Derivatives * Majeure Finance Topic 1: Introduction

advertisement

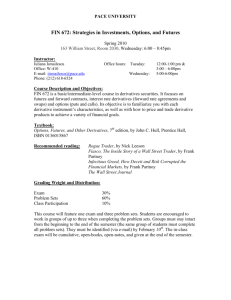

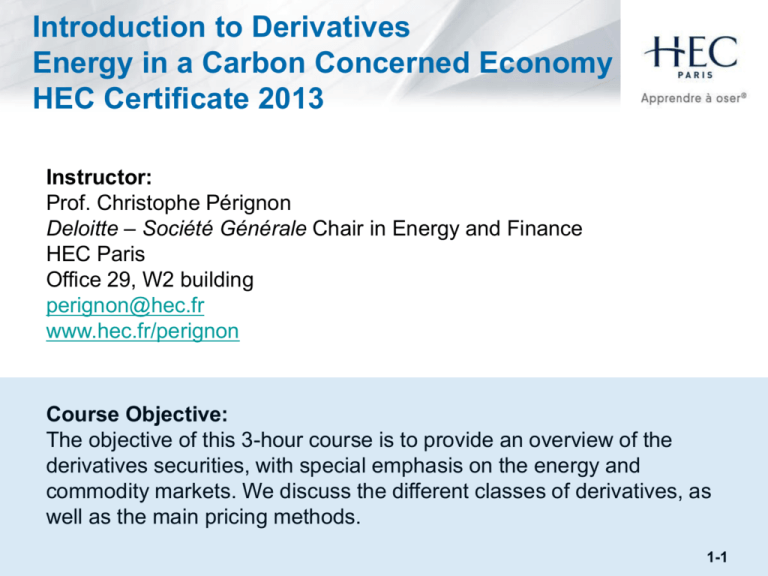

Introduction to Derivatives Energy in a Carbon Concerned Economy HEC Certificate 2013 Instructor: Prof. Christophe Pérignon Deloitte – Société Générale Chair in Energy and Finance HEC Paris Office 29, W2 building perignon@hec.fr www.hec.fr/perignon Course Objective: The objective of this 3-hour course is to provide an overview of the derivatives securities, with special emphasis on the energy and commodity markets. We discuss the different classes of derivatives, as well as the main pricing methods. 1-1 Introduction to Derivatives Topic 1: Introduction Prof. Christophe Pérignon, HEC Paris Energy in a Carbon Concerned Economy HEC Certificate 2013 1-2 The Nature of Derivatives • A derivative is a financial asset whose value depends on the value of another asset, called underlying asset • Examples of derivatives include Futures, Forwards, Options, Swaps, Credit Derivatives, Structured Products • Derivatives, while seemingly new, have been used for thousands years * Aristotle, 350 BC (Olive) * Netherlands, 1600s (Tulips) * USA, 1800s (Grains, Cotton) * Spectacular growth since 1970’s • Increase in volatility + Black-Scholes model (1973) 1-3 Examples of Underlying Assets • • • • • • • Stocks Bonds Exchange rates Interest rates Commodities/metals Energy Number of bankruptcies among a group of companies • Pool of mortgages • Temperature, quantity of rain/snow • Real-estate price index • Loss caused by an earthquake/hurricane • Dividends • Volatility • Derivatives • etc 1-4 Trading Activity Notional Principal ($bio) Number of Contracts (mio) 70000 180 60000 160 140 50000 120 40000 100 30000 80 60 20 2012 2010 2009 2008 2007 2006 2005 2004 0 2011 Options 2003 2012 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 0 2011 Options Futures 2002 10000 40 2001 Futures 2000 20000 Source: Bank for International Settlement (BIS) 1-5 Trading Activity (II) Notional Amounts Outstanding ($bio) 800000 700000 600000 Others CDS Commodities 500000 Equity 400000 Interest rate 300000 Foreign exchange 200000 100000 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Bank for International Settlement (BIS) 1-6 Ways Derivatives are Used • To hedge risks (reducing the risk) • To speculate (betting on the future direction of the market) • To lock in an arbitrage profit (taking advantage of a mispricing) Net effect for society? 1-7 Risk Management in Practice Survey of International Evidence on Financial Derivatives Usage by Bartram, Brown and Fehle (2009, http://ssrn.com/abstract=424883): • 7,319 non-financial firms from 50 countries • 60% of the firms use derivatives 45% FX risk / 35% Interest rate risk / 10% Commodity price risk Hedging Increases Firm Value: 1-8 The Risk Management Policy of French Firms Study Etude MEDEF-HEC 2012 http://appli9.hec.fr/hec-medef/doc/MEDEF-2012-rapport-final.pdf 5 4.5 4 3.5 3 Risque de récession Coût de financement Prix des matières premières Risque de change 1-9 The Risk Management Policy of French Firms (II) Etude MEDEF-HEC 2012: Financial Hedging vs. Operational Hedging 4 3 2 1 Faire payer en Fournisseurs euro ses en dehors de clients hors la zone euro zone euro Forwards Futures Employés en Unités de dehors de la production en zone euro dehors de la zone euro Swaps Dettes en devises