Share capital

advertisement

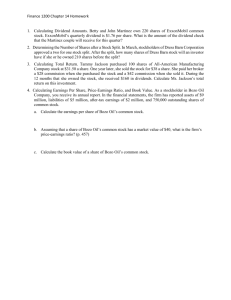

BRIEF EXERCISE 14-1 (a) Mar. (b) 1 Stock Dividends (400,000 × 5% × $5)..................... 100,000 Stock Dividends Distributable .......................... 100,000 31 Stock Dividends Distributable ................................ 100,000 Common Shares ............................................... 100,000 Wei Tse’s percentage ownership would not change as a result of a stock dividend. Prior to the stock dividend, Wei Tse’s ownership percentage was 0.5% (2,000 ÷ 400,000). After the stock dividend, Wei Tse’s ownership percentage remains 0.5% (2,100 ÷ 420,000). BRIEF EXERCISE 14-2 (a) (b) (c) (d) Share capital Retained earnings Total shareholders’ equity Number of shares Before $2,000,000 600,000 $2,600,000 225,000 After $2,270,000* 330,000* $2,600,000 247,500 * Number of shares issued: 225,000 × 10% = 22,500 shares Stock dividend: 22,500 shares × $12 = $270,000 Retained earnings will decrease and share capital will increase by this amount. BRIEF EXERCISE 14-3 Transaction (a) (b) (c) (d) (e) Declared a cash dividend Paid the cash dividend declared in (a) Declared a stock dividend Distributed the stock dividend declared in (c) Split stock 2-for-1 Assets Liabilities Shareholders’ Equity Number of Shares NE + – NE – – NE NE NE NE NE NE NE NE NE + NE NE NE + BRIEF EXERCISE 14-4 (a) Dec. (b) Dec. 31 31 Common Shares (8,000 × $6.25*) .................. Contributed Surplus— Reacquisition of Common Shares............ Cash ........................................................... 50,000 Common Shares (8,000 × $6.25*) .................. Retained Earnings ........................................... Cash ........................................................... 50,000 10,000 *Average share price = $250,000 ÷ 40,000 shares = $6.25 5,000 45,000 60,000 BRIEF EXERCISE 14-5 (a) (b) Feb. Dec. Average cost per share: $12.60 ($50,000 + $265,000) ÷ (10,000 + 15,000) 8 22 Common Shares (1,000 × $12.60) .................. Contributed Surplus— Reacquisition of Common Shares............ Cash ........................................................... 12,600 Common Shares (2,000 × $12.60) .................. Contributed Surplus— Reacquisition of Common Shares ................. Retained Earnings ........................................... Cash ........................................................... 25,200 2,600 10,000 2,600 200 28,000 EXERCISE 14-1 Before Action After Cash Dividend After Stock Dividend After Stock Split Total assets $1,875,000 $1,851,000 $1,875,000 $1,875,000 Total liabilities Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders’ equity $ 75,000 1,200,000 600,000 1,800,000 $ 75,000 1,200,000 576,000 1,776,000 $ 75,000 1,242,000* 558,000 1,800,000 $ 75,000 1,200,000 600,000 1,800,000 $1,875,000 $1,851,000 $1,875,000 $1,875,000 60,000 60,000 63,000 120,000 Number of common shares * $1,200,000 + (60,000 shares × 5% × $14) = $1,242,000 EXERCISE 14-2 1. Dec. 2. 3. 4. 31 Cash Dividends—Preferred (20,000 × $4 ÷ 4) ................................. Dividend Expense .............................. 20,000 20,000 31 Stock Dividends—Common .................... Dividends Payable ................................... Common Stock Dividend Distributable..................... Retained Earnings .............................. 12,000 12,000 31 Preferred Shares ....................................... Retained Earnings .............................. 1,400,000 31 Dividends Payable ................................... Cash Dividends—Preferred ............... (40,000 × $2 ÷ 4 = $20,000, not $40,000) 20,000 12,000 12,000 1,400,000 Before split: Annual dividend = 20,000 × $4 = $80,000 After split: Annual dividend = 40,000 × $2 = $80,000 20,000 EXERCISE 14-3 (a) Jan. 6 12 Mar. July Nov. 17 18 17 Dec. 30 Cash ....................................................... Common Shares .............................. (200,000 shares × $1.50) 300,000 Cash ....................................................... Common Shares .............................. (50,000 shares × $1.75) 87,500 Cash ....................................................... Preferred Shares .............................. (1,000 shares × $105) 105,000 Cash ....................................................... Common Shares .............................. 