11/9&12 - Andrew Spath

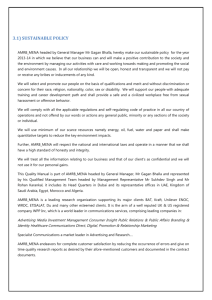

advertisement

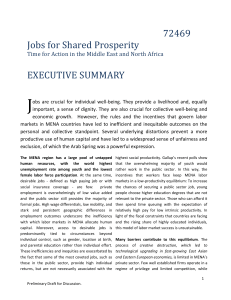

351 Spath The Political Economy of the Middle East Lecture outline • • • • • • Define Political Economy Historical background on MENA’s Political Economy Review Political Economy of Oil The Political Economy of Demographics Major challenges to MENA economic development Strategies for development--how can things get better? Political Economy An area of study focusing on the interaction between political institutions, the political environment, and the economic system. Some topics: monopolies, rent-seeking, government fiscal policy, etc. Political Economy Approach A social scientific approach that assumes that individuals & groups make political decisions that reflect economic preferences or in the same way they make economic decisions Historical Background • Effects of colonization on post-colonial states: – Weak states with narrow wealthy elites – Poor infrastructures, exploited resources, uneducated populations – Revolution & coups that result in strong, powerful autocrats – State control & bloated public sectors • Notable exceptions: – – – – Lebanon: The Christian advantage Algeria: Revolutionaries with little to work with Turkey: A generation ahead of the rest Israel: European training, militarism, aid & Nasdaq Oil—a blessing or a curse? • • • • • • • Control of MENA oil by the “Majors” Formation of OPEC (1960) 1967 War and Qaddhafi’s precedent Nationalization The 1973 War & the embargo US, European & Japanese responses Oil & foreign intervention: 1953 coup in Iran, 1973 conflict, the New Great Game, Iraq & Kuwait, pipeline diplomacy, Oil in recent wars • Oil & economic development: The “resource curse”, Rentier state & economic sectors Is oil a weapon?? Natural Resources: Services: • Foreign aid in return for military assistance, alliance or diplomatic support • Migrant labor—remittances • Navigation—Suez • Tourism & pilgrimage: holy places, historic sites, and recreation • Banking POPULATION GROWTH (1992) Development Indicators • GDP per capita and PPP • HDI • MENA countries rank below average in achieving decent quality of life for citizens Classroom exercise - Deconstruct R&W Chapter 7 - What is State-Led Economics? - What are main points and arguments in the chapter? Key Points from R&W Ch.7 • Dominant Public sector (government involvement, acts as employer, sometimes manager) • Need for revenues through taxation, resource revenue, tourism • Monopolization of Industry • Success based not on efficiency, but on other outcomes (jobs, social safety net, equity, self-sufficiency and state control) short-term gains • ISI – Import substitution industrialization • Overinvestment (contributes to short-term goals, but is not does not follow principles of efficiency) Contradictions of State-Led Growth • Decent performance in second half of 20th century – Output and output/cap grew respectably – Employment and structural change to industry was not underwhelming • Given population growth, limited nat. resources (exc. oil), low literacy, instability, not too bad for starters. But development is longterm, not short-term. BUT… • Industry was not competitive on international market (‘infant industries’ never grew up) • GOALS: supply cheap inputs for other industries; provide jobs for increasing labor force • ISI – important substitution industrialization – Trouble creating economies of scale • State over-investment + high import/export ratio = DEBT Major challenges to MENA economic development • • • • • • • • • • • • • Short term goals of political elites Debt Bloated public sectors Conflict, instability, sanctions, shifting alliances & wars Corruption & nepotism Inadequate laws & regulations = lack of private investment (*) Poor fit among region’s economies Unbalanced distribution of capital & labor Distorted economies—rentier states Demographic growth Education Technological depth Brain drain Capital investment in MENA • Attracted 3% of $62bln Foreign Direct Investment into Less Developed Countries • Offshore funds held by MENA nationals in 1994: $600bln 1994 numbers, R&W 224 How can things get better? • Political stability & reform • Avoiding failed paradigms: ISI, centralized management & crony capitalism • Developing competitive advantages & export-led industries • Disengaging the state from industry & services • Reducing the size of the public sector (increase privatization) • Reduction of armament expenditures • Transparency in disposal of oil income • Regulatory reforms & independent court systems • Cross-investment & capital retention • Talent retention • Stabilization of population growth • Regional trade arrangements • Equity temporarily sacrificed for efficiency (reduce deficits - this hurts) • Avoid overkill – prevent downward spiral of contraction (need some state involvement – borrowing, priming industries) All of this requires CREDIBILITY Why would private investors believe kings and presidents embracing economic reform verbally, especially when control is highly centralized in the leader’s hands? These leaders must show that their commitments to economic reform are credible. - Build reputation for consistency in reform - Block retreats from reform - Get help (IMF, World Bank, EU, etc.) The MENA region