Decedent's Final and Fiduciary Returns

advertisement

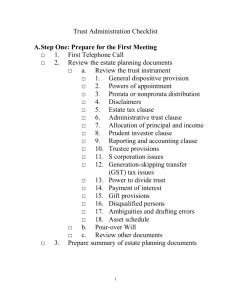

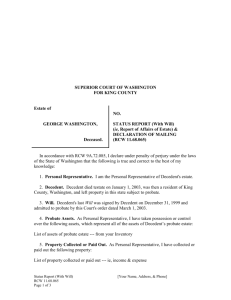

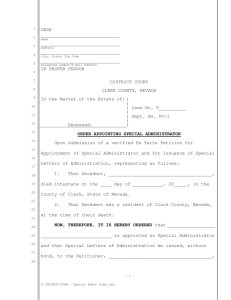

The Expert in Tax Education Decedent’s Final and Fiduciary Returns The Expert in Tax Education 2 Decedent’s Final and Fiduciary Returns Presented by XXXX Developed by Kathy Hubbard, EA Summer 2014 The Expert in Tax Education Objectives •To address common scenarios that small tax practitioners encounter with decedents' final and fiduciary returns, •To provide a quality fact base with ample references, worksheets and examples for the tax professional •To provide information specific to Texas. 4 The Final 1040 •Final Tax Year is January 1 - DOD •Final 1040 Year ends December 31 •NO ES 2210 penalties, but full pay 4/15 •Return due 4/15, extendable to 10/15 •Full amount, no proration for standard, over age 65 and/or blind deductions exemption, incl if decedent was a dependent 5 1040 Filing Requirements Depend Upon Gross Income Age Filing Status Other Tax or Filing Obligations 6 Gross Income •Controlled by both age and filing status, •Ranges from $950 (dependent under age 65) to $21,800 (married couple, both over age 65) •Measured from January 1 to midnight on DOD 7 Age For tax purposes, one reaches age 65 on the day before one’s 65th birthday 8 Filing Status There are exceptions to the customary status and income filing rules. 9 Filing Status If a married couple normally files jointly, even though they live apart, and one of them dies, a return must be filed if gross income is at least $3,800. 10 Filing Status Where a couple files jointly, and one dies, and the surviving spouse remarries, the decedent must file married separately! This is a post-mortem impact on filing status. 11 Filing Status If the decedent normally filed head of household, but passed away less than 181 days into the year, Status reverts to single (or mfs): The qualifying relatives were not in the decedent’s care for over half the year. 12 Filing Status If Decedent is a Qualifying Child: If the decedent is a child, s/he qualified the relative with whom she spent the majority of her days that final year for HOH. 13 Other Tax or Filing Obligations •Taxes! •AMT •Uncollected SS, Medicare, RRTA •Recapture taxes •Self employment or church wages 14 Other Tax or Filing Obligations •If 1040 not otherwise required, can file standalone: Form 5329 additional tax on a qualified plan Schedule H, household employment taxes Form 8606 for non-deductible IRA contributions. 15 Other Tax or Filing Obligations •Credits Require Filed Claim Earned Income, child, prior year minimum tax, education and fuel credits Withholdings and estimated tax payments. 16 Never Overlook Special Tax Forgiveness Provisions Mortally wounded warriors or civilians serving in combat zones, injured and/or deceased victims and families of victims harmed by terrorist attacks, and astronauts who perish in the line of duty. 17 Never Overlook The particulars surrounding the passing of these military and civilian persons, and The discreet types of tax relief applicable to their tax accounts and sometimes those of their families. 18 Never Overlook Certain death benefits paid to survivors of public safety officers IF Killed due to traumatic injuries sustained in the line of duty After September 10, 2001 Which are excluded from both income and estate taxes. 19 Who Signs the Return? The Personal Representative! 20 Who is a Personal Representative? Executor named in the will* Administrator appointed by the court* Trustee of decedent’s trust* Surviving spouse Successor in possession of property* * File form 56, required, § 6903 21 Decedent’s and Successor's Income Passed Without Probate Pass Under LWT Ownership styles Testamentary transfer Community Joint Joint with surv’ship rights Life estate Specific bequests Residual bequests Beneficiary designations Pay on Death Remainder Will can “pour over” to a “living” trust Will can create trusts Trust property 22 Income Documents W2s & 1099s issued through end of year or end of account: Request reissued 1099, or Issue 1099 for nominee’s share Review monthly detail on bank and brokerage statements 23 Income Documents On Decedent’s Return Sch B Interest and Dividends in full, less nominee portion reduction Sch C,E,F Income and Expense to DOD (may need to report full 1099 and deduct nominee portion) Sch D True or 1099B gross, code Nnominee Pension/IRA/Other Reported portion on correct return line, “Post Mortem Income” is subtracted on Line 21. con’t On Beneficiary’s Return Sch B Nominee portion Schs C,E,F Post mortem income and expenses Sch D Nominee portion, long term usually DOD cost basis § 1014 Report on correct return line, if known, or line 21. 