because the recomputed basis is lower than

advertisement

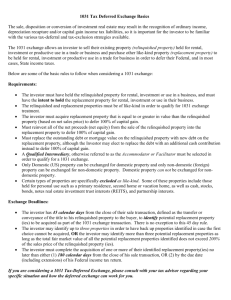

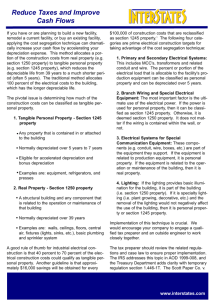

What About 1031 Exchanges and Recapture? • What is recapture? – Portion of a capital gain representing tax benefits previously taken and taxed as ordinary income. – IRS will “recapture” the accelerated depreciation received in the event of the sale of the property. Recapture 1245 property is purchased for $10,000 two years ago. The owner sells the property for $9,000. $3,000 has been taken in depreciation. Adjusted cost basis = $10,000 - $3,000 = $7,000 Gain on the sale = $9,000 - $7,000 = $2,000 Since the sale price of $9,000 is less than the recomputed cost basis of $10,000 ($7,000 + $3,000), the total gain will be treated as ordinary income. Recapture If the property is sold for $13,000 $3,000 has been taken in depreciation. Adjusted cost basis = $10,000 - $3,000 = $7,000 Gain on the sale = $13,000 - $7,000 = $6,000 Since the sale price of $13,000 is greater than the recomputed cost basis of $10,000 ($7,000 + $3,000), $3,000 will be treated as ordinary income and $3,000 will be treated as capital gain. 1031 Exchanges • What is a 1031 exchange? A 1031 exchange is a method for deferring any gain realized when investment property is sold for a profit and the proceeds are rolled over into a new investment property of like kind. Recapture and 1031 Exchanges. Property A Relinquished Purchased for $2M Adjusted Cost Basis of $1M Property B replacement Purchased for $4M New Cost Basis = $1 M carried over from the original property Sold for $4M 39 year depreciation Sale of $4M with a purchase of $4M into like property equates to no taxes on the transaction. I will be relinquishing my current property and acquiring new property. How will this affect my 1031 exchange? Here is what a 1031 exchange would look like without cost segregation. Property A Relinquished Purchased for $1M 39 Year Depreciation Held for 5 years Valued at $2M Adj. basis = $871,795 Property B Replacement 1031 Purchased for $3M Carryover Cost basis = $871,795 $1M in excess cost basis 1031 Exchanges and Cost Segregation The carry over cost basis of $871,795 will continue to be depreciated over the remaining 34 years based on Property A. The new cost basis of $1M will begin a new 39 year depreciation schedule. $871,795 Cost Basis $1M Cost Basis Total Depr. Tax Benefit (40%) Years 1-34 $25,641 $25,641 $51,282 $20,513 Years 35-39 $0 $25,641 $25,641 $10,256 1031 Exchanges and Cost Segregation A Cost Segregation study is performed on the new property. 30% of the property is reclassified to 5, 7 and 15 year property. This accelerated depreciation will result in increased depreciation of $104,904 compared to the $51,282 based on 39 year schedule. This results in a yearly tax benefit of $36,716 – A 205% increase over the original schedules. 1031 Exchanges and Cost Segregation By combining the 1031 exchange and cost segregation, the owner has deferred $1,000,000 in capital gains and increased his annual depreciation deduction from $25,641 on Property A to $104,904 on the new property. With proper planning these two methods can provide tremendous tax saving opportunity. Executing these two methods together should be carefully considered with a tax professional. Can The Exchange of Cost Segregated Property Lead to Recapture? Cost segregation can result in recognition of gain in an otherwise tax-deferred 1031 exchange. Fair Market Value Relinquished Replacement $4M $4M Can The Exchange of Cost Segregated Property Lead to Recapture? Relinquished 1245 Property Fair Market Value $900,000 Adjusted Cost Basis $700,000 Cost Recovery $300,000 Recomputed Cost Basis $1,000,000 The relinquished property has 1245 property with an adjusted cost basis of $700,000. The cost recovery of this property has been $300,000 Can The Exchange of Cost Segregated Property Lead to Recapture? A cost segregation study is performed on the replacement property Replacement 1245 Property Fair Market Value $500,000 Can The Exchange of Cost Segregated Property Lead to Recapture? Relinquished Property Replacement Property Fair Market Value $4,000,000 $4,000,000 FMV of 1245 $900,000 $500,000 The owner believes this is a non-taxable transaction due to the overall FMV of the two buildings Can The Exchange of Cost Segregated Property Lead to Recapture? Not exactly - Code Sec. 1031 requires that the relinquished property and the replacement property be like-kind. Relinquished Property Replacement Property Fair Market Value $4,000,000 $4,000,000 FMV of 1245 $900,000 $500,000 Problem Can The Exchange of Cost Segregated Property Lead to Recapture? If the relinquished property is not like-kind to any portion of the replacement property, then all of the realized gain on that relinquished property will be recognized in the exchange. The portion of the recognized gain attributable to depreciation recapture will be treated as ordinary income. Recapture Example Example 1 – 1245 property sold for $900,000 Relinquished 1245 Property Fair Market Value $900,000 Adjusted Cost Basis $700,000 Cost Recovery $300,000 Recomputed Cost Basis $1,000,000 In this example, because the amount realized upon the disposition of the property ($900,000) is lower than the recomputed basis, the entire gain is treated as ordinary income. Gain taxable as ordinary income = $200,000 Recapture Example Example 2 – 1245 Property sold for $1,200,000 Relinquished 1245 Property Fair Market Value $1,200,000 Adjusted Cost Basis $700,000 Cost Recovery $300,000 Recomputed Cost Basis $1,000,000 In this example, because the recomputed basis is lower than the amount realized upon the sale, the excess recomputed basis over the adjusted basis is treated as ordinary income. The remaining amount from the sale is treated as capital gain. Gain taxable as ordinary income = $300,000 Capital Gain = $200,000 Recapture and 1031 Exchange Example Example 3 – 1245 property is disposed of in an exchange. The replacement 1245 property has a fair market value of $500,000 Relinquished 1245 Property Fair Market Value $900,000 Adjusted Cost Basis $700,000 Cost Recovery $300,000 Recomputed Cost Basis $1,000,000 This transaction represents a trade down in $400,000 of 1245 property. Therefore, the owner has ordinary recapture equal to the realized gain of $200,000. Recapture and 1031 Exchange Example Example 4 – 1245 property is disposed of in an exchange. The replacement 1245 property has a fair market value of $1,000,000 Relinquished 1245 Property Fair Market Value $900,000 Adjusted Cost Basis $700,000 Cost Recovery $300,000 Recomputed Cost Basis $1,000,000 There is no recapture. If the replacement property is composed of equal or greater value of 1245 property , the owner can defer the entire gain without any recapture. Is This Recapture Worth It? Is This Recapture Worth It? The owner effectively “purchased” the extra ordinary income deductions at the cost of possibly recapturing these deductions as ordinary income in a later exchange. Had the owner stuck with the 39 year schedule, there would only have been $25,000 per year of deductions with no recapture at the time of the exchange. TIME VALUE OF MONEY 1031 Exchanges and Cost Segregation These options should all be discussed and analyzed with a tax professional. CPC can help look at the benefits and risks associated with such a transaction.