étrangères Payer des fournisseurs de la zone euro en devises étrangères COFACE Options 1-10 Introduction to Derivatives Topic 2: Futures and Forwards Prof. Christophe Pérignon, HEC Paris Energy in a Carbon Concerned Economy HEC Certificate 2013 2-1 Futures Contracts • A FUTURES contract is an agreement to buy or sell an asset at a certain time in the future for a certain price • By contrast in a SPOT contract there is an agreement to buy or sell an asset immediately • The party that has agreed to buy has a LONG position (initial cash-flow = 0) • The party that has agreed to sell has a SHORT position (initial cash-flow = 0) 2-2 Futures Contracts (II) • The FUTURES PRICE (F0) for a particular contract is the price at which you agree to buy or sell • It is determined by supply and demand in the same way as a spot price • Terminal cash flow for LONG position: ST - F0 • Terminal cash flow for SHORT position: F0 - ST Futures are traded on organized exchanges: • Chicago Board of Trade, Chicago Mercantile Exch. (USA) • Montreal Exchange (Canada) • EURONEXT.LIFFE (Europe) • Eurex (Europe) • TIFFE (Japan) 2-3 Example: Gold Sept 07, 2011 (10.26 NY Time) S0 = $1,810.1 Source: www.kitco.com Oct 2011 $1,797.0 Nov 2011 $1,803.2 Dec 2011 $1,801.4 Dec 2012 $1,812.0 F0 (Nov 2011) = $1,803.2 Source: www.cmegroup.com 2-4 Quotes retrieved on September 7, 2010 2-5 Sep-18 Apr-18 Nov-17 Jun-17 Jan-17 Aug-16 Mar-16 Oct-15 May-15 Dec-14 Jul-14 Feb-14 Sep-13 Apr-13 Nov-12 Jun-12 Jan-12 Aug-11 Mar-11 Oct-10 Jul-12 May-12 Mar-12 Jan-12 Nov-11 Sep-11 Jul-11 May-11 Mar-11 Jan-11 Nov-10 Sep-10 CME Copper Futures Prices 3.52 3.51 3.5 3.49 3.48 3.47 3.46 3.45 CME Natural Gas Futures Prices 7 6.5 6 5.5 5 4.5 4 3.5 Measuring Interest Rates • • • • A: Amount invested n: Investment period in years Rm: Interest rate per annum m: Compounding frequency For any n and m, the terminal value of an investment A at rate Rm is: A(1+Rm / m)mn limm –›∞ A(1+Rm / m)mn = A e r n where r is the continuously compounded interest rate per annum • $100 grows to $100er×T at time T • $100 received at time T discounts to $100e-r×T at time zero • A risky cash-flow of $X received at time T discounts to $Xe-k×T at time zero, where k = r + p and p is the risk premium 2-6 Forward Contracts • Forward contracts are similar to futures except that they trade on the over-the-counter market (not on exchanges) • Forward contracts are popular on currencies and interest rates 2-7 Market Organization • Derivatives Exchanges vs. Over-the-Counter (OTC) • Standardized vs. Tailor-Made Products – Underlying asset – Size of the position – Delivery date – Delivery location – Market Makers and Liquidity – Default risk and Collateral 2-8 Contract Specifications: Futures on CAC40 Index Contract CONTRAT À TERME FERME SUR L’INDICE CAC 40 (FCE) Underlying Asset CAC 40 stock index, made of 40 French blue chip companies, computed by Euronext Paris SA, released every 30 seconds (value of 1000 on Dec. 31, 1987) Notional Value of the index × 10 € Minimum Tick 0,5 index point (5 €) Maximum Price Fluctuation +/- 200 points with respect to last closing price. As soon as the futures price exceed this limit, trading is suspended Maturity Date Third Friday of the month at 4PM Liquidation Settled in Cash. The terminal value of the index is the average value of the index between 3:40 and 4:00PM (41 observations). Margin Margin requirement