Ch 1

advertisement

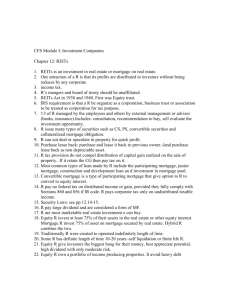

Ch.1 Overview of Financial Management and Financial Environment 1. Types of Business Organization: 1) Sole proprietorship 2) Partnership 3) Corporations 4) Hybrid 1) Sole proprietorship Advantages: - Easily and inexpensively formed - Subject to few government regulations - Avoid corporate income tax Limits: - Unlimited personal liability - Limited to the life of the individual who create - Difficult to obtain large sums of capital 2) Partnership – more than one owner. Advantages: - Easy and inexpensive to set up Limits: - Unlimited liability - Limited life - Difficult to transfer ownership • Limited partnership has limited partners and general partners. Limited partners do not involve in management and can lose only his or her investment whereas general partners involve in management and have unlimited liabilities. In both regular and limited partnerships, at least, one partner is liable for debts of the partnership. However, in a Limited Liability Company or Limited Liability Partnership, all partners enjoy limited liability regard to the business liabilities and their potential losses. 3) Corporations Separation of owners from management. Advantages: - Unlimited life - Easy transferability of ownership - Limited liabilities Limits: - Double taxations: corporate and individual levels - More time consuming documentation and reports: charter and a set of bylaws • Charter includes; (1) name of proposed corporation, (2) types of activities it will pursue, (3) amount of capital stock, (4) number of directors, (5) names and addresses of directors. This charter is filed with the secretary of the state in which the firm will be incorporated. • Bylaw includes; (1) how directors are elected, (2) whether the existing stockholders will have the first right to buy any new shares the firm issues, (3) procedure for changing the bylaws. - Different types: • Professional Corporation (PC) or Professional Association (PA). Though Corporation, it does not allow to relieve professional liability (e.g. malpractice of doctors, lawyers, etc). • S Corporation: small size business and 100 owners. Taxed like a proprietorship. • 2. Growing and managing a Corporation • Agency problem: conflict of interest between management and shareholders • Corporate governance in order to address agency problem. Here corporate governance is a set of rules that control company’s behavior towards its directors, managers, employees, shareholders, creditors, customers, competitors, and community. 3. Primary Objective of Corporation • Stock holders elect directors who then hire managers to run a corporation • Goal of management is to maximize the fundamental or intrinsic price of common stock rather than the market price. • Maximizing stock price also benefit social welfare: (1) owners of stock are society, (2) Consumer benefit resulting from high quality and low cost, and (3) employees benefit, .etc (1) Managerial actions to maximize shareholder wealth • Firm value is determined by a company’s ability to generate free cash flows (FCF) now and in the future. The improvement of FCF will improve the intrinsic value of a firm. • FCF = sale revenue – operating costs – operating taxes – required new investments in operating capital. • Value = 𝐹𝐶𝐹 𝑛 ∞ 𝑛=1 (1+𝑊𝐴𝐶𝐶)𝑛 • Here WACC is weighted average cost of capital 4. An overview of the Capital Allocation Process • 1) Direct Transfers • 2) Indirect Transfers though Investment Bankers underwriting the security issues. • 3) Indirect Transfer through a Financial Intermediary such as banks and funds. • Figure 1-1 5. Financial Securities • 1) Major Financial Instruments (Table 1-1) • 2) The process of securitization – mortgage securitization: • - S&L, banks or specialized mortgage originating firms originate mortgage and sell them to investment banks. The investment bundle them into packages and then use these package as collateral for bonds sold to pension funds, insurance and other investors. • Congress facilitated this process by creating two stockholder-owned but government sponsored entities – Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac) which have a small amount of equity and a huge amounts of debt. • Since then, S&L and banks originate and pool mortgage and then sell them to Fannie Mae which uses them as collateral in order to sell bonds. • This process (1) increases lendable funds, (2) transfer of risk of mortgage to Fannie Mae, and (3) increases liquidity for holders of the debts. • This process benefit investors (lenders) through diversification – bundled mortgage and an improved return. 6. Cost of money Raised capital is not free. • For debt, borrowers have to pay interest. • For equity, firms have to pay dividends. 4 fundamental factors affecting the cost of money: (1) Production opportunities: The returns available within an economy from investments in productive assets (2) Time preferences for consumption: The preferences of consumers for current consumption as opposed to saving for future consumption. (3) Risk: The chance that an investment will provide a lower or negative return (4) Inflation: The amount by which prices increase over time. Economic conditions and policies that affect the cost of money (1) Federal reserve policy FED controls money supply by: - open market operation to buy or sell treasury securities - discount rate - reserve requirement (2) Budget deficit or surplus: The larger the deficit, the more money supply and the higher the interest rates (3) Business activity (4) International trade balance (deficit or surplus): The larger the trade deficit, the more we must borrow and this will drives up the interest rates (5) International country risk (6) Exchange rate risk 7. Financial Institutions 1) Investment banks: an organization that underwrites and distributes new investment securities and helps businesses obtain financing. It also provide consulting and advisory services and brokerage services. 