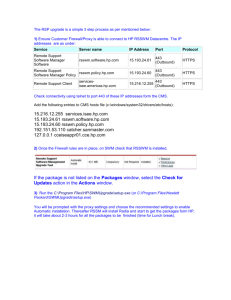

Japanese Market Profile

advertisement

A MARKETING PLAN FOR JAPAN Prepared by: The Philippine Japan Team JAPAN OUTBOUND TRAVEL Prepared by: The Philippine Japan Team WHY TARGET JAPAN? ECONOMIC POWER • It is the world’s second largest economy (US$5.465 Trillion). It is a rich country with enormous personal savings. • It has one of the highest per capita GDP in the world US$28,000 in 2003 (estimated) • Real GDP growth of 2.5% in 2003 WHY TARGET JAPAN? • Japan is one of the biggest sources of the world’s outbound travellers and the biggest tourism spenders. WORLD’S TOP TOURISM SPENDERS 2002 90 79.9 80 70 60 58.0 50 40.4 40 30 61.4 53.2 26.7 24.1 20 13.3 15.4 20.2 7.6 10 7.1 0 USA Germany UK Japan China Korea Int'l. Tourism Expenditure (in US$ Billion) Outbound Travel (in Million) * USA figures exclude outbound to Canada and Mexico Source: WTO Tourism Highlights 2003 DOT Foreign Offices WHY TARGET JAPAN? STRONG RP-JAPAN RELATIONS • The Philippines has close historical ties and a strong, vibrant relationship with Japan in trade, business, investments and tourism. • The 2nd largest investor in the Philippines, representing 37% of total foreign Direct Investment for the Philippines. • The top Official Development Assistance (ODA) donor country – No. 1 source of external development funds. • 2nd largest export market of Philippine products. • Consistently the 2nd largest source market for tourism for the past 10 years averaging 19-21% share of total visitor arrivals. JAPAN OUTBOUND TRAVEL SUMMARY OF FINDINGS (2003 JTB SURVEY) Japanese outbound travel dropped 19.5% to 13.3 M in 2003 in the aftermath of SARS (far larger decrease than that following the 1991 Gulf War and the 9/11 in 2001). Proportionate decline in average expenditure per traveller from ¥309,100 in 2000 to ¥271,000 in 2003. JAPAN OUTBOUND TRAVEL Total Japan Outbound Travel Market & Expenditure (8.93% ) (9.13% ) (0.64% ) 17,819 (3.49% ) (-9% ) 16,695 16,803 (12.66% ) (-5.93% ) 16,358 16,215 15,298 15,806 19,000 17,000 15,000 (1.93% ) 16,528 Total Expenditure per Trip Per Pax (-19.53% ) 13,300 13,579 13,000 11,000 9,000 7,000 5,000 3,000 1,000 -1,000 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 ¥ US $ Not available 404,000 4,299 361,000 3,318 331,000 2,737 327,000 2,496 326,000 2,861 309,000 2,867 296,000 2,435 293,000 2,339 271,000 2,338 2000 was the peak year for Japan outbound travel, due to 2 consecutive years of strong yen and income growth. • SARS had the greatest impact on Japan outbound travel, bringing it down to lower than 1994 levels. Source: JTB Report 2004 PROFILE OF THE JAPANESE OUTBOUND TRAVELLER By Point of Origin SUMMARY OF FINDINGS (2003 JTB SURVEY) Hokkaido Majority of Japanese travellers are from Greater Tokyo, Kinki/Kansai, and the Tokei Regions. In terms of prefectures: Tokyo/Kanagawa, Osaka and Aichi (in that order). Tohoku Koshin-etsu•Hokuriku Chugoku Kanto (Greater Tokyo) Tokai (Aichi) Shikoku Kyushu Okinawa Kinki (Osaka) PROFILE OF THE JAPANESE OUTBOUND TRAVELLER By Overseas Destination SUMMARY OF FINDINGS (2003 JTB SURVEY) • • Inspite of SARS in 2003, China remains Japan’s top overseas destination with 16.95% market share of