is 225 points per contract Margin is reduced for trading on spread (long and short positions on contracts with different maturities) Transaction Cost Trading Fee (Euronext Paris) : 0,14 € Clearing Fee (LCH.Clearnet) : 0,13 € 2-9 Default Risk and Margins • Two investors agree to trade an asset in the future • One investor may: – regret and leave – not have the financial resources Margins and Daily Settlement 2-10 Margins • A margin is cash (or liquid securities) deposited by an investor with his broker • The balance in the margin account is adjusted to reflect daily gains or losses: “Daily Settlement” or “Marking to Market” • If the balance on the margin account falls below a prespecified level called maintenance margin, the investor receives a margin call • If the investor is unable to meet a margin call, the position is closed • Margins minimize the possibility of a loss through a default on a contract 2-11 Hedging with Futures: Theory • Proportion of the exposure that should optimally be hedged is: sS h r sF * sS is the standard deviation of DS, the change in the spot price during the hedging period, sF is the standard deviation of DF, the change in the futures price during the hedging period r is the coefficient of correlation between DS and DF. 2-12 Hedging with Futures: Example • Airline will purchase 2 million gallons of jet fuel in one month and hedges using heating oil futures • From historical data sF =0.0313, sS =0.0263, and r= 0.928 0.0263 * h 0.928 0.7777 0.0313 • The size of one heating oil contract is 42,000 gallons • Optimal number of contracts: = 0.7777 × 2,000,000 42,000 = 37.03 2-13 Pricing Futures • Suppose that: – The spot price of gold is $1,250 – The quoted 1-year futures price of gold is $1,300 – The 1-year US$ interest rate is 1.98% per annum – No income or storage costs for gold • Is there an arbitrage opportunity? 2-14 • NOW – Borrow $1,250 from the bank – Buy gold at $1,250 – Short position in a futures contract • IN ONE YEAR – Sell gold at $1,300 (the futures price) – reimburse 1,250 exp(0.0198) = $1,275 ARBITRAGE PROFIT = $25 NOTE THAT ARBITRAGE PROFIT AS LONG AS S0 exp(r T) < F0 2-15 Pricing Futures (II) • Suppose that: – The spot price of gold is $1,250 – The quoted 1-year futures price of gold is $1,265 – The 1-year US$ interest rate is 1.98% per annum – No income or storage costs for gold • Is there an arbitrage opportunity? 2-16 • NOW – Short sell gold and receive $1,250 – Make a $1,250 deposit at the bank – Long position in a futures contract • IN ONE YEAR – Buy gold at $1,265 (the futures price) – Terminal value on the bank account 1,250 exp(0.0198) = $1,275 ARBITRAGE PROFIT = $10 NOTE THAT ARBITRAGE PROFIT AS LONG AS S0 exp(r T) > F0 Therefore F0 has to be equal to S0 exp(r T) = $1,275 2-17 Futures Pricing (III) For any investment asset that provides no income and has no storage costs F0 = S0erT Immediate arbitrage opportunity if: F0 > S0erT F0 < S0erT short the Futures, long the asset long the Futures, short sell the asset 2-18 When an Investment Asset Provides a Known Dollar Income Consider a Futures on a bond S0 = $900, F0 = $850 Tbond = 5 years, Tfutures = 1 year Coupon in 6 months: $40 Coupon in 12 months: $40 r(6 months) = 1%, r(12 months) = 2% • NOW – Borrow $900 (39.80 for 6 m and 860.20 for 12 m) – Buy 1 bond at $900 – Short position in the Futures 2-19 • IN 6 MONTHS – Receive first coupon and