(In)Justice of Exchange

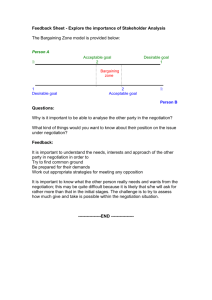

advertisement

Michael Munger PPE Program Duke University Fleeming Jenkin Economic freedom fosters economic growth & high income. High income fosters political freedom. Therefore: If you want political freedom, start with economic freedom Unless you already believe this, not persuasive to many people Sometimes, perhaps just “People aren’t bright enough to understand my BRILLIANT argument!” But what is really the counterargument? Why are people not persuaded of the importance of economic freedom? 1. Nozick: Capitalist acts between consenting adults 2. Sir George Jessel: If there is one thing more than another public policy requires it is that men of full age and competent understanding shall have the utmost liberty of contracting, & that their contracts when entered into freely & voluntarily shall be held sacred and shall be enforced by courts of justice. Therefore, you have this paramount public policy to consider – that you are not lightly to interfere with this freedom of contract. A core argument for markets, then, is that voluntary exchange makes both parties better off The public policy implication is that the state should take only minimal actions to regulate voluntary exchange, and those actions should foster such exchanges by reducing transactions costs A theory of justice in market exchange. Accepts the norms of market exchange, including bargaining over price and the absence of an obligation for charity Erogatory--quality of acts that are esteemed, praiseworthy, or morally "required." (An "erogator" is someone pays out or gives away more value than s/he receives: nice) Super-erogatory--more than is morally required, a self-sacrificing act of charity (heroic) Our claim is that super-erogatory acts are never morally required in market exchange. Neither are they proscribed. They are something else entirely. But are erogatory acts required in market exchange? What would they be? We specify a bargaining model based on 3 claims 1. If the bargaining setting satisfies certain criteria of "fairness" (process considerations), then any price negotiated is a just outcome. No erogatory obligations, ever. 2. If bargaining is "unfair" then there may an erogatory obligation to exchange. 3. If the bargaining setting is unfair enough, the stronger party may be obliged to sell at his opportunity cost, or value of outside option The Mancgere The Itinerant Padre The roots of the English word “monger,” a common merchant or seller of items are quite old. In Saxon writings of the 11th century, described in Sharon Turner’s magisterial three-volume History of the Anglo-Saxons (1836), we find a very striking passage where a merchant (mancgere) defends the “market price” on moral grounds. “I say that I am useful to the king, and to ealdormen, and to the rich, and to all people. I ascend my ship with my merchandise, and sail over the sea-like places, and sell my things, and buy dear things which are not produced in this land, and I bring them to you here with great danger over the sea; and sometimes I suffer shipwreck, with the loss of all my things, scarcely escaping myself.” “What things do you bring to us?” “Skins, silks, costly gems, and gold; various garments, pigment, wine, oil, ivory, and orichalcus, copper, and tin, silver, glass, & suchlike.” “Will you sell your things here as you brought them here?” “I will not, because what would my labour benenfit me? I will sell them dearer here than I bought them there, that I may get some profit, to feed me, my wife, and children.” Itinerant Padre: Radford (Economica, 1945), "Economics of a POW Camp" “Very soon after capture people realized that it was both undesirable and unnecessary, in view of the limited size and the equality of supplies, to give away or to accept gifts.... ‘Goodwill’ developed into trading as a more equitable means of maximizing individual satisfaction.” Itinerant Padre: Radford (Economica, 1945), "Economics of a POW Camp" “Stories circulated of a padre who started off round the camp with a tin of cheese and five cigarettes and returned to his bed with a complete [Red Cross] parcel in addition to his original cheese and cigarettes.” North Carolina's Anti-Gouging Law in 1996 (General Statutes 75-36) (a) It shall be a violation of G.S. 75-1.1 for any person to sell or rent or offer to sell or rent at retail during a state of disaster, in the area for which the state of disaster has been declared, any merchandise or services which are consumed or used as a direct result of an emergency or which are consumed or used to preserve, protect, or sustain life, health, safety, or comfort of persons or their property with the knowledge and intent to charge a price that is unreasonably excessive under the circumstances. (Later amended to be even more restrictive, outlawing price changes reflecting cost increases up the supply chain, August 2006, SL2006-245, GS 75-38). They clapped. Appeared to be happy. What is the objection? Why do so many states have these laws? If I wanted to offer ice for sale for $12 per bag today, could I do it? “The laws and conditions of the production of wealth, partake of the character of physical truths. There is nothing optional, or arbitrary in them... this is not so with the distribution of wealth. That is a matter of human institution solely. The things once there, mankind, individually or collectively, can do with