total outbound travel. Top 3 destinations in 2003 (2000) * China * Korea * Hawaii • 2.250 M (2.202 M) 1.802 M (2.472 M) 1.324 M (1.856 M) None of the markets in 2003 recaptured 2000 levels. All regions infected with SARS suffered major declines. PROFILE OF THE JAPANESE OUTBOUND TRAVELLER By Gender SUMMARY OF FINDINGS (2003 JTB SURVEY) Majority of Japanese travellers in 2003 is male. Both male (7.61M) and female (5.69M) markets decreased in 2003. The female market continues to drop (for 3rd consecutive year) due to safety/security concerns. Men in their 30’s have overtaken women in their 20’s (segment with the most rapid growth in 2000) as the largest market segment in 2003. Departure ratio (including repeat travellers) for men in their 40’s is the highest. Remarkable decline in the elderly market (men over 60 and women over 50). PROFILE OF THE JAPANESE OUTBOUND TRAVELLER By Spend SUMMARY OF FINDINGS (2003 JTB SURVEY) • Total overseas travel expenditure per trip per person is ¥271,000, little change over the years. • Middle aged women spent the most on shopping (¥98,000). • Elderly women are the biggest spenders with ¥347,000, followed by middle-aged women (¥324,000), and elderly men (¥317,000). Least spenders are single men and women. • The highest travel expenditure is for overseas study/school trips at ¥483,000. PROFILE OF THE JAPANESE OUTBOUND TRAVELLER By Purpose of Travel SUMMARY OF FINDINGS (2003 JTB SURVEY) Japanese travel primarily for tourism, 80% to Guam/Saipan and Hawaii for sightseeing, natural/scenic attractions, shopping, R&R. Business Travel is increasing, especially to China. VFRs remain strong (U.S. Mainland and Canada). PROFILE OF THE JAPANESE OUTBOUND TRAVELLER Breakdown of Japan Tourism Market into Activities in Destinations Tourism Sightseeing Natural attractions Shopping Honeymoon Gourmet sampling VFR Art galleries & museums Rest & Relaxation Business Swimming Total Japan Outbound 2000 = 17.8 M 2003 = 13.3 M Trainings/ inspection trips Theme Park Golf Scuba Diving Overseas study / school trips Other Sports Wedding ceremony Attendance in meetings Theatrical performances / concerts / movies Night Tour Others VFR No answer Gambling Others Historical attractions Cultural attractions PROFILE OF THE JAPANESE OUTBOUND TRAVELLER By Type of Travel Arrangement SUMMARY OF FINDINGS (2003 JTB SURVEY) Package Tours is the most common type of overseas travel (46% from 50.8% in 2000) BUT individually arranged (FIT) type of travel (42.1% from 34% in 2000) will increase, especially via the Internet which had a phenomenal growth. Predominantly mono destination in travel format. THE JAPANESE OUTBOUND TRAVEL MARKET SUMMARY OF FINDINGS (2003 JTB SURVEY) Security concerns, while declined slightly still continue to be the biggest factor hindering travel. “Costs too much” rises. Language has become less of a concern. THE JAPANESE OUTBOUND TRAVEL MARKET CONCLUSION Inspite of its economic downturn, decreasing volume of outbound travel, and decreasing travel expenditures, Japan remains a huge market for tourism and travel. JTB’s 2004 forecast remains high at 16.5 M outbound Japanese! THE JAPANESE TRAVELLER TO THE WORLD 2003 Predominantly Male (30-39’s) Travels by