FHA 203(k) Underwriting Seminar

advertisement

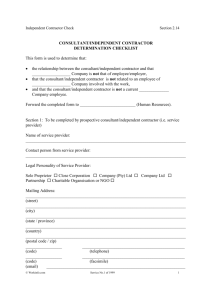

FHA 203(k) Rehabilitation Loan Program Underwriting Seminar October 4, 2011 FHA 203(k) Underwriting Seminar Topics for Discussion: • Program Overview/Re-engineering • FHA 203(k) Specific Disclosures • Streamline FHA 203(k) vs. Full FHA 203(k) • Permits • Contractor Acceptance Procedures • Plan Review, Specifications of Repairs, Estimates • Contingency Reserves • Appraisal Requirements 2 FHA 203(k) Underwriting Seminar Topics for Discussion: • Maximum Loan-to-Value • Maximum Mortgage Calculation • Underwriting Considerations • Funding Issues • M&T Draw Process • M&T Resources 3 Industry Statistics and M&T Experience • Americans have spent on avg. approx $125 billion annually in home renovation since 2008 • Overall new construction lending down 72% since 2005 – 2.1 Million starts in 2005 compared to 585,000 in 2010 – 2011 down 2.3% - some estimates as low as 570,000 starts this year • National Association of Home Builders: – Remodeling Market Index – Combines ratings of current remodeling activity with indicators of future activity. • Up 10% in Q1 2011 – Softened somewhat in Q2 2011 but it is still the second highest RMI since Q3 2007 4 Industry Statistics and Commentary • According to the Harvard University’s Joint Center for Housing Study, 2010 results indicate greater spending on larger remodeling projects, as well as core home improvement projects such as window and roof replacement. – Kitchen remodels were up nationwide by 191% year-over-year. Average major kitchen remodel is $57,000 (minor is $21,000); – Bathroom remodels increased 30 percent. Average bathroom remodeling project is $16,000 • According to this same study, they are forecasting a 13 percent increase from April through June; and spending on renovations may increase 3.5% annually through 2015. 5 Industry Statistics and Commentary • U.S. Unemployment Rate as of last month is 9.1%. • Big Box Stores – Earlier this year, Home Depot announced they must hire 60,000 seasonal associates – Lowes just introduced the Home Improvement App for iPhone and iPod • National Retail Federation – U.S. Consumer confidence at a 3 year high earlier this year; Retail spending increased 0.4% in the second quarter • Driving force of this surge in home rehabilitation will be the baby boomers – The first of whom are reaching 65 and are preparing their homes for retirement. They need better lighting, less barriers, more things in convenient locations. – In 2011, 13% of the US population is age 65 or older – It’s estimated that there are 75 million people in the “baby boomer” generation (those born from 1946 to 1964) 6 Why FHA 203(k)? • Traditional Loan Options Less Prevalent in the Current Market – Disappearance of second mortgage loans. Second lien production down 80% since 2008 – Home Equity Line of Credit – Borrowers have less equity to tap into Home values down 31% since July 2006 100% LTV’s no longer available. Typical LTV is now 90% • Limited Competition. Fragmented Market. Few Lenders play in the 203K Arena. • 80% of US homes are 20+ yrs old. – Home improvement activity appears to be migrating from simple replacement projects and energy retrofits to broader remodels / upgrades. 7 Why FHA 203(k)? • Negative Equity: 22.3% of all mortgage holders are upside down. This represents 14 million homes – FHA 203(k) permits after-improved value • Foreclosures – 2.2 million as of 2010. – One of the primary tenets of the program is to assist potential homeowners with acquiring and rehabilitating single family properties. • Short Sales; REO’s; distressed sales – Another principle of the program is to restore the existing housing stock 8 Industry FHA 203(k) Rehab Volume Trend 9 FHA 203(k) at M&T • M&T has experienced rapid growth since late 2008 and has become the third largest 203(k) lender in the country only behind Wells Fargo and Bank of America • This significant growth in volume has warranted closer management. The Six Sigma 203(k) Rapid Improvement Process initiative, effort commenced in the fall of 2010 and continues today. • Core 203(k) RIP Committee is comprised of approximately 40 individuals and includes Sales, Product Development, Ops, Accounting, Risk, Technology, Asset Management, LSS 10 FHA 203(k) at M&T • M&T EasyBuild Construction & FHA 203(k) Rehabilitation Dichotomy: EasyBuild FHA 203(k) 2006 2010 $800+M $20M $20M $600+M • Originated 1400+ units in 2010 • Issued 11,285 draw checks in 2010 11 M&T Rehabilitation Program Product Mix Channel Mix 11% 2%1% 34% 42% 47% 63% 203(k) 12 203(k) Streamline HomeStyle Remodel Retail Broker Correspondent 2011 Opportunities • • • • Increase Correspondent business Improve product knowledge Improve file quality & U/W productivity Better tracking & communication to customers throughout the draw process • Better technology 13 Pre-Settlement: • • • • • • • • • Corresp Announcement (PB2010-20) Contractor Acceptance Checklist (Exhibit 03-099) - MEME Contractor’s Resume (Exhibit 02-410) FHA 203(k) Borrower’s Acknowledgement (VMP457). Homeowner/Contractor Agreement (VMP744) Borrower’s Identity of Interest Certification (VMP601) Consultant’s Identity of Interest Certification (VMP602) 203(k) Permit Certification (Form 8000) Plan Review / Specification of Repairs signed by Consultant (not required for 203(k) Streamlines) (VMP600) - Consultant • Draw Request Form (HUD Form 2452) (not required for 203(k) Streamlines) • 203(k) Maximum Mortgage Worksheet (VMP435) 14 15 16 • Revised during re-engineering efforts. • No longer require SS# - easier for the Contractor • More space to fill in data Contractor must sign and date 17 It is very important that this disclosure is read and understood by the applicant(s). It is extremely informative. All mortgage staff members involved with 203(k)s should read it in its entirety. The applicant(s) must check one of these boxes to instruct M&T how to apply the net interest income on the rehabilitation repair escrow account. SAMPLE COPY ONLY All applicant(s) must sign and date here. The loan officer must sign and date here. 18 This dollar amount must match the amount of the individual contractor’s estimate. On a standard 203(k), if there is more than one contractor, the sum of the totals of all the Homeowner/Contractor Agreements must equal the Total of Repairs on the Specification of Repairs and entered on line B1 of the 203(k) maximum mortgage worksheet. This is the date that the work will be completed. It must be no later than 6 months from the closing date. 19 On a streamline 203(k) the sum of the total of all the Homeowner/Contractor Agreements must be entered on line B1 of the 203(k) maximum mortgage worksheet. Each non-signature page must be initialed by the applicant(s) and the contractor. For a streamline 203(k) the contractor must also provide a detailed estimate, signed and dated by all the applicant(s) and the contractor for the work being completed. SAMPLE COPY ONLY Page 2 must also be initialed by the applicant(s) and the contractor. 20 This page must be signed and dated by the applicant(s) and the contractor. By signing this agreement, the contractor is agreeing to do the project for the dollar amount on page 1of this agreement. It is important that the dollar amount equals the contractor’s estimate. SAMPLE COPY ONLY 21 The 203(k) loan requires a specific Identity-of-Interest Certification form. Make sure the one you use includes the required language and has all the parties listed as in this form. There can be no Identityof-Interest on a 203k with any other parties involved in the transaction, including the contractor and borrower(s). This blank must be checked indicating that the Borrower’s will occupy the residence. The borrower(s) sign and date here. SAMPLE COPY ONLY 22 This form is completed by the HUD approved FHA Consultant for a standard 203(k). Consultant’s software packages may differ so the format may not be exactly the same from each one. On a standard 203(k) the consultant must sign and date here or he/she may provide a separate signed and dated certification. 23 SAMPLE COPY ONLY The 203(k) loan requires a specific Identity-ofInterest Certification form. Make sure the one you use includes the required language and has all the parties listed as in this form. There can be no Identity-of-Interest on a 203k with any other parties involved in the transaction, including the contractor and borrower(s). • Revised during reengineering efforts • Must be completed by the Consultant or local municipality • Borrower must sign 24 This form is completed by the HUD approved FHA Consultant for a standard 203(k). Consultant’s software packages may differ so the format may not be exactly the same from each one. However it must document the detail of repairs for all applicable construction line items. These line items must correlate to the line items on the Draw Request. Line item #1 is always for Masonry; line item #2 is always for Siding, etc. Each line item will have a subtotal. These subtotals are brought over to the last page for a “Recap of Subtotals”. SAMPLE COPY ONLY For purposes of this training, line items 4 through 35 are NOT included. 25 NOTE: Permit fees, consultant fee, architectural fees and engineering fees are NOT to be listed in any of the line items in the Specification of Repairs nor in line #35, miscellaneous. These items must be listed separately on the 203k MMWS. If they were put in the Spec of Repairs in error, they would be included in the max mortgage calculation twice. This bottom section is preferred but not always in all consultants’ software. At a minimum the borrower(s) and the contractor must sign this Re-Cap of Subtotals of the Specification of Repairs. 26 This is the final page of the Specification of Repairs. It lists each line item description and the sub-total for all of the 35 construction line items and totals them in line 36, TOTAL COST OF REPAIRS. This should mirror the Draw Request. Line item 35 is for miscellaneous repairs that do not “fit” in the other 35 line items. For example, if the property is a HUD REO and HUD is paying for Lead Based Paint repair, the amount would be listed separately on line 35. The TOTAL COST OF REPAIRS, line 36, is to be entered on line B1 of the 203k MMWS. The consultant will recommend a % for contingency reserves but the underwriting can override. The consultant must sign and date here and include his/her FHA Consultant ID#. This form is completed by the HUD approved FHA Consultant for a standard 203(k). He/she breaks down the total cost of the renovation project into 35 construction line items. The consultant completes column 1 prior to underwriting. After closing and work progresses, the consultant (after his/her inspection) determines how much money from each line item is to be paid and enters it in column 3. The consultant also completes the Suggested Contingency Reserve Amount as a percentage. SAMPLE COPY ONLY The Totals of repairs, Line 36, is what is entered on Line B1 of the 203(k) maximum mortgage worksheet. 27 SAMPLE COPY ONLY Page 2 does NOT need any signatures prior to closing. 28 SAMPLE COPY ONLY 29 The “As-Is” value is always the sales price on a purchase (except for a HUD REO) and the “As-Is” value is the “As-Is” value stated on the appraisal for refinances. Line 36 (Totals) on the Draw Request is entered here (B1)for a standard 203(k) and the total of all the contractor’s estimates are entered for a streamline 203(k). SAMPLE SAMPLE COPY COPY ONLY ONLY The borrower(s) sign the final worksheet at closing. The borrower(s) sign the final worksheet at closing. 30 This form must be complete when the loan is submitted to underwriting to determine the maximum insurable mortgage amount. Streamline 203(k) vs. Full 203(k) • Program Option Eligibility Matrix • Definition of Structural Repair 31 Program Option Eligibility Matrix PARAMETER FHA 203(k) - FULL FHA 203(k) – STREAMLINE Eligible Properties •1-4 Family including HUD REO’s • Mixed Use • 1 Family including HUD REO’s • 2-4 Family Repair Amounts • Minimum $5,000; no max up to FHA max mortgage amount. • No minimum; maximum rehabilitation amount is $35,000 including any fees not paid out-of-pocket. (Line B14 of the MMWS cannot exceed $35,000) Repair Types • Structural and non-structural. • Landscaping or site amenities. • No outbuildings. • Non-structural only. • No landscaping or site amenities. • No outbuildings. Plan Review / Specification of Repairs • Required by HUD Consultant. • The Consultant’s work write-up must be detailed and include estimates for labor and materials. • The Underwriter must be satisfied that the estimates provided by the borrower are in-line with the Consultant’s. The higher of the two should be used in calculating the maximum mortgage. • No plan review or Consultant required. Contingency Reserve •15% minimum required. • If Consultant quotes > 15%, the higher amount must be used. • M&T has discretion to impose a higher figure. • 10% minimum required. • 15% required if utilities not on or if property is vacant. • M&T has discretion to impose a higher figure. Draw Disbursements • Consultant inspects property and identifies the percentage of work complete to date. • Maximum 5 draws. • 10% holdback on each disbursement. • Checks cut in contractor and borrower’s names. • First draw limited to 50% of total repair costs, incl. labor. • Maximum 2 draws. • No holdbacks. • Checks cut in contractor and borrower’s names. • No more than 2 payments per specialized contractor. Inspections and Title Updates • Required prior to each disbursement. • Two bringdowns performed: one at 50% of renovation dollars advanced and one at final draw • Homeowner-Contractor Agreements • Required for each Contractor. • Required for each Contractor. Mortgage Payment Reserve • Up to 6 months of PITI can be financed, if the home is not habitable during renovation. • Borrower must move into property within 30 days of closing. Mortgage payments may not be escrowed. 32 • • For inspections, case-by-case depending on the number of contractors Certificates from municipalities are acceptable in lieu Only 1 bringdown at final draw is performed 33 34 Permits • Municipality Requirements • Refinance vs. Purchase and application for permits • Delays in Rehabilitation Project post-closing (19% of issues) 35 Building Permits Building Permits Proper building permits are required prior to any monies being advanced for a particular repair type. The requirements of the municipality in which the property is located must be adhered to. A lender’s permit certification must be signed by an official of the municipality for all 203(k) transaction types indentifying all recorded permits. 36 Active Loans Problem Categories Analysis 37 Contractor Acceptance • Maximum 3 Subcontractors or General Contractor Required • NO Self-Help • Relatives/employers not permitted (no Identity of Interest) • Correspondent Bulletin 2010-020 • Contractor Acceptance Checklist 38 Contractor Acceptance Contractor Acceptance Contractor acceptance is required for all transactions, both Standard and Streamlines. All rehab must be performed by a qualified and experienced contractor chosen by the borrower and completed in a workmanlike manner. • Borrowers may not use relatives/employers as their contractors; review Identity of Interest disclosure for details on other restrictions. • Borrower is limited to a total of 3 sub-contractors or a General Contractor will be required. • The borrower may NOT act as the General Contractor. “Self-Help” loans are NOT permitted • Contractor’s Resume, should be completed by all contractors. • The Underwriter must validate the Contractor(s) selected by the borrowers are acceptable to lender. 39 Plan Review/Specifications of Repairs/Estimates • Plan Review/Specifications of Repairs (not required for 203(k) Streamline transactions) • Draw Request form • Repair Estimates • Estimates from “box stores” (i.e. Lowes/Home Depot) 40 Repair Estimates Repair Estimates • Borrowers must provide written contractor estimates for all work being included in their repair escrow. − Estimates should include the cost for labor and materials. − Estimates must itemize all work being included. − All estimate amounts must match the Homeowner/Contractor Agreement(s), Form 2420. − Compare with appraisal to ensure all required repairs match and have estimates. 41 Repair Estimates – Materials or appliance estimates from “box stores” (i.e. Home Depot, Lowe’s, etc.) must be accompanied by labor estimates from the installing contractor who will install the materials. Whether the installing contractor is independent OR a sub-contractor for a store, they must still provide an executed Homeowner/Contractor agreement, and be “Accepted” by lender. Exception: free-standing appliances (or items that do not require installation or labor to install) may be presented as stand-along estimates (i.e. free-standing stove, washer, dryer). Paint must always be accompanied by a labor estimate. 42 Contingency Reserves 43 Appraisal Requirements • • • • • 44 Document Expirations/Extensions Declining Market Policy Second Appraisals Properties Listed for Sale Mixed-Use, Multi-Family Homes Appraisal Requirements Appraisal Extensions and Expiration • Appraisals are good for 120 days. If a borrower signs a valid contract or is approved for a loan prior to the expiration date of the appraisal, the term of the appraisal may be extended by an FHA DE Underwriter for 30 days to allow for the approval of the borrower and the closing of the loan. Appraisals expired beyond this one-time extension (That do not close within 150 days of the application date) are NOT eligible for an “Appraisal Update Report” (FNMA 1004D). M&T will require a full 1004 (or applicable form) to be completed. The appraiser must include a Market Conditions Addendum (100MC) with all appraisal reports. 45 Declining Markets Policy A property is determined to be in a Declining Market if the appraiser indicates that the property is located in a declining area in both the neighborhood section as well as in the housing trend section, and/or determine if there is an “over-supply” of properties, OR the property is identified by Desktop Underwriter (DU) or Loan Prospector (LP) through Total Scorecard as being located in an area of concern. 46 Declining Markets Policy • If deemed by the appraiser to be in a Declining Market OR if there is an “over-supply” – the appraisal must include: – Two(2) comparables (as similar as possible to subject) closed within 90 days prior to the effective date of the appraisal, and – Two (2) active listings or pending sales in comp position 4-6 or higher (in addition to the three settled sales comps in position 1-3). The listing/pending sales MUST included the original list price, any revised list prices, and total DOM (days on market); adjust active LISTINGS to reflect list-to-sale price ratios for the market; and adjust PENDING sales to reflect the contract purchase price or reflect list-to-sale price ratios for the market. – Absorption rate analysis on the 1004 MC. 47 Second Appraisals Second Appraisals • A second appraisal will be required when: − The loan amount (excluding the UFMIP) will exceed $417,000, and − The LTV (excluding the UFMIP) is equal to or greater than 95%, and − The property is determined as being in a declining market. • The second appraisal must be completed by an FHA approved appraiser, selected by the DE Lender underwriting the loan. The Lender is NOT to request a second case number through FHA Connection, but to independently engage the appraiser. 48 Second Appraisals Second Appraisals • If the second appraisal has an estimated value more than 5% lower than the original appraisal, the maximum mortgage must be calculated using the lower of the two appraised values. The second appraisal must be included in the FHA insurance binder. If the second appraisal is used to recalculate the maximum mortgage amount, the appropriate information from that appraisal must be entered into the appraisal logging screen in FHA Connection. 