24 Income In Respect of a Decedent IRD Arises From Certain Assets or Rights, and Retains the Decedent’s “Tax Character” 25 §691 IRD Earned Before, Paid After Interest, Dividends, Rents and Royalties, Uncollected salaries, wages, vacation, bonus and sick pay, Certain deferred compensation and stock option plans, Annuity and retirement plans in excess of basis (ROTH IRA’s excepted,) Difference between the face amount and decedent’s basis in an installment plan 26 Expenses in Respect of a Decedent Mortgage Interest Investment Interest Property & state income taxes Medical Expenses paid within a year of death Business and Investment Expenses Review rules for depreciation, depletion and installment sales 27 Beware the HSA Pre Mortem Post Mortem Contributions Unless spouse is Deductible beneficiary, Distributions for FMV of Accounts Medical Expenses Subject to Income Tax not Taxable Less amounts used to pay decedent’s medical expenses within 1 year of death. The Fiduciary's Expenses •Attorney Fees •Fiduciary and Estate Return Fees •Court Costs •Fiduciary Fees •Fiduciary Premium Bond Fees •Certain investment management fees and other costs incurred because of the entity’s status as an estate or trust § 67(e)(1). •Miscellaneous expenses which exceed 2% of the estate adjusted gross income. 29 Expenses Subject to 2% AGI Reduction Preparation fees for forms 709 (gift) or 1040, Maintenance, utilities and insurance to protect the value of the non-trade or business property, Non unique portfolio management and advisory fees. 30 Pub 559: Table B Source A B Enter total from 1099 C D Amount Enter portion reportable on reportable on estate's or decedent's beneficiary's final return return Part of column C that is IRD* Interest: Bank XYZ 500 350 150 12 Credit Union 300 200 100 10 20,000 9,000 11,000 Gross Proceeds ETC Stock * Required for Form 706 31 Form 1041 Returns: Due Dates On the 15th day of the 4th month after the tax year ends Extend for 5 months on Form 7004 FYE established by initial return filed 32 Fiduciary Returns: Filing Requirements §6012 Gross Income Any Taxable Income Beneficiaries Other Tax or Filing Obligations 33 Gross Income At least $600, or Any taxable income; Generally, uses same rules as individual income determination §641(b) 34 Beneficiaries Income notwithstanding, filing required if any beneficiaries are non resident aliens [Reg. 1.641(a)(2) and 1.61-1(a).] For an estate (or trust) to claim a “distribution deduction” for funds paid to a beneficiary, Forms K1 must be attached to the return 35 Other Tax or Filing Situations Claiming and having refunded income taxes withheld by payers Distributing final year excess deductions and losses to beneficiaries Owing taxes on wages paid to the decedents domestic employees by the estate 36 Post Mortem Planning Claiming accrued interest income from Series EE Bonds on the decedent’s final lower tax bracket return, Selecting fiscal or cash accounting method, Selecting a fiscal year, Redeeming income and paying expenses within a fiscal year. 37 Estimated Tax Payments No ES payments due on decedent’s final return or estate’s tax years ending before 2 years following DOD No ES payments due if tax for current year <$1,000 No ES payments due if prior year tax on a full 12 month year was $0 Otherwise, follow the 100/110% individual safe harbor regime under §6654(I) 38 Estate vs. Trust Estate Trust Special ES rules Only §6654(I) rules for ES Standard Deduction $600* Standard Deduction either $300 or $100* S-Corps are qualified shareholders S-Corps are only allowable partners for 2 years * No standard deduction allowed in the fiduciary return’s final year 39 Estate vs. Trust Estate con’t Trust Can select fiscal year end, Must use calendar year, May allocate ES payments to beneficiaries in final year by filing form 1041-T by the 65th day of the calendar tax year. May allocate ES payments to beneficiaries any year by filing form 1041-T 40 Active Rental Participation Estates Trusts Only active if the For 2 years post DOD, trust is actively if the decedent participating -qualified for active participation, the estate IRS says this means the trustee, but qualifies, § 469(i)(4) some courts have After 2 years, same said this means the rules as trust beneficiaries …! 