reimburse $40 • IN 12 MONTHS – Receive second coupon $40 – Sell the bond at $850 (futures price) – Reimburse $860.20 exp(0.02) = 877.58 ARBITRAGE PROFIT = $12.42 TO PREVENT AN ARBITRAGE PROFIT: I2 + F0 – [S0 – I1exp(-r6m 0.5)] exp(r12m 1) = 0 F0 = [S0 – I1exp(-r6m 0.5) – I2exp(-r12m 1)] exp(r12m 1) F0 = (S0 – I) exp(r T) where I is the PV of all future incomes 2-20 When an Investment Asset Provides a Known Yield Yields: Income expressed as a % of asset price, usually measured by continuous compounding per year, and denoted by q Yields work just like interest rates e.g. Final value after T years of S0 dollars invested in an asset generating a yield q is S0 eqT Intuitively, we have: with cash income: F0 = (S0 - I)erT with yield: F0 = (S0 e-qT)erT = S0 e(r - q)T 2-21 Accounting for Storage Costs Storage costs can be treated as negative income: F0 (S0+U )erT where U is the present value of the storage costs Alternatively F0 S0 e(r+u )T where u is the storage cost per unit time as a percent of the asset value 2-22 Cost of Carry • The cost of carry, c, is the storage cost plus the interest costs less the income earned • For an investment asset F0 = S0ecT • For a consumption asset F0 S0ecT • The convenience yield, y, is the benefit provided when owning a physical commodity. • It is defined as: F0 = S0 e(c–y )T 2-23 Examples Source: www.theoildrum.com Source: Quarterly Bulletin, Bank of England, 2006 2-24 Introduction to Derivatives Topic 3: Options Prof. Christophe Pérignon, HEC Paris Energy in a Carbon Concerned Economy HEC Certificate 2013 3-1 1. Definitions • A call option is an option to buy a certain asset by a certain date for a certain price (the strike price K) • A put option is an option to sell a certain asset by a certain date for a certain price (the strike price K) • An American option can be exercised at any time during its life. Early exercise is possible. • A European option can be exercised only at maturity • ITM, ATM, OTM 3-2 Example: Cisco Options (CBOE quotes) From NASDAQ : Option Cash Flows on the Expiration Date • Cash flow at time T of a long call : Max(0, ST - K) • Cash flow at time T of a long put : Max(0, K - ST) 3-3 2. Relation Between European Call and Put Prices (c and p) • Consider the following portfolios: Portfolio A : European call on a stock + present value of the strike price in cash (Ke -rT ) Portfolio B : European put on the stock + the stock • Both are worth Max(ST , K ) at the maturity of the options • They must therefore be worth the same today: c + Ke -rT = p + S0 3-4 3. The Binomial Model of Cox, Ross and Rubinstein • An option maturing in T years written on a stock that is currently worth S ƒ Su ƒu S d ƒd where u is a constant > 1 : option price in the upper state where d is a constant < 1 : option price in the lower state 3-5 • Consider the portfolio that is D shares and short one option S u D – ƒu S d D – ƒd • The portfolio is riskless when S u D – ƒu = S d D – ƒd or ƒu f d D S u S d 3-6 • Value of the portfolio at time T is: S u D – ƒu or S d D – ƒd • Value of the portfolio today is: (S u D – ƒu )e–rT • Another expression for the portfolio value today is S D – f • Hence the option price today is: f = S D – (S u D – ƒu )e–rT • Substituting for D we obtain: f = [ p ƒu + (1 – p )ƒd ]e–rT e rT d where p ud 3-7 Example: Call (K=21, T=0.5, r=0.12) D 24.2 22 20 1.2823 A 3.2 B 2.0257 18 0.0 E 19.8 0.0 C 16.2 F 