Security Analysts and Conflicts of Interest

advertisement

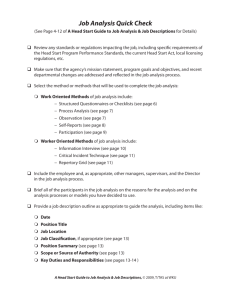

Security Analysts and Conflicts of Interest Jay R. Ritter Cordell Professor of Finance University of Florida Security analysts who work for brokerage firms that do investment banking, trade stocks (brokerage), and provide research on these stocks are known as “sell-side” analysts I will focus exclusively on equity analysts What do security analysts do? Public pronouncements – Buy/sell recommendations – Target prices – Earnings forecasts – Written reports What do security analysts do? Private (telephone calls) – Summarizing information – Passing along private (inside) information Sell-side security analysts are like professors We don’t make money by selling our research papers to PBFJ and other journals We get paid indirectly through a higher salary if we publish influential research papers • Security analysts are paid indirectly if they attract - investment banking deals - trading commissions that include soft dollars • Soft dollars are investor commissions paid for services in excess of pure trade execution. Conflicts of interest • Need to get information from management • Need to appease investors long in stock • Need to attract banking mandates What do practitioners think? “If an analyst is negative on you, you are not going to hand their bank a significant role in your stock issuance, that’s for sure. That person becomes the mouthpiece to the investment community for your firm.” Amylin Pharmaceuticals CFO Mark Foletta, as quoted in Investment Dealer’s Digest. These conflicts create an incentive to issue optimistic recommendations During the TMT (Tech, Media, and Telecom) bubble of the late 1990s, these conflicts of interest became severe Where were the regulators? Recent years have seen major changes The commissions per share paid by institutional investors in the US have collapsed in the last seven years from an average of about 4.5 cents per share to about 1.5 cents per share This is a weighted average of ECNs, “crossing networks”, and full-service brokers 100 90 80 BUY 70 Per Cent 60 50 HOLD 40 30 20 10 SELL 0 July 00 Jan 01 July 01 Jan 02 July 02 Jan 03 July 03 Jan 04 July 04 Proportion of buy, hold, and sell recommendations from U.S. sell-side analysts, 2000-2004. Source: Reuters Estimates The Financial Services Authority (FSA) in the UK has encouraged unbundling The salaries of sell-side analysts have been falling Many sell-side analysts have moved to the buy-side In Europe and North America, junior analyst jobs have been outsourced to India More research is being offered on Asian stocks What are the most important qualities of a good analyst? a) Accurate earnings forecasts b) Timely buy and sell recommendations c) Insightful written reports d) Setting up meetings with management e) Accessibility/responsiveness of phone calls f) Industry knowledge Private value of information Investors are willing to pay for information only when it is valuable Value can be measured as the ability to generate positive abnormal returns The private value of public information is zero The private value of private information can be considerable This distinction is at the heart of the conflicts of interest problem Academic research Grossman and Stiglitz (1980 AER) “The Impossibility of Informationally Efficient Markets” --There is an equilibrium degree of inefficiency Underwriters Affiliated: Managing syndicate members – Lead underwriter(s) – Co-managers Unaffiliated – Non-managing syndicate members – All others Are conflicts of interest different for affiliated and unaffiliated analysts? – Incumbent’s advantage – Currying favor Bradley, Jordan, and Ritter (2008 RFS) “Analyst Behavior Following IPOs: The ‘Bubble Period’ Evidence” Academic research focuses on public, measurable info like EPS forecasts Institutional investors don’t care about this info But are these measurable variables correlated with useful telephone calls? A good book Confessions of a Wall Street Analyst (2006) by Dan Reingold with Jennifer Reingold Dan Reingold was an II all-star analyst who covered telecoms from 1984-2003 Summary Analyst conflicts are difficult to regulate because of the economics of information Information has different public and private value, so there is an externality Academics are able to measure the public pronouncements, which institutional investors don’t care about