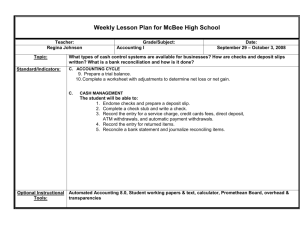

Chapter 7

Cash

Accounting, 21st Edition

Warren Reeve Fess

PowerPoint Presentation by Douglas Cloud

Professor Emeritus of Accounting

Pepperdine University

© Copyright 2004 South-Western, a division

of Thomson Learning. All rights reserved.

Task Force Image Gallery clip art included in this

electronic presentation is used with the permission of

NVTech Inc.

Some of the action has been automated,

so click the mouse when you see this

lightning bolt in the lower right-hand

corner of the screen. You can point and

click anywhere on the screen.

Objectives

1. Describe the nature of cash and the importance

After over

studying

of internal control

cash.this

you should

2. Summarize chapter,

basic procedures

for achieving

internal control over

cashto:

receipts.

be able

3. Summarize basic procedures for achieving

internal control over cash payments, including

the use of a voucher system.

4. Describe the nature of a bank account and its

use in controlling cash.

Objectives

5. Prepare a bank reconciliation and

journalize any necessary entries.

6. Account for small cash transactions

using a petty cash fund.

7. Summarize how cash is presented on

the balance sheet.

8. Compute and interpret the ratio of cash

to current liabilities.

Control Over Cash

Many companies need several cash

accounts to account for different cash

categories and funds.

Most companies have multiple bank

accounts. The title for each bank account

should be: Cash in Bank—(Name of Bank)

Preventive controls protect cash from theft

and misuse of cash.

Detective controls are designed to detect

theft or misuse of cash and are also

preventive in nature.

Retailers’ Sources of Cash

Cash

Receipts

CASHIER’S

DEPARTMENT

Register

records

ACCOUNTING

DEPARTMENT

Remittance

advices

Mail Receipts

Retailers’ Sources of Cash

CASHIER’S

DEPARTMENT

ACCOUNTING

DEPARTMENT

1

Deposit ticket

Deposit receipt

Bank

Controlling Cash Received

from Cash Sales

19 Cash

3 142 00

Cash Short and Over

Sales

8 00

3 150 00

To record cash sales and actual

cash on hand.

Cash sales for March 19 totaled $3,150.00 per

the cash register tape. After removing the

change fund, only $3,142.00 was on hand.

Controlling Cash Received

in the Mail

Most companies’ invoices

are designed so that

customers return a portion

of the invoice, call a

remittance advice.

Controlling Cash Received

in the Mail

1. The employee who opens the mail should initially

compare the amount received with the amount on the

remittance advice.

2. The employee opening the mail stamps checks and

money orders “For Deposit Only” in the bank account

of the business.

3. All cash is sent to the Cashier’s Department where

checks and money orders are combined with receipts

from cash sales and a bank deposit ticket is prepared.

Controlling Cash Received

in the Mail

4. The remittance advices and their summary totals are

delivered to the Accounting Department where a clerk

prepares the records of the transactions and posts them

to the customer account.

5. The stamped duplicate copy of the deposit ticket is

returned to the Accounting Department where a clerk

compares the receipt with the total amount that should

have been deposited.

Internal Control of Cash

Payments

1. Cash controls must provide assurance that

payments are made for only authorized

transactions.

2. Cash controls should ensure that cash is used

efficiently.

3. A voucher system provides assurance that

what is being paid for was properly ordered,

received, and billed by the supplier.

13

A voucher system is a set of

procedures for authorizing

and recording liabilities and

cash payments.

Basic

Features of

the Voucher

System

Basic Features of the

Voucher System

A voucher system normally uses vouchers.

The system normally has a file for unpaid

vouchers and a file for paid vouchers.

Usually prepared by the Accounting

Department after all necessary supporting

documents are received (purchase order,

supplier’s invoice, and a receiving report).

In preparing the voucher, the accounts

payable clerk verifies the quantity, price, and

mathematical accuracy of the supporting

documents and files the paid voucher.

A summary received from

the bank of all account

transaction is called a

statement of account.

A bank reconciliation is a listing

of the items and amounts that

cause the cash balance reported

in the bank statement to differ

from the balance of the cash

account in the ledger.

