Sept 2011 - Southwest Los Angeles Association of REALTORS

CALIFORNIA HOUSING

MARKET: 2012 FORECAST

Southwest LA AOR

November 8, 2011

Leslie Appleton-Young, Chief Economist

News You Can Use from C.A.R.

“Stories of Home” Facebook Contest

Ask your clients to post a video about YOU!!!

Enter by Nov. 30 for a chance to win a $500 Lowe’s gift card!

www.facebook.com/carealtors

“Stories of Home” tab

Overview

US and California Economies

California Housing Market

Regional & Local Markets

2011 Annual Market Survey

2012 Housing Market Forecast

U.S. Economic Outlook

2011: A Year of Wild Cards

Oil Price Spikes

Political

Change on

Capitol

Hill

Arab Uprising

Debt Limit

Ceiling &

Downgrade of US Debt

Sovereign

Debt

Crisis in

EuroZone

Stock

Market

Volatility

4%

3%

2%

1%

0%

-1%

-2%

-3%

-4%

-5%

-6%

-7%

-8%

8%

7%

6%

5%

Gross Domestic Product

2010: 2.8%; 2011 Q3: 2.5%

ANNUAL PERCENT CHANGE, CHAIN-TYPE (2005) $

ANNUAL

2009 Largest Annual Drop since 1938 (-3.4%)

QTRLY

Components of GDP

Percent Change

3.0

2.5

0.5

0.0

-0.5

2.0

1.5

1.0

-1.0

-1.5

Consumption Fixed Nonres.

Investment

SOURCE: US Dept of Commerce,

Bureau of Economic Analysis

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Net Exports Government

Performance Targets for National Economy

Unemployment

Current Target

This Year -

Projected

6% 9.0%

1.7% US GDP

Nonfarm Job

Growth

CPI

3% or higher

3%+ or

400K+/mo

2.5%

1.0%

3.2%

SOURCE: California Association of REALTORS®

Consumers Pulling Back

Home Equity & Reverse Wealth Effect

Consumer Spending 2011 Q3: 2.4%

8%

6%

4%

2%

0%

-2%

-4%

QUARTERLY PERCENT CHANGE

SOURCE: US Dept of Commerce, Bureau of Economic Analysis

40%

35%

30%

25%

20%

15%

10%

5%

0%

CA Underwater Mortgages

Negative Equity Share in CA Near Negative Equity Share in CA

30,2%

0,046

SOURCE: CoreLogic

8%

6%

4%

2%

0%

Unemployment Stubbornly High

September 2011

California (11.9%) vs. United States (9.1%)

14%

CA US

12%

10%

SOURCE: CA Employment Development Division

Unemployment Rate

Los Angeles County, September 2011: 12.2%

15%

13%

11%

9%

7%

5%

3%

1%

-1%

SOURCE: CA Employment Development Division

500,000

400,000

300,000

200,000

100,000

0

-100,000

-200,000

-300,000

-400,000

-500,000

-600,000

-700,000

-800,000

-900,000

U.S. Job Growth: Flat in August

Month-to-Month Changes

Recession Job Losses: 8.4 million

Since Jan’10: +1.8 million

SOURCE: US Dept of Labor, Bureau of Labor Statistics

California Non-farm Job Growth

Month-to-Month Changes

Recession Job Losses: 1 million

Since Jan’10: +170,000

100000

80000

60000

40000

20000

0

-20000

-40000

-60000

-80000

-100000

-120000

-140000

-160000

SOURCE: CA Employment Development Division

Nonfarm Employment By Region

(Thousands)

Southern California

Bay Area

Central Valley

Central Coast

North Central

CALIFORNIA

Nonfarm Nonfarm

Employment Employment

Sep-10

7,684.1

Sep-11

7,763.6

Change

79.5

Percent

Change

1.0%

3,028.4

3,062.9

34.5

1.1%

1,842.6

460.6

127.9

13,847.9

1,844.7

464.9

129.2

14,098.5

2.1

4.3

1.3

250.6

0.1%

0.9%

1.0%

1.8%

SOURCE: CA Employment Development Division

Nonfarm Employment

Los Angeles County, September 2011: Up 0.8% YTY

Y-T-Y PERCENT CHANGE

2%

0%

-2%

-4%

-6%

-8%

SOURCE: CA Employment Development Division

Where are California’s Jobs?

