Construction Oversight - The Association of Environmental

advertisement

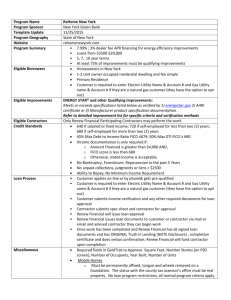

Water Infrastructure Projects Clean Water: Drinking Water: CW Cap Grant $191,136,855 DW Cap Grant $38,189,086 4% Admin. $7,645,474 4% Admin. $1,527,563 Project Funds $183,491,381 Project Funds $36,661,523 20% Match CDBG $38,227,371 20% Match CDBG $7,637,817 Subtotal for Projects $221,718,752 Subtotal for Projects $44,299,340 EIT Share @ 25% $73,906,251 EIT Share @ 25% $14,766,447 Total for Projects $295,625,002 Total for Projects $59,065,786 Loan Forgiveness Total $57,341,057 Loan Forgiveness Total $11,456,726 % Loan Forgiveness 19.40% % Loan Forgiveness 19.40% Water Infrastructure Projects Givens: Total for Projects, AMP & Aux. Power $354,690,789 Sandy SRFs $229,325,941 Loan Forgiveness Total $68,797,782 Match Total $45,865,188 FY2015 Funding Appropriation amount Sources Amount available when leveraged with NJEIT Sandy Supplemental Appropriation Bill $271 million $360 million Annual DEP SRF 2015 Base Year Program $669 million $880 million $940 million $1.2 billion TOTAL FY2015 Projects Project Type (#) Project cost submitted Estimated spend Resiliency (59) $381.8 million $230 million Clean Water (104) $568.9 million $340 million Drinking Water (67) $248.7 million $150 million $1.2 billion $720 million TOTAL (230) FY2016 Projects Project Type (#) Project cost submitted Estimated spend Clean Water (79) $861.1 million $340 million Drinking Water (58) $189.5 million $150 million $1.05 billion $490 million TOTAL (137) For FY2016, the DEP/NJEIT submits our reports to the Legislature in January and again in early April. The Legislature typically approves the authorization and appropriation bills in late May or June. Project Eligibilities Additional Subsidization (Loan Forgiveness) Affordability Criteria Fiscal Sustainability Plans (AMPs) A/E Procurement 6 Examples of new project types for which the CWSRF can now provide assistance, include: • Privately owned stormwater projects in • • • MS4 areas New decentralized systems Water efficient appliances in private residences Technical assistance for small and medium POTWs States have the permanent authority to provide additional subsidization There is no minimum amount of additional subsidization required The maximum percentage that may be provided ranges from 0% 30% Additional subsidization may only be provided to a municipality or intermunicipal, interstate, or State agency for the following: • To benefit a municipality that meets the State’s affordability criteria • To benefit individual ratepayers in the residential user rate class • To implement a process, material, technique, or technology that: addresses water or energy efficiency goals mitigates stormwater runoff, or encourages sustainable project planning, design, and construction By September 30, 2015, States must establish affordability criteria that will assist them in identifying applicants that would have difficultly financing projects without additional subsidization Affordability criteria must be based on: • • • • income unemployment data population trends, and other data determined relevant by the State If States have existing affordability criteria that meet these requirements, they may continue to use those criteria Projects involving the repair, replacement, or expansion of a publicly owned treatment works are now required to develop a fiscal sustainability plan (FSP) • Applies to new project applications received on or after October 1, 2014 States will have the flexibility to set deadlines and establish standards for FSP development to meet the statutory requirements: • an inventory of critical assets that are part of the treatment works • an evaluation of the condition and performance of inventories • • • assets or asset groupings a certification that the assistance recipient has evaluated and will be implementing water and energy conservation efforts as part of the plan a plan for maintaining, repairing, and replacing the treatment works, and a plan for funding such activities Federal procurement requirements in title 40, chapter 11 of the United States Code now apply to A/E services contracts funded with federal dollars for an amount of project assistance equal to the federal capitalization grant • New solicitations, significant contractual amendments, and contract renewals initiated on or after October 1, 2014 are subject to this requirement If States have an equivalent state requirement, they may comply with that instead • Must include A/G certification with capitalization grant application Requirements can be broadly grouped into the following categories and apply to the State, funding recipients, and contractor(s)/subcontractor(s) as appropriate: • • • • • Eligibility Procurement Mandatory Contract Provisions Reporting During Project Activity Ongoing Reporting Requirements The activities for which reimbursement is sought must address a disaster related impact and address a National