Reasons for Differences Between Depositor’s

Records and the Bank Statement

Outstanding checks

Deposits in transit

Service charges

Collections

Not-sufficient-funds (NSF)

checks

Errors

Steps in a Bank Reconciliation

1. Compare each deposit listed on the bank statement

Add deposits not recorded by the bank to the

with unrecorded deposits appearing on the preceding

balance

according and

to the

statement.

period’s

reconciliation

withbank

deposit

receipts.

2.Deduct

Compare

paid checks

with outstanding

checks

outstanding

that havechecks

been paid

appearing on the preceding period’s reconciliation and

by

the

bank

from

the

balance

according

to

the

with recorded checks.

bank statement.

3. Add

Compare

bank

credit memorandums

to entries

in the

credit

memorandums

that have

not been

journal.

recorded to the balance according to the

depositor’s records.

Steps in a Bank Reconciliation

4.Deduct

Compare

bankmemorandums

debit memorandums

to entries

debit

that have

not been

recording cash payments.

recorded from the balance according to the

5. List any errors discovered during the preceding steps.

depositor’s records.

BANK

Bank’s

books

Beginning balance

$3,359.78

Depositor’s

records

Beginning balance

$2,549.99

Power Network prepares to reconcile the

monthly bank statement as of July 31, 2006

BANK

Bank’s

books

Beginning balance

Add deposit not

recorded by bank

$3,359.78

Depositor’s

records

Beginning balance

816.20

$4,175.98

A deposit of $816.20 did not

appear on the bank statement.

$2,549.99

BANK

Bank’s

books

Beginning balance

Add deposit not

recorded by bank

$3,359.78

816.20

$4,175.98

Depositor’s

records

Beginning balance

Add note and interest

collected by bank

The bank collected a note in the

amount of $400 and the related

interest of $8 for Power Networking

$2,549.99

408.00

$2,957.99

BANK

Bank’s

books

Beginning balance

Add deposit not

recorded by bank

$3,359.78

816.20

$4,175.98

Depositor’s

records

Beginning balance

$2,549.99

Add note and interest

collected by bank

408.00

$2,957.99

Deduct outstanding

checks:

No. 812 $1,061.00

No. 878

435.39

No. 883

48.60 1,544.99

deposit of

$637.02

did not appear

ThreeAchecks

that

were written

during the

on appear

the bankon

statement.

period did not

the bank statement:

#812, $1,061; #878, $435.39, #883, $48.60.

BANK

Bank’s

books

Beginning balance

Add deposit not

recorded by bank

$3,359.78

816.20

$4,175.98

Deduct outstanding

checks:

No. 812

$1,061.00

No. 878

435.39

No. 883

48.60 1,544.99

Depositor’s

records

Beginning balance

$2,549.99

Add note and interest

collected by bank

408.00

$2,957.99

Deduct check returned

because of insufficient

funds

$300.00

The bank returned an NSF check from one of the

firm’s customers, Thomas Ivey, in the amount of

$300. This was a payment on account.

BANK

Bank’s

books

Beginning balance

Add deposit not

recorded by bank

$3,359.78

816.20

$4,175.98

Deduct outstanding

checks:

No. 812

$1,061.00

No. 878

435.39

No. 883

48.60 1,544.99

Depositor’s

records

Beginning balance

$2,549.99

Add note and interest

collected by bank

408.00

$2,957.99

Deduct check return

because of insufficient

funds

$300.00

Bank service

charges

18.00

The bank service charges totaled $18.00.

BANK

Bank’s

books

Beginning balance

Add deposit not

recorded by bank

$3,359.78

816.20

$4,175.98

Deduct outstanding

checks:

No. 812

$1,061.00

No. 878

435.39

No. 883

48.60 1,544.99

Depositor’s

records

Beginning balance

$2,549.99

Add note and interest

collected by bank

408.00

$2,957.99

Deduct check return

because of insufficient

funds

$300.00

Bank service

charges

18.00

Error recording

Check No. 879 9.00

327.00

Check No. 879 for $732.26 to Taylor Co. on account,

erroneously recorded in journal as $723.26.