2) Deposit-taking financial intermediates • Savings and Loan Association (S&Ls): accepted deposits from many small savers and then loaned this money to home buyers and consumers. • Credit union: cooperative association whose members’ savings are loaned only to other members. • Commercial bank: raise money from deposits or by issuing stock or bonds to investors. Some one with a bank account can write checks, use debit cards, etc. And investors can receive dividends or interests. 3) Investment Funds • Mutual funds: organizations that pool investor funds to purchase financial instruments and thus reduce risk through diversification. - Money market funds: investment in low-risk securities and allow investors to write checks against their accounts. • Exchange Traded Funds (ETFs): similar to mutual funds. ETFs funds buy a portfolio of stocks of certain type and then sell their own shares to the public. • Hedge funds: similar to mutual funds. - Limited to institution investors and small number of net worth individuals. - Mutual funds are registered and regulated by SEC but hedge funds are less regulated. - Minimum investment requirement ( $1 million). • Private Equity Companies: they buy and then manage entire firms. - Limited to a small number of large investors. - Tend to privatize public firms and then sell them later at premium. • 4) Insurance and Pension funds • Pension funds: retirement funds. Primarily investing in bonds, stocks, mortgages, and real estate. • Life insurance companies: take premium and invest in bonds, stocks, etc. • 5) Regulation of Financial Institutions • After repealing Glass-Steagall’s separation of commercial and investment banking in 1999, huge financial service corporations emerged. These financial service corporations provide services of commercial banking, S&Ls, Mortgage, investment banking, etc. 8. Financial Markets 1) Physical asset markets: goods, tangible assets, real assets markets Financial markets: claims on real assets (financial securities) 2) Spot and futures markets: assets are bought or sold for “ on the spot” or for delivery at some future date. 3) Money markets: financial markets for short term and high liquid debt securities. Capital Market: financial markets for intermediate or long term bonds and stocks. 4) Mortgage market: loans on residential, agricultural, commercial, and industrial real estate. Commercial credit market: loans on autos, appliance, education, vacations, and so on. 5) World, national, regional and local market 6) Primary Markets: markets in which corporations raise capital by issuing new securities. Secondary market: markets in which existing, already outstanding, securities are traded. Ex) NYSE 7) Private market: The market where transactions are worked out directly between two parties. Ex) bank loan or private debt placement Public market: The market where standardized contracts are traded on organized exchange. Ex) issuing securities or public debts 9. Trading Procedure 1) Two basic types of stock markets • Physical location exchange: NYSE, AMEX and regional stock exchanges • Electronic dealer-based markets: Nasdaq, over the counter and electronic communication networks (ECNs) 2) Matching buy and sell orders: - Outcry auction: meet and communicate with shout and hand signals. E.g) CBOT - Dealers market: list bid and ask quotes and then contact a specific dealer to match. E.g) NASDAQ - Electronic communication network (ECN): post buy and sell prices and then ECN automatically match with close prices. E.g) Instinet and Archipelago. • 3) Types of stock market transactions: • - Going public and seasoned equity offering. • 10. Secondary stock market • 1) New York Stock Exchange • Privately held firm owned by members and merged with Archipelago in 2006. The merged one also has Pacific Exchange. The combined one is called NYSE group and became a public firm. • The NYSE group merged with Euronext in 2007 and became NYSE Euronext. • Formal organization having tangible physical locations that conduct auction markets in designated (“listed”) securities. • More than 300 members in NYSE had seats giving rights to trade on the exchange. The trading license is also leased. Most of the larger investment banks operate brokerage departments or members with the leased trading licenses. • 2) National Association of Securities Dealers (NASD) or NASDAQ • Self-regulatory body that licenses brokers and oversees trading practices. • Its own listing requirement. • More than 400 dealers making a market, generating good liquidity. • Operate Nasdaq OTC Bulletin Board, which lists quotes for stocks that are registered with the SEC but are not listed on any exchange because of small size or less profitability. • Nasdaq operates Pink Sheet which provides quotes on company that are not registered with SEC. 11. Stock market performance • Figure 1-4. • 12. The Global Economic Crisis • Assignment 1: Summarize the section of “The Global Economic Crisis” - page 36 to 45.