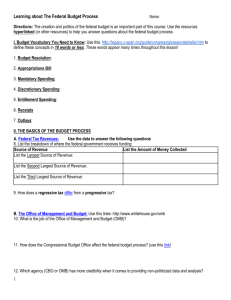

Notes

advertisement

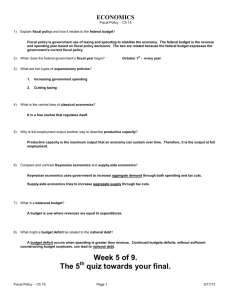

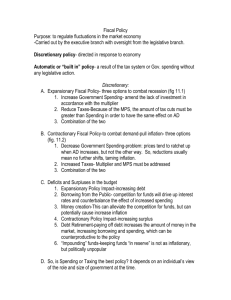

Fiscal Policy Fiscal Policy • The government directly controls its own expenditure and can thereby directly affect aggregate demand. • The government controls the tax levels and therefore they can indirectly impact the spending of households that pay taxes. – Expansionary policy: Increase spending, cut taxes. – Contractionary policy: Decrease spending, raise taxes Sources of Revenue HK 2004/2005 Land Premium & Sales 20% Profit Tax 24% Investment Income 10% Betting, Fees, Duties 25% Salaries Tax & Property, Other 21% HK Government Outlays by Category 2005/06 Support 12% Community Affairs Economic 3% 6% Social Welfare 14% Education 22% Security 10% Infrastructure 10% Environment and Food 4% Housing 6% Health 13% Stabilization policy • In an economy subject to shocks to aggregate demand (animal spirit shocks, external shocks, asset market shocks), the economy will have a self-correcting mechanism. • However, if this self-correction mechanism takes a long time to work, then government may use policy to speed adjustment. – Use expansionary policy to close a recessionary gap – Use contractionary policy to close an inflationary gap Demand Driven Recession Counter-cyclical fiscal policy YP P 3 P* 1 2 Y* Recessionary Gap SRAS w/ 1. Economy in LT equilibrium 2. Demand shifts in 3. Government increases AD spending to shift the AD curve back AD′ Y Demand Driven Expansion Counter-cyclical fiscal policy YP P SRAS 1. Economy in LT equilibrium 2. Demand shifts out 2 P* 3. Government cuts spending to shift the AD AD′ curve back 1 3 Y* w/ AD Inflationary Gap Y US Recessions are becoming shorter as stabilization policies were adopted. Average Length of Contraction 25 Months 20 15 10 5 0 1854-1919 1919-1945 1945-2001 Lags and Fiscal Policy • Administrative lags for fiscal policy may likely be large. • Except in absolute dictatorships, government will have mechanisms for building a consensus for expenditures. Adjusting this consensus will be time consuming. • If lags are too long, stabilizing government spending or transfer payments may have a destabilizing effect, shifting out demand after the economy has already recovered. Automatic Stabilizers • Taxes are usually collected as a fraction of incomes of households. Even if the government keeps the tax rate unchanged. – When the economy goes into a boom, taxes are automatically raised mitigating the effects of the boom. – When the economy goes into a recession, taxes are automatically cut, ameliorating the recession. Budget Deficit • Governments in most economies issue debt to make up for shortfalls in revenues in relation to spending. Budget Deficit = Expenditures – Taxes • Tax collection is cyclical so the budget deficit tends to be counter-cyclical. • Maintaining a balanced budget over the cycle means raising taxes in a recession an cutting taxes in a boom which makes the business cycle more extreme. Procyclical Budget Surplus in HK .12 .08 .04 .00 -.04 -.08 1990 1992 1994 1996 1998 2000 2002 2004 2006 Budget Surplus (as a % of GDP) Detrended GDP Turkey Thailand Singapore Poland Peru Mongolia Israel India Cote d'Ivoire Chile Botswana Belarus Albania 180 160 140 120 100 80 60 40 20 0 % Most Economies Have Positive Government Debt. Debt/GDP Hong Kong Has Traditionally had negative Debt. Government Wealth 800000 700000 600000 500000 400000 300000 200000 100000 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 0 Why would a persistent deficit be a problem? Two Reasons 1. High government borrowing may push up interest rates and crowd out investment 2. High government borrowing means that the interest obligations of the government will rise. Example: US Government runs a deficit to finance military spending r S´ S I r** r* LF** LF* LF Problem • Compare budget deficit in a globalized economy with deficit in closed economy. • What are the differences in impact on investment and real interest rates? -1.00% -2.00% -3.00% -4.00% -5.00% -6.00% -7.00% 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 Budget Surplus in USA (as a % of GDP) 0.00% Government Interest Payments per US Resident $1,000.00 $900.00 $800.00 $600.00 $500.00 $400.00 $300.00 $200.00 $100.00 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 $0.00 1975 1996 US$ $700.00 Learning Outcomes • Students should be able to: • Explain the uses of counter-cyclical fiscal policy in stabilization. • Explain the effect of budget deficits on real interest rates on capital markets. • Explain the negative effects of long-term budget deficits.