ARIZONA STATE UNIVERSITY

advertisement

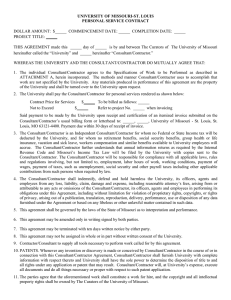

Independent Contractor Check Section 2.14 CONSULTANT/INDEPENDENT CONTRACTOR DETERMINATION CHECKLIST This form is used to determine that: the relationship between the consultant/independent contractor and that __________________ Company is not that of employee/employer, that the consultant/independent contractor is not related to an employee of __________________ Company involved with the work, and that the consultant/independent contractor is not a current ______________ Company employee. Forward the completed form to __________________________ (Human Resources). Section 1: To be completed by prospective consultant/independent contractor (i.e. service provider) Name of service provider: ___________________________________________________________________________ Contact person from service provider: ___________________________________________________________________________ Legal Personality of Service Provider: Sole Proprietor Close Corporation Company (Pty) Ltd Company Ltd Partnership Charitable Organsisation or NGO Mailing Address: ___________________________________________________________________________ (street) ___________________________________________________________________________ (city) ___________________________________________________________________________ (state / province) ___________________________________________________________________________ (country) ___________________________________________________________________________ (postal code / zip) _________________ ________________________________________________ (code) (telephone) _________________ ________________________________________________ (code) (facsimile) (email) _________________________________________________________________ © Workinfo.com Service No.1 of 1999 1 Independent Contractor Check Section 2.14 Taxpayer Identification Number:________________________________________________ Section 2: To be completed by service provider. Please answer all questions and sign in space provided. Do you determine what means or methods to use in achieving the desired results? _____yes _____no Do you set your own priorities on time, effort, and hours of work? _____yes _____no Do you receive little or no training, supervision, or instruction from the _______________ Company? _____yes _____no Do you provide similar services to other clients? _____yes _____no Do you engage in entrepreneurial activities in an established business at risk for loss? _____yes _____no Do you provide your own stationary, telephone, stenography service, business forms, equipment, tools? _____yes _____no Do you have your own insurance for work-related injuries? _____yes _____no Are you a nonresident alien? _____yes _____no Are you currently employed by ________________ Company? _____yes _____no Do you have a relative employed at ________________ Company? If yes, list relative’s name and dept. _____ no _____ yes _______________________________________________________ I UNDERSTAND THAT AMOUNTS RECEIVED UNDER AN INDEPENDENT CONTRACTOR/CONSULTANT AGREEMENT ARE SUBJECT TO ALL APPLICABLE INCOME TAXES, AND THAT NO TAXES WILL BE WITHHELD FROM ANY PAYMENTS DUE TO ME (EXCEPT FOR PAYMENTS TO NONRESIDENT ALIENS) SINCE I AM NOT AN EMPLOYEE OF ___________________________ COMPANY. UNDER PENALTY OF PERJURY, I CERTIFY THAT THE ABOVE INFORMATION IS TRUE AND CORRECT. _____________________________________________________ Signature of Proposed Service Provider/Date Section 3: To be completed by the Department requesting the service. Human Resources approval is required before a for services can be entered into between _______________ Company and the proposed service provider. © Workinfo.com Service No.1 of 1999 2 Independent Contractor Check Section 2.14 Specific service to be provided: ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ Department or College requesting the services: ___________________________________________________________________________ Departmental contact person: ______________________ Phone: _______________________ Mail Code: _______________________ Location where services will be provided: ___________________________________________________________________________ Start date: Stop date: Total fee: _______________________ _______________________ R______________________ (excl. VAT) Fee is based on : fixed fee hourly or daily rate cost per unit other(specify) _______________________ _______________________ _______________________ _______________________ Does ________________ department pay travel expenses, lodging and/or meals? __________no _____yes (specify) ______________________________________________ ___________________________________________________________________________ _______________________________________________ APPROVED/DISAPPROVED by Human Resources. Departmental Representative’s Signature/Date _____________________________________________ HR Department representative/Date © Workinfo.com Service No.1 of 1999 3