BANK

Bank’s

books

Beginning balance

Add deposit not

recorded by bank

$3,359.78

816.20

$4,175.98

Deduct outstanding

checks:

No. 812

$1,061.00

No. 878

435.39

No. 883

48.60 1,544.99

Adjusted balance

$2,630.99

Depositor’s

records

Beginning balance

$2,549.99

Add note and interest

collected by bank

408.00

$2,957.99

Deduct check return

because of insufficient

funds

$300.00

Bank service

charges

18.00

Error recording

Check No. 879

9.00

327

Adjusted balance

$2,630.99

Now, if desired, we can

prepare a formal

statement for Power

Networking.

Power Networking

Bank Reconciliation

July 31, 2006

Balance per bank statement

Add: Deposit not recorded by bank

$3,359.78

816.20

$4,175.98

Deduct: Outstanding checks

No. 812

No. 878

No. 883

Adjusted balance

Balance per depositor’s records

Add: Note and interest collected by bank

$1,061.00

435.39

48.60

1,544.99

$2,630.99

$2,549.99

408.00

$2,957.99

Deduct: NSF check (Thomas Ivey) returned$300.00

Bank service charges

18.00

Error in recording Check No. 879

9.00

327.00

Adjusted balance

$2,630.99

Journal entries must be prepared

for those items that affected the

depositor’s side of the

reconciliation.

Power Networking

Bank Reconciliation

July 31, 2006

Balance per bank statement

Add: Deposit not recorded by bank

$3,359.78

816.20

$4,175.98

Deduct: Outstanding checks

No. 812

No. 878

No. 883

Adjusted balance

$1,061.00

435.39

48.60

Balance per depositor’s records

Add: Note and interest collected by bank

Deduct: NSF check (Thomas Ivey) returned

Bank service charges

Error in recording Check No. 879

Adjusted balance

1,544.99

$2,630.99

$2,549.99

408.00

$2,957.99

$300.00

18.00

9.00

327.00

$2,630.99

Entries Related to a Bank Reconciliation

July 31 Cash

Notes Receivable

Interest Receivable

Note collected by bank.

408 00

400 00

8 00

Power Networking

Bank Reconciliation

July 31, 2006

Balance per bank statement

Add: Deposit not recorded by bank

$3,359.78

816.20

$4,175.98

Deduct: Outstanding checks

No. 812

No. 878

No. 883

Adjusted balance

$1,061.00

435.39

48.60

Balance per depositor’s records

Add: Note and interest collected by bank

Deduct: NSF check (Thomas Ivey) returned

Bank service charges

Error in recording Check No. 879

Adjusted balance

1,544.99

$2,630.99

$2,549.99

408.00

$2,957.99

$300.00

18.00

9.00

327.00

$2,630.99

Entries Related to a Bank Reconciliation

July 31 Cash

408 00

Notes Receivable

400 00

Interest Receivable

Note collected by bank.

30 Accounts Receivable—Thomas Ivey

Miscellaneous Administrative Exp.

Accounts Payable—Taylor Co.

Cash

NSF check, bank service

charges, and error in

recording Check no. 879.

8 00

300 00

18 00

9 00

327 00

Petty

Cash

On August 1, issued Check No. 511 for $100

to established a petty cash fund.

Aug. 1 Petty Cash

Cash

Established petty cash fund.

100 00

100 00

At the end of August, the petty cash receipts

indicated expenditures for the following items:

office supplies, $28, postage (office supplies),

$22; store supplies, $35, and miscellaneous

administrative items, $3.

Aug. 31 Office Supplies

Store Supplies

Miscellaneous Administrative Exp.

Cash

Replenished petty cash fund.

50 00

35 00

3 00

88 00

Financial Analysis and Interpretation

Solvency is the ability of a business to meet

its financial obligations (debts) as they are

due.

Solvency analysis focuses on the ability of

a business to pay or otherwise satisfy its

current and noncurrent liabilities.

This ability is normally assessed by

examining balance sheet relationships.

Financial Analysis and Interpretation

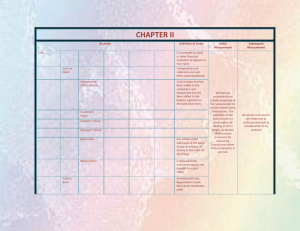

Doomsday Ratio

Laettner Co. Oakley Co.

A. Cash and equivalents

B. Current liabilities

Doomsday ratio A / B

$100,000 $ 120,000

400,000 1,500,000

0.25

0.08

Use: To indicate

thethese

company’s

ability to

How are

ratios used?

meet creditors obligations in the

worst case assumption that should

the business cease to exist.

Chapter 7

The End