Employment Trends:

Construction & Financial Sectors Biggest Losers

Industry 2005 Jul-11

Year to

Date

Mining and Logging

Construction

Manufacturing

Trade, Transportation & Utilities

Information

Financial Activities 920,300 755,800 -164,500

Professional & Business Services 2,160,700 2,136,200 -24,500

Educational & Health Services 1,593,400 1,837,000 243,600

Leisure & Hospitality

23,600

905,300

27,600

567,300

4,000

-338,000

1,502,600 1,257,600 -245,000

2,822,100 2,641,500 -180,600

473,600 455,400 -18,200

Other Services

Government

TOTAL

1,475,200 1,531,600 56,400

505,500 484,500 -21,000

2,420,200 2,380,200 -40,000

14,802,500 14,074,700 -727,800

SOURCE: California Association of REALTORS®

CA New Housing Permits

2010: 44,601 units, +22.5% YTY; Aug 2011: +2.6% YTD

300,000

250,000

200,000

150,000

100,000

50,000

0

Single Family Multi-Family

SOURCE: CBIA

Consumer Confidence Slipping Again

October 2011: 39.8

160

140

INDEX, 100=1985

120

100

80

60

40

20

Crisis of Confidence :

Small Business Optimism Down

Source: National Federation of Independent Business

Consumer Price Index

September 2011: All Items +3.9% YTY; Core +2.0% YTY

4%

2%

0%

-2%

-4%

PERCENT CHANGE FROM A YEAR AGO, 100=1982-1984

16%

14%

All Items

Core

12%

10%

8%

6%

Monetary Policy

6,00%

5,00%

4,00%

3,00%

2,00%

1,00%

0,00%

Mortgage Rates @ Historical Lows

Debt Down Grade Ignited Flight to Quality

FRM ARM

MONTHLY WEEKLY

5%

4%

3%

2%

1%

0%

10%

9%

8%

7%

6%

Classic Liquidity Trap: Consumers Deleveraging

Low Rates and Low Borrowing

FRM

ARM

Federal Funds

SOURCE: Federal Home Loan Mortgage Corporation

Fiscal Policy

US Deficit Highest in Decades

2010: 11% of GDP (Revenues – Expenses)

Deficit as a % of GDP

4,0%

2,0%

0,0%

-2,0%

-4,0%

-6,0%

-8,0%

-10,0%

-12,0%

Source: US Treasury, BEA, compiled by C.A.R.

Note: Positive = Surplus

US Debt Jumped as Government

Responded to Financial Crisis

2010: 93% of GDP

100,0%

90,0%

80,0%

70,0%

60,0%

50,0%

40,0%

30,0%

20,0%

10,0%

0,0%

Source: US Treasury, compiled by C.A.R.

Debt as a % of GDP

Obama Jobs Proposal

What:

$450 Billion stimulus: Tax cuts ($250B) and infrastructure spending ($200B)

Why:

Economy is stalled/Avoid double-dip

Zero job growth in August/high unemployment

Stabilize confidence: consumer, business, investor

How:

Increase taxes on the rich

Entitlement Reform

Tax Reform

Housing

Obama Mortgage Refinance Proposal

“HARP II”

What:

Make it easier for homeowners who are significantly underwater AND not behind on their payments to refi at today’s low rates. Mortgage sold to Fannie or Freddie on or before May 31, 2009

Help 1 million homeowners to refinance)

Why:

Housing market is stalled / Consumers leery of spending

How: Modify the Home Affordable Refi Program

Eliminates 125% cap

Waives some GSE fees if loan term reduced

Eliminates appraisals & extensive underwriting

Modifies Reps and Warranties

What Happened?

