Sector profile.

advertisement

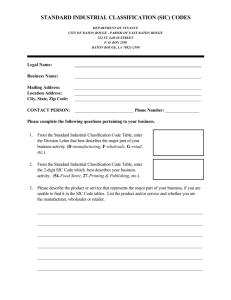

THE FINANCIAL & PROFESSIONAL SERVICES SECTOR IN GREATER MANCHESTER: SECTOR PROFILE NOVEMBER 2013 1 INTRODUCTION Projected to lead the economic recovery in Greater Manchester (GM) and with the highest employment growth forecast across all sectors in the coming decades, Financial & Professional Services (FPS) is a key industry to the UK and GM economy. The FPS sector in GM is larger than in all other city regions in Great Britain (GB) outside of London, providing 20% of total employment (approx. 240,000 people) in over 17,000 firms. Research by Pro.Manchester1 suggests that to support the sector meet its growth potential and maximise the positive impact on GM, it will be important to ensure that local residents have the appropriate skills to access employment opportunities in the sector and that good links between FPS firms and GM’s higher education institutes are established. For the purpose of this report, the sector has been broken down as follows: Rental and leasing activities (SIC code 77) Security and investigation activities (SIC code 80) Services to buildings and landscape activities (SIC code 81) Office administrative, office support and other business support activities (SIC code 82) Activities of membership organisation (SIC code 94) Activities of extraterritorial organisations and bodies (SIC code 99) Employment activities (SIC code 78) Financial service activities, except insurance and pension funding (SIC code 64) Insurance, reinsurance and pension funding, except compulsory social security (SIC code 65) Activities auxiliary to financial services and insurance activities (SIC code 66) Real estate activities (SIC code 68) Legal and accounting activities (SIC code 69) Activities of head offices & management consultancy activities (SIC code 70) Translation and interpretation activities (SIC code 743) 1 Pro.Manchester is a corporate membership organisation representing those employed in the financial and professional service community in and around Greater Manchester. 2 2 THE DEMAND FOR SKILLS FROM THE SECTOR The Business Base There are 17,000 FPS businesses within GM, which represents one quarter (24%) of GM’s entire business base. Looking in more detail, office administration, office support and other business support activities account for almost half of businesses within the sector. Legal and accounting activities is the next largest sub-sector. Table 1: Number of Financial and Professional Service sector businesses in Greater Manchester by sub-sector, 2012 No OF BUSINESSES IN Greater Manchester % SECTOR Office administrative, office support and other business support activities 6,946 40% Legal and accounting activities 2,120 12% Real estate activities 1,823 10% Activities of head offices; management consultancy activities 1,533 9% Services to buildings and landscape activities 1,160 7% Financial service activities, except insurance and pension funding 888 5% Activities of membership organisations 775 4% Activities auxiliary to financial services and insurance activities 705 4% Employment activities 652 4% Rental and leasing activities 505 3% Security and investigation activities 238 1% Insurance, reinsurance and pension funding, except compulsory social security 89 1% Translation and interpretation activities 4 - Activities of extraterritorial organisations and bodies 3 - 17,441 100% FPS SUB-SECTOR TOTAL Source: IDBR, 2012 By district, Manchester has the highest number of Financial and Professional Services sector companies, followed by Trafford and Stockport. These instances roughly follow the share of total businesses within the conurbation. There are few instances where FPS and all-sector businesses shares differ significantly. 3 Table 2: Greater Manchester Financial and Professional Service businesses by locality, 2012 No OF FPS BUSINESSES % OF FPS No OF ALL BUSINESSES % OF TOTAL Manchester 4,072 23% 13,939 20% Trafford 2,408 14% 8,385 12% Stockport 2,301 13% 8,829 12% Bolton 1,561 9% 7,037 10% Salford 1,465 8% 6,098 9% Wigan 1,455 8% 7,057 10% Bury 1,119 6% 4,763 7% Rochdale 1,042 6% 4,945 7% Oldham 1,020 6% 5,076 7% 998 6% 4,786 7% 17,441 100% 70,915 25.6% DISTRICTS Tameside TOTAL Source: IDBR, 2012 The data from the Inter-Departmental Business Register (IDBR) shows that GM’s Financial and Professional Service sector businesses are likely to be small to medium in terms of total numbers of employees; this fits the profile of businesses within other areas of the economy, with over 90% of Greater Manchester’s businesses in this size range. 80% of businesses in the Financial and Professional Services sector employ between 19 people, and 16% employ between 10-50 people. Within the largest sub sector (office administrative, office support and other business support activities) 91% of businesses employ only 1-9 people. Within the second largest sector (Legal and accounting activities) 74% of businesses employ 1-9 people, 22% employ 10-50 people and the remaining 5% employ more than 50. 4 Table 3: Employee size of Financial and Professional Service sector businesses in Greater Manchester by sub-sector, 2012 Financial and Professional Service Sub-Sector 01-09 10-50 50-250 250+ TOTAL Rental and leasing activities 374 109 19 3 505 Security and investigation activities 144 59 25 10 238 Services to buildings and landscape activities 879 225 39 17 1160 Office administrative, office support and other business support activities 6304 561 69 12 6946 Activities of membership organisations 609 146 17 3 775 3 - - - 3 Employment activities 326 188 108 30 652 Financial service activities, except insurance and pension funding 529 307 35 17 888 Insurance, reinsurance and pension funding, except compulsory social security 39 30 12 8 89 Activities auxiliary to financial services and insurance activities 491 162 39 13 705 Real estate activities 1522 246 47 8 1823 Legal and accounting activities 1563 461 82 14 2120 Activities of head offices; management consultancy activities 1207 248 64 14 1533 4 - - - 4 13,994 2,742 556 149 17.441 Activities of extraterritorial organisations and bodies Translation and interpretation activities TOTAL Source: IDBR, 2012 Number and profile of Financial and Professional Service sector employees in Greater Manchester Data from the Business Register and Employment Survey (BRES) shows that in 2011 there were over 235,000 employees working within the GM Financial and Professional Service sector, which represents over a fifth (21%) of total employment in GM. The largest sub-sectors by employment are Legal and Accounting activities and Employment activities. Next largest are Activities of head offices; management Consultancy activities and Services to buildings and Landscape activities. 1 in 10 employees in the sector work in Financial service activities (excluding insurance and pension funding). 5 Table 4: Number of FPS sector employees in Greater Manchester by sub-sector, 2011 SUB-SECTOR No OF EMPLOYEES % SECTOR Legal and accounting activities 33,000 14% Employment activities 32,270 14% Services to buildings and landscape activities 27,580 12% Activities of head offices; management consultancy activities 27,350 12% Financial service activities, except insurance and pension funding 24,140 10% Activities auxiliary to financial services and insurance activities 18,790 8% Real estate activities 18,640 8% Office administrative, office support and other business support activities 16,560 7% Security and investigation activities 13,880 6% Activities of membership organisations 8,780 4% Rental and leasing activities 8,720 4% Insurance, reinsurance and pension funding, except compulsory social security 6,060 3% Translation and interpretation activities 30 0% Activities of extraterritorial organisations and bodies 0 0% 235,840 100% TOTAL Source: Business Register and Employment Survey, 2011 Manchester accounts for 35% of employees in the Financial and Professional Service sector. Next largest are Trafford (15%) and Salford (13%). This is representative of the broader employment profile across all sectors in GM, with 27% of all employment found in Manchester, 11% found in Trafford and 10% found in Salford. This is in slight contrast to the previous section, which indicated that Stockport (10%) is the third largest in terms of numbers of businesses in the sector, with Salford a little way behind in those figures. The map below shows the geographical distribution of FPS employment in GM and highlights the strategic importance of Manchester city centre. FPS accounts for over half of employment in Manchester city centre, representing 67,500 individuals. Furthermore, around a quarter of FPS employees and one-in-eight FPS firms in GM are based in the city centre, as well as one-in-three large FPS firms. Other, smaller, concentrations are found in Trafford Park, around the Airport, and close to the town centres of Bolton and Bury. 6 Figure 1: Greater Manchester FPS sector employees by locality, 2011 Source: Business Register and Employment Survey, 2011 Sector Growth Forecasts The Greater Manchester Forecasting Model (GMFM) allows us to look at projected changes in both employment and Gross Value Added (GVA) for the Financial and Professional Service sector at the Greater Manchester, regional North West and national UK levels. The model identifies FPS as the key driver to economic recovery for the whole of the North West, with GM taking the lead due to the strong presence of the sector. However, growth within the sector is not forecast to be uniform with, for example, employment in insurance estimated to fall rapidly due to the competitive pressures in this sector and the rise of online activity. In employment terms, the sector is forecast to expand by 17% over the next decade to 2022, representing approximately 45,000 jobs. This is around half of the 91,900 jobs expected to be created in GM over the next ten years, further illustrating the importance of the FPS sector to the conurbation’s economic recovery. Looking at the economic output associated with the sector, GVA generated by FPS is estimated to increase by 50% to 2022, translating into a contribution of £6.2bn to the GM economy. Again this is nearly half of the £14.6bn output forecast for GM by 2022. 7 3 THE SUPPLY OF SKILLS TO THE SECTOR This section reviews data on the number of apprentices, further education and higher education students who live in GM and who are studying FPS sector related courses. It aims to give an indication of the potential supply of skilled labour to the sector. However, when reviewing the following data the following caveats should be noted: 1. A person’s subject of study is not necessarily an indicator of their future employment occupation; 2. Many GM learners are studying for academic qualifications (e.g. history, geography) which could make them suitable for employment in a range of sectors – these learners are not included in the analysis; 3. Across the relevant datasets up to 10% of learners have their study subject listed as unknown – these learners are not included in the analysis; 4. The latest available data on 16-19 year old and Higher Education students is less current (2011/12 vs. 2012/13) than the latest available data on 19+ and apprenticeship students; and 5. There is no official line on which subjects of study are directly relevant to which sectors of the economy, therefore New Economy has had to make a judgement on which subjects and apprenticeship frameworks map to which sectors – detail on this mapping exercise is provided in an appendix to this report. Thus the figures presented are indicative of the pool of labour from which the sector could recruit. 16–19: Further education (FE) and school sixth forms From the latest Education Funding Agency (EFA) data (2011/12), the following course categories have been identified as being most relevant to the FPS sector: Accounting and Finance Administration Business Management Business, Administration and Law Mathematics and Statistics Public Services Service Enterprises Law and Legal Services Economics Analysis of the EFA data shows that in 2010/11, approximately 10% of all 16-19 students in GM were studying an FPS sector relevant course; 26,600 out of 257,600 students across all subjects. 8 The number of starters within FPS courses has been increasing year on year, with an estimated percentage increase since 2007 of 9%, but this is slower than the rate across all subjects, which since 2007 has increased by 13%. In 2010/11, modes of attendance for these selected courses were weighted heavily in favour of full-time students (95%). Part-time study was mostly undertaken in Administration and Service Enterprises. The gender profile of FPS students was slightly in favour of females: 52% to 48% males, and the gap between the numbers has stayed very stable since 2007. Students in FPS related topics were fairly evenly distributed among Greater Manchester local authorities, with the highest concentration being residents in Manchester (18%), followed by Wigan (12%) and Stockport (11%). The lowest concentration was in Trafford (6%). Data also shows the main providers in the FPS sector in 2010/11. Unlike in other sector areas, and the general overview as a whole, no provider stands out as being the leader in this sector, with starts being fairly evenly spread. Institutions with the highest number of starts were Salford City College, Bury College and Manchester College. Other providers within the top 10 included: Oldham Sixth Form College Ashton Sixth Form College Loreto College Xaverian College Aquinas College Wigan and Leigh College Bolton Sixth Form College Adult Skill Funding Agency (SFA) funded provision (excluding apprenticeships) In 2012/13 the SFA funded nearly 22,300 FPS training starts by GM residents aged 19 and over. Four sector subject areas account for the lion’s share of these learner starts: Business Management – 7,300 starts Administration – 5,800 starts Media and Communication – 5,700 starts Accounting and Finance – 3,300 starts 9 SFA funded provision to the sector has declined by 25% over the past five years with noticeable falls in the numbers of Business Management, Accounting and Finance, and Media and Communication starts. Looking in more detail at the types of residents on these courses shows that: SFA funded learners are evenly split between males and females; Just over half are studying at Level 3 and above – this is far higher than the all sectors figure of 21%. Figure 2. Level of study by Greater Manchester residents of SFA funded logistics courses, 2012/13 Level Level 1 & Entry Level 2 Level 3 Level 4+ Source: SFA, 2012/13 Logistics 10% 30% 51% 2% All sectors 20% 20% 21% - The largest providers of the FPS sector training in GM by number of SFA funded starts include: The Manchester College Salford City College Bury College Wigan and Leigh College Apprenticeships Every year approximately 4,000 GM residents start an apprenticeship framework that is related to the FPS sector. Over 75% of these starts are in relation to Business Administration frameworks. The next most important frameworks are Accounting/Accountancy, with just over 500 starts per year. There has been strong growth in the number of FPS sector GM apprenticeship starts – up by 126% since 2008, although an almost identical rise has been seen in terms of all sector GM apprenticeship starts. Over half (57%) of FPS sector apprenticeship starts in GM are at the intermediate (or lowest) level. Within Business Administration frameworks there were nearly 1,300 Advanced level apprenticeship starts; and within the Accountancy/Accounting frameworks there was 166 higher level starts. 10 70% of FPS apprenticeship starts are made by females; across all GM apprenticeships 54% of starts are by females. Apprenticeships are mainly started by younger people, with almost three quarters being under 25 years (73% in 2012/13 - with 38% between 16 and 18 years, and 35% 19 to 24 years). This trend has been fairly consistent for the sector since 2008/09. Age Groups Under 19 19-24 25-30 31-49 50-64 65+ Total Number Apprenticeship starts 2012 / 2013 (total number) 1491 1383 406 540 137 0 3957 With regards to apprenticeship providers, Economic Solutions Limited is by far the largest provider, with nearly 1,900 starters in 2012/13. The next largest providers were Damar, Kaplan Financial, Bury College and Total People. 11 Higher education There are four universities within GM (Manchester Metropolitan University, University of Bolton, University of Manchester, and the University of Salford). Together these institutions grant approximately 33,800 qualifications per year2. Due to the classification of HE data, it is difficult to clearly identify how many of these graduates qualified with degrees that are directly relevant to the sector. It is possible, however, as with the previous sections on EFA and SFA data, to make a judgment call to select from the list of courses those that are most likely related to the Financial and Professional Services sector. From the Higher Education Statistics Authority (HESA) data, the following courses have been selected: Law Business & administrative studies Mathematical sciences Computer science Languages Across the four universities, these three courses totaled 10,675 qualifications (32% of the annual total). As with the distribution among total courses, the University of Manchester offers the highest proportion of qualifications relevant to the Financial and Professional Services sector, followed by MMU, Salford and then Bolton. HESA also produces data on which sectors a sample of these graduates subsequently start work in: 2 The 2010/11 Destination Leaver Survey found that of over 14,000 GM HEI graduates, 26% (c. 3,500) were working in areas related to the Financial and Professional services sector six months later; and The total number of GM graduates working in the Financial and Professional service sector was relatively evenly spread across the main sub-sectors. Higher Education Statistics Authority, 2010/11 qualifiers data 12 4 KEY SKILLS ISSUES FACING THE SECTOR According to the UK Commission for Employment and Skills (UKCES) 3, a number of drivers present challenges to the FPS sector over the medium-term. These include: Increased regulation; Global competition; and Technological change. These challenges also present opportunities for the sector which include: Building on pre-eminence in certain niche market sectors; Competing successfully in growing markets in Asia and other parts of the world; Dealing with the ongoing challenges of increased regulation to restore confidence in those parts of the sector most damaged by the financial crisis; and Using new technologies to develop new products and modes of service delivery to meet the requirements of more demanding customers, and to provide more efficient services. The sector’s demand for skills is generally oriented towards highly skilled and qualified people in managerial, professional, and associate professional occupations who have typically been educated to first degree level or above. However, it needs to be borne in mind that the sector has a strong demand for other occupational groups, in particular clerical and administrative, and sales and customer service workers and there are many people employed in the sector who will be more typically qualified to Level 3. It is worth remembering, in this respect, that the largest sub-sector within FPS is ‘office administrative, office support and other business support activities’. Given the adverse effect of the economic downturn on recruitment, the sector faces the challenge of ensuring the skills supply is increased in order to facilitate recovery and growth over the longer term. Whilst the sector engages in a relatively high amount of training relative to the rest of the economy, the evidence indicates that in the financial sector the take-up of vocational qualifications is relatively low compared with the economy as a whole. Employers appear to be reluctant to use vocational qualifications because they do not see a good fit between these and the sector’s skill needs; perhaps, also, parity of esteem issues are involved. Certainly in the financial sub-sector, there is relatively limited engagement with external providers of training. However, the evidence suggests that where employers have made use of programmes such as apprenticeships they can point to a number of benefits from having done so. Potentially, apprenticeships provide an alternative pathway into a sector which has traditionally been reliant upon graduates from higher education. 3 Sector Skills Insights : Financial and Business Services, available here: http://www.ukces.org.uk/publications/er56-sector-skills-insights-professional-business 13 Appendix A: Definitions used to produce this report SIC Codes Financial service activities, except insurance and pension funding (SIC code 64) Insurance, reinsurance and pension funding, except compulsory social security (SIC code 65) Activities auxiliary to financial services and insurance activities (SIC code 66) Real estate activities (SIC code 68) Legal and accounting activities (SIC code 69) Activities of head offices & management consultancy activities (SIC code 70) Translation and interpretation activities (SIC code 74.3) Rental and leasing activities (SIC code 77) Employment activities (SIC code 78) Security and investigation activities (SIC code 80) Services to buildings and landscape activities (SIC code 81) Office administrative, office support and other business support activities (SIC code 82) Activities of membership organisation (SIC code 94) Activities of extraterritorial organisations and bodies (SIC code 99) EFA tier 2 subject areas Accounting and Finance Administration Business Management Business, Administration and Law Mathematics and Statistics Public Services Service Enterprises Law and Legal Services Economics 14 SFA tier 2 subject areas Accounting and Finance Administration Business Management Business, Administration and Law Media and Communication Apprenticeship Frameworks Accountancy Accounting Advising On Financial Products Business Administration Business and Administration Contact Centres Contact Centre Operations Insurance Payroll Providing Financial Services Providing Financial Advice Providing Mortgage Advice 15