them as they like.” (Mill, Collected Works, 1965, emphasis mine). I. Euvoluntary exchange is always just II. Exchange that is not euvoluntary is nonetheless often welfare-enhancing. Objections to exchange are generally misplaced objections to disparities in the pre-existing underlying distribution of wealth and power, which exchange actually mitigates. (1) conventional (2) conventional ownership by both parties capacity to transfer and assign this ownership to the other party (3) the absence of post-exchange regret, for both parties, in the sense that both receive value at least as great as was anticipated at the time of the agreement to exchange 4. Absence of uncompensated externalities 5. neither party is coerced, in the sense of being forced to exchange by threat 6. neither party is coerced in the alternative sense of being harmed by failing to exchange. In the political world, “power” is measured by the capacity of one person or a group to impose his, or its, will on others through the threat of violence. That is the sense of “coercion” in number 5 above. In the economic world, power in an exchange relationship is measured by the disparity in "outside options," or BATNAs: the "best alternative to a negotiated agreement." This concept of the “Best Alternative to a Negotiated Agreement,” or BATNA, comes from Roger Fisher and William L. Ury. Getting to Yes: Negotiating Agreement Without Giving In (Boston, MA: Penguin Books, 1981). Jane can sell or not sell; Bill can buy or not buy. But if the BATNAs (outcome of failure to exchange) are disparate or dire, the exchange is not euvoluntary. Disparate: 1. U(BATNAJ) – U(BATNAB)≥(Threshold1) Dire: 2. U(BATNAB) < (Threshold2) Suppose I go to a grocery store to buy water, and the price is $1,000 per bottle I laugh and push my cart along. I’ll buy water elsewhere, drink tap water, or many other alternatives. I’m almost indifferent between water at Kroger or Food Lion for market price of $0.90, or even Whole Foods for $3.00. So, even though water is a necessity (I’ll die without it!) I have choices. And, I have money, and we all agree that I own that money and can transfer it, and we all agree that each store owns the water, and can transfer it. Finally, the water is not poisonous, and tastes good, so I won’t regret purchasing it, if I choose to do so. So the exchange is euvoluntary. Now, let’s suppose instead that I am far out in the desert, and am dying of thirst. I’m rich, and I happen to have quite a bit of cash on me, but I can’t drink that. A four wheel drive taco truck rolls over the hill, and pulls up to me. I see that the sign advertises a special: “3 tacos for $5! Drinks: $1,000. 3 drinks for only $2,500” “¿qué te gustaría, gringo?” I argue with the driver. “Have a heart, buddy! I am dying of thirst!” He asks if I have enough money to pay his price, and I admit that I do. The driver shrugs, and says, “Up to you! Have a nice day!” and starts to drive off. I stop him, and buy 3 bottles of water for the “special” price of $2,500. Was the exchange euvoluntary? EUVOLUNTARY OR NOT, EXCHANGE IS JUST. Social Philosophy and Policy, 28 (2011): 192-211 Tried to problematize "voluntary" exchange for public policy. Distributed paper: what is moral? What are the obligations of the individual? The first objection [to the claim that exchange is voluntary] is an argument from coercion. It points to the injustice that can arise when people buy and sell things under conditions of severe inequality or dire economic necessity. According to this objection, market exchanges are not necessarily as voluntary as market enthusiasts suggest. A peasant may agree to sell his kidney or cornea in order to feed his starving family, but his agreement is not truly voluntary. He is coerced, in effect, by the necessities of his situation. (What Money Shouldn’t Buy, http://www.iascculture.org/HHR_Archives/Commodification/5.2HSandel.pdf ) Locke, John. 1661 / 2004. Venditio. Locke: Political Writings (ed. By David Wooton). Hackett Publishing. emptio et venditio: “buying and selling” Questions: 1. What is the “just price?” Locke’s answer: the market price is always just 2. But then, when would a moral person be justified in making his own “market price”? For Locke, there must be many buyers and sellers, and no one can (much) influence the price. If the buyer or seller has enough market power to set the price, he must act as if he cannot. BUT: This artificial or fictitious bargain can take account of other factors, such as opportunity cost. Brilliant argument, very modern and very economistic. A ship at sea that has an anchor to spare meets another which has lost all her anchors. What here shall be the just price that she shall sell her anchor to the distressed ship? To this I answer the same price that she would sell the same anchor to a ship that was not in that distress. For that still is the market rate for which one would part with anything to anybody who was not in distress and absolute want of it. And in this case the master of the vessel must make his estimate by the length of his voyage, the season and seas he sails in, and so what risk he shall run himself by parting with his [extra] anchor, which all put together he would not part with it at any rate, but if he would, he must then take no more for it from a ship in distress than he would from any other. (Locke, 1661/2005, Venditio, pp. 445–6; emphasis added). There is a problem