Economic Idea - Wright State University

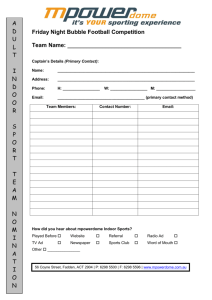

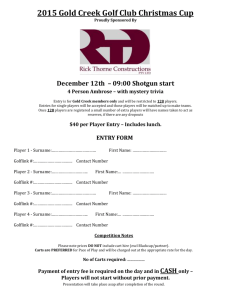

advertisement