Package Tours mono destination packages Books thru a travel firm Travels 5-7 days usually in April / May (Golden Week) or November / December Mostly come from Tokyo using Narita Airport •Motivated to travel primarily by “desire to visit a destination” Usually gets his travel information from reading pamphlets Favorite Destinations China Korea Hawaii Travels primarily for Tourism Favorite Activity in Destination is viewing natural / scenic attractions followed by shopping Travels with friends and relatives Spends an average of ¥ 271,000, mostly on shopping JAPAN OUTBOUND TRAVEL Total Japan Outbound Travel vs. Japan Arrivals To The Philippines 18,000 16,695 16,000 17,819 16,803 16,358 16,215 15,806 15,298 Legend: 16,528 14,000 13,579 Japan Outbound (in millions) 13,300 Japan Inbound to the Phils 12,000 10,000 8,000 6,000 390,517 4,000 2,000 277,825 323,199 350,242 376,714 387,513 343,840 361,631 341,867 322,896 0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Source: JTB Report 2004 PHILIPPINE MARKET SHARE OF JAPAN OUTBOUND TRAVEL 2000/2003 Total Japan Outbound Travel vs. Japan Arrivals To The Philippines Legend: Japan outbound travel 180 Japan arrivals to the Philippines 160 17,819M 140 13,300M 120 Total Philippine Arrivals vs. Japan Arrivals To The Philippines 100 200 180 80 160 1,992,169 1,907,226 140 120 60 100 80 60 40 20 40 390,517 (2.19%) 0 2000 20 322,896 (2.43%) 2003 …but Japan remains largely underpenetrated 390,517 (19.60%) 0 2000 Legend: Total Philippine Arrivals 322,896 (16.93%) 2003 Japan arrivals to the Philippines Sources: DOT Statistics and JTB Report PHILIPPINE MARKET SHARE OF JAPANESE OUTBOUND TRAVELLING FOR TOURISM 2000/2003 Total Japanese Travelling for Tourism vs. Japan Arrivals To The Philippines for Leisure Legend: 200 180 160 11,332,852 140 8,389,984 120 100 80 60 40 20 0 250,848 (2.21%) 2000 189,308 (2.26%) Total Japanese Travelling for Tourism 2000 : Nearly 80% visit Guam, Saipan and Hawaii Japan arrivals to the Philippines for leisure 2003 Source: DOT Statistics and JTB Report PHILIPPINE MARKET SHARE OF JAPAN ARRIVALS TO ASEAN 1998-2004 Total Japan Arrivals to ASEAN vs. Arrivals to the Philippines 1998 1999 2000 2001 2002 2003 2004 Jan-Apr Thailand 986,264 1,071,482 1,206,549 1,177,599 1,239,421 1,042,349 - Singapore 843,683 860,661 929,887 755,766 723,431 434,036 174,598 Indonesia 469,409 606,102 662,045 611,314 620,722 548,630 - Malaysia 252,178 286,940 455,981 397,639 354,563 213,527 100,473 Philippines 361,631 387,513 390,517 343,840 341,867 322,896 128,528 200 Vietnam 95,258 113,514 152,755 204,860 279,769 209,730 94,102 180 160 3,858,391 2,896,134 140 Laos 12,936 14,860 20,687 15,547 19,801 17,766 - Cambodia 13,386 17,885 19,906 17,952 96,796 88,401 40,298 120 100 80 60 40 Myanmar 20,525 17,014 16,096 20,118 20,744 18,799 7,680 20 390,517 (10.12%) 2000 Brunei Darussalam TOTAL 6,639 3,061,909 3,172 3,379,143 Ranking based on 2000 figures 3,968 3,858,391 2,033 3,546,668 2,251 3,699,365 2,896,134 545,679 322,896 (11.15%) 0 Legend: Total Japan Arrivals to ASEAN 2003 Japan arrivals to the Philippines Sources: DOT Statistics and ASEAN Secretariat THE JAPANESE TRAVELLER TO THE PHILIPPINES 2000 / 2003 Predominantly MALE (45-54’s) Mostly