with the analysis. It ignores "non-worseness." An example: Russ Roberts and the Chilean Housekeeper Suppose that, in order for the stronger party to act morally, the weaker party must actually be harmed in some material sense. This possibility is accounted for by the “nonworseness” principle, described by Zwolinski (2008) interpreting Wertheimer (1996). Zwolinski describes nonworseness this way: “In cases where A has a right not to transact with B, and where transacting with B is not worse for B than not transacting with B at all, then it cannot be seriously wrong for A to engage in this transaction, even if its terms are judged to be unfair by some external standard.” (p. 357). What if the maximum price you (weaker ship) would pay for a SECOND anchor is less than I (stronger ship) would reasonably accept? Then no bargain, because surplus is negative. But then your material misery is purchased at the cost of my moral smugness. There is a surplus, because you would pay more for a FIRST anchor than I would require to sell a SECOND anchor. So, trapped in a paradox. I am not required to give away the anchor, but can charge the value of a second anchor far out at sea (still quite valuable). Could sell, because value of buying first anchor to you exceeds cost of selling second anchor from me. But MY moral qualms require that I create a fictitious bargain where you have a “better” position: suppose you have an anchor, and are considering buying a second anchor. Locke did not recognize non-worseness. In his analysis, A's moral obligations rule out a transaction that would have benefitted B. Yet A is also not obliged to give B the anchor. Consequently, the concern that bargaining is unfair to B rules out an exchange very valuable to B. This is a greater injustice than the unfair exchange would have been. Fairness a property of process Justice a property of outcome Any plausible theory of just market exchange must balance two conflicting moral considerations: euvoluntariness (true voluntariness) and Pareto efficiency. Voluntariness requires that neither party is coerced into exchange by threat of violence or other form of direct harm. Euvoluntariness imposes the additional requirement that neither party is coerced by the lack of a decent alternative to a negotiated agreement. Pareto efficiency, on the other hand, requires that voluntary, mutually beneficial exchanges should always be allowed, even if they are not euvoluntary. P.O. takes the status quo BATNAs as given, and exogenous. Euvoluntary exchange is both fair and just, and should not be interfered with by either the state or moral considerations. Bargaining is unrestricted. Non-euvoluntary exchange is always unfair, and violates a central moral intuition about exploitation. Is it unjust? Have to consider non-worseness. If the person making a moral choice, and the person paying the material consequences are identical, then punishing non-euvoluntary exchange might be justified (ice-buyers were denied ice, but saw evil-doers punished. They clapped!) But if the person who is concerned about his morality is different from the person bearing the material consequences, there is a problem. Economic freedom An obligation to exchange Markets may be unfair, but more just than alternatives A justification for market price Why? Toby often said James Buchanan told him to cultivate a "healthy disregard for boundaries." The theory is operationalized through a “fictitious negotiation,” using a formal model of bargaining. The model assumes that two parties have values for the exchange, and outside options (BATNAs) The fictitious negotiation model is parametric. The free parameter is the observer’s revulsion toward the imbalance in bargaining power, which is captured by the disparity threshold. Rather than being a constant, the disparity threshold is a decreasing function of the direness of the weaker party’s outside option, but the particular shape of the function varies from observer to observer. Briefly, the fictitious negotiation model is as follows: 1. Neither party is morally obliged to suffer harm by an act of market exchange. (Voluntary, nonsupererogatory exchange) (Charity is allowed, but is outside the logic of the exchange model, a la Radford) 2. The negotiation will be fair and exchange will be euvoluntary if and only if the disparity between the parties’ outside options does not exceed a certain threshold (eqn #12, p. 11). The magnitude of the disparity threshold depends on the relative abjectness of the weaker party (argument 1). Further, the direr the weaker party’s outside option, in absolute terms (argument 2), the lower the disparity threshold. 3. If the negotiation is fair, all non-supererogatory outcomes are just. A non-supererogatory outcome is either a mutually beneficial agreement or the disagreement outcome, in which the parties get their respective outside options (BATNA). 4. If the negotiation is unfair, the stronger party must devise a fictitious negotiation, in which the weaker party has an improved BATNA. The BATNA must be improved until 1 of 2 things happens: (a) The disparity in BATNAs is reduced until it is no longer unfair. This does not require a zero disparity; only that it equals the disparity threshold. (b) The surplus of the fictitious negotiation is reduced to O. This can happen because the surplus of any negotiation decreases as the parties’ outside options improve. (Non-worseness)