49 Properties Listed for Sale Properties Listed for Sale • Properties currently listed for sale are NOT eligible for FHA refinances, whether fully qualifying, rate/term or, streamline. • Properties previously listed and then canceled, are eligible for a Rate-Term/Streamline Refinance subject to the following: − M&T requires that the file contain conclusive evidence, from a third party source, that the listing was canceled at least one full day prior to the application date. − Any property currently listed for sale upon or after the date of application will be ineligible for an FHA refinance transaction with M&T. 50 Mixed-Use Property Q: Can we utilize FHA financing for a mixed-use property? A: Yes, under the full 203(k) program ONLY. The maximum living units would be 4. The commercial component on a one-story dwelling can’t be over 25%; on a 2-story it can’t be greater than 49%; and on a 3-story it can’t be over 33%. The renovations can only be done to the residential portion. 51 Maximum Loan-to-Value Property Type 1-4 Unit Primary uMax Purchase Rate/Term Refi Max LTV Max CLTV Max LTV Max CLTV 96.50% 96.50% 110.00%u 110.00%u LTV/CLTV for condominiums is 100% For PURCHASES, divide the base mortgage amount by the LESSER of: • The sum of the sales price plus the total rehabilitation cost; OR • The after-improved appraised value. For REFINANCES, divide the base mortgage amount by the LESSER of: • The unpaid principal balance plus the total rehabilitation cost (Line B14 from the HUD-92700); note that B-14 does not include prepaids/closing costs; OR • The as-is value of the property as determined by the appraiser plus the total rehabilitation (Line B14 from the HUD-92700); note that B-14 does not include prepaids/closing costs; OR • The after-improved appraised value. 52 Maximum Mortgage Calculation • Common Issues • Examples 53 54 Maximum Mortgage Calculation • Execution of the FHA 203(k) Maximum Mortgage Worksheet (form HUD-92700) is required. • For PURCHASES, the base mortgage amount is calculated by multiplying 96.50% times the LESSER of: – The sum of the Sales Price plus the Total Rehabilitation Cost; OR – 110% of After-Improved Value. • For REFINANCES, the base mortgage amount is calculated by the LESSER of: – Sum of existing liens, the total rehabilitation cost, borrower-paid closing costs, prepaids, the discount points of the prepaid costs minus any MIP refund; OR – Sum of the As-Is value plus total rehab cost or 110% of After-Improved value multiplied by the 97.75% LTV factor. 55 Example #1: Purchase Let’s Complete a Maximum Mortgage Worksheet for a Purchase John and Mary are first-time homebuyers. They found a property they like at 11 Washington Drive, Clifton Park, NY and have successfully negotiated a purchase price of $95,000. The Seller has owned the property for 5 years. The property is in need of some repair. Foundation repair is required, so the loan will be a full 203(k). 56 Example #1: Purchase-Continued • • • • • • • • • • 57 Contract Sales price is $95,000.00 (Line A-1) “As-Is” Value is $95,000 (Line A-2) After-Improved Value is $130,000.00 (Line A-3) Estimate of Repairs $25,000.00 (Line B-1) 15% Contingency Reserve will be required (Line B-2) 3 Inspections @ $100 each and 2 Title Updates @ $100 (Line B-3) The Consultant Fee will be $600.00 (Line B-7) Building Permit will cost $150.00 (Line B-8) Rate is 4.25% with 0 discount points (Line B-12) LTV Factor is 96.50%. Case number obtained on 8/1/11. Upfront premium 1.00%. Annual premium 1.15% Example #1: Purchase 58 Example #1: Purchase Max Mortgage Worksheet Page 1 Example #2: Streamline 203(k) Let’s Complete a Maximum Mortgage Worksheet for a Purchase Tom and Sue Jones have lived at 123 Main Street, New York, NY for 3 years. They would like to make some improvements to their home, all are cosmetic in nature. One contractor will be doing the work. Their current mortgage is an FHA. So there will be an MIP refund of $2,300.00 59 Example #2: Streamline 203(k)-Continued • • • • • • • • • • 60 Existing Debt is $295,000.00 (Line A-1) “As-Is” Value is $300,000.00 (Line A-2) The After-Improved Value is $315,000,00 (Line A-3) Borrower Paid Closing Costs will be $2,700.00 with prepaids of $2,600.00 (Line A-5) Initial Estimate of Repairs is $28,800.00 (Line B-1) A 10% Contingency Reserve is required (Line B-2) 1 Inspection @ $100.00 and 1 Title Update @ $100.00 (Line B-3) Building Permit Fee is $100 (Line B-8) Interest Rate is 4.875% with 0 points (Line B-12) LTV factor is 97.75%. Case Number Dated 8/1/11. Upfront MI is 1.00%, annual MI is 1.15% Example #2: Streamline 203(k) Max Mortgage Worksheet Page 1 61 Example #3: Purchase HUD REO Needing Lead Based Paint Abatement Jack and Jill Brown are purchasing a home located at 653 Ushers Road in Ballston Lake, NY. It is a HUD foreclosure. Their loan officer has obtained a copy of the Property Condition Report, the “As-Is” Appraisal and the Lead Based Paint Report from the realtor and has gone over the reports with Mr. and Mrs. Brown. Based on the required repairs and the repairs the Browns want to do to the property, this will have to be a full 203(k). 