Group 3 03. Teece, 19.1.2016

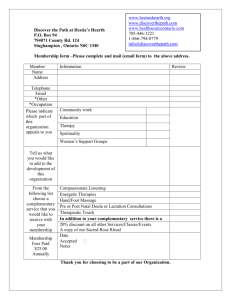

advertisement

Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy - David J. Teece Yali Chai Siru Liesola Ella Leppänen Susanna Mikkola Johanna Rauhala Assignment • Discuss the relevance of the article in 2016 • What has changed in the last 30 years that has had an effect on the thoughts put forward in the article? • What points in the article are still valid or may be even more relevant now than when the article was published? First-to-market won’t automatically win Key issues Appropriability Regime (environmental factors excluding firm & market structure) Factors to consider ● ● Nature of technology Legal instruments ○ ● patents, trade secrets, copyrights Degree of tacit/codified knowledge Preparadigmatic Dominant Design Paradigm ● ● ● Complementary Assets ● Many fluid designs and concepts Loose manuf. processes ● ● Few standard ways to act → dominant design Competition shifts to price Marketing, competitive manufacturing, aftersales support, distribution channels Level of specialization ○ ● Paradigmatic generic, specialized, cospecialized Channel strategy ○ contractual and integration modes Implications for profitability Tight appropriability: Profits easier to realize & more time to clarify the right design and to access assets Weak appropriability: Must utilize business strategy to secure position and evade imitators Until dominant design has emerged: Economies of scale unavailable Design is the main competitive factor Little to be gained through compl. assets After dominant design has emerged: Access to complementary assets critical Specialized assets increase protection and secure long-term profit WHAT HAS CHANGED DURING THE PAST 30 YEARS? 1986 2016 DIGITIZATION GLOBALIZATION Market globalization Production globalization Access to knowledge → speed of technology improvement Industrial Internet - Optimized Solutions Machine-Machine communication Access to bigger markets Rise of the service economy and monetization of user data Increased competition Cloud services Global partnerships - outsourcing, open innovation Digital Marketing - Less resources needed to access consumers Company perspective Consumer perspective Social networking & Sharing economy Consumers have increased access to the internet, while companies have access to more data from their customers changing the way companies and consumers interact globally. Due to the reduced costs it is easier for smaller companies to build ecosystems and reach large amounts of consumers. Digitization has changed the complementary assets companies posses eg. marketing channels, distribution networks and manufacturing. CONSIDER THIS: the world’s largest taxi company, has no vehicles the world’s most popular media company, creates no content the world’s most valuable retailer, owns no inventory the world’s largest accommodation provider, owns no real estate Key Concepts Appropriability regime (environmental factors excluding firm & market structure) Dominant Design Tight appropriability regimes with high tacit knowledge and extensive intellectual property protection. Success is realized through business model innovation → more weak appropriability regimes and less tacit knowledge. Success is realized through an innovative product and/or process and the complementary assets around it. Advantageous appropriability regimes are not always characterized by strong intellectual property protections → legal instruments are not always applicable. Clear dominant design Preparadigmatic phase: Dynamic markets and evolving consumer needs & wants change the dominant design often. Preparadigmatic stage: focus on the product innovation, competition amongst design. Complementary Assets Paradigmatic stage: focus on the process innovation, competition amongst prices Paradigmatic phase: success emerges not from prices but from the user base and the ecosystem around the service which increase the switching costs for users. Specialized complementary assets were within the firm/ and or gained from partnerships that helped to profit from innovation. Complementary assets with less resources → sharing economy allows consumers to take part, emphasizing the importance of building your network→ smaller companies can also profit. Building the complementary asset network required resources → bigger companies had an advantage over smaller companies. 1986 Product & Process Innovations The importance of intangible assets that are not easily copied eg. brand name, value and user base has increased. 2016 Service economy & Business Model innovations WHAT IS STILL RELEVANT? 1986 2016 Appropriability regime Key Concepts (environmental factors excluding firm & market structure) The Coca-Cola formula has been a closely kept trade secret for over a century. In general, innovations around processes are easier to be secured because the processes themselves take place behind the closed doors of a firm’s factories. “The appropriability regime (Teece 1986) the innovating service firms face is generally weaker than what firms in manufacturing sectors face.” Dominant Design QWERTY keyboard: specifically designed to overcome operative limitations (mechanical typewriter). Universally preferred over other keyboard designs. Spotify found a gap in the market, and what users really wanted (any artist, any song for free), and an appropriate pricing model. Spotify beat other competitors and became the market leader. Now in 2016, instead of lowering unit costs, it is more about finding right pricing model. Complementary Assets Even though RC Cola was the first firm to commercialize both diet cola and cola in a can, rivals Coca Cola and Pepsi soon imitated the concept and kicked RC Cola out of the market based on their marketing capabilities and brand name recognition, i.e. their complementary assets. As an early entrant Netflix was able to build a vast database of movies. Over time Netflix has however lost some of its complementary assets and become rather a substitute than a complementary good to traditional content providers. Product & Process Innovations Service economy & Business Model Innovations WHAT IS MORE RELEVANT? 1986 2016 What is more relevant? • Partnerships • • Alliances between established companies and small innovators are even more likely to be formed resulting in capturing more value from the complementary assets. Furthermore, high-tech start-up companies that require access to complementary assets have more accessible opportunities through forming alliances with larger enterprises. These alliances will take place both in the R&D and marketing ends of the value chain, and have today become more common. • Emerged ecosystems [1] • • Companies have increased interest towards studying engagement experiences of their customers as the foundation of value co-creation. Google, Amazon, Microsoft. • Industry Convergence [2] • • Loss of incumbents’ leading positions “Blurred” boundaries between industries [1] http://jultika.oulu.fi/Record/nbnfioulu-201303041077 (18.01.2016 22:59) [2] http://www.innovationmanagement.se/2013/11/25/the-limits-of-industry-centered-strategic-thinking-in-an-era-of-convergence/ (18.01.2016 23:15) What is more relevant? Appropriability regime Legal environment Intellectual Property rights • Tesla patent release Creates a common rapidlyevolving technology platform which other companies in electric car business and the world would all benefit from Nature of innovation • Traditional manufacturing countries like China and India are constantly moving up in value chain • Countries are investing in innovations and striving to turn their complementary assets into co-specialized assets o Moving up the value chain is allowed by technological knowledge spillover o Technologically more backward regions (China) can profit from spillovers from technologically more advanced regions (US) Concluding summary The relevance of the article • The key concepts are still relevant for traditional industries, however, new forms of value creation have emerged • Product/process innovation vs. business model innovation A framework for designing a different business model for existing products - Karan Girotra and Serguei Netessine Thank you! Questions? References Risk-driven business model: http://www.defineyourcompany.com/#the-big-idea Globalization: http://study.com/academy/lesson/what-is-globalization-of-businessdefinition-impact-effects.html What is more relevant: http://www.sciencedirect.com/science/article/pii/S0048733306001363 Tesla: https://www.teslamotors.com/fi_FI/blog/all-our-patent-are-belong-you