0.0 • Value at node B = e–0.12×0.25(0.6523×3.2 + 0.3477×0) = 2.0257 • Value at node A = e–0.12×0.25(0.6523×2.0257 + 0.3477×0) = 1.2823 3-8 4. The Black-Scholes Model Assumptions • The stock price follows dS S dt sS dz where dz dt and is (0,1) • Short selling of securities is permitted • No transaction costs or taxes • Securities are perfectly divisible • No dividends during the life of the option • Absence of arbitrage • Trading is continuous • Risk-free interest rate is constant 3-9 Concept Underlying Black-Scholes • The option price and the stock price depend on the same underlying source of uncertainty: f = f(S) • We can form a portfolio consisting of the stock and the option which eliminates this source of uncertainty • The portfolio is instantaneously riskless and must instantaneously earn the risk-free rate • This leads to the Black-Scholes differential equation 3-10 The Black-Scholes Formulas cBS S 0 N ( d1 ) K e rT N ( d 2 ) pBS K e rT N ( d 2 ) S 0 N ( d1 ) ln( S 0 / K ) ( r s 2 / 2 )T where d1 s T ln( S 0 / K ) ( r s 2 / 2 )T d2 d1 s T s T where N(x) is the probability that a normally distributed variable with a mean of zero and a standard deviation of 1 is less than x 3-11 Introduction to Derivatives Topic 4: Swaps Prof. Christophe Pérignon, HEC Paris Energy in a Carbon Concerned Economy HEC Certificate 2013 4-1 1. Interest Rate Swaps • • • • Consider a 3-year interest rate swap initiated on 5 March 2011 between Microsoft and Intel. Microsoft agrees to pay to Intel an interest rate of 5% per annum on a notional principal of $100 million. In return, Intel agrees to pay Microsoft the 6-month LIBOR on the same notional principal. Payments are to be exchanged every 6 months, and the 5% interest rate is quoted with semi-annual compounding. 5% Intel MSFT LIBOR 4-2 Microsoft Cash Flows ---------Millions of Dollars--------LIBOR FLOATING FIXED Net Date Rate Cash Flow Cash Flow Cash Flow Mar. 5, 2011 4.2% Sep. 5, 2011 4.8% +2.10 –2.50 –0.40 Mar. 5, 2012 5.3% +2.40 –2.50 –0.10 Sep. 5, 2012 5.5% +2.65 –2.50 +0.15 Mar. 5, 2013 5.6% +2.75 –2.50 +0.25 Sep. 5, 2013 5.9% +2.80 –2.50 +0.30 Mar. 5, 2014 6.4% +2.95 –2.50 +0.45 4-3 2. Credit Default Swaps (CDS) Payment if default by reference entity Default protection buyer Default protection seller CDS spread • Provides insurance against the risk of default by a particular company • The buyer has the right to sell bonds issued by the company for their face value when a credit event occurs • The buyer of the CDS makes periodic payments to the seller until the end of the life of the CDS or a credit event occurs 4-4 (Source: http://ftalphaville.ft.com/tag/cds/) 4-5 Implied Probability of Default 1-year CDS contract on firm i, with CDS spread = S/year p = default probability R = recovery rate Protection buyer: fixed payment = S Protection seller: contingent payment = (1-R)p S is set so that the value of the swap is 0: S = (1-R)p or p = S / (1-R) If S = 500bp and R = 0.25: p = 6.6% If S = 500bp and R = 0: p = S = 5% 4-6 4-7 3. Total Return Swap Exchange Traded Fund (ETF) Physical ETF vs. Synthetic ETF 4-8 Introduction to Derivatives Topic 5: Structured Products Prof. Christophe Pérignon, HEC Paris Energy in a Carbon Concerned Economy HEC Certificate 2013 5-1 1. Capital Protected Products (CPP) • Structured Products are financial securities based on positions in one or several underlying assets and in one