Chart: 1 DRIVE index - Global Banking & Finance Review

advertisement

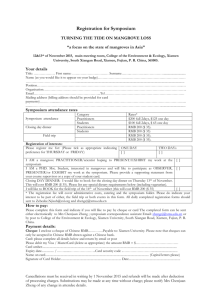

26 February 2014 Key charts and graphs Chart: 1 DRIVE index 60 55.2 55.1 54.9 54.7 54.3 55 50 4Q12 1Q13 2Q13 3Q13 4Q13 Chart 2a: Change in RMB customer order/ invoices and trade settlement in P12M 3% 3% 33% 36% 4% 34% 9% Expected usage increase in N12M 4% 14% 20% 73% 65% No change Unsure 57% 54% 57% Do not use 2% 2% 1% 3% 4Q12 1Q13 2Q13 3Q13 4Q13 Expected usage decrease in N12M Base: All respondents Chart 2b: Change in RMB customer order/ invoices and trade settlement in N12M 8% 39% 40% 9% 36% 38% 11% 7% 39% 43% 10% 8% 25% 28% 8% Unsure 63% 52% 5% 2% 4Q12 Base: All respondents Usage increased in P12M No change 1Q13 2Q13 3Q13 4Q13 Do not use Usage decreased in P12M 26 February 2014 Chart 3a: Usage of RMB payment and receivables services 25% 16% 26% 30% Currently using or will consider in N12M 75% 1Q13 84% 2Q13 No need for this product 74% 70% 3Q13 4Q13 Base: All respondents Chart 3b: Usage of RMB trade services 5% 5% 4% 9% Currently using or will consider in N12M 95% 95% 96% 90% 1Q13 2Q13 3Q13 4Q13 No need for this product Base: All respondents Chart 4a: Business results in the past 12 months (sales turnover) 11% 14% 16% 39% 41% 18% 16% 15% 2% 18% 4Q12 1Q13 Base: All respondents 4% 53% 15% 1% 2Q13 3Q13 No change Don't know 16% 12% 3% 13% +10% +5-10% 40% 49% 19% 17% 8% 17% -10% 17% -5-10% 3% 4Q13 26 February 2014 Chart 4b: Business performance outlook in the next 12 months (sales turnover) 3% 3% 16% 14% 15% 8% 4% 20% 15% +10% +5-10% 44% 59% 50% 48% 53% No change Don't know 23% 19% 8% 12% 9% 12% -10% 18% 5% 3% 2% 5% 4% 4Q12 1Q13 2Q13 3Q13 4Q13 -5-10% Base: All respondents Chart 5: Initiation of RMB trade settlement Don’t know/ Unsure 7% My Company 34% Supplier 28% Overseas Customers 31% Base: Companies using RMB trade settlement service Chart 6: Overall RMB products or services usage 26% 74% 1Q13 Base: All respondents 14% 24% 30% Used ANY RMB products in P12M 86% 76% 70% Did not use any RMB products in P12M 2Q13 3Q13 4Q13 26 February 2014 Chart 7a: RMB products used in the past 12 months FX Spot 36% RMB Denominated Structured Inv. … 9% Deliverable Forward Other FX Linked to RMB Structured Inv. … 9% 5% FW Swap / Cross Currency Swap 4% RMB Bonds 3% RMB Letter of Credit 1% RMB Term loan 1% Structured Forward 1% RMB Saving and cheque account 1% RMB Insurance and MPF 0% QFII Products 0% Base: Companies using any RMB products Chart 7b: RMB products intended to use in the the next 12 months FX Spot 42% RMB Denominated Structured Inv. … 6% Deliverable Forward Other FX Linked to RMB Structured Inv. … 6% 5% FW Swap / Cross Currency Swap RMB Bonds 6% 2% RMB Letter of Credit 6% RMB Term loan 5% Structured Forward 4% RMB Saving and cheque account RMB Insurance and MPF QFII Products 0% 6% 1% Base: Companies intending to use RMB products in N12M Chart 8: Percentage of RMB in company’s liquid assets 60% 72% More than 20% 11-20% 11% 8% 9% 3Q13 16% Less than 10% 17% Refused 7% 4Q13 Base: Companies with RMB as part of the company's liquid asset 26 February 2014 Chart 9: Percentage of customer order/ invoices denominated in RMB in overall sales turnover 10% or less 55% 11 - 30% 21% More than 30% 21% Refused 2% Base: Companies using RMB customer order/ invoices Chart 10: Percentage of RMB trade settlement in total trade settlement services 10% or less 58% 17% 11-30% More than 30% Refused 12% 13% Base: Companies using RMB trade settlement service 26 February 2014