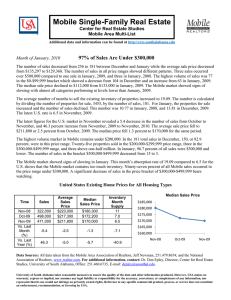

Mortgage Originations: 1990-2010

•

Refinance vs. Purchase

ORIGINATION (BIL $) 30-YR FIXED RATE MORTGAGE

12.0% 900

800

700

600

500

400

300

200

100

0

Refinance Originations (Bil $)

Purchase Originations (Bil $)

Fixed Rate Mortgage 10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

Source: Mortgage Bankers Association of America

Trustee Sales in Anaheim

Scheduled for 10/7/10

1872 W. Admiral, 92801

• 3 bed, 2.5 ba, built in

1982

• Purchased in Sept 2005 for $594,000 with 30% down.

• In April 2006, added a second for $57,000.

• In Oct 2006, refinanced the second into a new second for $100,000.

• Defaulted in 2010

• Zestimate of current value

= $364,000.

1572 W. Orangewood, 92802

• 3 bd, 2 ba, 2,016 sq ft built in 1977.

• Purchased in June 2003 for $455,000 with 30% down.

• March 2004: added a second for $75,000; added a third for $90,500; added a fourth for

$80,000.

• Within one year of purchase, the property had

$565,000 in debt on it!

• Defaulted in 2010.

• Zestimate of current value

• = $442,000.

• 3 bd, 2 ba, 1,314 sq ft built in 1956.

• Sold for $568,000 in

2005 and went into default

• Purchased as REO in

2007 for $417,000 with zero down..

• Defaulted in 2010.

• Zestimate of current value = $367,500.

8871 Regal, 92804

2414 E. Underhill, 92806

• 3 bd, 2 ba, 1,459 sq ft built in 1957.

• Purchased for $640,000 in July 2006 with piggyback financing:

$500,000 first and

$140,000 second, i.e. zero down.

• Defaulted in 2010.

• Zestimate of current value = $387,000.

Conclusions

•

Excessive borrowing against home equity is the untold part of the foreclosure story.

•

“House Prices, Home Equity-Based Borrowing, and the U.S. Household Leverage Crisis” by Mian and

Sufi:

American Economic Review

:

•

39% of new defaults from 2006 to 2008

• attributable to home equity borrowing

Understanding the Financial Crisis

Federal Issues – Critical Concerns

High-cost Loan Limit - expires 10/1/11

Future of Fannie and Freddie in flux - Increase guarantee fee likely

FHA targeted for market share drop

Tax Reform on the horizon – MID?

QRM (Qualified Residential Mortgage)

20% Down – Is the future of the 30 year mortgage in doubt?

