Record Keeping

advertisement

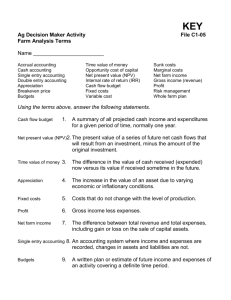

Record Keeping Ag Management Chapter 2 Why Keep Records Comply with income tax reporting requirements Assist in planning and management Kinds of Records Cash Flow Summary Net Worth Statement Income Statement Detailed Enterprise Analysis Good Records Allow You To… Compare past performance with present performance and future goals. In other words they show you where you’ve been, where you are and where you are going. The Records System Steps to Setting Up A Records System Select a record keeping system suited to your particular needs 2. Select an accounting system suited to your business situation 3. Select a method of reporting farm income and expenses 4. Develop procedures to get exactly the information needed from the records 1. Financial Records Receipts and expenses Give the net worth statement, income statemet and cash flow summary Physical Records Show the production of crops and livestock and the usage of inputs Include Crop yield records Livestock births, deaths and weanings Unpaid family labor Acres planted Bushels harvested Factors For Level of Record Selection The amount of information desired from the records The amount of time you can devote to record keeping Your record keeping abilities 3 Levels of Record Keeping Income Tax Purposes Only Income Tax plus some business analysis A complete farm or ranch business analysis Accounting System Defining Accounting Terms Accounting Period: a regular period of time, as a month or a year, for which an operative statement is drawn up. Cash Accounting: records income and expenses based on the actual cash transaction Accural Accounting: reports income and expenses in the time period they occur. Income when it is recoverable and expenses when they are payable. Single Entry: List receipts and expenses without any effort to maintain a current balance between them Double Entry: Keeps track of current changes each time a transaction is made-each credit transaction must be balanced by a debit transaction. Procedures 4 Ideas to Help Set Up A Record Keeping System Learn about the system before starting to use it. Develop a habit of keeping the record system up- to-date. Make enteries regularly and enter complete information. Do most business through a bank account Get the bank statement each month and reconcile the checkbook and record keeping system XX Record Keeping Procedure Steps See text p. 2-8 Inventory You Must Inventory Get a true picture of the business and nonbusiness finanacial situation Reflect noncash income and expenses. Provide a management tool To place values on business and nonbussiness assets. Factors that Determine Inventory Date Significance in the business operation Convenience to the operator Examples—see p. 2-9 Most Popular Inventory Date for Farmers and Ranchers January 1 The ending inventory for one year is also the beginning inventory for the next. Inventories need to be completed at the same time each year to ensure accuracy. Items to be inventoried See p. 2-10 and 2-11 Guidelines For Making Inventory Counts Measure quantities in commonly used units Group like items Methods for Putting Dollar Value on Farm Inventories Book value Current value Book Value Formula Cost - Depreciation=Book Value Current Value Formula Actual cost or market value- Sale Expense= Current Value Other Methods of Valuation Cost Minus Depreciation Cost Minus Depletion Market Cost Net Market Price Farm Production Cost Cost or Market Value Actual Amount (Value of Liability Owed) Cash Inflows and Cash Outflows Cash Reciepts are Funds Flowing IN and Include Business Income Nonbusiness Income Income from the sale of items purchased for resale Income from the sale of capital assets Money borrowed or accounts recievable paid Cash Expenditures Flowing OUT Business expense Purchase of items for resale Purchase of capital assets Principal paid on accounts payable Nonbusiness investments Family Living Expense According to Publication 225 The Farmer’s Tax Guide…. Crop sales Government payments Custom work Patronage dividends Refunds Re-sales Cash rent Commodity Credit Loans Crop Insurance Livestock Products Raised Non-breeding Livestock Items purchased for resale Capital Sales ARE ALL CONSIDERED FARM INCOME!!! Non-Business Income Income received from all sources other than farming Sources of Non-Business Income Wages, salaries and other earnings Always include gross wages as non farm income and deductions from wages as non-farm expenses Investments such as dividends received, stock distributions, partnership income, investment clubs and income from nonfarm business Depletion income from oil and gas royalties, mineral lease bonuses, gravel sales, and timber sales Interest received from savings accounts, NOW checking accounts, and savings bonds Rental income from rental houses, for use of farm land, income received from sale of crop shares Non-taxable income such as gifts, inheritances, life insurance proceeds, interest on tax-free bonds, social security benefits, money borrowed, payment from loans to other people and reimbursement of non-business expenses Cash Flow Summary Start Cash Flow Summary A record of the cash inflows and outflows of the business for a year Used to compare to the cash flow projection to determine if the operation is staying within budget and to help make business decisions Other Records Other Useful Records Credit Hired Labor Enterprise Supplemental Why Hired Labor Records are Useful Provide a basis for determining rewards Help determine the real contribution of labor to an enterprise Taxes Involved with Hired Labor Records Income and Social Security (FICA) Unemployment (FUTA) Enterprise Records Accounting records, farm reciepts and expenses that are directly related each specific farm enterprise 3 General categories Major Enterprise Minor Enterprise Overhead Enterprise Items that CAN NOT be allocated to farm enterprise Capital Sales and Purchases Inflow & Outflow from loans Non-farm receipts and expenses Internal Transfers The movement some items from one enterprise to another. Example: Feeding hay from the hay enterprise to cows in the cattle enterprise Supplemental Records Supply additional information which helps provide a more complete record system 4 Good Reasons to Keep Family Living Records Help identify family living receipts and expenses Assist the farmer or rancher in accounting for income and expenses that are not listed in the farm records Help develop future family living budgets Help identify nonfarm business incomes and expenses Summary See text p. 2-35 Assignment Chapter 2 Assignment Sheets 1 & 2 The table for Assignment Sheet 2 #2 will be e- mailed to you. DUE DATE: Review Sheet DUE DATE Chapter 2 Quiz on: Chapter 1 & 2 Test on: