Chapter 15 Credit Derivatives

advertisement

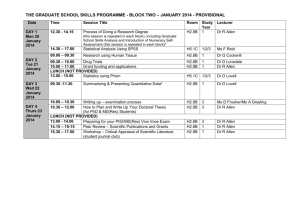

Chapter 15 Credit Derivatives BIS Capital Requirements for Credit Derivatives • • • • • Interest rate derivatives total $65 trillion FX derivatives exceed $16 trillion Equity derivatives $2 trillion As of 6/01: credit derivatives = $1 trillion. Insurance cos. are net suppliers of credit risk protection. Banks and securities firms are net buyers. Figure 15.1. • BIS II proposes harmonization of treatment of credit derivatives. “w” factor adjusts risk weight. Saunders & Allen Chapter 15 2 Figure 15.1 Breakdow n of CDS market participants. 70 60 Protection Purchased Protection Sold 50 40 30 20 10 0 Banks Securities Corporates Insurance Firms Companies Hedge Funds Govt/Export Credit Agencies Saunders & Allen Chapter 15 Mutual Funds Pension Funds 3 Credit Spread Call Option • Payoff increases as the credit spread (CS) on a benchmark bond increases above some exercise spread ST. • Payoff on option = Modified duration x FV of option x (current CS – ST) • Basis risk if CS on benchmark bond is not closely related to borrower’s nontraded credit risk. • Figure 15.3 shows the payoff structure. Saunders & Allen Chapter 15 4 Figure 15.2 Hedging the risk on a loan to a w heat farmer. Payoff on Loan to Farmer Payoff Value of Put Options on Wheat 0 B Borrow er Assets Saunders & Allen Chapter 15 5 Figure 15.3 The payoff on a credit spread option. Payoff ST 0 Credit Spread Premium Saunders & Allen Chapter 15 6 Default Option • Pays a stated amount in the event of default. • Usually specifies physical delivery in the event of default. • Figure 15.4 shows the payoff structure. • Variation: “barrier” option – if CS fall below some amount, then the option ceases to exist. Lowers the option premium. Saunders & Allen Chapter 15 7 Figure 15.4 A default option. Par Value of Loan 0 Default No Default Premium Saunders & Allen Chapter 15 Repayment Performance 8 Breakdown of Credit Derivatives: Rule (2001) British Bankers Assoc Survey • 50% of notional value are credit swaps • 23% are Collateralized Loan Obligations (CLOs) • 8% are baskets (credit derivatives based on a small portfolio of loans each listed individually. A firstto-default basket credit default swap is triggered by the default of any security in the portfolio). • 6% are credit spread options Saunders & Allen Chapter 15 9 The Total Return Swap • Swaps fixed loan payment plus the change in the market value of the loan for a variable rate interest payment (tied to LIBOR). • Figure 15.5 shows the structure. • Table 15.1 shows the cash flows if the fixed loan rate=12%, LIBOR=11%, and the loan depreciates 10% in value over the year (at swap maturity). Buyer of credit protection (the bank lender) receives 11% and pays out (12% - 10%) = 2% for a net cash inflow of 9%. Saunders & Allen Chapter 15 10 Figure 15.5 Cash flow s on total return sw ap. F Other FI (Counterparty) (PT P0) P0 Sw ap Bank Lender Loans to Manufacturing Firm One Year LIBOR Saunders & Allen Chapter 15 11 Credit Default Swaps (CDS) • CDS specifies: – – – – Identity of reference loan Definition of credit event (default, restructuring, etc.) Payoff upon credit event. Specification of physical or cash settlement. • July 1999: master agreement for CDS by ISDA • Swap premium = CS • Figure 15.6 shows the cash flows on the CDS. Saunders & Allen Chapter 15 12 Figure 15.6 A credit default sw ap (CDS). X Basis Points per Year Seller of Credit Protection Buyer of Credit Protection Payment Credit Event Loans to Customers (e.g. Bank Lender) No Credit Event Zero Saunders & Allen Chapter 15 13 Pricing the CDS: Promoting Price Discovery in the Debt Market • Premium on CDS = PD x LGD = CS on reference loan • Decomposition of risky debt prices to obtain PD (see chapter 5): PD = [1 – (1+RF)/(1+RF+CS)]/(LGD/100) • Basis in swap market (CDS premium CS) because: – Noise and embedded options in risky debt prices. – Liquidity premium in debt market. – Default risk premiums in CDS market for counterparty default risk. Increase as correlations increase and credit ratings deteriorate. Table 15.2. – High cost of arbitrage between CDS and debt markets. Saunders & Allen Chapter 15 14 Table 15.2 CDS Spreads for Different Counterparties Correlation Between the Counterparty & Reference Entity AAA AA A BBB 0.0 0.2 0.4 0.6 0.8 194.4 191.6 188.1 184.2 181.3 194.4 190.7 186.2 180.8 176.0 194.4 189.3 182.7 174.5 164.7 194.4 186.6 176.7 163.5 145.2 Saunders & Allen Chapter 15 15 Hedging Credit Risk with Credit Risk Forwards • Credit forward hedges against an increase in default risk on a loan. • Benchmark bond CSF. MD=modified duration. • Actual CST on forward maturity date. Figure 15.7 Credit Spread at End of Forward Agreement CST > CSF CSF > CST Payment Pattern on a Credit Forward Agreement Credit Spread: Seller (Bank) Receives (CST – CSF) x MD x A Pays (CSF – CST) x MD x A Credit Spread: Buyer (Counterparty) Pays (CST-CSF) x MD x A Receives (CSF – CST) x MD x A • Figure 15.8: Hedging loan default risk by selling a credit forward contract. Even if CSF > CST, then there is a maximum cash outflow since CST > 0 Saunders & Allen Chapter 15 16 Figure 15.8 Hedging loan default risk by selling a credit forw ard contact. Payoff Gain Maximum Value of Loan 0 CS T CS F 0 CS T CS F 0 Value of Loan/ Payoff From Credit Forw ard at Maturity of Forw ard Contract Maximum Loss on Credit Spread Forw ard (CS T 0) Payoff on Forw ard Contract Payoff Loss Saunders & Allen Chapter 15 17 Credit Securitiizations CLO, CLN, CDO Since assets remain on the balance sheet, then there is no reduction in capital requirements, except under 1/2002 regulations for securities with recourse, direct credit substitutes, and residual interests supervised by US bank regulators. Sets risk weights from 20% (for AAA and AA rated) to 200% (for BB), but no change for unrated. • High spreads in ABS market makes cost of financing high for banks. • Might need borrowers’ consent to transfer loan to a SPV. • Reputational effects: ex. In July 2001, American Express took a $1 billion charge because default rates on its CDOs were 8% rather than the expected 2%. Saunders & Allen Chapter 15 18 Synthetic Securitization BISTRO (Broad Index Secured Trust Offering) • $10 billion loan portfolio backed by $850 million: • Originating bank buys credit protection with a CDS that absorbs all credit losses after the threshold is met (eg., 1.5% so bank absorbs the first $150 million of losses). • The BISTRO SPV is securitized with $700 million in US Treasury securities. • So: holders of the BISTRO do not take credit losses unless the defaults exceed $850 million. • Can use diversified portfolio (including loan commitments, letters of credit, and trade receivables) not eligible for inclusion in CLOs, CLNs or CDOs. Saunders & Allen Chapter 15 19 Figure 15.9 BISTRO structure. (Under BIS I market risk capital rules, the intermediary bank can use VAR to determine the capital requirement of its residual risk position.) Fee Originating Bank Contingent pay ment on losses exceeding 1.5% of portf olio Credit Swap on $10 billion Portf olio Senior & Subordinated Notes Fee Intermediary Bank BISTRO SPV Capital Market Inv estors $700 million Contingent pay ment on losses $700 million exceeding 