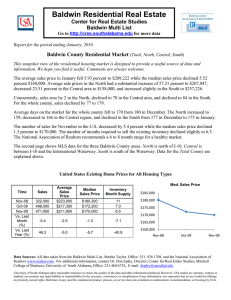

U.S. Economic Outlook

2005 2006

•

2008 2009 2010 2011f 2012f

3.1% 2.7% 2.0% 0.0% -2.6% 2.9% 1.7% 2.0% US GDP

Nonfarm Job

Growth

Unemployment

1.7% 1.8% 1.1% -0.6% -4.4% -0.7% 1.0% 0.9%

5.1% 4.6% 4.6% 5.8% 9.3% 9.6% 9.0% 8.9%

CPI 3.4% 3.2% 2.8% 3.8% -0.4% 1.6% 3.2% 2.3%

Real Disposable

Income, %

Change

1.3% 4.0%

Forecast Date: September 2011

SOURCE: California Association of REALTORS®

2.2% 0.5% 0.9% 1.4% 1.7% 1.5%

California Economic Outlook

2005 2006

•

2008 2009 2010 2011f 2012f

Nonfarm Job

Growth

Unemployment

Rate

1.8%

5.4%

1.7%

4.9%

0.8%

5.4%

-1.3% -6.0% -1.4%

7.2%

1.5% 2.1%

11.4% 12.4% 12.0% 11.2%

Population

Growth

1.2% 1.1% 1.1% 1.2% 1.1% 0.9% 0.9% 0.9%

Real Disposable

Income, %

Change

1.3% 3.4% 1.5% 0.1% -2.2% 1.6% 1.5% 2.0%

Forecast Date: September 2011

SOURCE: California Association of REALTORS®

California Housing Market

California Sales of Existing Homes and Median Price

Housing Cycle Comparisons 1970- 2011

Sales of Existing Detached Homes Median Price UNITS/MEDIAN PRICE $

700,000

-44%

600,000

500,000

400,000

300,000

200,000

100,000

0

-61%

-25%

SOURCE: California Association of REALTORS®

Sales of Existing Detached Homes and Consumer Confidence

• California, September 2011 Sales: 487,940 Units, Up 0.4% YTD, Up 4.1% YTY

Sales Consumer Confidence UNITS

700,000

600,000

500,000

400,000

300,000

200,000

100,000

0

100

80

60

40

20

0

INDEX

160

140

120

SOURCE: California Association of REALTORS®; The Conference Board

*Sales are seasonally adjusted and annualized

Median Price of Existing Detached Homes

California, September 2011: $287,440, Down 8.3% YTY

P: May-07

$594,530

$700,000

$600,000

$500,000

$400,000

$300,000

$200,000

$100,000

$0

T: Feb-09

$245,230

-59% from peak

SOURCE: California Association of REALTORS®

California’s Million-Dollar Home Sales

Year

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2,718

4,271

3,773

3,362

2,890

2,298

2,522

2,017

2,651

3,762

5,366

8,906

13,101

10,658

15,703

20,595

18,621

24,436

22,529

36,990

42,506

54,773

50,010

Number of Homes

Source: DataQuick Information Systems

MONTHS

20

10

8

6

4

2

0

18

16

14

12

Unsold Inventory Index

California, September 2011: 5.1 Months

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS®

Unsold Inventory Index: Sept 2011

(By Price Range: Months)

Price Range (Thousand) Sep-10 Aug-11 Sep-11

$1,000K+

$750-1000K

$500-750K

$300-500K

$0-300K

11.1

6.8

6.3

5.6

5.1

9.1

6.2

5.6

5.2

4.6

10.0

6.1

6.0

5.4

4.7

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS®

Market Breakdown:

Equity v. Distressed

Sales

Share of Distressed Sales to Total Sales

60%

Aug-10 Jul-11 Aug-11

40%

20%

24,7% 25,2%

24,4%

19,3%

17,5%

18,9%

44,5%

42,9%

43,7%

0%

REOs

SOURCE: California Association of REALTORS®

Short Sales Distressed Sales

Tight Supply of Inventory for REO Sales

SOURCE: California Association of REALTORS®

REO & Short Sales: Southern California

(Percent of Total Sales)

100% Sept 2011

80% Short Sales

REO Sales

60%

15%

25%

40%

26%

24%

20%

20%

12%

0%

Los Angeles

Orange

35%

Riverside

50%

San

Bernardino

SOURCE: California Association of REALTORS®

8%

17%

San Diego

100%

80%

REO & Short Sales: Central Valley

(Percent of Total Sales)

Sept 2011

Short Sales

REO Sales

60% 12%

21%

50% 26%

40%

51%

20% 40%

37%

23%

0%

Madera

Merced

San Benito

Sacramento

SOURCE: California Association of REALTORS®

23%

37%

Kern

REO & Short Sales: Bay Area

(Percent of Total Sales)

