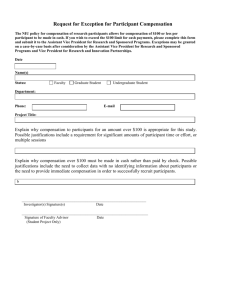

Table 2: Calculating the compensation reduction amount where the

advertisement

Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement Legislation 1. Read ss.4, 105B, 106 and 107 of the National Disability Insurance Scheme Act 2013 (NDIS Act) and the National Disability Insurance Scheme (Supports for Participants – Accounting for Compensation Rules 2013 (Supports for Participants – Accounting for Compensation Rules). 2. This Operational Guideline is consistent with the law as in effect on 9 December 2013. General principles 3. People with disability and their families and carers should have certainty that people with disability will receive the care and support they need over their lifetime. See s.4(3) of the NDIS Act. 4. People with disability should be supported to receive reasonable and necessary supports, including early intervention supports. See s.4(5) of the NDIS Act. 5. People with disability should be supported to receive supports outside the National Disability Insurance Scheme (NDIS), and be assisted to coordinate these supports with the supports provided under the NDIS. See s.4(14) of the NDIS Act. 6. The financial sustainability of the NDIS should be ensured. See s.4(17)(b) of the NDIS Act. Background 7. This Operational Guideline applies when a participant, or prospective participant, has received compensation under a judgement or settlement: a. In which the NDIS component of the amount of compensation is either fixed or objectively identifiable, or b. In which it is not possible to identify the NDIS component of the amount of compensation but the judgement or settlement fixes an amount of compensation, in respect of a personal injury that has caused, to any extent, their impairment. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 1 of 16 8. 9. In circumstances where the NDIS component of the amount of compensation is either fixed or objectively identifiable, a delegate is to apply: a. The criteria set out in Table 1 to determine whether a compensation reduction amount is payable, and b. The steps set out in Table 2 to calculate that amount. In circumstances where it is not possible to identify the NDIS component of the amount of compensation but the judgement or settlement fixes an amount of compensation, a delegate is to apply: a. The criteria set out in Table 3 to determine whether a compensation reduction amount is payable, and b. The steps set out in Table 4 to calculate that amount. 10. This Operational Guideline applies to both participants and persons who later become participants. 11. When a person receives one compensation payment awarded by a court and another payment as part of a settlement, each payment is to be treated separately and the compensation reduction amount for each compensation payment is to be worked out. This means that more than one compensation reduction amount will apply to the person, worked out in accordance with the relevant Operational Guidelines on compensation for revising the plan and reducing the supports. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 2 of 16 Table 1: Where the NDIS component is fixed by the judgement or settlement or can be objectively identified – r.3.1(a) Requirements Considerations (including evidence relied on and established facts) A participant’s plan must be revised and the reasonable and necessary supports stated in the plan reduced by an amount (the compensation reduction amount) if Criteria 1, 2, 3 and 4 are met: Criterion 1 Yes The person has suffered a personal injury which has caused, to any extent, their impairment, regardless of whether the person was a participant at the time of the injury. No Criterion 2 Yes The person was awarded compensation under a judgement or settlement in respect of that injury. No Criterion 3 Yes It is possible to identify the NDIS component of the amount of compensation. No Note: The NDIS component of an amount of compensation under a judgement or settlement means the component of the compensation that relates to the provision of supports of a kind that may be funded or provided under the NDIS after the date of judgement or settlement, and may include a component that consists of periodic payments. Criterion 4 Yes The NDIS component of the award of compensation is either fixed by a non-consent judgement or is objectively identifiable. No Example: Commutation of benefits under a statutory scheme. Commutation involves an agreement between the injured person and the compensation scheme for the payment of entitlements as a lump sum, rather than periodic payments. Were all of Criteria 1, 2, 3 and 4 met? Yes No Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 3 of 16 Requirements Considerations (including evidence relied on and established facts) If yes, the participant’s plan must be revised and the reasonable and necessary supports stated in the plan reduced by the compensation reduction amount, calculated in accordance with Table 2. Example Peter sustained a catastrophic brain injury in a motor vehicle accident in 2008. He was 45 years old at the time of the accident and was travelling to work. In addition to making a claim with his employer’s workers’ compensation insurer, Peter pursues a common law action against the at-fault driver and their CTP insurer. Peter’s common law claim proceeds to court and the court awards damages to Peter (in a non-consent judgement), including $4 million for future care and support and $1 million for past care. On 10 June 2015 Peter becomes a participant in the NDIS. His award of compensation must be taken into account in determining his reasonable and necessary supports because he satisfies the criteria of Table 1. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 4 of 16 Table 2: Calculating the compensation reduction amount where the criteria of Table 1 are met – rs.3.11 and 3.12 The purpose of calculating the compensation reduction amount is to ensure that a participant does not receive funding from the NDIS for reasonable and necessary supports that are funded under an amount of compensation received from a judgement or settlement. In circumstances where the criteria of Table 1 are met because a participant has received compensation by way of judgement or settlement and the NDIS component is fixed or can be objectively identified, then Table 2 provides that, as a general rule, their funding for reasonable and necessary supports from the NDIS is to be reduced by an amount equivalent to the value of the compensation for care and support received under that judgement or settlement. Steps Considerations (including evidence relied on and established facts) Calculations For the purposes of Table 1, to calculate the compensation reduction amount, follow Steps 1 to 5: Step 1 Identify the NDIS component of the amount of compensation. Note: See Criterion 3 in Table 1 for the meaning of NDIS component. Step 2 Subtract the amount (if any) that the delegate considers is equal to the total amounts that the participant has personally paid for supports that are of a kind that are funded or provided under the NDIS in the time between: 1. The date of the judgement or settlement, and 2. When the person became a participant. If the NDIS component includes a part that is by way of a periodic payment (for example, a payment each month or year), it is calculated as follows: 1. If the amount is specified in a judgement – that amount 2. If the amount is not specified in a judgement, but the delegate is satisfied that a specified amount was paid by the defendant to ensure the provision of the periodic payments – that amount, or 3. Otherwise - the value of the periodic payments as assessed in accordance with accepted actuarial standards, in consultation with the Scheme Actuary. This Step reflects that a participant may have paid for their own supports for a period. This subtraction means that the participant will not be disadvantaged by this, and their compensation reduction amount will be lower as a result. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 5 of 16 Steps Considerations (including evidence relied on and established facts) Step 3 This Step reflects that a participant may have had earlier plans which incorporated a reduction in respect of the same personal injury. Each time a plan is replaced or reviewed, this new or reviewed plan is to take into account earlier compensation reduction amounts to ensure it is not double counted. The duration of most plans is less than 12 months. Subtract the amount of any reduction in funding that has occurred under a previous plan in respect of this personal injury (if any). Calculations Step 4 – Consider whether the person has received more than one compensation payment If: 1. A person has received a compensation payment that is made up of (1) a part that is included in a judgement or settlement and (2) a part associated with an insurance or statutory scheme, and 2. A compensation reduction amount has been identified for the judgement or settlement, then: Note: A participant may have more than one compensation claim in respect of the same injury. For example, a participant may sustain their injury at work and receive workers’ compensation payments as well as common law damages from a court ordered judgement. Step 4.1 Subtract any compensation reduction amount worked out for: 1. An insurance or a statutory scheme, or 2. Another judgement This will be assessed under either this Operational Guideline or Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received under an Insurance Scheme or a Commonwealth, State or Territory Scheme. in relation to this injury. Step 4.2 Add the amount of any reduction in funding that has occurred under a previous plan in respect of this personal injury (if any). Step 4.3 Add the amount of any reduction in funding considered equal to the total amount paid personally by the participant This Step reflects that a participant may have had earlier plans which incorporated a reduction in respect of the same personal injury. Each time a plan is replaced or reviewed, this new or reviewed plan is to take into account earlier compensation reduction amounts to ensure it is not double counted. The duration of most plans is less than 12 months. This Step reflects that a participant may have paid for their own supports for a period. This subtraction means that the participant will not be disadvantaged by this, and their compensation reduction amount will be Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 6 of 16 Steps Considerations (including evidence relied