or several derivatives written on the assets • Sold by banks as a package since the 80’s in the US and 90’s in Europe • Attractive features: Upside participation; Leverage effect; Limited or no downside risk; No margin requirements • Extremely popular among individual investors • Underlying asset: equity, fixed income • Fancy names: Bonus, Diamant, Perles, Protein, Speeder, Turbo, Wave, etc • Traded on exchanges (e.g. EURONEXT) or secondary market organized by issuing banks 5-2 Example of CPP • Time 0, investor pays $5,000 • Time T, investor receives: $5,000*(1+0.75*(Stock Index Return)) if Stock Index Return > 0 or $5,000 if Stock Index Return ≤ 0 If stock index return is +10%: With structured product: CFT = 5,000 * (1 + 0.075) = 5,375 If direct investment in stocks: CFT = 5,000 * (1 + 0.1) = 5,500 If stock index return is -10%: With structured product: CFT = 5,000 If direct investment in stocks: CFT = 5,000 * (1 - 0.1) = 4,500 5-3 Example of CPP: Pricing Cash-flow at time T = CFT ; Stock Index Value = S CFT = 5,000 + 5,000 * 0.75 * Max( (ST – S0) / S0 ; 0) CFT = 5,000 + 5,000 * 0.75 * (1/ S0) * Max( ST – S0 ; 0) Suppose S0 = 10,000. Then CFT = 5,000 + 5,000 * 0.75 * (1 / 10,000) * Max( ST – 10,000 ; 0) CFT = 5,000 + (3/8) * Payoff ATM call Theoretical (Fair) Value of this structured product = V0 V0 = PV(5,000) + (3/8) * ATM call price This security is fairly priced if and only if V0 = $5,000 Bank makes a profit if ATM call price < (8/3) * (5,000-PV(5,000)) 5-4 2. Structure Debt • Massive use of structured loans by European local governments (municipalities, regions) during the past decade • Three features: long maturity; fixed/low interest rate for the first years; adjustable rate that depends on a given index (FX rate, interest rate, slope of the swap curve, inflation) • Problem: When volatility increases, interest rate explodes (>20% per annum, termed “toxic”) • Widespread: Thousands of local authorities contaminated in Austria, Belgium, France (20% of outstanding debt), Germany, Greece, Italy, Norway, Portugal, US, etc 5-5 5-6 An Example of Toxic Loan The City of Saint-Remy is being proposed by its bank a standard vanilla loan: • Notional: EUR20m • Maturity: 20 years • Coupon: 4.50%, annual Or, an FX linked loan, with same notional and maturity: • Coupon: Y1-3: 2.50% Y4-20: 2.50% + Max(1.30 – EURCHF, 0), uncapped The city is selling a put option on EURCHF with a strike at 1.30 The put is OTM as EURCHF is currently at 1.50 Vanilla loan coupon: 4.50% (1) Option pay-off if out of the money: -2.00% (receives annual premium) (2) Option pay-off if in the money: -2.00% + (1.30-EURCHF) (pays option pay-off) 5-7 Potential Scenari End of Year 3 EURCHF remains at 1.50 EURCHF drops to 1.20 Coupon = 2.50% Coupon = 12.50% Average coupon: 2.50% Average coupon: 11.00% Coupon = 30.50% Average coupon: 26.30% EURCHF drops to 1.02 Maturity = 20 years 5-8 Why Do Local Governments Use Toxic Debt? Pérignon and Vallée (2013) show that: • Politicians use toxic loans to hide debt, especially when the local government is highly indebted • Politicians running in politically contested areas are more inclined to use toxic loans • Toxic transactions are more frequent shortly before elections than after them • politicians are more likely to enter into toxic loans if some of their neighbors have done so recently (herding) • Source: http://ssrn.com/abstract=1898965 5-9