UC Davis and CalPERS Call for Review of Evidence Paper on

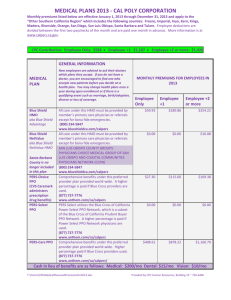

advertisement

UC Davis and CalPERS Call for Review of Evidence Paper on Corporate Governance DEADLINE: [INSERT DATE] We seek a subject expert (or experts) to write an objective and comprehensive review of evidence on corporate governance and its impact on the risk, return, and valuation of investments. This project is funded by CalPERS as they seek independent and objective evidence to support sensible policy and investment positions as they relate to corporate governance issues. Thus, by drawing on scientific evidence with solid empirical and theoretical foundations, subject experts will have an unusually strong platform to influence policy positions and the investment strategies of large global institutional investors. The review should consider this evidence from the perspective a large global institutional investor with investments in multiple asset classes including public stock, public bond, private equity, venture capital, fixed income, real estate, commodities, and infrastructure investments. The review should summarize the evidence regarding corporate governance and provide recommendations, as warranted, for how extant evidence can inform the management of a large multiclass investment portfolio. Ideally these recommendations would address sensible investment strategies or policies that would enhance the risk management or return of a large global institutional investor. These investors often provide important input into legislation affecting financial markets (e.g., Sarbanes-Oxley, Dodd-Frank, or International Financial Reporting Standards). Thus, the recommendations might also address sensible public policies that would serve the best interests of such an investor. We also seek to identify as yet unanswered questions where further research is required. To assist subject experts in the completion of the review, the UC Davis will provide research support to develop an annotated bibliography of the literature on corporate governance. Candidates The ideal candidate(s) for this review will have the following qualifications: PhD in economics, finance, or a related field, Strong familiarity with the literature on corporate governance, Published work on corporate governance. Expectations The selected candidate(s) would be expected to complete the following tasks: Provide an outline of the review paper by [INSERT DATE]. Present an overview of aims and objectives to the CalPERS board in [INSERT DATE]. Complete review of evidence working paper and post on SSRN by [INSERT DATE}. Present the results of the review of evidence at a practitioner/academic symposium to be hosted at UC Davis in [INSERT DATE]. Compensation Upon completion of the project, the candidate will receive an honorarium of $15,000. All reasonable travel expenses associated with CalPERS site visits, the CalPERS board meeting, and the symposium will be reimbursed. Rights to Work Product Authors will retain the copyright to the working paper and presentations. We encourage authors to pursue publication of the paper in a refereed journal. Authors will grant UC Davis and CalPERS a license to post and distribute the working paper version of the review of evidence and related presentation slides. CalPERS Background Historically, CalPERS corporate engagement process has the overarching objective of improving alignment of interest between providers of capital and company management. It is CalPERS view that improved alignment of interest will enable the fund to fulfill its fiduciary duty to achieve sustainable risk adjusted returns. As the nation's largest public pension fund with assets totaling $236.8 billion as of April 30, 2012, CalPERS investments span domestic and international markets. The CalPERS Board of Administration has investment authority and sole fiduciary responsibility for the management of CalPERS assets. With the Board's guidance, CalPERS Investment Committee and Investment Office carry out the daily activities of the investment program. CalPERS has generated strong long-term returns by effectively managing investments to achieve the highest possible return at an acceptable level of risk. The CalPERS portfolio is diversified into several asset classes, so any weaknesses in one area are offset by gains in another. The Board follows a strategic asset allocation policy that targets the percentage of funds invested in each asset class. Selection Committee [INSERT NAMES] To Apply To express an interest in writing a review of evidence paper on corporate governance as described above, please email the Project Coordinator Amanda L. Kimball (alkimball@ucdavis.edu) with the subject line “Governance Review.” In your email, provide the following information: (1) a brief statement of interest, and (2) a current curriculum vitae. (If you plan to coauthor the paper, please provide CVs for all authors.) The deadline for applications is [INSERT DATE]. We will promptly reply to all emails. The selection committee will review all candidates and inform candidates of the selection decision by [INSERT DATE].