MARRIED Travels ALONE Spends an average of US$ 133.89 DAILY TRAVELS primarily for HOLIDAY INDEPENDENT traveller Usually a PROFESSIONAL / BUSINESSMAN Usually a BUSINESSMAN Spends an average of US$ 79.80 DAILY Earns an average of US$ 62,949.43 annually Earns an average of US$ 63,698.99 annually HAS a university / college DEGREE Prefers a HOTEL as type of ACCOMMODATION Majority traveled in AUGUST and MARCH Majority traveled in DECEMBER and AUGUST Most are REPEAT VISITORS Stays an average of 6.37 NIGHTS Stays an average of 6.48 NIGHTS Is predominantly MOTIVATED BY WARM, FRIENDLY PEOPLE Legend: • 2000 & 2003 data • 2000 data • 2003 data Sources: Phil. Annual Visitor Sample Survey 2000 & 2003 DOT Statistics 2000 & 2003 CONCLUSIONS • Japan has consistently been our 2nd largest source market for tourism yet it remains largely underpenetrated. CONCLUSIONS MARKET • We have been tapping market segments like golf and diving which make up small segments of the tourist traffic from Japan. • Huge untapped tourism (leisure) market for Shopping Viewing Natural / Scenic Attractions We have always been a MARKET FOLLOWER, never a MARKET LEADER OR TREND SETTER. PRODUCT • We have the product attractions but few are ready for the market in terms of infrastructure and services • Low awareness about product offerings • No / Few new product offerings since 5/10 years ago. PRICE • Still competitive but becomes expensive when viewed in terms of value or content PROMOTIONS • Weak indistinct image, low awareness, largely overlooked product resulting in low trial • Lack of / absence of special / sale promotional offers • No advertising • Inconsistent, unsustained PR activities; lack of “good news” on the Philippines. • Lack of appropriate collaterals in Japanese. Inefficient distribution. DISTRIBUTION • Travel wholesalers lack incentives to mobilize BUDGETS • Widely dispersed use of available tourism budgets CONCLUSIONS • Japan needs a ONE-COUNTRY APPROACH considering its importance to the Philippines not only for tourism but for trade, business, investments, socio-cultural exchange. • While the DOT concentrates on the tourism segment, other government agencies can help increase Japanese arrivals to the Philippines for the following strong market segments: Business Travel VFR’s Elderly Market - DTI/BOI et al DFA/DOLE/OWWA PRA CONCLUSIONS DOT MUST FOCUS, • We need to identify the market segment of Japan’s outbound travel that remains largely untapped, has the highest potential, and whose needs we can meet; and focus on it our marketing/promotions efforts and resources. WE FOCUS ON THE JAPANESE WOMEN 30’s-50’s MARKET SEGMENT 4.354 M IN 2003 (3.05 for Tourism) JAPANESE WOMEN AGE 20-29 30-39 40-49 50-59 GENERAL CHARACTERISTICS TOTAL OUTBOUND 2003 •Makes the decision on 1.623 M 1.234 M .630 M .867 M Single Women - 15-29’s - 30-44’s Travel with friends and relatives Married Women - Employed - Housewives Travel with husband Middle-Aged Women PREFERRED STYLE OF TRAVEL •Travels abroad as where to travel long as possible, even if infrequently. •Travels primarily for • Less interest on TOURISM (especially historical sites, more single females) on NATURE and scenery. • SHOPPING is primary • Relaxes at just one activity in destination (especially 15-29 singles or two destinations. • Wants to visit a different and housewives) place each trip. • High interest in • Stays at any hotel as long as natural/scenic has basic amenities. attractions and • Eats at restaurants where gourmet sampling locals eat. • Uses PACKAGE TOURS • Visits famous destinations. (especially married • Participates in a convenient package tour. women) • Makes many purchases (Group travel is strong and souvenirs for family for 30-44 singles) and friends. • Prefers FREE-TIME Package tours • Has very strong desire to travel overseas (especially married women) COMPETITORS FOR THIS MARKET: Single Women - Europe - East Asia (Korea/Taiwan, HK) - ASEAN (Thailand, Indonesia, Singapore, Malaysia) Married Women - East Asia (Korea/Taiwan, HK) - ASEAN (Thailand, Indonesia) - Hawaii (Saipan) (especially housewives) - Europe (for employed Middle Aged - Europe WE FOCUS ON THE JAPANESE MALE (MARRIED & MIDDLE-AGED) MARKET SEGMENT 4 M in 2003 (2 M for Tourism**) Married Men = (Between 15-44) 2M Middle Aged Men = 2 M (Between 45-49) _______ 4 M* GENERAL CHARACTERISTICS PREFERRED STYLE OF TRAVEL • 46 % Travels for TOURISM • 30% for BUSINESS • Majority are Repeat Travellers Both segments are big spenders at ¥287,000 for Middle Aged Men and ¥283,000 for Married Men. Main motivation to travel is to take a holiday. Married Men, in particular want to visit a specific destination. Married Men travel with wife (34%) or fellow employees (20.5%) Middle Aged Men travel alone (35.3%) or with fellow employees (22.2%). Travels abroad as long as Married possible, even if infrequently Men Enjoyment of “nature and scenery” ranks first “Rest and Relaxation” a strong preference with married men High interest in shopping Middle (for married men) and Aged gourmet sampling (for middle-aged men). Interest in Night Tours. Eats at restaurants where locals eat Visits a different place each trip Middle Aged Men opt for individually arranged travel; Married Men use either package tour or individually arranged travel. Married Men who use package tours prefer the FREE TIME package. Middle Aged Men use either full package or FREE TIME package tour; both book through a travel firm, but Internet usage increasing COMPETITORS FOR THIS MARKET: - US East Coast - Indonesia/ Malaysia) - Guam / Saipan - China/Taiwan/ Hong Kong - Thailand/ Singapore - Germany * Based on % of Married Men (13.8%) and Middle Aged Men (13.3%) among total respondents of JTB Factual Survey of the Overseas Travel Situation; applied to Japan’s Total Outbound of 13.3M. **Based on 46% of Total Male Market segment travelling for Tourism in 2003. JAPANESE OUTBOUND TRAVEL MARKET 1. Japanese outbound travel is almost 50/50 male/female. 2000 2003 Male : 9,536,000 7,606,000 Female : 8,284,000 5,690,000 2. The female 20-29’s segment ruled overseas outbound travel for over 13 years but was overtaken by the male 30-39’s in 2003 due to security/ concerns. 3. Over a 14-year period (1990-2003), the female 30-39’s segment is the only one steadily increasing its market share. All other segments have decreased/increased market share according to market forces. (economy, safety/security concerns). 