the beginning of every month, beginning on July 1, 2011. As of September 1, 2011, what is the balance in the Unearned Revenue account? a. $4,500 b. $9,000 c. $13,500 d. $18,000 30) Forgetting to recognize the expense of using up a months worth of rent would cause: a. Assets and liabilities to be understated b. Revenues to be overstated and expenses to be understated c. Liabilities to be understated and stockholders’ equity to be overstated d. Assets and stockholders’ equity to be overstated