The Automotive Industry Julianna Egner, Mac Bishop, John

advertisement

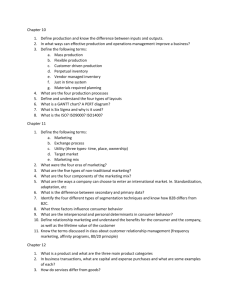

The Automotive Industry Julianna Egner, Mac Bishop, John Nitti, Logan White April 11, 2011 AEM 4550 – Economics of Advertising Jura Liaukonyte Agenda Industry Analysis Advertising Analysis o o For Dealerships For Brands Advertising Strategies Recalls & Brand Reputation Recent Advertising Innovations Investment & Advertising Recommendations Why the Automotive Industry? Automobile industry a staple of the U.S. economy Americans have developed a deeply patriotic connection to this auto manufacturing tradition Over $100 billion in revenue in 2010 Industry expected to grow Billions of $ spent on advertising every year Health of the industry impacts nationwide advertising Industry Analysis Industry Definition Sub-divided 1. 2. Industry: Car and Automobile Manufacturing Companies that manufacture car and automobile chassis Light Truck and Sport Utility Vehicle Mfg. – Companies that manufacture light trucks and utility vehicles, such as vans, pick up trucks, and sport-utility vehicles Produce vehicles in assembly plants Major Products and Services Compact and subcompact sedans Luxury Cars Mid-size and full-size sedans Sports cars Major Products and Services CUVs (crossover vehicle) Large Pickup Trucks Small Pickup Trucks Large Vans Small Vans SUVs Current Industry Condition Recession brings trouble for the big three: Ford, Chrysler, GM o o o Bankruptcy Restructuring Large losses or dismal profits Reasons o Reliance on SUVs and larger cars Signs of Relief In 2011, industry profit margins will be relatively healthy at 2.0% Car industry revenue to grow at an estimated rate of 4.2% annually to $102.3 billion by 2016 o o Shifting consumer preferences General recovery in demand Improving consumer sentiment Credit availability is recovering Why People Buy? Past: All about price Current: Price, running cost, environmental effects Motor vehicle affordability on the rise Green revolution o o Consumers will continue to demand environmentally friendly cars Price of gas will rise in 2011 Distribution Model < Car & Automobile Light Truck and SUV > International Influence Imports represent 51.0% of domestic demand for automobiles Exports generate 19.1% of industry revenue Operating Conditions Technology o o Design, Innovation (hybrid, plug-in hybrid electric vehicles ) Engineering, and Production method Most auto manufactures are working on a hybrid or plug-in electric Regulation o o and Policy The Government compiles complaints from consumers and will prod a manufacturer to recall a vehicle if warranted. Obama administration – efficiency mandate o o Cars - Average 39 mpg Light trucks - Average 30 mpg Competitive Landscape 174 total companies as of 2007 HHI for top 50 firms=1448.8 Car CR4 = 55.6 Light Truck/SUV CR4 = 73.5 Industry Structure Market Concentration: Medium Competition in Industry: Medium Barriers to Entry: High Competitive differentiation: o o o o o o o Price Quality Efficiency Supply-chain integration Industrial relations Types of cars manufactured Product innovation Industry Data - Cars Industry Data – Light Truck & SUV Global Competition Finding an efficient business model to operate in this globalized industry environment is key. Example: One Ford: streamlined design and manufacturing platform across Ford’s global markets GM’s joint venture with China’s Shanghai Automotive Industry Corporation Market Concentration Market Share Others 34% Toyota 17% Honda 12% Hyundai 10% GM 15% Ford 12% Competitor Highlights Toyota: o 2009 – 2010: U.S. market share fell from 19.5% to 16.8% o Toyota Prius first mass-produced hybrid gasolineelectric car – major success for Toyota. o Toyota Motors is world's largest automotive manufacturer (overtaking GM in 2008) GM o 2006 – 2011: U.S car sales fell at a troubling 10.3% annualized rate o Total U.S. car sales fell 4.3% annually o Panicked and angry car buyers opted to purchase cars from other companies Competitor Highlights Ford o CEO restructuring the company’s business practices since 2006 o Put Ford in a better position when the recession hit. “One Ford” initiative has helped Ford share designs and other efforts across global divisions Honda o Notable for