62 Example #3: Purchase HUD REO Needing Lead Based Paint Abatement-Continued • • • • • • • • • • • • Contract Sales price is $90,000.00 (Line A-1) “As-Is” Value is $89,000.00 (Line A-2) After-Improved Value is $150,000 (Line A-3) Closing Costs total $2,700.00 (Line A-5) Repairs will cost $40,000 (Line B-1) Lead Based Paint Abatement will cost $5,000 (Included in Line B-1) A 15% Contingency is required (Line B-2) 4 Inspections @100 ea. and 2 Title Updates @ $100 ea. (Line B-3) Consultant’s Fee will be $700.00 (Line B-7) The Building Permit Fee is $150.00 (Line B-8) Interest rate is 5.00% with 0 discount (Line B-12) HUD credit towards lead base paint abatement will be $4,000 (Reflected in Line C-4) 63 Example #3: Purchase HUD REO Needing Lead Base Abatement Max Mortgage Worksheet Page 1 64 Underwriting Considerations • Debt-to-Income Ratios/Compensating Factors • Identity of Interest/Conflict of Interest – Not Permitted – Employee of a Lender • Property Flipping • Lowest Sales Price in Last 12 Months • Nontraditional Credit/Insufficient Credit/Thin Credit Profile – Credit Score Required: Nontraditional Credit Not Permitted in Lieu of Score – Insufficient Credit/Thin Credit Profile: Credit Score Provided Group I and Group II Credit Reference Requirements 65 Underwriting Considerations • Refinance Considerations – Second Mortgage Payoffs and Seasoning Requirement – No Cash Back • Additional Consideration – Loan Amounts Exceeding $400,000 – Refer Findings Report – Streamline Refinance Transactions 66 Debt-to-Income Ratios Debt-to-Income Ratio Guidelines: The following applies for loans that have DTI ratios above the prescribed 43% maximum, even when FHA Total Scorecard approval has been obtained. DTI Range < = 43% > 43% and <=50% >=50% Compensating Factors Minimum FICO Total Scorecard Approved Compensating Factors 620-639 Required 2 required (from list below) 640 Required 2 required (from list below) Not permitted. 1. Reserves (liquid or non-liquid) of at least two (2) months PITI (Gift funds may not be considered) 2. LTV <= 90% 3. Residual income >= 1.5 months PITI * 4. Payment shock of less than 25% ** 5. Documented additional income not being used to quality * Residual Income = Gross income less sum of housing payment and all debts. ** Payment shock = Take the amount of the new payment, minus the amount of the old payment, and then divide that number by the old payment. Example: Currently paying $650. New payment is $1,015. Payment shock = 56.15%. 67 68 Identity of Interest Example #1 • Borrower works for ABC Remodeling as a secretary. She wants to use ABC Remodeling as her contractor on the 203K. • Not Allowed--due to the “Conflict of Interest”. There is a business relationship between the contractor and borrower. 69 Identity of Interest Example #2 CONTRACTOR RELATED • If the borrower is related to the contractor and the contractor is self-employed as the sole contractor/owner of the firm then this would be a conflict of interest. This is not allowed. • If a relative (i.e. borrower's Dad) works for the selected Contractor that is a large firm and Dad has no ownership in the firm and the quote for renovations comes from the firm and is not signed by the relative (i.e. Dad) then you do not have an identity of interest and can approve the loan. 70 Identity of Interest Example #3 LANDLORD/TENANT • Permitted only if the landlord/tenant relationship is the ONLY relationship. If the landlord/tenant has an additional layer (i.e. blood relationship or marriage or law), it is not eligible. • Borrower (tenant) is purchasing landlord’s house and has lived there for 3 years. The landlord is the grandfather. • Not allowed--the borrower has a family relationship with the landlord. 71 Anti-Flipping Policy Property flipping is a practice whereby a property is sold a short period of time after it is purchased by a seller for a considerable profit with an artificially inflated value and often abetted by a lender’s collusion with an appraiser. The list of EXEMPT entities (Sellers who do not have to comply with anti-flipping, regardless of length of ownership) Sales by HUD of its Real Estate Owned can be located in ML2006-14. 72 Anti-Flipping Policy—Exempt List • • • • Sales by other US government agencies Sales by non-profits approved to purchase HUD REO’s Sales of properties acquired thru inheritance Sales of properties purchased by employers or relocation agencies connected with relocations of employees • Sales of properties by state and federally chartered financial institutions and GSE’s (Fannie and Freddie) • Sales of properties by local and state government agencies • Sales of properties located in federal disaster areas designated by the President 73 Anti-Flipping Policy Anti-flipping requirements for the properties owned by sellers for 180-360 days can be located in ML2006-14. Properties owned by sellers for less than 180 days are not permitted by M&T, unless they are an EXEMPT entity (noted above). M&T may require a 2nd appraisal for properties sold >180 days if the resale value is 100% or the resale value is >5% than the lower sales price. 