Objective. National Objectives are: • Benefit low/moderate income (LMI) persons; • Prevent or eliminate slums, blight; Or • Meet an Urgent Need Eligible Costs include construction costs and related soft costs (engineering, financial, administrative, other professional services) for the mitigation of Superstorm Sandy damage or for the construction of resiliency measures to harden infrastructure against future extreme weather events. The NJDEP and NJDCA will jointly determine individual project eligibility. Recipients must comply with Federal Requirements at 24 CFR Part 85.36 (“Common Rule”), Section 3 Requirements, Disadvantaged/Minority Owned/Women-Owned/Veteran Owned Business Requirements and State/local laws Common Rule covers small purchases, competitive bidding and procurement by competitive proposals. Section 3 Requirements are intended to provide employment, job training and contracts opportunities to low and very low income persons (LMI) in the project area. The requirements apply to contracts and subcontracts in excess of $100,000 AND, once triggered, apply to the entire project. Recipients must make a good faith effort to promote hiring and training of LMI. Goals are: • • • 30% of new hires to be Section 3 residents, 10% of the total dollar amount of the construction contracts to be awarded to Section 3 business concerns, and 3% of the total of all non-construction contracts (administrative, financial, a/e, other professional services) to be awarded to Section 3 business concerns. Section 3 Residents are low or very low income individuals living in the project area whose annual wages or salary are 80% or under the Area Median Income for a one person family in the project area (local income limits available from the NJDCA – Sandy Recovery Unit). Section 3 Businesses are owned by at least 51% Section 3 residents, or 30% of employees are Section 3 residents or were so within 3 years of the date of first employment. Recipients must take active steps to provide contracting opportunities to small and disadvantaged businesses; minority, veteran-owned, and women-owned businesses. Recipients must also comply with applicable State and local laws (e.g. “Local Public Contracts Law”) and New Jersey Environmental Infrastructure Financing Program requirements. All contracts must comply with: Labor Standards, Davis Bacon Act Contract Work Hours and Safety Standards Act Copeland Anti-Kickback Act Fair Labor Standards Act State Prevailing Wage Rates Recipients must hold a pre-construction conference to review requirements. Prime contractor is responsible for full compliance, including subcontractors. Each step of the project process must be appropriately documented. To that end recipients must maintain accurate records of: Information confirming subject project was determined eligible. Written agreement Procurement efforts including documentation of compliance with the requirements outlined above (Section 3, etc.). Compliance with mandatory implementation requirements such as Davis Bacon Act, et al. Financial statements and records Audits Progress Reports Draw down requests including invoices, purchase orders, vouchers Monitoring reports & associated correspondence The State (NJEIFP) must properly monitor, submit reports and keep proper records pertaining to CDBG projects. The State must: Notify the DCA Disaster Recovery Division representative of the start of construction Designate of a Labor Standards Compliance Officer who will: Ensure wage rate determinations are properly posted – photographic evidence required Ensure wage rates are paid Conduct employee interviews to establish accuracy of the payroll records. Record on Form HUD-11. Take Actions to correct violations The State must also establish a “Labor Standards Enforcement” file as part of the records for each construction project. The file must contain: Bid documents containing wage decisions and labor standards provisions Verification of contractor eligibility Executed construction contracts containing the provisions and wage decisions Pre-con meeting minutes Notification of start of construction Weekly payrolls Apprentice registration records On-site employee interview records and copies of correspondence Any memorandums and forms related to Labor Standards enforcement The State must maintain overall program files in the following categories: Administrative Financial Project activity records The administrative records must include: Disaster Recovery Action Plan submitted to HUD Executed grant agreement/memorandum of understanding Eligibility & National Objective determinations Personnel files HUD monitoring correspondence Citizen participation compliance documentation Fair Housing & Equal Opportunity records Environmental Review records Documentation of compliance with Davis-Bacon Act, Uniform Relocation Act, Section 3 Requirements, and Minority/Women’s/Veteran’s Business enterprises requirements The State must maintain financial records for each project. The