Investor Presentation, August 2007

advertisement

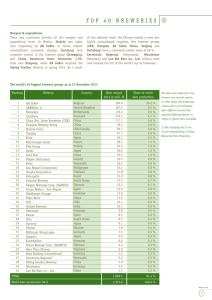

United Breweries Limited Investors Meeting August 2007 1 The Indian Beer Industry 2 Alcohol Consumption <0.5% Wine 5% 78% Spirits/ Liquor 8% Beer is under represented in India 21.5% India Beer 87% Emerging Markets 3 Consumption Per Capita 83 litres 1 litre per capita is a major milestone achieved in India in the last 12 months, BUT ……… 23 litres 24 litres 12 litres 1 litre India Indonesia China World Average USA 4 Industry Growth 30% 25% Future: strong double digit growth 20% 15% 10% 5% 5 Year CAGR 2005 2006 2007 2008 + 5 Opportunity for Growth • Current population 1.1 billion • Over 50% of the population is below the age of 25 years, demographics remain until 2020 •Increasing personal GDP •The emerging young population hold more liberal views on alcohol, than earlier generations Higher penetration Sustainable profit growth 6 UBL’s Capability • Iconic brand – KINGFISHER • Balanced portfolio of supporting brands • Manufacturing network across all major states • Leadership in cold chain management, and point of sale visibility • Established trade relationships 7 UBL’s Competitive AdvantageThrough our Promoters Equal to competition S&N • Brewing Competitive Advantage UBL processes • Procurement synergies • International best practice • Experience in capacity investment • People resource UB Group • Strength in distribution • Enhanced recognition through KFA • Relationship with USL • Buying influence • Route to market influence • One stop portfolio of leading brands for modern trade 8 Competitor Positions • SABM – Established in India as the No 2 player – Investment in capacity – Brand launches eg Peroni, Castle • International brands have not worked – Castle launched over 2 years ago > No market share – Peroni launched over 6 months ago > No market share – Fosters launched over 5 years ago, pre advertising ban > 2% market share 9 Competitor Positions • Carlsberg – Acquired Himneel brewery early 2007, new greenfield breweries in Rajasthan & Maharashtra. Plans to launch a Polish beer. • A–B – JV brewery with Crown in AP, plans to build more greenfield units. Recent launch of Budweiser & Armstrong beer brands • APB – 2007 acquisition of Aurangabad brewery, greenfield construction in progress in AP. • Coors – Announced plan to build a greenfield unit in Maharashtra • Inbev – Recently announced JV entry into India. 10 Impact of Competitors • • • • Invest in the market Invest in capacity Provide consumers with more choice Drive improvement through the upstream supply chain BENEFIT ALL PLAYERS IN THE INDUSTRY 11 Environment for New Competitors • Excessive State regulation and intervention – – – – Route to market Economics, need to have a brewery in each state Pricing Licensing • Driver of growth is Strong beer, – all new International entrants brands are leaders in Mild beer not Strong • Ban on advertising alcohol 12 UBL Reaction to Competition Maintain profitable Industry leadership • Aggressively invest in new capacity, and upgrade process technology – Lower cost of investment: • Europe $100 per HL • Russia $55 per HL • India $35 per HL • Develop and launch exciting new products – Kingfisher Ultra, Kingfisher wine 13 FULL YEAR FY’07 14 Performance Highlights – FY’07 • KF Strong overtakes KF premium to become India’s biggest selling beer, sales of over 26m cases • Invested around Rs200Cr in new capacity, to increase own brewery capacity by 20%, and 2 new greenfield breweries with over 8.5m cases of capacity pa • Completed acquisition of KBDL, and now fully merged into UBL • Market capitalisation exceeds $1bn • Total annual dividend of 25% 15 Market Share 48% 33% 9% 6% UBL SABM MM 4% Mt Shiv Others 16 Profit Performance – FY’07 Rs172 Cr +24% Rs162 Cr +18% Rs65 Cr +350% EBITDA UBL Net Profit Rs55 Cr +550% EBITDA Net Profit Consolidated 17 Q1’08 18 Performance Highlights Q1’08 • KF Strong and KF premium outgrow the industry • New greenfield breweries commissioned and in operation • Capacity investment for 2008-09 on track • Market capitalisation exceeds $1.7bn 19 Kingfisher Performance – Q1’ 08 9.3m 7.7m +7.6% +28.5% 7.2m 7.15m June 06 June 07 Industry Growth +7.2% Premium June 06 June 07 Industry Growth +19.5% Strong 20 Profit Performance Q1’ 08 • Price increases achieved on around 55% of volume • Results impacted by: – Capped capacity of Hyderabad brewery impacts UBL standalone results by Rs6Cr, profit of Rs6Cr recorded in UMBL – Continuing impacts of prices increases on barley and hops affects margins • UBL stand alone now includes KBDL, MBDL & ABDL, not included in last years numbers 21 Profit Performance – Q1’08 Rs105 Cr +18% Rs79 Cr +54% Rs71 Cr +5% Rs65 Cr +57% EBITDA UBL PBT EBITDA PBT Combined 22 THANK YOU 23