74 Lowest Sales Price in 12 Months Clarification on Chain of Title Requirement • Mortgagee Letters 95-40 and 00-25 state the Direct Endorsement lender must obtain evidence of prior ownership when a property was sold in the last year and that prior ownership must be reviewed for undisclosed identity of interest transactions. Lenders are reminded that this is a continuing requirement and applies to ALL transactions. The 203(k) mortgage must be based on the lowest sales price in the last year. 75 Lowest Sales Price in 12 Months Lowest Sales Price in the Last 12 Months • Guideline applies regardless of the entity conducting the transfer. (no exemptions as with the Property Flipping Rule) • Only exception is with an inheritance. Current sales price may be utilized. • If a foreclosing entity acquired a property at auction and the auction price was below their foreclosed outstanding balance, the outstanding balance may be utilized in the maximum mortgage calculation if properly documented by the foreclosing lender. Documentation reflecting the last transfer or sales price may include the foreclosure deed, affidavit of debt or sheriff’s sale notice to name a few. 76 Lowest Sales Price in the Last 12 Months Example #1: Sales contract with a purchase price of $80,000. Seven months ago the seller (private individual) acquired the property for $50,000 at a foreclosure auction. Maximum mortgage calculation will be based on $50,000. 77 Lowest Sales Price in the Last 12 Months Example #2: Sales contract with a purchase price of $50,000. Eight months ago, the seller (the foreclosing entity themselves) took the property via foreclosure for the remaining outstanding loan balance of $18,000. Maximum mortgage calculation will be based on $18,000. 78 Lowest Sales Price in the Last 12 Months Example #3: Sales contract with a purchase price of $90,000. Eleven months ago, the seller acquired the property via inheritance for $1.00. Maximum mortgage calculation will be based on $90,000. Recommendation is for 2 appraisal reports to support the $90,000 sales price. 79 Non-Traditional Non-Traditional Credit When a borrower has no credit score, no traditional credit (appearing on credit report), and/or is deemed “Out of Scope” by the AUS Engine, the loan is ineligible for FHA financing with M&T. Manually underwritten loans are ineligible for FHA financing with M&T, regardless of FICO score. 80 Insufficient Credit Insufficient Credit • Insufficient credit is defined when „the information in the standard credit report is not sufficient for the lender to make a prudent underwriting decision‟ (even if a Total Scorecard Approve/Accept/Eligible was obtained). Insufficient credit is also identified when there is a “thin-file” credit report, where a credit score was generated, but based only on a few tradelines. (Example: Your borrower has a 705 FICO score, but it is based on only two tradelines – a gas card with 6m history and a credit card with 9m history. This would be deemed a “thin-file” credit profile, and could, at underwriter discretion, require augmentation by alternate/non-traditional credit references). M&T will allow augmentation of insufficient credit on a loan where the borrower meets the minimum FICO score requirements AND receives an approval thru the AUS Total Scorecard, but the underwriter deems the credit history to be “shallow” or “thin.” 81 Insufficient Credit The following guidance is for the borrowers with an insufficient credit history: • Qualifying ratios are to be computed only on those occupying the property and obligated on the loan, and may not exceed 31% for the top ratio and 43% for the bottom ratio (regardless of AUS approval). • Borrowers should have two (2) months of cash reserves following mortgage loan settlement from their own funds (no cash gifts should be counted). • No more than one 30-day delinquency on payments due to any non-traditional credit reference (see below); • No public records/judgments/collection accounts/court records reporting (other than medical) in the last 12 months. 82 Insufficient Credit • Compensating factors are not applicable, and should NOT be used as approval leverage, for borrowers with insufficient credit • Non-traditional credit references may not be used to enhance or overcome any poor credit history on a traditional credit report. • Augmentation of the borrower’s existing thin/shallow credit must be developed with non-traditional/alternate credit references. The lender must develop a verifiable credit history (from the traditional credit report and non-traditional sources listed below) of at least three (3) references covering the most recent 12 months activity from date of application. 