on and established facts) for supports of a kind funded under the NDIS Act after the compensable event and before becoming a participant. lower as a result. Step 5 The Supports for Participants – Accounting for Compensation Rules do not define what constitutes special circumstances, and a wide range of circumstances can be considered. Special circumstances may include financial hardship suffered by the participant. Consider whether to ignore and not recover part or the whole of the compensation reduction amount if it is appropriate because of the special circumstances of the case. Calculations Once these Steps have been applied, the compensation reduction amount will be the total remaining after Step 5 has been considered. However, the compensation reduction amount cannot be negative. If, after working out the compensation reduction amount, the amount is nil or less than nil, the delegate is to record the compensation reduction amount as nil and therefore there will be no reduction in the person’s supports. The amount is to be recovered over the expected lifetime of the participant in accordance with accepted actuarial standards, and not as a lump sum. Delegates are to consult their supervisor in relation to approaching the Scheme Actuary. Example After Peter becomes a participant on 10 June 2015, he is assessed as requiring a package of care and support of $200,000 a year. Peter’s compensation reduction amount is calculated as follows: Step 1: Identify the NDIS component of the amount of compensation. This is the component that relates to the provision of supports of a kind that may be funded or provided under the NDIS after the date of the judgement. This is worked out to be the entire amount awarded for future care and support – $4 million. Step 2: Subtract the amount that the delegate considers is equal to the amounts the participant has paid for supports that are of a kind that are funded or provided under the NDIS in the time between the date of the judgement and when the person became a participant. In this case, Peter used a commercial provider to provide his own care and support between the time of the judgement in 2013 and the date he became a participant in the scheme on 10 June 2015. The cost of this care and support was $400,000. Peter also spent $250,000 modifying his house. The delegate considers that all of the cost of care and support and all of the cost of the home modifications are supports of a kind that are funded by the NDIS and subtracts $650,000 from the amount identified in Step 1. Step 3: Subtract the amount of any reduction in funding that has occurred under a previous compensation reduction amount. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 7 of 16 This is Peter’s first NDIS plan, there has been no previous compensation reduction amount and Peter has not received any other compensation payments that could result in a compensation reduction amount. Step 4: Consider whether the person has received more than one compensation payment. This is Peter’s only compensation payment. Step 5: Consider whether to ignore and not recover part or the whole of the compensation reduction amount if it is appropriate because of the special circumstances of the case. Peter does not appear to have special circumstances and therefore it is not appropriate to ignore and not recover part or the whole of the compensation reduction amount As the compensation reduction amount is not negative, Peter’s compensation reduction amount does not change. Peter’s compensation reduction amount is therefore $3.35 million. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 8 of 16 Table 3: Where the NDIS component is not fixed by the judgement or settlement or cannot be objectively identified – r.3.1(b) Requirements Considerations (including evidence relied on and established facts) A participant’s plan must be revised and the reasonable and necessary supports stated in the plan reduced by an amount (the compensation reduction amount) if Criteria 1, 2, 3 and 4 are met: Criterion 1 Yes The person has suffered a personal injury which has caused, to any extent, their impairment, regardless of whether the person was a participant at the time of the injury No Criterion 2 Yes The person was awarded compensation under a judgement or settlement in respect of that injury. No Criterion 3 Yes Criterion 2 and Criterion 3 of Table 1 are not met. No Note: That is, the NDIS component of the amount of the judgement or settlement is not fixed or cannot be objectively identified. Criterion 4 Yes The judgement or settlement fixes a total amount of compensation in respect of the injury, but it is not itemised. No Were all of Criteria 1, 2, 3 and 4 met? Yes No If yes, the participant’s plan must be revised and the reasonable and necessary supports stated in the plan reduced by the compensation reduction amount, calculated in accordance with Table 4. Example Jessie is injured in an accident and becomes a participant in the NDIS soon after the injury. Jessie’s injury is not covered by a statutory scheme and she elects to sue a third party for damages, including past and future care and support, lost income and pain and suffering. The parties agree to settle the matter without admission of fault and compensation is fixed at $70,000. The settlement fixes an amount of compensation but the NDIS component cannot be objectively identified. Jessie’s compensation must be taken into account in determining her reasonable and necessary supports because she satisfies the criteria of Table 3. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 9 of 16 Table 4: Calculating the compensation reduction amount where the criteria of Table 3 are met – rs 3.13 to 3.16 The purpose of calculating the compensation reduction amount is to ensure that a participant does not receive funding from the NDIS for reasonable and necessary supports that are funded under an amount of compensation received from a judgement or settlement. In circumstances where the criteria of Table 3 are met because a participant has received compensation by way of judgement or settlement (but the NDIS component is not fixed or cannot be objectively identified), then Table 4 provides that, as a general rule, their funding for reasonable and necessary supports from the NDIS is to be reduced by an amount equivalent to the value of the compensation for care and support calculated to have been received under that judgement or settlement. Steps Considerations (including evidence relied on and established facts) Calculation For the purposes of Table 3, to calculate the compensation reduction amount, follow Steps 1 to 6: Step 1 – Note the amount of compensation identified in Table 3 and subtract amounts that are payable under Commonwealth and state/territory legislation Step 1.1 Note the amount of compensation fixed under the judgement or settlement. Step 1.2 Subtract the sum of the amounts (if any) payable in respect of the amount of compensation under: 1. The Health and Other Services (Compensation) Act 1995 2. The Health and Other Services (Compensation) Care Charges Act 1995 3. Part 3.14 of the Social Security Act 1991, or 4. A law of the Commonwealth, a state or a territory, prescribed by the Supports for Participants – Accounting for Compensation Rules. This Step has the effect of reducing the participant’s award of compensation because other legislation requires the participant to repay amounts back from their award of compensation. It would be unfair to the participant to not reduce the compensation received in these circumstances. This reduction means that the compensation reduction amount will be lower than it would have been otherwise. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 10 of 16 Steps Considerations (including evidence relied on and established facts) Step 1.3 This Step has the effect of reducing the participant’s award of compensation because the participant is subject to a period of preclusion under a statutory scheme of entitlements. It would be unfair to the participant to not reduce the compensation received in these circumstances. Subtract an amount the delegate considers reflects the value of any period of preclusion: 1. 2. That arises from a Commonwealth, a state or a territory statutory scheme of entitlements (for example, the Social Security Act 1991), and Calculation This reduction means that the compensation reduction amount will be lower than it would have been otherwise. Is in respect of the injury. Step 1.4 Subtract 50% of the amount of compensation if Step 1.3 does not apply (because the person is not subject to a period of preclusion) and: 1. The participant claimed damages in relation to lost earnings or lost capacity to earn, and 2. The amount of compensation fixed under the judgement or settlement included an amount in respect of those damages. This Step reflects the general approach to calculating the amount of an award of compensation that is not for care and supports (i.e. for damages in relation to lost earnings or lost capacity to earn). It only applies if Step 1.3 does not apply. Step 2 – Ensure that the compensation reduction amount is not greater than the value of the NDIS providing reasonable and necessary supports Step 2.1 Calculate the value of the reasonable and necessary supports that would have been provided to the participant and funded under the NDIS Act over the participant’s expected lifetime had the participant been a participant from the time of the compensable event Note: This amount is to be calculated in accordance with any applicable actuarial model published by the NDIA on its website. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 11 of 16 Steps Considerations (including evidence relied on and established facts) Calculation Step 2.2 Compare the amount calculated at the end of Step 1 to the amount calculated under Step 2.1. Step 2.3 (A) If the amount calculated in Step 1 is greater than the amount calculated in Step 2.1 – the amount determined under Step 2.1 replaces the amount calculated in Step 1 as the compensation reduction amount. Step 2.3 (B) If the amount calculated in Step 1 is less than the amount calculated in Step 2.1 – the amount determined under Step 1 remains as the current compensation reduction amount. This Step reflects that the compensation reduction amount should not be greater than the value of the NDIS providing reasonable and necessary supports. It would be unfair to the participant if this was otherwise. This Step reflects that the compensation reduction amount should only be reduced to the extent that the value of the NDIS providing reasonable and necessary supports is less than that amount. Step 3 – Subtract any reasonable and necessary supports paid by the participant Step 3.1 Subtract an amount equivalent to the total of the amounts that were paid by the participant for supports of the kind that funded under the NDIS in the period between the compensable event and the date the person became a participant. This Step reflects that a participant may have paid for their own supports for a period. This subtraction means that the participant will not be disadvantaged by this, and their compensation reduction amount will be lower as a result. Step 4 – Subtract any amounts obtained by the NDIA from the participant from the previous recovery of NDIS amounts or compensation reduction amounts Step 4.1 Subtract any recoverable amounts obtained by the NDIA from the participant under ss.106 and 107 of the NDIS Act in respect of the compensable amount. Step 4.2 Subtract any amount deducted under s.105B of the NDIS Act. Ss.106 and 107 deal with the recovery of NDIS amounts received by a participant from a judgement or settlement. S.105B deals with recoverable amounts obtained by the NDIA after the NDIA instituted action or took over a claim to obtain compensation under s.105. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 12 of 16 Steps Considerations (including evidence relied on and established facts) Step 4.3 This Step reflects that a participant may have had earlier plans which incorporated a reduction in respect of the same personal injury. Each time a plan is replaced or reviewed, this new or reviewed plan is to take into account earlier compensation reduction amounts to ensure it is not double counted. The duration of most plans is less than 12 months. Subtract the amount of any previous compensation reduction amount determined and applied by the NDIA. Calculation Step 5 – Consider whether the person has received more than one compensation payment If: 1. A person has received a compensation payment that is made up of (1) a part that is included in a judgement or settlement and (2) a part associated with an insurance or statutory scheme, and 2. A compensation reduction amount has been identified for the judgement or settlement, then: Note: A participant may have more than one compensation claim in respect of the same injury. For example, a participant may sustain their injury at work and receive workers’ compensation payments as well as common law damages from a court ordered judgement. Step 5.1 Subtract any compensation reduction amount worked out for: 1. An insurance or a statutory scheme, or 2. Another judgement This will be assessed under either this Operational Guideline or Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received under an Insurance Scheme or a Commonwealth, State or Territory Scheme. in relation to this injury. Step 5.2 Add the amount of any reduction in funding that has occurred under a previous plan in respect of this personal injury (if any). Step 5.3 Add the amount of any reduction in funding equal to the total amount paid personally by the participant for supports This Step reflects that a participant may have had earlier plans which incorporated a reduction in respect of the same personal injury. Each time a plan is replaced or reviewed, this new or reviewed plan is to take into account earlier compensation reduction amounts to ensure it is not double counted. The duration of most plans is less than 12 months. This Step reflects that a participant may have paid for their own supports for a period. This subtraction means that the participant will not be disadvantaged by this, and their compensation reduction amount will be Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 13 of 16 Steps Considerations (including evidence relied on and established facts) of a kind funded under the NDIS Act after the compensable event and before becoming a participant. lower as a result. Calculation Step 6 – Consider any special circumstances Step 6.1 Consider whether to ignore and not recover part or the whole of the compensation reduction amount if the delegate considers it is appropriate because of the special circumstances of the case. The Supports for Participants – Accounting for Compensation Rules do not define what constitutes special circumstances, and a wide range of circumstances can be considered. Special circumstances may include financial hardship suffered by the participant. Once these Steps have been applied, the compensation reduction amount will have been calculated. However, the compensation reduction amount cannot be negative. If, after working out the compensation reduction amount, the amount is nil or less than nil, the delegate is to record the compensation reduction amount as nil and therefore there will be no reduction in the person’s supports. The amount is to be recovered over the expected lifetime of the participant in accordance with accepted actuarial standards, and not as a lump sum. Delegates are to consult their supervisor in relation to approaching the Scheme Actuary. Example Jessie has settled her claim for compensation against the third party for $70,000. At the time of settlement Jessie has a life expectancy of eleven years and the value of the