Immediate Steps - The Berman Law Group

advertisement

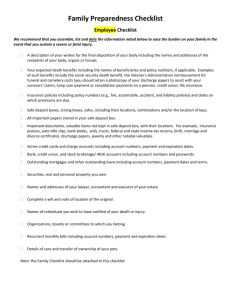

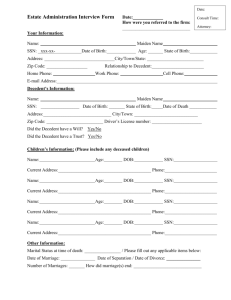

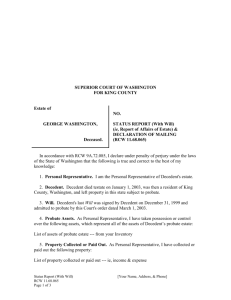

Immediate Steps • Contact your funeral director for proper arrangements, copies of death certificate, preparing obituary notices, transportation arrangements, etc. • List and notify immediate family, friends and employer or business associates. • Notify the decedent’s attorney and executor of the Will. • Notify Insurance companies (life, health, auto, etc) of death and immediate cancellation or payments. • Thoroughly review all life and casualty insurance and death benefits including SS, credit union, trade union, fraternal, military, etc. • Determine all debts and installment payments. If accounts were joint ownership, consult with creditors about extended payments. • If deceased was living alone, notify utilities, landlord, DMV, and Post office to redirect mail. • Gather all important documents: The decedent’s financial and other records must be gathered for the purposes of probating the estate and preparing the decedent’s and the estate’s income tax returns. In searching for these and other important documents, check safe deposit boxes, desk drawers (both at work and at home), briefcases, lockers, safes, etc. Also, keep a careful eye on the decedent’s mail. Never throw out official-looking documents. The following list includes most documents and pieces of information that are commonly considered important: • Address books • Automobile titles • Bank statements • Business records (if self-employed) • Check register (current year) • Contracts • Funeral instructions • Life insurance policies and annuities • Notes payable • Notes receivable • Partnership agreements • Past employment information • Pension information • Real property deeds • Retirement account statements • Securities statements • Stock certificates • Tax preparer's or accountant's name and address • Tax return source documents (current year) • Tax returns (last three years) • Trust agreement • Unpaid bills • Will • These difficult tasks could be handled by our team of experts in order to ease your burden!