The title of PPT

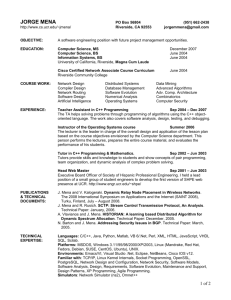

advertisement

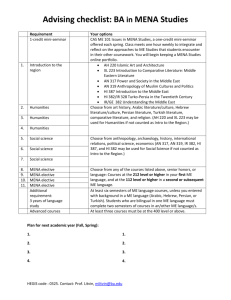

Economic Outlook: Turkey & Arab World Serkan ÖZCAN AGM, Economic Research & Strategy June 2012 Current Outlook for Turkey and MENA 2 New Stars: Turkey & MENA Realizations and Expectations of GDP Growth Rate 2002-11 Avg. Growth Realizations 6% Sub-Saharan Africa 5% MENA 4% Lagging countries 3% G7 2% Turkey CIS Leading countries Advanced economies EU Eurozone 1% 0% 0% 1% 2% 3% 4% 5% 2012-17 Avg. Growth Forecasts Source: IMF, Odea 3 6% 7% One Factor Two Problem: Surplus in MENA, Deficit in Turkey... Gross National Savings/GDP (%) 45 40 35 30 Emerging economies Advanced economies MENA Turkey G7 CEE 40.9 36.8 25 20 15 12.5 10 1980-89 1990-99 2000-09 2010 2011 12.0 2012 2013-17 Current Account Balance/GDP (%) 15 10 5 14.5 Emerging economies Advanced economies MENA Turkey G7 CEE 13.2 9.4 0 1980-89 1990-99 2000-09 2010 2011 2012 2013-17 -5 -7.1 Source: IMF, Odea -10 4 -9.9 -7.9 Budget surplus is expected only in MENA through high oil... Robust Fiscal Performance 140% Public Debt stock/GDP (2012-17 forecasts) G7 120% Eurozone 100% 80% 60% Turkey 40% MENA 20% 0% -6% -5% -4% -3% -2% -1% 0% 1% Budget balance/GDP (2012-17 forecasts) Source: IMF, Odea 5 2% 3% 4% Risk premiums are improving in both MENA and Turkey... Improving Risk Premiums Change in current account balance/GDP (2012-17 - 2006-11) 5% CIS 4% 3% EMs 2% Turkey MENA 1% 00% 0% -2% -1% 0% 1% 2% -1% Eurozone -2% Change in budget balance/GDP (2012-17 - 2006-11) Source: IMF, Odea 6 3% 4% 5% But fiscal break-even oil prices have reached to new highs... US$/barrel Source: IMF calculations 7 Yemen 237 Bahrain 119 Iran 117 Libya 117 Iraq 112 Algeria 105 United Arab Emirates 84 Oman 77 Saudi Arabia 71 Kuwait 44 Qatar 42 Turkish exports to MENA doubled during 2006-12... Trade Relationship Between Turkey and MENA Region Turkish exports to MENA (Bn US$) Turkish imports from MENA (Bn US$) 7.9 times in exports and 4 times in imports in the last decade 40 35 34 29 30 25 20 16 17 15 10 6 7 5 0 2000 2001 2002 2003 2004 2005 Source: IMF, Odea 8 2006 2007 2008 2009 2010 2011 Despite recession in EU, trade volume reached record level Trade volume between Turkey and MENA reached 20%, record level as of April 2012... In the last decade, both of exports and imports increased above the growth rates of total figures. Accordingly, share of MENA’s exports in total exports increased to 28% as of April 2012 from 15% in 2003, while the share of imports from MENA was 15%... Turkish Exports to MENA (3MA, YoY Changes) 80% -60% -80% -60% 9 Mar-12 Jun-11 Sep-10 Dec-09 Mar-09 Jun-08 Sep-07 Dec-06 Mar-03 Jun-02 Sep-01 -40% Dec-00 Mar-12 Jun-11 Sep-10 Dec-09 Mar-09 -40% Jun-08 -20% Sep-07 -20% Dec-06 0% Mar-06 0% Jun-05 20% Sep-04 20% Dec-03 40% Mar-03 40% Jun-02 60% Sep-01 60% Dec-00 80% Imports from MENA Mar-06 Exports to MENA Total imports Jun-05 100% 100% Sep-04 Total exports Dec-03 120% Turkish Imports From MENA (3MA, YoY Changes) %11 of Turkish Private Debt Received From MENA, Through Foreign Branches and Affiliates of Local Banks... Long-term External Private Debt Stock in Turkey - Country of Creditors (As a % total debt) 14% 13% Bahrain MENA 12% 11% 10.6% 10% 8.8% 9% 