CBA

Commonwealth Bank

Impacts/ Changes to Operations Resulting from G20 Reform

31st August 2015/ Confidential

Discussion Points

Reporting – intraday or T+1

Reconciliation – with trade repository

Collateral – portfolio and material terms recs, margin calls

Clearing – Mandatory clearing via direct or by broker

Maintenance of client information – correctly identifying clients

Commonwealth Bank of Australia Confidential

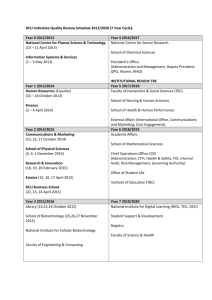

Items in solid colour indicates confirmed dates:

No or Low impact for this project/IT Medium Business/IT Impact High Impact for Project, & IT

Indicates uncertainty in Regulations and/or dates not finalised:

2014/15 OTC Reform Regulation Project Impact Assessment

Jan 15 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan 16 Feb

Large Trader Reporting changes – Phased dates from 30/09/2014 to Changes to the trade reporting solution 30/04/2016

Substituted Compliance Expiry of Cross Border Relief on 1/12/15 Possible Part 45 & 46 Entity Implementation

Mandatory Execution (SEF’s) – Ongoing timeline linked to clearing

Footnote 513: Relief expires 30/09/15

Margin on Uncleared – IM margin Phase in from 1/12/15. VM required from 1/12/15

Commodity Position Limits & Aggregation

– Date TBC

SEC Requirements

– Quarterly De Minimus Calculations . Implementation dates TBC

Relief exp for Val Reporting of Cleared Trades (letter – 14-90) 30 Jun 15

Central Clearing Interest Rates Q3/4 2015

Volcker Rule – 21 July 2015

UTI Pair & Share

– 1 Oct 2015 (counterparts to agree to UTI)

Client Delegation Phase 3A Credit &

Rates

ASIC Reporting Exemption Expiry : Entity Identifiers , UTI pairing and sharing,

Collateral, Entity Name, Lifecycle, ETD Reporting, unmasking 30 Sep 15

Phase 3A commence rpting of collateral barriers & valuations for credits & rates 2 Nov 15

ASIC Client Delegation Phase 3A Other Asset classes & 3B All Products

12 Oct 15

ASIC Client Delegation Phase 3A Backloading 19 Oct 15

Rpting

– 24 Feb 15

FX Securities Conversion

Transactions Exp 30 Sep 16

Phase 3A commence collateral, barriers and valuations for FX,

Commods and equities 2 May 16

Mandatory Clearing. Q1 2016 (Date TBC) . Final Regs & Determination June 2015

ASIC Margin on Uncleared : APRA consultation Q2/Q3

ASIC Legal Entity Name Exemption expiry (subject to TR capability) – 1 July 2015

HKMA Consultation period

HKMA to set Mandatory

Reporting dates Cam

Reporting : Expanded products and scope. Earliest

May 2015

Mandatory Clearing Q4 2015 (TBC)

FX Reporting Phase 1

‘Booked in’

1 May

Phase 1d Entities Backloading for

Credit & Rates Transactions 1 Apr 15

FX, Credit and Rates derivatives Reporting

‘Traded In’ & Additional Fields – 1 Nov

USI/UTI Feb 2016

Russia, China, Malaysia &

Sth Africa & Japan are being monitored

Mandatory Clearing & MTF’s for Rates & Credit Q3 /4 2015 (TBC)

Margin on Uncleared

Collateral Rpting (CBA date) Oct 2015

Reporting Dead Trades

2016

New Jurisdictional fields 27 March

14/02/15 Version

Reporting Deadline for

Backloading 30 Apr

Monitoring Other Canadian Provinces

Highlights

CBA cleared their first OTC trade via LCH in March 2012.

CBA was the first Australian bank to clear an AUD swap via the

ASX on the 10 Sept 2013.

CBA has cleared over 10k OTC trades through different exchanges.

In June 2015 CBA participated in the biggest ever AUD swap compression with the London Clearing House – in terms of notional reductions – a total of $4.3 trillion.

CBA is reporting approximately 70k trades to different trade repositories.

Commonwealth Bank of Australia Confidential

Issues

Needed to implement a number of tactical solutions to meet tight deadlines.

There were and still are a number of manual processes in place.

Increased resourcing required to handle new processes and extra workload.

Client maintenance issues, needed to ensure clients were flagged against correct jurisdictions within our product systems.

A number of product system changes required.

Commonwealth Bank of Australia Confidential

Questions

?

Commonwealth Bank of Australia Confidential