Accounts Payable Presentation - Finance and Administrative Services

advertisement

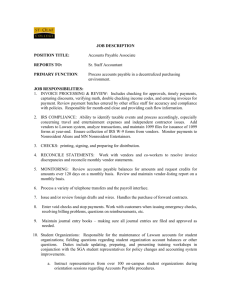

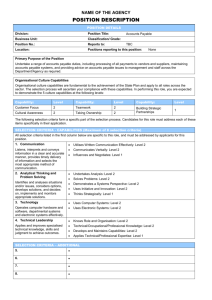

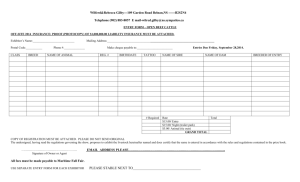

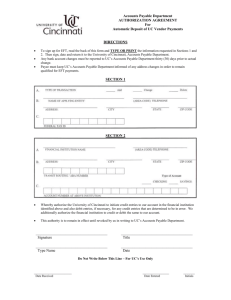

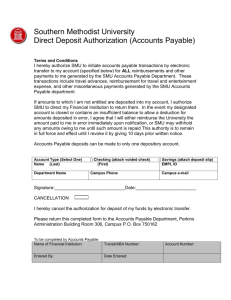

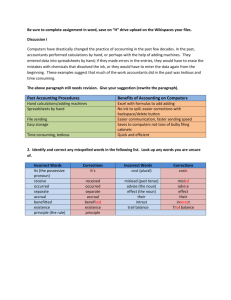

Accounts Payable Procedure Updates •Accounts Payable Department •Accounts Payable Forms •Food Purchases •Credit Card Payments •Direct Deposit Authorization •Accounts Payable Do’s •Accounts Payable Don’ts •Accounts Payable Scenarios Accounts Payable Department Maricarmen Ramirez – Accounting Group Supervisor Bertha Arriaga – Accounting Assistant – AP Gabriela Gonzalez – Accounting Assistant – AP Kelly Lara – Accounting Assistant – AP Rachel Ramirez – Accounting Assistant – AP Beatriz Saldana – Accounting Assistant – AP Jeanette Villarreal – Accounting Assistant – AP Vanessa Limon – Accounting Assistant – Travel Patricia Jackson – Accounting Assistant – Travel Marcy Gonzalez – Records Technician (Temporary) X4609 X4659 X4691 X4642 X4649 X4631 X4673 X4618 X4656 X4654 Accounts Payable Forms Account Code Classifications Prepayment Form (BO-1300) Institutional Membership Form (BO-8400) Direct Deposit Authorization Form (BO-5200) AP Check Cycle Calendar FY2015 December 2014 IRS Form W-9 (Request for Taxpayer Identification Number (TIN) and Certification) Consultant Services Rendered Form (BO-6610) Departmental Signature Authority Form (BO-1800) Food Purchases An approved Purchase Order is required – Food matrix listing allowable purchases is located in Jagnet If the purchase order covers more than one meeting- the following documents must be submitted for each: Detailed Receipt – signed by FM and PO # noted (unallowable: taxes and tips) Meeting Agenda Meeting Sign In Sheet All paperwork should be submitted within 3 days of purchase Reminder: Vendors may charge late fees or place accounts on hold for late payment on invoices. Credit Card Payments Credit card payments are now being processed for vendors accepting payment without additional fees to the college. An approved purchase order or travel authorization is still required prior to payment. Direct Deposit Authorization – EFT payments Used for employee travel per diem payments, tuition and mileage reimbursements EFT payment allows funds to be transferred directly to the employee’s financial institution, without the need to cash or deposit a printed check No worries about check being lost in the mail Direct Deposit Authorization Form #BO-5200 Accounts Payable Do’s Do submit all required backup documents with the Prepayment form (prior to purchase) Do submit all itemized receipts for prepayment purchases (after purchase) Do submit an Institutional Membership form when processing payment for any type of memberships Do submit an agenda and sign in sheets for all food purchases for staff meetings Do remind vendors that South Texas College is tax exempt Accounts Payable Do’s (Cont) Do remind vendors to submit all invoices to AP at South Texas College, PO Box 9500, McAllen, TX 78502-9500 Do submit Consultant Services Rendered form after services are completed by performer Do remember that Accounts Payable and Human Resources keep separate records, when correcting address with HR, please also contact AP department, otherwise reimbursements may be sent to the wrong address Do meet all Accounts Payable deadlines, especially at the end of the fiscal year Accounts Payable Don’ts Don’t promise early payment to vendors. The College follows a 30 day payment policy Don’t request an Emergency Hand-Cut Request form every time a deadline is not met. Some vendors, if contacted, are willing to wait for the check cycle or accept credit card payment Don’t hold invoices/receipts at your department Don’t alter invoices Accounts Payable Scenarios Accounts Payable Calendar Invoices Food Purchases Consultant Services Receipt Required PO Payments Thank you 1. Please call us if you have questions 2. Please comply with Accounts Payable deadlines