1.5% of US Treasury portf olio securities Credit Swap on First $700 Million of Losses Saunders & Allen Chapter 15 20 Pricing a Credit Linked Note (CLN) • $100 million 5 year coupon CLN guarantees payment of principal at maturity, but all coupon payments end if a default event occurs. Rf = 5% and CS = 7% • PV of principal = $100/1.055 = $78.35 million. If selling at par, then PV of coupon payments = $100 – 78.35 = $21.65 million. Table 15.3 Pricing a Credit-Linked Note Off The Spread Curve Year 1 2 3 4 5 Cumulative Probability of Default 7.22% 13.91 20.13 25.89 31.24 Expected Coupon Payment (1-.0722)C (1-.1391)C (1-.2013)C (1-.2589)C (1-.3124)C Present Value of Coupons .8837C .7808C .6900C .6097C .5388C Notes: C is the fixed coupon payment on the CLN. The risk-free rate is assumed constant at 5 percent p.a. and the credit spread is fixed at 7 percent p.a. Saunders & Allen Chapter 15 Source: Risk, (2000). 21 Appendix 15.1 • In this replication, the investor (swap risk seller): – Purchases a cash bond with a spread of T + Sc for par – Pays fixed on a swap (T + Sc) with the maturity of the cash bond and receives LIBOR (L) – Finances the position in the repo market at a rate quoted at a spread to LIBOR (L - x) – Pledges the bond as collateral and is charged a haircut by the repo counterparty. • First 2 transactions hedge the interest rate risk. The last 2 transactions reflect the cost of financing the purchase of the risky bond. Fig. 15.10 • The credit risk exposure of the swap seller = Sc – Ss + x which is the spread between the risky bond premium and the swap spread in the fixed-floating market plus the cost of setting up the arbitrage using repos. Saunders & Allen Chapter 15 22 Figure 15.10 Replicate default sw ap exposure, protection for the sw ap seller. Source: Credit Def ault Swaps, Merril Ly nch, Pierce, Fenner, and Smith, Inc., October 1998, p. 12. Corporate Asset T Corporate Spread $100 T Sw ap Spread Investor Sw ap Market L Repo Rate (L x) $100*(1-Haircut) Collateral Repo Market Saunders & Allen Chapter 15 23 Appendix 15.2 BIS II Capital Regulations for ABS • Assets can be removed from balance sheet only if there is a “clean break” such that the transferred assets are: – Legally separated from the bank, and – Placed into a SPV, and – Not under the direct or indirect control of the originating bank. • If there is “implicit recourse” then the bank may not be able to remove assets from balance sheet. • If the ABS has an early wind down provision, then the originating bank must apply a minimum 10% conversion factor. • Banks investing in ABS have risk weights ranging from 20% (AAA and AA) to 50% (A+ to A-) to 100% (BBB+ to BBB-) to 150% (BB+ to BB-) to 1250% or a 1-for-1 capital charge if ABS is rated B+ and below Saunders & Allen Chapter 15 24 ABS Regulatory Arbitrage under BIS I and BIS II • $100 million of BBB loans with capital charge of $8 million. • Place loans into SPV and sell 2 tranches of ABS. – Tranche 1: $80 m rated AA since only absorb default losses up to 0.3%. Sold to outside investors. – Tranche 2: Residual $20m absorb all other credit losses – rated B. Retained by bank. • Under BIS I, the bank’s capital requirement would be $20m x 8% = $1.6 m, a reduction of $6.4 million. • Under BIS II, the capital charge on the $20 million tranche would be $20 million (1-for-1), thereby eliminating any arbitrage incentives. Saunders & Allen Chapter 15 25 Figure 15.11 Regulatory arbitrage under BIS I. Originating Bank $100m BBB Loans Purchased by Originating Bank SPV Tranche 1 $80m of Loans Rated AA Tranche 2 $20m of Loans Rated B Investors Saunders & Allen Chapter 15 26