Money Handout

advertisement

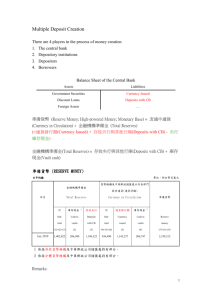

Handout - Chapter 12: Money Section 12.1: Money and its Uses The Functions of Money ● Three separate functions of money in any economy: ○ a means of exchange ○ a store of purchasing power ○ a measure of value ● Means of Exchange ○ ____________ is a system with which participants trade one product for another. ○ Leads to a ______________________, or a situation where someone purchasing an item finds a seller who wants what the purchaser is offering in return. (If a barber wants to buy a clock, they have to find a clockmaker who wants a haircut.) ○ _________ removes this coincidence of wants as everyone is trading for a common item, that can be used to trade for something else later on. ● Store of Purchasing Power ○ Money’s major advantage is its ____________, in other words, the ease with which it can be turned into a means of payment. In this case it is instantly turned into a means of payment, as it is perfectly liquid. ○ __________________ also has a hand in the liquidity of money. If a person were to keep their money with them at all times, they benefit from having highly _______ assets. However, they lose potential income, typically in the form of interest, that the wealth could create if it was in a stock or bond. ● Measure of Value ○ The idea of deterring bartering through using a common good is known as a __________________, or a pricing standard. ○ This pricing standard can be extended to _______________ of an economy, like GDP which uses money, specifically the USD, as its basis of measurement. ○ With bartering, different items have different values, and leads to the question “How much does this cost?” bringing an answer of “It depends on what you’ve got.” ● The Canadian Financial System ○ _______________ are institutions or businesses that accept funds provided by savers and lend these funds to borrowers. Deposit takers keep _______________ on hold, to provide depositors the ability to withdraw funds. Fall under two categories: chartered banks and near banks. ● Chartered Banks ○ _________________ are deposit-takers allowed by federal charter to offer a wide range of financial services. ○ There are 77 chartered banks operating in Canada, however six of them dominate the industry, holding a majority of Canadian chartered banks’ assets. As such, the Canadian chartered banking system is an _____________. ○ The oligopoly of the Canadian chartered banking system leads to market inefficiencies, but also strengthens the financial stability of the Canadian system. ● Near Banks ○ ____________ are deposit-takers that are not chartered and have more specialized services, such as trust companies, mortgage loan companies, and credit unions. ○ Trust companies distribute various forms of accounts, like estates and ______________ , mainly to households. ○ Mortgage loan companies specialize in, obviously, __________________. ○ Credit unions, which are common in Québec, are non-profit institutions that take deposits and grant loans to _______________. ● Other Financial Institutions & The Financial System ○ ____________________ offer insurance policies to their clients, and use the funds they make off of the insurance to purchase various types of incomeproducing assets. ○ Investment dealers buy and sell financial securities, like _________________, for their customers (think Wall Street). ○ In 1980, because of financial deregulation,“financial supermarkets” have sprouted up, which offer a wide variety of these services, under one corporation. These corporations typically tend to be ____________________. 1. “Any commodity can act as money as long as all participants in an economy agree to use it”. Do you agree or disagree? Explain. The Supply of Money ● Made up of currency and some deposits ○ Currency includes paper money and coinage ○ Deposits are given to deposit-takers and lent out to borrowers, who pay interest ■ Demand Deposits are funds to which depositors have immediate access ■ Notice Deposits are funds for which deposit-takers may require notice before withdrawals can be made ■ Term Deposits are funds to which depositors have no access for a fixed period of time ■ Foreign Currency Deposits are funds held by Canadians that are valued in foreign currency Money Defined ● The 5 definitions used by economists and government decisions makers are M1, M1+, M2, M3, and M2+ ○ M1 consists of currency outside chartered banks and publicly-held demand deposits at chartered banks ○ M1+ consists of M1 plus chequable notice deposits at chartered banks and near banks ○ M2 consists of M1 plus notice deposits and personal term deposits at chartered banks ○ M3 consists of M2 plus non-personal term deposits and foreign currency deposits at chartered banks ○ M2+ consists of M2 plus corresponding deposits at near banks and some other liquid assets ● Near money is all the deposits not included in M1+ plus some other highly liquid assets Choosing A Definition - Demand deposits and notice deposits are used mostly as the means of payments as they seem to fit the best as the definition of money. As a result of the statement above, many economists concluded that the most accurate measure of the money supply is M1+. Other economists like broader definitions and therefore, they prefer the measure to be M2+ in order to include other assets. - The recent innovations in payment methods have caused accounts that uses M2+ to increase in their liquidity. The Role of Credit Cards Credit Cards: A means of payment that provides instantly borrowed funds ❖ One of the main causes for increasing the liquidity of M2+. ❖ Credits cards does not represent money. It is a way for buyers to borrow funds for a short period. ❖ Credit cards has an indirect effect on the money supply because of the way the depositors use their deposit accounts. When credit cards are used for a purchase, the lending institution makes a loan (credit) to the user which is the same amount of the sale. This loan will last as long as it takes until the user pays off the monthly bill. ❏ Well-timed purchases using credit cards do not settle for more than a month (no interest charged Example: A person making a $50 purchase with a credit card is essentially taking a short-term loan for the same amount. As long as