83 Insufficient Credit FHA defines non-traditional references in two GROUPS (see below). All GROUP I references should be exhausted, and understand why they are not available, before reviewing GROUP II references. • GROUP I Credit References include: – Rental Payment History » Direct Written Verification of Rental History (VOR) is acceptable if the landlord is a professional management firm (the professional management firm must be independently verified, i.e. Yellow Pages listings, etc.) OR » Satisfactory 12 month rental payment history, as certified by a Credit Reporting Agency, OR » Satisfactory 12 months consecutive canceled checks from borrower » A copy of the front and back of each check is required when canceled checks are provided as documentation. The print must be legible, the date of the bank endorsement for deposit must be clearly evident on the back of each check, and the check must clearly identify the servicer, landlord or management company. 84 Insufficient Credit – – – – – – Payment of Utilities (not included in the monthly rent) Electricity Gas / Fuel Oil, etc. Water Payment of Cable Television Service Payment of Home Land-Line Telephone Service • GROUP II Credit References include: – Payment of Cellular Phone Service / Internet Providers – Payments for Automobile Insurance, Life Insurance Policies (excluding payroll deducted), Renter’s Insurance – Payment for Child Care – Payment of a Private Loan – Must be documented by a written agreement – Must be accompanied by 12months canceled checks 85 Insufficient Credit – Payments to Local Stores » Department Stores » Furniture / Appliance Stores » Specialty Stores /Rental Stores, etc. – Payments of School Tuition – Documented 12 months history of saving by regular deposits (at least quarterly/non-payroll deducted/no NSFs), resulting in an observed, documented, increasing balance to the account. • What constitutes an “acceptable” Alternate Credit or NonTraditional Credit reference letter? – Prepared on Creditor’s letterhead – Dated (valid for 90 days, like other credit docs) – Signed by Creditor 86 Additional Underwriting Considerations • Refinance Considerations – Second Mortgage Payoffs and Seasoning Requirement – No Cash Back • Additional Consideration – Loan Amounts Exceeding $400,000 – Refer Findings Report – Streamline Refinance Transactions 87 Funding Issues 88 Top 10 Funding Issues 1. Permit Fees on Maximum Mortgage Worksheet should appear on B8– contractor including in B1 which is not correct 2. Contractor Acceptance Checklist missing or incomplete– Product Bulletin 2010-020 distributed 6/29/10 with an effective date of registrations dated on or after 7/28/10 3. 203k Fees not consistently reflected on HUD 1 settlement statement as per M&T’s RESPA interpretation – Product Bulletin 2010-009 distributed 4/9/10 with an effective date of registrations on or after 4/14/10 4. Contractor work write up not included in appraisal 5. Liability Insurance which is current, not expired, and covers the rehabilitation total 89 Top 10 Funding Issues Continued 6. 7. Work write ups do not equal B1 HUD REO – must have an as is appraisal from HUD and the after improved appraisal 8. Lead Based Paint disclosures not complete or missing a. If hazards are present must provide the 203k Financing LBP Agreement addendum 9. Rehabilitation Loan Agreement incomplete a. Dates and signatures missing b. Suggest 6 months from close date to complete project for consistency 10. In general - Agreements, write ups, estimates and proposals missing signatures, initials & dated where applicable a. Please do not use highlighters on any documents-all our files are scanned upon purchase which if highlighter is used makes document illegible 90 Top 10 HUD-1 Review Issues 91 1. All Rehab. Money from the Max. Mtge. Worksheet not reflected/collected on the HUD1 2. Sections B thru I at the top of page 1 missing information and/or not accurate 3. Lines mislabeled or not labeled at all for fees collected 4. Failure to collect 2 month cushion for each tax in the escrow reserves 5. Missing signatures and dates from all applicable parties Top 10 HUD-1 Review Issues-Continued 92 6. Comparison page does not match the last GFE issued in the file 7. Charges for 2nd appraisals and/or core logic on the HUD1 & the supporting documentation is not in the file 8. Provide proof that the taxes/hazard/flood have been paid (POC on HUD1 is not recognized as proof) 9. Grant and/or homebuyer assistance program funds listed as a credit on the HUD1 and the supporting documentation is not in the file 10. Lead Based Paint Stabilization Funds are not reflected on HUD1 M&T Draw Process • Department Overview/Expectation Setting • Process Flow • Problem Loan Categories 93 Active Loans Problem Categories Analysis 94 M&T Resources • MEME – 203(k) Reference Guide – Product Pages – FHA Underwriting and Eligibility Standards • M&T University 95 MEME 96 97 98 99 100