2,000,000 Common Shares (200,000 × $1.91*) ............................ Retained Earnings ................................. Cash (200,000 × $1.95) .................... Common Shares (150,000 × $1.91*) ............................ Contributed Surplus— Reacquisition of Common Shares .. Cash (150,000 × $1.80) .................... *Average Cost per Common Share: Number of Common Transaction Date Shares Issued January 6 200,000 January 12 50,000 July 18 1,000,000 Total 1,250,000 $2,387,500 1,250,000 = $1.91 300,000 87,500 105,000 2,000,000 382,000 8,000 390,000 286,500 16,500 Proceeds of Issue $ 300,000 87,500 2,000,000 $2,387,500 270,000 EXERCISE 14-3 (Continued) (b) There are 900,000 common shares remaining, at an average cost of $1.91**. **Average Cost per Common Share: Transaction Date January 6 January 12 July 18 Nov. 17 Dec. 30 Total Number of Common Shares Issued Proceeds of Issue 200,000 50,000 1,000,000 (200,000) (150,000) 900,000 $ 300,000 87,500 2,000,000 (382,000) (286,500) $1,719,000 $1,719,000 900,000 = $1.91 EXERCISE 14-7 (a) FYRE LITE CORPORATION Statement of Retained Earnings Year Ended December 31, 2014 Balance, January 1, as previously reported .......................................... Add: Correction for understatement of 2013 profit due to error, net of $21,2501 income tax expense 63,750 Balance, January 1, as adjusted ............................................................ Add: Profit ............................................................................................ Less: Excess cost of reacquired shares......................... Cash dividends ...................................................... 2 $85,000 × 25% = $21,250 $750,000 × (1 − 25%) = $562,500 713,750 562,5002 1,276,250 $ 50,000 245,000 Balance, December 31 ........................................................................... 1 $650,000 295,000 $981,250 (b) Note X: During the year, the corporation completed a 3-for-1 stock split on its common shares. On the balance sheet, the number of common shares outstanding will have tripled in number. EXERCISE 14-8 Item 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Contributed Capital Share Capital Additional NE NE NE NE I NE NE NE I NE NE NE NE NE NE NE D I NE NE Retained Earnings Accumulated Other Comprehensive Income Total Shareholders’ Equity D NE NE NE D NE I NE NE I NE NE NE NE NE NE NE I NE I D NE I NE NE NE I I D I PROBLEM 14-1A (a) Cash Dividend a b Stock Dividend 3-for-2 Stock Split (1) Assets $12,000,000 − $600,000a = $11,400,000 No effect = $12,000,000 No effect = $12,000,000 (2) Liabilities No effect = $4,000,000 No effect = $4,000,000 No effect = $4,000,000 (3) Common shares No effect = $2,000,000 $2,000,000 + $600,000b = $2,600,000 No effect = $2,000,000 (4) Retained earnings $6,000,000 − $600,000 = $5,400,000 $6,000,000 − $600,000 = $ 5,400,000 No effect = $6,000,000 (5) Total shareholders’ equity $8,000,000 − $600,000 = $7,400,000 No effect ($8,000,000 + $600,000 − $600,000 = $8,000,000) No effect = $8,000,000 (6) Number of shares No effect = 400,000 20,000 increase (20,000 + 400,000 = 420,000) 200,000 increase (400,000 × 3 ÷ 2 = 600,000) 400,000 × $1.50 = $600,000 400,000 × 5% × $30 = $600,000 PROBLEM 14-1A (Continued) (b) 1. Cash dividend Cash dividend 1,000 × $1.50 = $1,500 Fair value of shares 1,000 × $28.501 = $28,500 1 2. Stock Dividend Stock dividend 1,000 × 5% = 50 shares Fair value of shares 1,050 × $28.57142 = $30,000 2 3. Assumed that fair value of the shares would likely drop by the amount of the cash dividend ($30 − $1.50 = $28.50) Assumed that fair value of the shares would drop accordingly ($30 ÷ 105% = $28.5714), the same amount as the stock dividend. Stock Split Stock split 1,000 × 3 ÷ 2 = 1,500 shares Fair value of shares = 1,500 × $203 = $30,000 3 Assumed that fair value of the shares would likely decrease