41 Qualified Revocable Trusts can Elect to be Taxed as Estates §645 Treats QRT as an estate, or QRT and Estate as the estate, File Form 8855 – review election due date variables, and Check the “estate” and “645 election” boxes on 1041 42 The 65 Day Rule §663(b) Available to both trusts and estates: Allows 65 days after the close of the tax year to determine and distribute income to beneficiaries 43 Example 1 Estate Inflows & Outflows Total On Final 1041 IRA $ 5,000 $ 5,000 Checking acct cash $ 30,000 0 Reportable Income Inflows marshaled $ 5,000 $ 35,000 Court and Attorney Fees -$ 4,000 Taxable Income $ 1,000 Net cash on hand $ 31,000 Estate Distributes All -$ 31,000 Form K-1 Box 5 Income -$ 4,000 $ 1,000 44 Example 2 Estate Inflows & Outflows Total On Final 1041 IRA $ 5,000 $ 5,000 Checking acct cash $ 30,000 0 Reportable Income Inflows marshaled $ 5,000 $ 35,000 Court and Attorney Fees -$ 8,000 -$ 8,000 Taxable Income - $ 3,000 Net cash on hand $ 28,000 Estate Distributes All -$ 28,000 Form K-1 Box 11 A - $ 3,000 45 The Decedent’s Home The personal residence gets the step up in basis § 1014, and If sold, closing expenses would generate a loss -- non deductible for a personal loss, thus not deductible; If occupied by one or more beneficiary, -that use is considered a distribution. 46 The Decedent’s Stuff •If will says the kids (people) get the rest, and •If the executor/ heirs donate the stuff to a charity, •Then each heir donated a 1/X undivided interest in the stuff, and • The rules for individual non-cash donation documentation apply. 47 Distributable Net Income (DNI) §643 & the Distribution Deduction § 651 48 What is DNI? Amount of income of the estate or trust for the taxable year determined under: the terms of the governing instrument, and applicable local law §643(b), but NOT The Internal Revenue Code 49 Terms of the Governing Instrument How many wills or trusts say that the executor or trustee should use the Internal Revenue Code and not local UPIA for preparing the 1041 returns and determining principal and income?!! 50 Now What? READ THE ENTIRE WILL AND / OR TRUST! Be familiar with the Uniform Principal and Income Act and the Uniform Prudent Investor Act. 51 Trust vs Estate? Trusts have extended lifetimes and more conditional beneficiary structures; the UPIAs were designed to govern their asset preservation and management. Decedent’s estates are generally short lived & designed to distribute all assets, but still come under § 643(b). 52 Fiduciary Income Derived from each states’ adoption of some form of the Uniform Principal and Income Act; Classifies receipts as “principal” and “income” (without regard to the IRC), for instance: Municipal interest and corporate bond interest are interest income Equities are principal; when stock is sold, the type of principal is exchanged from equity to cash, and remains classified as principal. 53 Net Exempt Income If an estate has $8,000 in taxable interest income, And $2,000 in municipal interest income, Thus total income of $10,000, of which 20% is tax exempt, And it has $1,000 in administration expenses, Then it cannot deduct 20% of the administration expense from taxable income; Its NEI is $1,800 ($2,000 - $200); Similar perorations of expense required where some beneficiaries are exempt organizations. 54 DNI Formula § 643 Starts with taxable income, Adds back the exemption amount Removes capital gain, and Adds in Net Exempt Income. 55 The Distribution Deduction The lower of the amount distributed § 661(a)(2) or The amount deductible under the DNI rules, § 651(b), and Income is carried out first. 56 Texas Property Code Title 9, Trusts Chapter 116, Uniform Principal and Income Act 116.005 Allocation Powers: Trustee may allocate between principal and income Chapter 117, Uniform Prudent Investor Act 57 Fiduciary Tax Rates for 2013 If Taxable Income Is: The Tax Is: Not over $2,450 15% of the taxable income Over $2,450 but not over $5,700 $367.50 plus 25% of the excess over $2,450 Over $5,700 but not over $8,750 $1,180 plus 28% of the excess over $5,700 Over $8,750 but not over $11,950 $2,034 plus 33% of the excess over $8,750 Over $11,950 $3,090 plus 39.6% of the excess over $11,950 58 2013 Exemption Amounts for AMT Under § 55(b)(1) the excess taxable income above which the 28% tax rate applies is $179,500 The amounts used under § 55(d)(3) to determine the phase out of the exemption amounts is $ 76,950 59 Net Investment Income Tax Beginning 2013: NIIT is 3.8% on the lesser of Net investment income, or The excess of the MAGI over the threshold amount 60 When are Trusts and Estates Liable for NIIT? When they have undistributed Net Investment Income, and Have AGI over the dollar amount at which the highest tax bracket for an estate or trust begins for such taxable year (for tax year 2013, $11,950). 