its unusually high spending on research-anddevelopment (R&D) o o o Competitive in hybrid market – Honda Insight o Equivalent to about 5% of revenue Did not achieve the commercial success of the rival Toyota Prius. Hyundai o Second largest Asian automaker o Sales rose 7.2% annually since 2006 while the U.S. market decreased 4.3% annually o Have kept prices low while radically improving vehicle design Brand Equity Brand Values from Interbrand’s Best Global Brands 2010 Rank Prev. Rank 11 Brand Brand Value ($m) Change Revenue ($B) 8 26,192 -16% 204.44 12 12 25,179 6% 69.00 15 15 23,219 3% 80.14 20 18 18,506 4% 92.55 50 49 7,195 3% 128.95 53 55 6,892 6% 168.13 63 65 5,461 9% 46.97 65 69 5,033 9% 78.46 72 74 4,404 4% 80.75 91 88 3,562 1% 2.15 Advertising-to-Sales 2010: Revenues = $76,664 for cars, $94766 for light trucks = $171.43 billion $13 billion spent on advertising = 7.6 Ad-to-sales ratio o Medium A-S-R o Highest: Liquor (15.6%) Organization Integrated o o o o o supply chain Design Engineer Manufacture many of the components and parts Market Sell Supply network: steel, raw materials, other components Advertising Analysis Overview Many different advertising strategies in their ad campaigns o o o o o Informative Combative Persuasive Celebrity Endorsement Emotional Appeal $13 billion spent on advertising in 2010 Advertising spending is expected to persist at 2.2% of revenue in 2011 Auto Industry Advertising 2 layers to advertising in the auto industry 1. 2. Advertising by dealerships Advertising by brands Dealerships Nationwide Local Lower Quality Establish Personal relationship Brands Informative High Quality Persuasive Combative Dealership Advertising Dealership Advertising o o o o o o o Primarily informative in nature Demand is more price elastic Ads are more focused on price than car attributes Ads are almost always local and usually feature the boss of the dealership— “personal connection” Ads are lower in quality and much less expensive to produce Often loud, repetitive, and low quality Notable slogan: “No Hassle, No Razzle Dazzle” from a local Ithaca dealership Dealership Ads http://www.youtube.com/watch?v=A82A mZ3Glmk Dealership Advertising Trends Dealership advertisements reflect consumer preferences in local area Consumer preferences influenced o o o o Climate Income Reason for purchase (car use) Car culture of city Data o o on dealership advertising 2008-2010 Sub-sample of different markets nationwide Associations between brands and cities, etc. Dealership Advertising by City Top advertised brands by market Dealership City Top Advertised Brand Total Amount Spent ($) Atlanta, GA Ford F-Series 1,277,509 Dallas, TX Ford F-Series 9,693,999 Denver, CO Ford F-Series 2,727,011 Houston, TX Ford F-Series Los Angeles, CA BMW 3-Series 7,223,330 8,570,245 New York, NY BMW 3-Series 6,345,458 Normalized Dealership Adv. Highest Total Dealership Spending by City City Population (mil) Adv. Spending Adv. Per Capita Los Angeles 9.9 $102,669, 540 $10.37 New York 8.4 $44,609,248 $5.31 Houston 2.3 $39,159,786 $17.03 Dallas 1.3 $38,815,813 $29.86 San Francisco .9 $33,640,608 $37.38 Philadelphia 1.6 $18,582,866 $11.61 Phoenix 1.6 $16,601,331 $10.38 WILKES BARRE WACO TUCSON SPRINGFIELD MO SOUTH BEND SEATTLE SAN DIEGO SALT LAKE CITY ROCHESTER PORTLAND OR PHOENIX PADUCAH OKLAHOMA CITY NEW YORK MINNEAPOLIS MIAMI LOS ANGELES LEXINGTON KNOXVILLE JOHNSTOWN JACKSON,MS HOUSTON GREEN BAY FRESNO DES MOINES DAYTON DALLAS COLUMBIA,SC CLEVELAND CHICAGO CHARLESTON, WV CEDAR RAPIDS BOSTON BATON ROUGE AUSTIN ALBUQUERQUE Ford F-Series Total dealership advertising spending for the F-Series by city 10000000 9000000 8000000 7000000 6000000 5000000 4000000 3000000 2000000 1000000 0 ATLANTA AUSTIN BALTIMORE BATON ROUGE BIRMINGHAM BOSTON CHARLOTTE CHICAGO CINCINNATI CLEVELAND COLUMBUS,OH DALLAS DAYTON DENVER FRESNO FT. MYERS HONOLULU HOUSTON JACKSONVILLE KANSAS CITY LAS VEGAS LOS ANGELES LOUISVILLE MIAMI MILWAUKEE MINNEAPOLIS NEW YORK NORFOLK OKLAHOMA CITY OMAHA PHILADELPHIA PHOENIX PITTSBURGH PORTLAND OR ROCHESTER SACRAMENTO SALT LAKE CITY SAN DIEGO SAN FRANCISCO SEATTLE SPOKANE ST LOUIS WACO WILKES BARRE BMW 3-Series Total dealership advertising spending for the 3-Series by city 9000000 8000000 7000000 6000000 5000000 4000000 3000000 2000000 1000000 0 Advertising Spending by City Top o Spender: Los Angeles Total spent by dealerships 2008-2010 = $102,669,540 Why? o o 17.8 million people in metropolitan area Extremely strong car culture – revolutionary highway system, mediocre mass transit o o Cars crucial to livelihood in the city Highest income disparity but extreme wealth in the area Brand Advertising Brand o o o o o Advertising More persuasive in nature Demand is more price inelastic Ads are more focused on car attributes than price Ads are typically national or regional, covering a much larger area than dealership ads Ads are higher in quality and much more expensive to produce and air Total Ad Spending Total Ad Spending by Parent Company 0% 0% 0% 0% 12% 5% BMW Ag 0% Chrysler Group Llc 6% Daimler Ag Ford Motor Co 18% Fuji Heavy Industries Ltd 11% 1% Honda Motor Co Ltd Hyundai Corp 6% 0% General Motors Corp 18% Mazda Motor Corp MITSUBISHI MOTORS CORP 12% 9% Nissan Motor Co Ltd Porsche AG Spyker Cars NV SUZUKI MOTOR CO LTD Toyota Motor Corp Volkswagen Ag Total Ad Spending Auto industry “Big Three” top spenders on advertising: 1. 2. 3. Ford – 18% GM – 18% Chrysler – 12% Biggest 1. 2. 3. advertising threats: Toyota – 12% Nissan – 11% Honda – 9% Average Ad Spending by Brand Volkswagen highest spender = $167,510 per ad Average Ad Spending by Parent Brand Volkswagen Ag Toyota Motor Corp SUZUKI MOTOR CO LTD Porsche AG Nissan Motor Co Ltd MITSUBISHI MOTORS CORP Mazda Motor Corp Hyundai Corp Honda Motor Co Ltd General Motors Corp Fuji Heavy Industries Ltd Ford Motor Co Daimler Ag Chrysler Group Llc BMW Ag $0 $20,000 $40,000 $60,000 $80,000 $100,000$120,000$140,000$160,000$180,000 Average Ad Spending by Brand Highest 1. 2. 3. 4. 5. spenders per ad: Volkswagen Ford Nissan Honda Hyundai Implications o o Primarily foreign automakers Trying to win larger part of the market o o Buying more expensive ad spots, large audiences Foreign brands higher reputations recently Brand Ad Spending Trends Ford Fiesta Ford Focus Ford Fusion Ford Mustang Ford Taurus Lincoln MKS Lincoln MKZ Ford Fusion – Gas powered or Hybrid Emphasis on Fuel Efficiency “We Speak Value. We Speak MPG” Volvo C70 Buick Enclave Volvo S80 Buick Lacrosse Buick Lucerne Cadillac CTS GM – Chevrolet Malibu Gas powered, but fuel efficient – 33 MPG “Fuel economy that a comparable Toyota Camry can’t match” Chevrolet Aveo Chevrolet Camaro Chevrolet Cobalt Chevrolet Equinox Chevrolet HHR Chevrolet Impala Chevrolet Malibu Pontiac G5 Pontiac G6 Pontiac G8 Brand Ad Spending Trends Acura Acura RL Acura TL Acura TSX Honda Accord Honda Civic Honda Fit Honda Accord – Honda’s bestseller Honda Insight – Honda’s hybrid Lower starting price than Prius ($18,200 v. $23,050) Honda Insight Lexus ES Toyota Prius – Put hybrid vehicles on the map “Harmony between man, nature and machine” Toyota Corolla – Comparable to the Honda Accord Lexus HS Lexus IS Lexus LS Scion TC Scion xB Toyota Camry Toyota Corolla Toyota Prius Toyota Yaris Brand Ad Spending Trends Average Cost /Ad by Day of Week $180,000 $163,743 $160,000 $140,000 $111,557 $120,000 $102,690 $110,035 $101,367 $100,000 $80,707 $80,000 $57,404 $60,000 $40,000 $20,000 $0 SUN MON TUE WED THU FRI SAT *Sunday Early Fringe = 6pm *Prime Access 1 = 7pm (post evening news) *Late news = 11pm Weekend Late News Weekend Late Fringe Sunday Morning Sunday Early Fringe 2 Sunday Early Fringe 1 Sunday Afternoon Saturday Prime Access Saturday Morning Saturday Early Fringe 2 Saturday Early Fringe 1 Saturday Afternoon Prime Access 2 Prime Access 1 Prime Overnight Morning Daytime 2 Morning Daytime 1 Late News Late Fringe Early News 2 Early News 1 Early Morning 2 Early Morning 1 Early Fringe 2 Early Fringe 1 Afternoon Daytime 2 Afternoon Daytime 1 Brand Ad Spending Trends Average Spent/Ad by Time of Day $400,000 $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 Implications Sunday Why? o o o Sporting events Awards shows Largest audience – home with family, etc. Time 1. 2. 3. highest ad spending by brands – of day with highest ad spending: Sunday Fringe 2 – ends of sporting events, etc. Prime Access 1 – Post evening news, entertainment television, game shows Late News – Post sitcoms, dramas Advertising by Program Type Average Advertising Cost/Program Type $500,000 $400,000 $300,000 $200,000 $100,000 $0 Advertising by Program Type Program 1. 2. 3. type with highest average cost: Professional Football – Game Professional Football – Post-Game Award/Pageant/Parade/Celebration Primarily air on Sundays Fits with data on time of day spending o o o Highest ad spending Sunday Fringe 2 Sundays around 6pm Coincides with end of games and beginning of post-games Where Brands Advertise BMW – 79% advertising during Golf Mercedes – 15% advertising during Golf 14% during News Forum/Interview shows GM – 45% advertising during college and professional sporting events Toyota – 21% advertising during drama shows 15% during Professional Football Games Conclusion: Luxury brands advertise to target educated consumers of higher socioeconomic status Advertising Strategies Brand Informative Advertising Conveys simple search attributes to consumers Consumers look for product specs and special features when making purchasing decisions Automotive Industry: o o o o Fuel efficiency Technical features – engine size, horsepower, etc. Price point Available financing Brand Informative Advertising Highlighted attributes differ between product categories o o o o o o Luxury Economy Truck/SUV Hybrids Sport Minivan Informative: Luxury Target new features usually focusing on technological and performance upgrades Primarily in TV commercials Mercedes: http://www.youtube.com/watch?v=Ho4PI9 zaZy4&feature=related Informative: Economy Economy class brands’ informative advertising highlights vehicle o o o o Fuel efficiency (MPG) Price Performance Warranties Informative: Economy Informative: SUVs & Trucks SUV & Truck advertising focuses on qualities such as: o o o Fuel efficiency (MPG) Towing Capacity Usability features Informative: Hybrids Informative Advertisements in the hybrid segment focus on o o o New hybrid technology and how it works, Ecological benefits of hybrids Fuel efficiency (MPG) Informative: Minivan Similar o o o o to economy, but also focuses on Kid friendly attributes Ease of use Storage capabilities Long distance travel capabilities Persuasive Advertising Goal: to portray your respective brand’s vehicles as different from those of your competitors so as to alter consumers’ tastes and create a perceived product difference o o Emotional Appeals Image Changing Perceived product difference allows brand to charge more for their products o Decreases elasticity of demand relative to price Emotional Appeals Social (Status) Fear Humor Lifestyle Endorsement Social Appeals Ads o will target the idea of “fitting-in” Toyota - recent campaign with the Highlander http://www.youtube.com/watch?v=80pN UxIczig Fear Appeals Within the automotive industry, most of the fear appeals mention safety attributes o o Show the harsh realities of accidents and their possible effects Highlight brand’s unique safety features Fear Appeals Acura: o http://www.youtube.com/watch?v=6p9ZH G8Fac0 Mercedes: o http://www.youtube.com/watch?v=_jqnR2 pucm4&feature=related Humor Appeals Humor is an element that is used in around 30% of advertisements across industries Benefits: o o In Excellent tool to catch the viewer’s attention Can help in achieving better recall – potential to increase sales auto industry, sometimes parody the use of sex appeals Humor Appeals Volkswagen: http://www.youtube.com/watch?v=GTq M1LLxMSg Lifestyle Appeals Many brands strive to target the lifestyle of their customers or the lifestyles their customers would like to have o o o Sporty/outdoorsy Family oriented High status Advertisements highlight activities associated with target lifestyle Lifestyle Appeals BMW: http://www.youtube.com/watch?v=Jt662ix43k Endorsements Celebrities and well known personalities often endorse certain products Endorsements can help drive sales Potential to increase advertisement recall if celebrity is appealing to the consumer Endorsements http://www.spike.com/video- clips/bnhcqi/cadillac-tiki-barber http://www.youtube.com/watch?v=CE2lI BQn2KM Image Changing Automakers trying to change their brand image in response to rising fuel prices and to appeal to a more environmentallyconscious nation. o SUVs now made as hybrids—they are trying to change image from gas guzzling to eco-friendly haulers Example: Mustang & Mileage Mustang’s recent commercial—who would’ve thought 5 years ago that advertising for a model like Mustang would ever focus on MPGs? Bloggers: “Who the hell buys a Mustang for the mileage?” http://www.youtube.com/watch?v=ZAX5 50biM7c Honda Odyssey & Dads Honda o Odyssey Reinventing the image of the minivan. SoccerMom Cool Dad Combative Advertising Method used in mature markets Goal: To shift consumers preferences towards the advertising firm o o Redistribution of consumers among brands No expansion of the market Differs o o o o by segment in the auto industry Luxury Economy Sports Cars Hybrids Combative: Luxury Advertising focused in major cities, especially Los Angeles and New York (higher income areas) Notable Battle: Audi vs. BMW o o Perhaps the most clearly visible example of combative advertising in the entire industry Audi puts up a billboard in the LA metro area, BMW then responds with another right next to it Combative: Economy Nationwide Notable Battle: Toyota Camry vs. Honda Accord New Battle: Kia Optima vs. Toyota Camry o o o Camry has been the “go-to” economy vehicle in America, often first in consumers’ minds Kia trying to get into the game with the Optima Competitive advantage: Kia focuses on o o Lower price Features the Camry doesn’t have (aerodynamic styling and Sirius satellite radio) Kia Optima http://www.youtube.com/watch?v=wc9 Aj7RTUlY Combative: Sports Cars Notable o o Battle: Subaru vs. Audi/BMW Audi and BMW more prestige and better reputation for manufacturing sleek and fancy-looking sports cars Subaru chosen to focus on performance, specifically engine capability, as its competitive advantage Combative: Hybrid Notable o o Battle: Lexus vs. Infiniti Lexus - originally the main player in luxury hybrids Infiniti now getting into the game o o o Advertise how they are passing other hybrids Producing unassuming vehicles that exceed consumer expectations— “not what you think” Advertised as hybrid with performance Infiniti Hybrid http://www.youtube.com/watch?v=pzWy d10icS4&feature=relmfu Mixed-Method Advertising Combining elements from various advertising techniques and strategies Eminem for Chrysler o http://www.youtube.com/watch?v=SKL254 Y_jtc&bid=5079147&adid=233347236&pid=5 7249858&KWNM=super+bowl+commercial& KWID=150763308&channel=PS Audi o “Progress is Beautiful” campaign http://www.youtube.com/watch?v=LQ6R7 c3cnEE Recalls & Brand Reputation Product Recalls & Reputation Recall: when a manufacturer notifies all owners of a specific vehicle of a condition or defect that could affect safety or safe operation. Impact brands’ quality reputation – reputation based on the quality of the product provided by the brand o Quality reputation suffers the most from product recalls Benefits of a Good Reputation Reputation used as a solution to uncertainty for consumers Reputation a signal of quality Benefits to brands: o o o o Ability to charge higher prices (inelastic) Higher growth and sales Higher status in the minds of consumers Protection against new entrants to the market Reputation of a brand creates expectations for its products Liability of a Good Reputation Rhee and Haunschild (2003) Explored relationship between brand reputation and the impact of recalls on: o o o Market share Profits Consumer perceptions/attitudes Studied o o recalls between 1975 and 1999 Of the 46 automakers sampled, 1,853 recall events Average of 2.26 recalls per automaker per year Liability of a Good Reputation Severe recalls tend to decrease brand’s market share in following month Non-severe recalls result in no damage to an automaker’s market share o Why? Small recalls can be perceived as the automaker taking initiative to fix a problem High reputation automakers more likely to be damaged by recalls o Why? 1. Consumers greater expectations for these brands 2. Media focuses on recalls of reputation firms Toyota Recall 2009-2010 Problem: ‘sudden unintended acceleration’ Claimed ill-fitting floor mats caused pedals to stick True cause of sudden unintended accel. faulty accelerator pedals Recall: 22.4 million automobile owners received recall notices in 12 month period ending Summer 2010 o 8.54 million for faulty pedals and floor mats Recalls and Advertising Combat recalls with: Incentives Toyota offered an average of $2,256 in incentives Competitors also offer incentives o GM offered up to $1000 if traded in a Toyota Advertising Apologetic ads o Superbowl 2010 Stressed o o brands: Commitment to safety Importance of customer satisfaction Advertising Response << “As you may have heard, in rare cases, sticking accelerator pedals have occurred in some of our vehicles. We believe we are close to announcing an effective remedy. And we’ve temporarily halted production at some of our N. American plants to focus on the vehicles we’ve recalled. Why? Because it’s the right thing to do for our customers.” Toyota Recall 2009-2010 Toyota Pricing Data (April 2008-April 2010) No apparent break in the relative price of Toyota cars Recalled Toyotas lost 1% of their price advantage over unrecalled Toyotas Never larger than 2% change in price o Never outside the margin of error Conclusion: If recalls matter, small, short lived effect o Appears directly after initial media coverage of the recall event Ford & Bridgestone/Firestone Summer 2000: Tire tread separation on Bridgestone/Firestone tires o o Number one tire for Ford Explorers Recalled 6.5 million tires August 9, 2000 Prime recall o o o example of short lived impact of Survey of consumers attitudes toward Ford on August 16, 17 50% polled said “less likely” to buy vehicle with tires 25% SUV intenders who shun Explorer blame recall Impact of Apologetic Ads Apologetic campaign o Ads – newspaper advertising Ford President stating “Our goal is your safety and trust” Focus Groups August 12 & 13 to measure effectiveness of recall ad campaign o o o 34% participants said impression of Ford improved 5% said impression of Ford worsened 25% said more likely to consider a Ford next time they buy a vehicle based on how the company handled the situation Recent Advertising Innovations Online Advertising Joining trend towards online advertising Now utilize all main forms of online advertising o o o o Banner ads Search Engine Advertising (keywords) Rich media – full length car ads preface videos viewed on Youtube and Hulu Social Media – Facebook and Twitter Social Media – Facebook Facebook creates online community for lovers of a brand Automakers utilize Facebook to engage consumers o o o o Easy exchange of information between the two parties Dialogue that was not possible before Easy word of mouth marketing Encourage user generated content and interaction with the brand’s offerings Example: Toyota USA – Facebook voters determine which 100 do-gooders win Toyotas Social Media - Facebook Corporate o CEO stated: “Social media is the future” Ford o o initiative at Ford Explorer launch Used Facebook as integral part of the launch Real-time Facebook reveal with New York City launch event Social Media – Twitter Twitter can keep followers updated around the clock on brand news Recommendations Future Advertising Strategies Crucial to create a concrete identity of brand through advertising Move towards strengthening core products o Continuing emphasis on fuel efficiency Concrete identity that leaves old players of auto segment in dust o o Brand community like Saturn Advertising with many appeals like Audi Creation of strong brand community makes even harder for consumers to leave Future Advertising Strategies Move towards ads with more emotional appeals – ads that leave the greatest impact Mixed method advertising o o o o Humor appeals Social & Lifestyle appeals Image changing – new luxury, etc. Highlighting innovation Social media – better connection with consumers, greater reach & cheaper! Advertising Investments Advertising goal – reach large, interested audience with least expenditure audience o Earn highest return on investment Advertise more on college sports, less on professional sports o o o Similar audience Cheaper placements Also on Sunday, most popular advertising day Advertising Investments Family oriented cars Children’s/Family entertainment, daytime o o Luxury hybrids increase advertising across the board to compete o Target moms Even target kids – see cool minivan, tell parents about Prestige + Eco-friendly, previously unavailable Move advertising $ to similar programming that is less expensive o o Professional Football post-game pre-game Cheaper, but same target audience Questions?