100%

80%

60%

40%

20%

0%

Sept 2011

Short Sales

REO Sales

31%

27%

16%

19%

24%

Marin

Napa

13%

13%

22%

12%

San

Mateo

Santa

Clara

42%

22%

26%

Solano

Sonoma

SOURCE: California Association of REALTORS®

100%

REO & Short Sales: Rest of California

(Percent of Total Sales)

Sept 2011

80%

Short Sales

REOs

60%

40%

20%

0%

17% 9%

18%

37%

25%

5%

14%

49%

27%

31%

16%

15%

25%

16%

25% 30%

8%

33%

8%

51%

SOURCE: California Association of REALTORS®

California Foreclosure Inventory, September 2011

SOURCE: ForeclosureRadar.com

Foreclosures

Los Angeles County

6

4

2

0

THOUSANDS

14

12

10

8

SOURCE: Real Estate Research Council

Los Angeles

Preforeclosure: 3,403 • Auction: 4,247 • Bank Owned: 1,211

Source: ForeclosureRadar.com as of 11/4/11.

Los Angeles

Preforeclosure: 3,403

Source: ForeclosureRadar.com as of 11/4/11.

Los Angeles

Auction: 4,247

Source: ForeclosureRadar.com as of 11/4/11.

Los Angeles

Bank Owned: 1,211

Source: ForeclosureRadar.com as of 11/4/11.

Inglewood

Preforeclosure: 278 • Auction: 300 • Bank Owned: 125

Source: ForeclosureRadar.com as of 11/4/11.

Regional Housing

Markets

Los Angeles

Sales of Residential Homes

Los Angeles, October 2011: 687 Units

Down 14.4% MTM, Down 2.1% YTY

SOURCE: Clarus Market Metrics

Median Price of Residential Homes

Los Angeles, October 2011: $300,000

Down 11.4% MTM, Down 8.7% YTY

SOURCE: Clarus Market Metrics

For Sale Properties

Los Angeles, October 2011: 6,729 Units

Down 5.6% MTM, Down 23.6% YTY

SOURCE: Clarus Market Metrics

Months Supply of Inventory

Los Angeles, October 2011: 3.9 Months

SOURCE: Clarus Market Metrics

Inglewood

Sales of Residential Homes

Inglewood, October 2011: 53 Units

, Up 3.9% MTM, Up 17.8% YTY

SOURCE: Clarus Market Metrics

Median Price of Residential Homes

Inglewood, October 2011: $240,000

Down 3.2% MTM, Up 1.7% YTY

SOURCE: Clarus Market Metrics

SOURCE: Clarus Market Metrics

For Sale Properties

Inglewood, October 2011: 323 Units

Down 7.4% MTM, Down 12.9% YTY

Months Supply of Inventory

Inglewood, October 2011: 3.3 Months

SOURCE: Clarus Market Metrics

2011 Annual Housing

Market Survey

Equity vs. REO vs. Short Sales

Share of Total Sales

Median Home Price

Square Footage

Price / SF

Sales-to-List Price Ratio

% of Sales With Multiple Offers

Avg. Number of Offers

% of All Cash Sales

Days on MLS

Days in Escrow

Equity Sales REO Sales Short Sales

58.7% 19.7% 20.2%

$431,000 $240,000 $287,000

1,783 1,500 1,600

$250

95.9%

$112

98.0%

$175

95.9%

35.2%

3.0

25.5%

67

35

58.3%

3.0

34.0%

50

35

57.5%

3.6

23.3%

141

45

1 in 3 Sellers Sold Because They

Were in Distress

35%

30%

25%

20%

Sold due to foreclosure/Short sale/Default 30%

15%

10%

5%

0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Q. What was the single most important reason for selling/buying the property?

Net Cash to Sellers

Median

$250 000

$200 000

$150 000

$100 000

$50 000

$75 000

$0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Q. What was the net cash gain or net loss to the seller as a result of this sale?

Proportion of Sellers Planning to

Repurchase

80%

70%

60%

50%

40%

30%

20%

10%

0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Q. Is the seller planning on purchasing another home?

