Government Intervention

advertisement

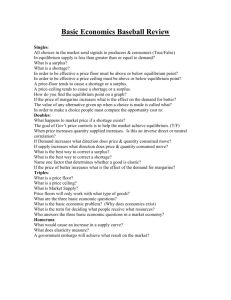

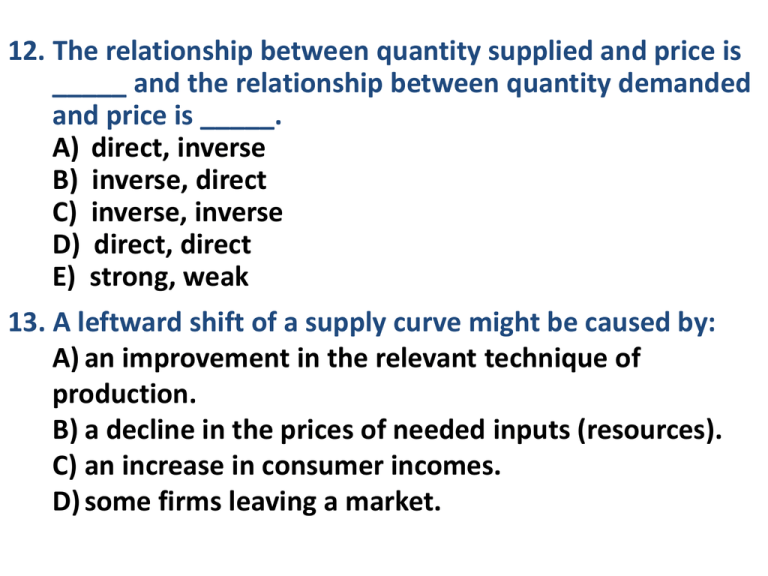

12. The relationship between quantity supplied and price is _____ and the relationship between quantity demanded and price is _____. A) direct, inverse B) inverse, direct C) inverse, inverse D) direct, direct E) strong, weak 13. A leftward shift of a supply curve might be caused by: A) an improvement in the relevant technique of production. B) a decline in the prices of needed inputs (resources). C) an increase in consumer incomes. D) some firms leaving a market. 14. Which of the following statements is correct? A) If demand increases and supply decreases, equilibrium price will fall. B) If the demand and the supply both fall at the same time, quantity will be indeterminate C) If demand decreases and supply increases, equilibrium price will rise. D) If supply increases and demand decreases, equilibrium price will fall. E) If supply falls and demand remains constant, equilibrium price will fall. 15. At price $20, there would be a SURPLUS of… A) 100 B) 150 C) 200 D) 50 E) 0 16. What would be the effect of a price floor at $60 A) It would ineffective D) A shortage of 100 B) A shortage of 50 E) A surplus of 100 C) Quantity demanded would increase 17. Which of the following statements is correct? A) If demand increases and supply decreases, equilibrium price will fall. B) If the demand and the supply both fall at the same time, quantity will be indeterminate C) If demand decreases and supply increases, equilibrium price will rise. D) If supply increases and demand decreases, equilibrium price will fall. E) If supply falls and demand remains constant, equilibrium price will fall. 18. If Buyer’s Max=$300, Seller’s Min=$150, & Price=$350 then A) consumer’s surplus is 50 B) consumer’s surplus is 100 C) producer’s surplus is 200 D) producer’s surplus is 50 E) there would be no exchange Government Intervention Basic Economic Concepts #6 Government Involvement #1-Price Controls: Floors and Ceilings #2-Import Quotas #3-Subsidies #4-Excise Taxes 6 #1-PRICE CONTROLS Who likes the idea of having a price ceiling on gas so prices will never go over $1 per gallon? 7 Price Ceiling Maximum legal price a seller can charge for a product. Goal: Make affordable by keeping price from reaching Eq. P Gasoline S $5 Does this 4 policy help consumers? Result: BLACK 3 MARKETS Price Ceiling To have an effect, a price ceiling must be below equilibrium 2 Shortage (Qd>Qs) 1 o 10 20 30 40 D 50 60 70 80 Q 8 Price Floor Minimum legal price a seller can sell a product. Goal: Keep price high by keeping price from falling to Eq. P Corn S $ Surplus (Qd<Qs) To have an effect, a price floor must be Does this above equilibrium Price Floor 4 3 policy help corn producers? 2 1 o D 10 20 30 40 50 60 70 80 Q 9 Are Price Controls Good or Bad? To be “efficient” a market must maximize consumers and producers surplus P S CS Pc PS D Qe 10 Are Price Controls Good or Bad? To be “efficient” a market must maximize consumers and producers surplus P S Price FLOOR Pc CS DEADWEIGHT LOSS The Lost CS and PS. PS INEFFICIENT! D Qfloor Qe 11 Are Price Controls Good or Bad? To be “efficient” a market must maximize consumers and producers surplus P S CS Pc PS D Qe 12 Are Price Controls Good or Bad? To be “efficient” a market must maximize consumers and producers surplus P S Pc DEADWEIGHT LOSS The Lost CS and PS. CS INEFFICIENT! Price CEILING PS D Qceiling Qe 13 #2 Import Quotas A quota is a limit on number of imports. The government sets the maximum amount that can come in the country. Purpose: •To protect domestic producers from a cheaper world price. •To prevent domestic unemployment 14 International Trade and Quotas Identify the following: 1. CS with no trade H 2. PS with no trade TLI 3. CS if we trade at world price (PW) HIJKLMNRS 4. PS if we trade at world price (PW) T 5. Amount we import at world price (PW) Q5-Q1 6. If the government sets This graphs show the domestic a quota on imports of supply and demand for grain. Q4 - Q2, what happens The letters represent area. to CS and PS? CS smaller PS bigger #3 Subsidies The government just gives producers money. The goal is for them to make more of the goods that the government thinks are important. Ex: •Agriculture (to prevent famine) •Pharmaceutical Companies •Environmentally Safe Vehicles •FAFSA 16 Result of Subsidies to Corn Producers Price of Corn S SSubsidy Price Down Quantity Up Everyone Wins, Right? Pe P1 D o Qe Q1 Q Quantity of Corn 17 18 #4 Excise Taxes Excise Tax = A per unit tax on producers For every unit made, the producer must pay $ NOT a Lump Sum (one time only)Tax The goal is for them to make less of the goods that the government deems dangerous or unwanted. Ex: •Cigarettes “sin tax” •Alcohol “sin tax” •Tariffs on imported goods •Environmentally Unsafe Products •Etc. 19 Excise Taxes Supply Schedule P Qs $5 140 $4 120 Government sets a $2 per unit tax on Cigarettes P S $5 4 3 $3 100 $2 80 $1 60 2 1 o D 40 60 80 100 120 140 Q 20 Excise Taxes Supply Schedule P Qs $5 $7 140 $4 $6 120 Government sets a $2 per unit tax on Cigarettes P S $5 4 3 $3 $5 100 $2 $4 80 $1 $3 60 2 1 o D 40 60 80 100 120 140 Q 21 Excise Taxes Supply Schedule P Qs $5 $7 140 $4 $6 120 P S $5 4 Tax is the vertical distance between supply curves 3 $3 $5 100 $2 $4 80 $1 $3 60 STax 2 1 o D 40 60 80 100 120 140 Q 22 FRQ #2