by one-third because of the stock split ($30 × 2/3 = $20) In terms of final value, the shareholder would be in the same position having received a cash dividend, a stock dividend or a stock split. However, a stock dividend or split would allow the shareholder to control the receipt of the cash and the related tax payment. Since the shareholder can control when the shares are sold, they can control when the income tax would have to be paid on any gains. Stock dividends and stock splits also provide the shareholder with an increased number of shares on which to generate future gains and dividends. Alternatively, some shareholders may prefer to receive a cash dividend since they do not have to sell the shares to obtain the cash. As well, there are often brokerage fees associated with selling shares. PROBLEM 14-2A (a) Date Jan. Feb. July GENERAL JOURNAL Account Titles and Explanation J1 Debit 15 Cash Dividends—Common ................................... Dividends Payable (90,000 × $1) ..................... 90,000 15 Dividends Payable ................................................. Cash ................................................................... 90,000 Credit 90,000 90,000 01 Memo: 3-for-2 stock split increases the number of shares to 135,000 (90,000 × 3 ÷ 2) Dec. 015 Common Stock Dividends ..................................... Common Stock Dividends Distributable (135,000 × 10% × $10) ................. 135,000 31 Income Summary ................................................... Retained Earnings ............................................. [($450,000 × (1 – 30%)] 315,000 31 Retained Earnings ................................................... Cash Dividends—Common ............................. Common Stock Dividends ............................... 225,000 135,000 315,000 90,000 135,000 PROBLEM 14-2A (Continued) (b) Common Shares Date Jan. Explanation 1 Balance Ref. Debit Credit Balance 1,100,000 Common Stock Dividends Distributable Date Dec. Explanation 15 Ref. Debit J1 Credit 135,000 Balance 135,000 Cash Dividends—Common Date Jan. Dec. Explanation 15 31 Closing entry Ref. J1 J1 Debit Credit 90,000 90,000 Balance 90,000 0 Common Stock Dividends Date Dec. Explanation 15 31 Closing entry Ref. J1 J1 Debit Credit 135,000 135,000 Balance 135,000 0 Retained Earnings Date Jan. Dec. Explanation 1 Balance 31 Closing entry 31 Closing entry Ref. J1 J1 Debit Credit 315,000 225,000 Balance 540,000 855,000 630,000 PROBLEM 14-2A (Continued) (c) LEBLANC CORPORATION Partial Balance Sheet December 31, 2014 Shareholders' equity Share capital Common shares, no par value, unlimited number of shares authorized, 135,000 shares issued ......................... Common stock dividend distributable .................................... Total share capital ..................................................................... Retained earnings ........................................................................... Total shareholders' equity ................................................... $1,100,000 135,000 1,235,000 00,630,000 $1,865,000 PROBLEM 14-3A (a) (b) Shares authorized Shares issued 1,000,000 437,000 Common shares $1,351,330 Contributed Surplus—reacquisition of Common shares Retained earnings $6,750 $719,420 Calculations: Common shares (a) Bal 1. 2. 3. $1,500,000 147,000 1,647,000 (30,800) 1,616,200 22,500 Number of shares (b) 500,000 35,000 535,000 (10,000) 525,000 5,000 Average issue price (a) ÷ (b) Cont. surplus — reacq. of common shares Retained earnings $3.00 $15,000 $720,000 3.08 15,000 (1) 800 15,800 720,000 3.08 720,000 4. 5. (1) (2) (3) 1,638,700 (55,620) 1,583,080 (231,750) $1,351,330 530,000 (18,000) 512,000 (75,000) 437,000 3.09 3.09 3.09 15,800 (2) (15,800) 0 (3) 6,750 $ 6,750 720,000 (580) 719,420 _ $719,420 (10,000 × $3.08) − (10,000 × $3) = $30,800 − $30,000 = $800 (18,000 × $3.09) − (18,000 × $4) = $55,620 − $72,000 = $(16,380). A maximum of $15,800 is deducted from contributed surplus; the remainder, $580, is deducted from retained earnings. (75,000 × $3.09) – (75,000 × $3) = $231,750 − $225,000 = $6,750