following information must be included in the records: Chart of accounts Accounting procedures manual (standard operating procedures) Journals and ledgers Source documentation-purchase orders, invoices, cancelled checks Procurement information-bids, contracts awarded Bank account records including Revolving Fund records Draw down requests Payroll records and reports Financial reports Audits Relevant correspondence The State will maintain the following records for each project: Eligibility determination National Objective achievement Agreement with funds recipient Procurement documentation Beneficiary location and characteristics Compliance with special requirements (environmental review, Section 3, Davis-Bacon, etc.). Section 3 records include names& addresses of businesses, types of jobs created, and hours & wages Budget & expenditure information including draw requests Project status Records are to be maintained a minimum of 5 years after completion of project activities. Citizens must have reasonable access to records HUD & Comptroller General have access at any time requested The State prepares an annual report – “Performance and Evaluation Report” (PER). Reports are submitted to HUD Projects are closed out once: • Activities are complete • Funds are expended • National Objectives are met • Any other Federal compliance is complete NJDEP’s Construction Management Section (CMS) provides oversight of funded projects to ensure they are constructed and managed in accordance with approved plans and specifications, loan agreement, and all applicable state and federal regulations. Authorization to Award – CMS reviews procurement documentation and low bidder’s proposal for compliance with program requirements prior to award. Preconstruction Conference – CMS meets with the contractor, engineer and owner to discuss the procedures to be followed to comply with the construction and environmental requirements of the contract documents and funding agreement. Interim Inspection – CMS inspects project records and construction site. Funding recipient is advised of any corrective actions required. Payment Requisitions – CMS verifies requested costs are within scope of approved contracts and site inspections are conducted to confirm reported construction progress. Final Inspection – CMS inspects project to verify completion of construction and restoration work, startup testing, training and O&M Manuals prior to start-up and final payment. Performance Certification – CMS monitors performance during first year of operation to ensure project conforms to design criteria. Funding recipient may not use debarred, suspended or ineligible contractors. All contractors, subcontractors, consultants, and sub recipients must be checked against: The System for Award Management (SAM) https://www.sam.gov State of NJ debarred list http://www.state.nj.us/treasury/debarred/. Contractors and subcontractors must have a valid NJ Public Works Contractor Registration. Addenda must be approved by NJDEP and receipt acknowledged by all bidders. Advertisement for bids on a public contract shall be in accordance with NJ Local Public Contract Law. Contractor’s Bid bond and surety must be listed on US Treasury Circular 570. Bid protests must be addressed prior to contract award. Funding recipient must provide a legal opinion contract is awarded to other than low bidder. Appropriations Act for 2014 (P.L. 113-76) includes AIS requirement for the DWSRF and the CWSRF programs. For projects for the construction, alteration, maintenance, or repair of a public water system or treatment works, with an assistance agreement executed beginning 1/17/14, recipients must use iron and steel products that are produced in the United States. “Iron and steel products”: products made primarily of iron or steel: lined or unlined pipes and fittings, manhole covers and other municipal castings, hydrants, tanks, flanges, pipe clamps and restraints, valves, structural steel, reinforced precast concrete, and construction materials. Municipal Castings: Access Hatches - Ballast Screen - Benches – Bollards - Cast Bases - Cast Iron Hinged Hatches, Square and Rectangular - Cast Iron Riser Rings - Catch Basin Inlet - Cleanout/Monument Boxes - Cleanout/Monument Boxes - Construction Covers and Frames - Curb and Corner Guards - Curb Openings - Detectable Warning Plates - Downspout Shoes (Boot, Inlet) - Drainage Grates, Frames and Curb Inlets – Inlets - Junction Boxes – Lampposts - Manhole Covers, Rings and Frames, Risers Structural Steel: Rolled flanged shapes, having at least one dimension of their cross-section three inches or greater, which are used in the construction of bridges, buildings, ships, railroad rolling stock, and for numerous other construction purposes. Such shapes are designated as wide-flange shapes, standard I-beams, channels, angles, tees and zees. Other shapes including H-piles, sheet piling, tie plates, cross ties, and those for other special purposes. Construction Materials: Those articles, materials, or supplies made primarily of iron and steel, that are permanently incorporated into the project, not including mechanical and/or electrical components, equipment and systems. Wire rods, Bar, Angles, Concrete Reinforcing Bar, Wire, Wire Cloth, Wire Rope and Cables, Tubing, Framing, Joists, Trusses, Fasteners (i.e., nuts and bolts), Welding Rods, Decking, Grating, Railings, Stairs, Access Ramps, Fire Escapes, Ladders, Wall Panels, Dome Structures, Roofing, Ductwork, Surface Drains, Cable Hanging Systems, Manhole Steps, Fencing and Fence Tubing, Guardrails, Doors, Stationary Screens. NOT CONSIDERED CONSTRUCTION MATERIALS: Pumps, Motors, Gear Reducers, Drives (including VFDs), Electric/Pneumatic/Manual Accessories Used to Operate Valves, Mixers, Gates, Motorized Screens, Blowers/Aeration Equipment, Compressors, Meters, Sensors, Controls and Switches, SCADA, Membrane Bioreactor Systems, Membrane, Filtration Systems, Filters, Clarifiers and Clarifier Mechanisms, Rakes, Grinders, Disinfection Systems, Presses, Conveyors, Cranes, HVAC (excluding ductwork), Water Heaters, Heat Exchangers, Generators, Cabinetry and Housings (such as electrical boxes/enclosures), Lighting Fixtures, Electrical Conduit, Emergency Life Systems, Metal Office Furniture, Shelving, Laboratory Equipment, Analytical Instrumentation, Dewatering Equipment AIS Waivers The USEPA may issue waivers at any point before, during, or after the bid process. Funding recipients are strongly encouraged to hold pre-bid conferences with potential bidders. A pre-bid conference can help to identify iron and steel products that may not be available from domestic sources. It may also identify the need to seek a waiver prior to bid. USEPA may issue a waiver if one or more of three conditions is met: 1. AIS would be inconsistent with the public interest; 2. Iron and steel products are not produced In the United States in sufficient and reasonably available quantities and of a satisfactory quality; or 3. Inclusion of iron and steel products produced in the United States will increase the cost of the overall project by more than 25%. De Minimis Waiver for Incidental Components: 1. May comprise not more than a total of 5% of the total cost of the materials used in and incorporated into a project; the cost of an individual item may not exceed 1% of the total cost of the materials used in and incorporated into a projects. 2. Examples of incidental components – small washers, screws, fasteners (i.e., nuts and bolts), miscellaneous wire, corner bead, ancillary tube, etc. 3. Examples of items that are clearly not incidental include significant process fittings (i.e., tees, elbows, flanges, and brackets), distribution system fittings and valves, force main valves, pipes for sewer collection and/or water distribution, treatment and storage tanks, large structural support structures, etc. 4. Funding recipients who wish to use this waiver should, in consultation with their contractors, determine the items to be covered by this waiver and must retain relevant documentation (i.e. invoices) for those items and document the total cost of material used in their project files. AIS Waiver Processing 1. Funding recipient prepares waiver request in accordance with USEPA guidance and submits to NJDEP. 2. NJDEP reviews request to ensure proper and sufficient documentation is provided. Once the waiver application is complete, NJDEP forwards application to USEPA for final determination. 3. USEPA will publish the request on its website for 15 days and receive informal comment. USEPA evaluate application against their checklist to determine whether it properly and adequately documents and justifies the statutory basis cited for the waiver – that it is quantitatively and qualitatively sufficient – and to determine whether or not to grant a waiver. AIS Documentation Step Certification Process – Creates a paper trail which documents the location of the manufacturing process involved with the production of steel and iron materials. Each handler (supplier, fabricator, manufacturer, processor, etc.) of the iron and steel products certifies that their step in the process was domestically performed. Name of the Manufacture Location of manufacturing facility where the process took place Description of the Product or item being delivered Signature by a manufacturer’s responsible party Alternatively, the final manufacturer that delivers the iron or steel product to the worksite, vendor, or contractor, may provide a certification asserting that all manufacturing processes occurred in the United States. May be acceptable, but may not provide the same degree of assurance as step certification. Additional documentation may be needed. Step certification is the best practice. AIS Documentation should be collected during shop drawings review and iron and steel products should be inspected for compliance when the arrive at the job site. What happens if non-compliant product is identified? NJDEP will notify funding recipient and propose corrective action If non-compliance is confirmed, NJDEP will consult with USEPA and take one or more of the following actions: 1. Request a waiver where appropriate; 2. require removal of the non-domestic item; or 3. withhold payment for all or part of the project. Davis-Bacon – Generally applies to Federally funded or assisted construction project valued at more than $2,000. Davis-Bacon wage rate determination and Poster must be displayed at job site. Funding recipient will review Contractor’s weekly Certified Payroll Reports (CPR). Are hours and wages properly reported? Are fringe benefits paid correctly? Are apprentices identified with certifications attached? Funding recipient must conduct interviews of contractor’s and subcontractor’s workers (DOL Standard Form 1445). Interviews should: Includes contractor and subcontractor and be representative by trade Ensure confidentiality Occur on work site Highlight discrepancies between interviews and CPRs. Change Order Requirements: Change orders must be: executed on NJDEP form; signed by owner, engineer and contractor; sealed by a NJ Professional Engineer; and accompanied by a resolution from the governing body. Change orders must include justification for contract modification and fully document change in contract costs. Change order work must be within the approved project scope. Change Orders shall not be used to substantially change the quality or character of the items or work to be provided, inasmuch as such would have been a determining factor in the original bidding. Change Orders generally should not exceed 20% of contract amount. Goal to subcontract (generally 10%) of contract amount to socially and economically disadvantaged (SED) firms. Contractor must prepare SED Utilization Plan outlining how they will meet SED goal. Monthly and quarterly reporting to document contractor’s efforts to meet SED goal. Prior to (or shortly after) loan agreement is awarded, contact authorized representative to conduct an account set-up meeting. Loan Agreement – Key Components Exhibit B - Basis of Determination of Allowable Project Costs • Identifies the total project budget and has line items for the individual cost classifications Exhibit C – Disbursement and Project Schedules • Projected disbursement schedule based on project budget, project start date, and timeframe for project completion • Project Schedule identifies major milestones from advertisement and contract award dates to construction completion and project performance certification Account Set-Up Meeting • • Obtain bank account information from loanee’s authorized representative, including the detailed account info to effectuate wire transfers Provide payment requisition forms and State Vouchers forms for recipients to request reimbursement for incurred costs as construction progresses and bills from contractor’s, consulting engineers are received Outlay Report and Request for Reimbursement from NJ Environmental Infrastructure Financing Program (Form SLP101) Fund Loan Disbursement Requisition State of New Jersey Payment Voucher (Form PV 6/93) Trust Loan Disbursement Requisition Project Backup information in sufficient detail to determine that the costs submitted for reimbursement are allowable and allocable to the project based on the approved scope and budget The payment requisition process is initiated by the subrecipient who submits a State of New Jersey Payment Voucher (PV) and the required documents/support to the Municipal Finance and Construction Element (MC & CE) The payment package is reviewed to insure that the cost documentation and the appropriate forms are complete and accurate. The assigned construction manager (who performs on-site visits and inspections) also reviews and approves the payment as part of the processing. After staff review and all of the required management approvals are obtained (5 approval signatures), the payment package is sent to the Division of Budget and Finance, Office of Trust Fund Management (TFM). TFM reviews the voucher package to ensure it has all of the required documentation and the approvals to process the payment and posts the disbursement to the individual loan Excel spreadsheet and paper log records. TFM prepares a State of New Jersey Accounting Bureau Vendor Payment Voucher (A1) and the Wire Transfer Memorandum to Cash Accounting in the Department of Treasury for each loan disbursement. Loan disbursements are drawn such that the Federal funds are received on the date that the wire disbursement is sent to the loan recipient. USEPA Reporting CWSRF/DWSRF Annual Reports USEPA’s On-Site Reviews and Performance Assessment Reports Benefits Reporting (CWBR & PBR) Federal Funds Accountability and Transparency Act (FFATA) Annual Audits NJEIT Auditors State Single Audit Act Questions? Gene Chebra NJ Department of Environmental Protection Division of Water Quality (609) 292-8960 Eugene.Chebra@dep.nj.gov www.nj.gov/dep/dwq