Core Product Tangible Product Augmented Product

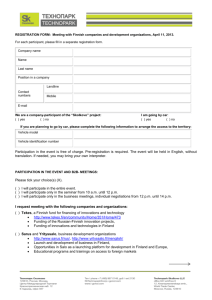

advertisement