NDIS providing reasonable and necessary supports to the participant is calculated by the NDIA to be $7,500 a year. She received one year of care and support from the NDIS before the case was settled and a delegate has made a decision under s.107 of the NDIS Act that $7,500 is to be recovered. Jessie has received $2,000 worth of medical services through Medicare and the $2000 is payable by Jessie under the Health and Other Services (Compensation) Act 1995. The settlement fixes an amount of compensation for the injury but the NDIS component cannot be objectively identifiable. The compensation reduction amount is calculated as follows: Step 1.1: Calculate the amount of compensation fixed under the judgement or settlement. The amount of compensation is $70,000. Step 1.2: Subtract the sum of the amounts (if any) payable in respect of the amount to compensation under the Health and Other Services (Compensation) Act 1995, the Health and Other Services (Compensation) Care Charges Act 1995, Part 3.14 of the Social Security Act 1991 or a law of the Commonwealth, a State or a Territory prescribed by the Supports for Participants – Accounting for Compensation Rules. In this case, Jessie had to pay $2,000 to the Health and Other Services (Compensation) Act 1995 and therefore $2,000 needs to be subtracted. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 14 of 16 Step 1.3: Subtract an amount the delegate considers reflects the value of any period of preclusion that arises from a Commonwealth, a state or a territory statutory scheme of entitlements and is in respect of the injury. Because Jessie is not precluded from income support, there is no deduction at this step. Step 1.4: Subtract 50% of the amount of compensation if Step 1.3 does not apply, the delegate is not satisfied that the participant claimed damages in relation to lost earnings or lost capacity to earn and the delegate is satisfied that the amount of compensation fixed under the judgement or settlement included an amount in respect of those damages. Jessie is not subject to a preclusion period for the purposes of Step 1.3. The delegate makes a decision that they are satisfied that: a. Jessie claimed damages for lost earnings or lost capacity to earn, and b. The final quantum under the judgement or settlement included an amount in respect of those damages. Therefore, 50% of the amount of compensation should be subtracted, which amounts to $35,000. Step 2: Ensure that the compensation reduction amount is not greater than the value of the NDIS providing reasonable and necessary supports. The amount remaining in this case is $33,000 which is less than the value of the reasonable and necessary supports that a delegate considers would have been provided to the participant and funded under the NDIS Act over the participant’s expected lifetime had the participant been a participant from the time of the compensable event (11 years at $7,500 per year). Therefore, the amount of $33,000 is not replaced. Step 3: Subtract any reasonable and necessary supports paid by the participant. Jessie became a participant soon after the injury. Jessie did not pay any money for supports of the kind that are funded under the scheme in the period between the compensable event and the date she became a participant. The delegate considers the equivalent amount to be zero. Therefore, there is no subtraction for Step 3. Step 4.1: Subtract any recoverable amounts obtained by the NDIA from the participant under ss.106 and 107 of the NDIS Act in respect of the compensable amount. Jessie received one year of care and support from the NDIS before the case was settled and a delegate has made a decision under s.107 of the NDIS Act that $7500 is to be recovered from her. Accordingly, an amount of $7,500 should be subtracted. Step 4.2: Subtract any amount deducted under s.105B of the NDIS Act. No deduction applies because the case was not conducted by the NDIA using its powers under s.105 of the NDIS Act so there was no amount recovered under s.105B. Step 4.3: Subtract the amount of any previous compensation reduction amount determined by the NDIA. No deduction applies under Step 4.3 because this is Jessie’s first plan to which a compensation reduction amount applies. Step 5: Subtract any other compensation reduction amounts in respect of the injury. There has been only one compensation payment received by Jessie in relation to this injury which means there is no other compensation reduction amount under r.3.1(a) in respect of the injury. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 15 of 16 Step 6: Consider whether to ignore and not recover part or the whole of the compensation reduction amount if it is appropriate because of the special circumstances of the case. Jessie does not appear to have special circumstances and therefore it is not appropriate to ignore and not recover part of the whole of the compensation reduction amount. As the compensation reduction amount is not negative, Jessie’s compensation reduction amount does not change. Jessie’s compensation reduction amount is therefore $25,500. Operational Guideline – Compensation – Revise the Plan and Reduce the Supports – Compensation Received from a Judgement or Settlement (v 1.0) Publication date: 9 December 2013 Page 16 of 16