8% Source: CBRT, Odea 10 Opportunities in Turkish Banking Sector Banking Soundness Indicators (%, latest available month for 2011) Qatar Turkey India Saudi Arabia Oman Lebanon Bahrain Czech Rep. Portugal UAE Kuwait NPL ratio 2 2.6 2.7 3 3.3 3.8 4 5.2 7.3 8 8.5 CAR 16.1 16.6 13.1 17.1 15.5 12.1 19.6 15 9.8 20.8 19 Loan/Deposit 92 98 91 80 103 85 93 83 76 98 93 Nominal GDP increased by almost 3.7 times during 2002-2011 and is expected to grow by 1.5 times in the next 5 years. Moreover, GDP per capita in Turkey is Strongly capitalized and regulated banking sector… Lower NPL ratio... GDP per capita (PPP, US$) 18,000 Turkey 16,000 Developing Asia Emerging and developing economies 14,000 2X of EMs MENA 12,000 CIS 10,000 8,000 6,000 almost 2 times of total emerging markets’. 4,000 2,000 Source: IMF, IIF, Odea 0 1980-89 11 1990-99 2000-09 2010 2011 2012 2013-17 What are the advantages of Turkey stock markets for Arab Investors? 12 Huge Potential, High Profits... Funds Raised through Istanbul Stock Exchange (ISE) During 2000 to March 2012: IPO&Right Issues US$ 37.1 billion Cash Dividend US$ 40.9 billion 25 20 US$ billion IPO&Right issues Cash Dividend 15 12.9 10 7.0 5 0 1986-89 1990-94 1995-99 Source: ISE, Odea 13 2000-04 2005-09 2010-2012/03 Market value/GDP ratio is expected to increase by 1.5 times in the next five years with the project of Istanbul Finance Center... Istanbul Stock Exchange (ISE) Market Value 1,800 80% 1,596 1,600 ISE Market value US$ billion 1,400 Market value/GDP 90% 80% 70% 1,200 60% 43% 1,000 50% 800 40% 600 30% 472.6 400 20% 200 10% 0 0% 2003 Source: ISE, Odea 2004 2005 2006 2007 F: ISE forecast 14 2008 2009 2010 2015F Risks 15 Recent sharp fall in oil prices to signal to downside risks... There is a significant downward risks due to the recent sharp fall in oil prices... Oil prices declined significantly by 25% in the past quarter due to the rise in downside risks regarding global economic activity and risk aversion in financial markets. The recent sharp fall in oil prices led to downward risks on growth rate in the remainder of the year, especially for MENA’s oil exporters. Oil Prices & Share of MENA Economies in World 140 120 Oil prices MENA's share in world 100 Oil Prices & Share of Turkish Economy in World 5.2% 140 5.0% 120 4.8% 100 Turkey's share in world 80 60 4.4% 1.15% 40 0 4.0% 1.10% 20 1.05% 0 1.00% 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 4.2% 1.30% 1.20% 60 20 1.35% 1.25% 80 4.6% 40 1.40% Oil prices 16 Is Risk Scenario Becoming New Base? The Effects of an Euro Area Crisis (Difference from IMF growth forecasts*) Source: IMF, Odea * Peak deviation of output from the IMF April baseline under the downside scenario, increased bank and sovereign stress in the Eurozone. 17 Conclusion 18 A SWOT Analysis for Relationship of Turkey and Arab World Strengths: Weaknesses: Huge potential Social and political instability Bright outlook Regional spillover risks Opportunities: Threats: Global liquidity Fragile Eurozone economies Robust fiscal balance Downside risks on global growth Room for enhance competitiveness Rising break-even oil prices Source: CBRT, Odea 19 Thank you for your attention... Serkan ÖZCAN AGM, Economic Research & Strategy Serkan.Ozcan@OdeaBank.com.tr June 2012 20