this debt is paid back by no later than a month, you are charged with not interest. However, if credit card balances are not cleared monthly, the interest rates are charged. For some people, rather than paying with currency for purchases throughout the months, they continue using credits cards and keep their funds inside their deposit account until the credit card payments are due. - by keeping funds inside their deposit accounts, they gain interest In Conclusion, if you use your credit card effectively, you can profit from it. Also, because credit cards is in use with the combination of deposit accounts, economists suggest that M2+ is the most accurate of money supply. The Role Of Debit Cards Debit Cards: A means of payment that instantaneously transfers funds from buyers to sellers ● Debit cards are not money ● a convenient way for holders to access monetary balances in the same way cheques are ● beneficial for people who are tempted to overuse the instant spending power provided by credit cards ● retailers who uses debit cards must pay for access to a sophisticated computer system that tracks the transactions ● retailers passes on this cost by charger a higher price on consumers ● in the long term, there is a downward pressure on prices as business costs associated with handling cash are reduced Section 12.2 The Money Market ● Money is demanded for reasons related to the following functions ● ● ● ● ● ● ○ Transactions Demand ○ Asset Demand __________________ demand occurs when there is a rise in the economy’s real output or price level, the total value expands and ultimately increases the demand for money. In contrast, a fall in real output decreases the total value and lowers the demand for money. _______________ the demand for money related to its use as a store of purchasing power, the main cost of holding money is the added income that could have been earned by converting it into a high paid asset. For example, a bond(s). __________ these are formal contracts that show the amount borrowed, by whom, for what period of time, and at what interest rate. They can also can be bought and sold among lenders on the open market. They are the most popular way for governments and large business to raise funds. They can easily be bought and sold before their term is ended. Money Demand: the amounts of money demanded at all possible interest rates. Money Demand Schedule: money demand expressed in a table. Money Demand Curve: money demand expressed on a graph. The Supply for Money ● Money Supply: a set amount of money in the economy, unadjusted for inflation, determined by government decision-makers. ● Money Supply Schedule: money supply expressed in a table. ● ________________: money supply expressed on a graph. ● It does not matter what the nominal interest rate is as the amount of money supplied is a contrast value. In the case where the government decision makers alter the money supply does the curve shift. ● Nominal Interest Rate: is the periodic interest rate multiplied by the number of periods per year. For example, a nominal annual interest rate of 12% based on monthly compounding means a 1% interest rate per month (compounded). Equilibrium in the Money Market ● The equilibrium level of the nominal interest rate is found at the intersection of the money demand and money supply curves . Surpluses and shortages help bring out equilibrium in the market. Section 12.3 Money Creation ● Since a substantial portion of money in the economy is held in the form of deposits, government policy-makers must take into account the actions of deposit-takers when setting the money supply ○ ________________: the minimum cash reserves that deposit-takers hold to satisfy anticipated withdrawal demands. ○ ________________: desired reserves expressed as a percentage of deposits or as a decimal. Reserve Ratio = desired reserves / deposit ○ ________________: cash reserves that are in excess of desired reserves. Excess Reserves = cash reserves - desired reserves As long as there’s excess reserves, new money will be created. ● There are five transactions in the money creation process: ○ First Transaction: ________________ - when saver A deposits a certain amount of money at a bank, the bank’s new cash assets and deposit liabilities increase by that amount. ex. ○ Second Transaction: _______________ - when the bank lends out excess reserves to borrower X, the bank’s new loan assets and deposit liabilities increase by the amount of excess reserves they lent out. ex. ○ Third Transaction: ________________- when borrower X withdraws the excess revenue from his/her deposit, the bank’s cash assets and deposit liabilities decrease by that amount of excess revenue. ex. ○ Fourth Transaction: ___________________ - when saver B deposits the amount of excess revenue from borrower X’s purchase in his/her account at another bank, the bank’s cash assets and deposit liabilities rise by that amount. ex. ○ Fifth Transaction: ___________________ - when the other bank lends out a certain amount in their excess reserves to borrower Y, added loan assets and deposit liabilities of that amount is added. Since borrower Y’s new deposit is money, the money supply increases by that amount. ex. ● The Money Multiplier: The value by which the _____________ of excess reserves is multiplied to give the __________ total change in money supply. Change in money supply = change in excess reserves x money multiplier ex. The initial change in excess reserves is $900 and the final change in money supply is $4500. $4500 = $900 x ?? 4500 / 900 = x 5=x Therefore money multiplier is 5. ● The Multiplier Formula: In money creation, the multiplier is the reciprocal of the reserve ratio. Change in money supply = change in excess revenue x money multiplier Money Multiplier = 1/reserve ratio. ex. With banks reserving 10% (0.10) of deposits, the money multiplier is 10 (=1.00/0.1). The initial change in excess reserves ($900) eventually causes an increase in the money supply of $9000. Money multiplier = 1 / reserve ratio. 10 = 1 / 0.10 Change in money supply = change in excess revenue x money multiplier $9000 = $900 x 10. Thought provoking questions: 1. “Any commodity can act as money as long as all participants in an economy agree to use it”. Do you agree or disagree? Explain. 2. “