61 Any Special Circumstances? There are special computational rules for certain unique types of trusts, such as Charitable Remainder Trusts and Electing Small Business Trusts, which can be found in the proposed regulations. 62 Any Exceptions? Grantor Trusts Charitable Trusts Retirement Trusts Real Estate Investment Trusts Common Trust Funds 63 NII Includes Interest, Dividends, Capital gains, Rental and royalty income, Non-qualified annuities, Income from businesses involved in trading of financial instruments or commodities, And businesses that are passive activities to the taxpayer (within the meaning of IRC § 469). 64 What Type of Gains? To the extent that gains are not otherwise offset by capital losses, the following gains are common examples of items taken into account in computing Net Investment Income: Gains from the sale of stocks, bonds, and mutual funds, and Capital gain distributions from mutual funds. 65 And NON Investment Income Is? Wages, Unemployment compensation; Operating income from a non-passive business, Social Security Benefits, Alimony, tax-exempt interest, Self-employment income, Alaska Permanent Fund Dividends (see Rev. Rul. 90-56, 1990-2 CB 102), and distributions from certain Qualified Plans (those described in IRC §§ 401(a), 403(a), 403(b), 408, 408A, or 457(b)). 66 What Expenses Reduce NII? Deductions that are properly allocable to items of Gross Investment Income, such as: • • • • Investment interest expense, Investment advisory and brokerage fees, Expenses related to rental and royalty income, And state and local income taxes properly allocable to items included in Net Investment Income. NIIT Thresholds for 1040 and 1041 • 1040 • MFJ, QW $250,000 • HoH, S $200,000 • MFS $125,000 • NOT indexed • for inflation • 1041 • • • • Dollar amount of the highest income tax bracket for such taxable year, for 2013 = $11,950 • THUS, indexed • for inflation A New Form for NIIT? • One New Form for both Forms 1040 & 1041 • Computes the NII Base in the first section, • Carries to different tax computation sections for individuals and fiduciaries. They Moved The Cheese! The inheritance tax was the main estate planning obstacle for the middle class, before the indexed $5M exemption & the portable spousal exemption became law. The challenge now is the NIIT!!! 70 Net Investment Income Tax Avoidance Distribute Income Decant Assets Disclaim Assets within 9 months, if possible and practical 71 Appendix 72 Documents Needed to Prepare 1041 Will and Order Admitting Will to Probate Letters Testamentary / of Administration Inventory of Property (If from the probate records, will not include non-probate property nor liabilities) Bank and brokerage statements with detail -- mandatory for determining pre and post mortem transactions (including those passing outside probate) 73 Documents Needed to Prepare 1041 con't Roster of Name, address and SSN (or EIN) of each named beneficiary, with amounts, dates & descriptions of all distributions to each Copy of Form 706 if filed All income forms (W2, 1099) Prepare: A DOD Balance Sheet at FMV, unless a 706 is filed with alternate date is elected) Prepare: Table B 74 Workpapers to Prepare for Form1041 A DOD Balance Sheet at FMV, (unless a 706 is filed with alternate date is elected) Table B or Equivalent 75 Governing Documents Analysis N/A Personal Representative? Alternative Representative? Independent? Bonded? Fee or Payment Allowed to Fiduciary? Specific Bequests? --Name Each 76 No Yes Governing Documents Analysis N/A Establishment of Trusts? -- Name Each Trust, Trustee & Beneficiary --Distributions required? Otherwise allowed? For? --Dissolution Determined by? Methods for Determining Income & Principal Named? Charitable Beneficiaries? Remainder & Income Beneficiaries? Residual Beneficiaries? 77 No Yes NAEA created this educational program as part of its firm commitment to providing up-to-date, convenient continuing education that focuses on the issues that members identify as top priorities. Members are invited to suggest further areas of study or to submit presentations by contacting hjones@naea.org. National Association of Enrolled Agents 1730 Rhode Island Ave, NW Ste 400 Washington, DC 20036 Toll free: 855-880-NAEA www.naea.org