4. Men in their 30’s have overtaken women in their 20’s (segment with the most rapid growth in 2000) as the largest market segment in 2003. JAPANESE OUTBOUND TRAVEL MARKET JAPANESE OUTBOUND TRAVEL MARKET 1. Higher percentage of women travelling for tourism than male. 2. Over 70% of all groups of women (except students) travel for tourism. 3. About 46% of married men and middle aged men travel for tourism; about 30% travel for business. JAPAN OUTBOUND TRAVEL 2003 By Purpose of Travel By Market Segment % MALE FEMALE Students Single Married Middle Aged Elderly Students Single 15-29 Single 30-44 Married (employed) Married (housewives) Middle Aged Elderly Tourism 57.1 71.2 47.0 45.2 59.2 63.3 72.6 72.9 69.1 68.3 74.9 80.4 Business - 12.3 27.5 31.4 10.8 - 1.7 4.8 2.4 0.5 2.6 0.3 Honeymoon 1.1 - 13.2 0.3 0.3 - - - 12.4 13.6 0.5 0.3 VFR 7.7 8.0 2.9 7.2 8.4 8.3 8.8 10.0 8.6 11.1 11.5 7.2 Training / Inspection Trips 6.6 4.1 2.3 3.6 3.5 5.3 2.7 1.3 0.7 - 0.9 - Conference Attendance 6.6 0.8 1.2 1.8 1.9 1.2 1.0 - 0.3 - 0.5 0.3 Overseas Study / School Trips 14.3 0.3 0.2 0.2 0.3 16.6 3.4 0.4 0.7 1.0 0.2 - 4.4 2.3 3.1 6.1 9.7 3.6 9.1 6.6 4.8 5.0 6.6 6.5 Others Source: Japan Tourism Marketing Factual Survey 2004 JAPANESE OUTBOUND TRAVEL MARKET The Male 20’s, 30’s, 40’s, 50’s market segments, though all decreased in 2003, total 6.04 M outbound travellers in 2003 (7.46 M at its peak in 2000). The Female 20’s, 30’s, 40’s, 50’s segments, though all decreased in 2003, total 4.4 M outbound travellers in 2003 (6.4 M at its peak in 2000). JAPANESE OUTBOUND TRAVEL MARKET JAPAN MARKET SEGMENTS TO SOUTHEAST ASIA (%) RP 2000 RP 2003 Male Students 15.6 0 15.4 3.4 Female Students 13.1 4.1 12.4 5.2 Single Women (15-29) 19.1 6.1 14.5 3.4 Single Women (30-44) 14.9 8.2 13.0 3.4 Married Women (employed) 20.5 2.0 14.1 1.7 Married Women (housewives) 9.8 2.0 15.1 3.4 Single Men 14.7 14.3 17.7 6.9 Married Men 14.9 10.2 15.9 20.7 Middle Aged Men 16.5 36.7 20.7 32.8 Middle Aged Women 14.6 12.2 13.1 1.7 Elderly Men 11.4 2.0 18.6 17.2 9.8 2.0 12.1 0 Elderly Women Notes: 1. Based on JTB Factual Survey of the Overseas Travel Situation covering 2.5M respondents who took 3.9M overseas trips in 2000 / 2003 2. Respondents: Male Female No Answer : 48.2% : 51.1% : 0.7% 100.0% 3. Philippines total in 2000 = 49,000 in 2003 = 58,000 out of 3.9M BREAKDOWN BY DESTINATION MALE MARKET SEGMENT H O N G K O N G S I N G A P O R E K O R E A T A I W A N FEMALE C H I N A T H A I L A N D M A L A Y S I A I N D O N E S I A P H I L I P P I N E S H O N G K O N G STUDENT 1.0 4.5 2.9 1.9 1.6 2.5 -- 1.3 3.4 SINGLE 8.8 11.4 17.8 17.9 9.6 13.2 18.4 3.8 6.9 S I N G A P O R E K O R E A T A I W A N C H I N A T H A I L A N D M A L A Y S I A I N D O N E S I A P H I L I P P I N E S 2.9 3.4 4.2 1.9 2.3 2.5 2.0 3.8 5.2 15-29 8.8 9.1 8.2 6.8 5.8 7.8 2.0 10.1 3.4 30-44 7.8 1.1 5.0 4.3 6.4 4.9 10.2 5.1 3.4 Employed 14.7 5.7 6.1 4.3 4.2 5.4 10.2 10.1 1.7 Housewives 4.9 2.3 6.6 1.9 2.3 4.9 8.2 6.3 3.4 MARRIED 13.7 14.8 12.5 13.0 11.3 8.8 22.4 22.8 20.7 MIDDLE-AGED 18.6 18.2 14.6 22.8 28.0 23.0 16.3 10.1 32.8 16.7 15.9 0.1 7.4 7.1 9.8 4.1 13.9 1.7 ELDERLY 2.0 8.0 7.2 10.5 13.5 10.8 4.1 5.1 17.2 --- 5.7 4.2 6.8 8.0 5.9 2.0 6.3 ---