Reasons Sellers Not Planning to

Buy Another Home

Seller is a lender/bank

Seller prefers to have less financial obligation

Poor credit background

Lack of cash for down payment

Out of work/unemployment

Decide to live with family/friends

Waiting for market to bottom

5.7%

10.9%

4.9%

4.7%

2.7%

11.4%

19.8%

0% 10% 20% 30% 40% 50%

Q. Why is the seller not planning to purchase another home?

Reasons For Selling

All Home Sellers

Foreclosure/Short

Sale/Default

Change in Family Status

Retirement/Move to

Retirement Community

Investment/ Tax

Consderations

Desired Better Location

Desired Smaller Home

Changed Jobs

Desired Larger Home

Other

0% 5% 10% 15% 20%

Q. What was the single most important reason for selling/buying the property?

25% 30% 35%

Cash Sales on the Rise

% of All Sales

30%

25%

20%

15%

10%

5%

0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

25%

20%

15%

10%

5%

0%

Investments & Second/

Vacation Homes

Investment/Rental Property Vacation/Second Home

7%

17%

10%

8%

6%

4%

8%

2%

0%

2008

Q. Was the buyer a foreign buyer?

Foreign Buyers

% of Foreign Buyers

6%

2009

5%

2010

6%

2011

California Housing

Market Forecast

SFH Resales

(000s)

% Change

Median Price

($000s)

% Change

Forecast Progress Report

2010

Projected

October

2010

492.0

-10.0%

$306.5

11.5%

2010 Actual

491.5

-10.1%

$303.1

10.2%

2011

Forecast

October

2010

502.0

2.0%

$312.5

2.0%

2011

Projected

491.1

-0.1%

$291.0

-4.0%

Forecast Date: September 2011 vs October 2010

Source: CALIFORNIA ASSOCIATION OF REALTORS®

California Housing Market Outlook

2005 2006 2007 2008 2009 2010 2011f 2012f

SFH Resales

(000s)

625.0

477.5

346.9

441.8

546.9

491.5

491.1

496.2

0.03% -23.6% -27.3% 27.3% 23.8% -10.1% -0.1% 1.0% % Change

Median

Price

($000s)

% Change

30-Yr FRM

1-Yr ARM

$522.7 $556.4 $560.3 $348.5 $275.0 $303.1 $291.0 $296.0

16.0%

5.9%

4.5%

6.5%

6.4%

5.5%

0.7%

6.3%

5.6%

-37.8% -21.1% 10.2%

6.0%

5.2%

5.1%

4.7%

4.7%

3.5%

-4.0%

4.5%

3.0%

1.7%

4.7%

3.1%

Forecast Date: September 2011

Source: CALIFORNIA ASSOCIATION OF REALTORS®

Closing Thoughts

Direction of Home Prices: Sellers

Skeptical; Buyers Hopeful

Down Flat Unsure Up

100%

80%

60%

40%

20%

0%

Sellers Buyers

Q: Do you think home prices in your neighborhood will go up, down or stay flat in one year, five years and 10 years?

Real Estate: It’s Time To Buy Again

“

Forget

stocks. Don't bet on

gold

.

After four years of

plunging

home prices, the

most attractive

asset class in America is

housing

.”

SOURCE: “Real estate: It’s time to buy again” Fortune Magazine’s 3/28/11 article written by Shawn Tully

8 in 10 Americans Agree Buying a Home is the Best Investment One Can Make

SOURCE: Pew Research Center’s “Home Sweet Home. Still. Five Years After the Bubble Burst”

8 in 10 Renters Would Like to

Buy in the Future

“…renters are hardly immune to the allure of homeownership, even in the face of the five-year decline in prices. Asked if they rent out of choice or because they cannot afford to buy a home, just

24% say they rent out of choice .”

SOURCE: Pew Research Center’s “Home Sweet Home. Still. Five Years After the Bubble Burst”