Chapter 14, sections 1-4

advertisement

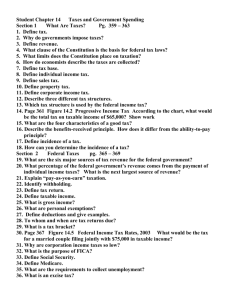

Chapter 14 Taxes and Government Spending Chapter 14 Section 1 What are taxes? Taxation is the primary way that the government collects money Without revenue, or income from taxes, government would not be able to provide goods and services Taxes and the Government The constitution gives Congress the power to tax The 16th amendment gives Congress the power to levy an income tax Limits on the Power to Tax Taxes must be for “the common defense and general welfare” Federal taxes must be the same in each state Government cannot tax exports Tax Bases and Tax Structures A tax base is the income, property, good or service that is subjected to a tax Proportional taxes are a tax for which the percentage of income paid in taxes remains the same for all income levels Tax Bases and Tax Structures Progressive Taxes are taxes for which the percent of income taxed increases as income increases Regressive Taxes are taxes for which the percentage of income taxed decreases as income increases Characteristics of a Good Tax 1) Simple- easy to understand 2) Economy- Government should be able to collect taxes without spending too much time or money 3) Certainty- Should know when the tax is due 4) Equity- Should be fair Who bears the burden of the tax? Incidence of a tax examines who bears the final burden of a tax If a good is inelastic, the consumer will bear the burden of the tax. If a good is elastic, the seller will bear the burden of the tax. Chapter 14 Section 2 Individual Income Taxes Federal Income taxes are collected throughout the year as you earn income Withholding is the process by which employers take tax payments from you before your receive your paycheck The federal income tax is progressive Filing a Tax Return A tax return is a form where you declare your income to the government A taxable income is a person’s total income minus exemptions and deductions Filing a Tax Return Exemptions are set amounts that you subtract from your income (spouse, kids) Deductions are variable amounts that you can subtract from your income (school supplies for students) Corporate Income Taxes Corporations must pay a federal tax on their income This is a progressive tax i.e. Profit = taxes Social Security, Medicare and Unemployment Taxes Social Security Tax- Funded by Federal Insurance Contributions Act (FICA). Go to those of old age, survivors and disability insurance. Medicare Taxes- Funded by FICA. Health insurance for those over 65 and some with disabilities. Unemployment Taxes- Collected by both the federal and state government. You can collect unemployment if you were laid off or are actively seeking work Other Types of Taxes Excise Tax- a tax on a production of a good (ex. Cigarettes) Estate Tax- a tax on the total value of money and property of a person that has died. Paid before inheritors receive their share Gift Tax- a tax on the money or property one living person gives to another Import tax- taxes on imported good are called tariffs Chapter 14 Section 3 Mandatory and Discretionary Spending Mandatory spending is money that lawmakers must spend on certain programs or to use for interest payments on the national debt Mandatory and Discretionary Spending Discretionary spending allows lawmakers to spend money wherever they like Discretionary Spending Defense spending- counts for about half of the federal government’s discretionary spending -includes military salaries, military equipment and operating costs of military bases Entitlements An entitlement program is a social welfare program that people are “entitled” to if they meet certain requirements (Social Security, Medicare) Medicaid- benefits low-income families, some people with disabilities and elderly people in nursing homes. Chapter 14 Section 4 State Budgets A state’s operating budget pays for everyday expenses such as salaries, supplies and maintenance of state facilities. A state’s capital budget pays for investment spending. Where are State Taxes Spent? Education- Help finance public state universities and some aid to local governments for K-12. Public Safety- State police systems and prisons Highways and Transportation- States build and maintain highways. Also pay some costs of waterways and airports Where are State Taxes Spent? Public Welfare- Support some public hospitals and clinics. Help pay for and administer federal benefits programs Arts and Recreation- State parks, some museums and historical sites Administration- Help keep the state running (Congressman) State Tax Revenues Limits to State Taxation -Since trade and commerce are considered national enterprises, states cannot tax imports or exports. They also cannot tax goods sent between states. State Tax Revenues Sales tax- sales taxes are the main source of revenue for many states Other state taxes include state income tax, excise tax and property tax Local Government Spending and Revenues Local government help assist with public school systems, fire protection, public transportation, record keeping (birth/death certificates) and law enforcement Local Government Spending and Revenues Property taxes are the main source of local revenue Local governments can collect their own excise, sales or income tax Some taxes, such as room and occupancy rates, are aimed at nonresidents in order for local governments to earn extra money