by threatening to build a pipeline. He appropriated quasi rents from

advertisement

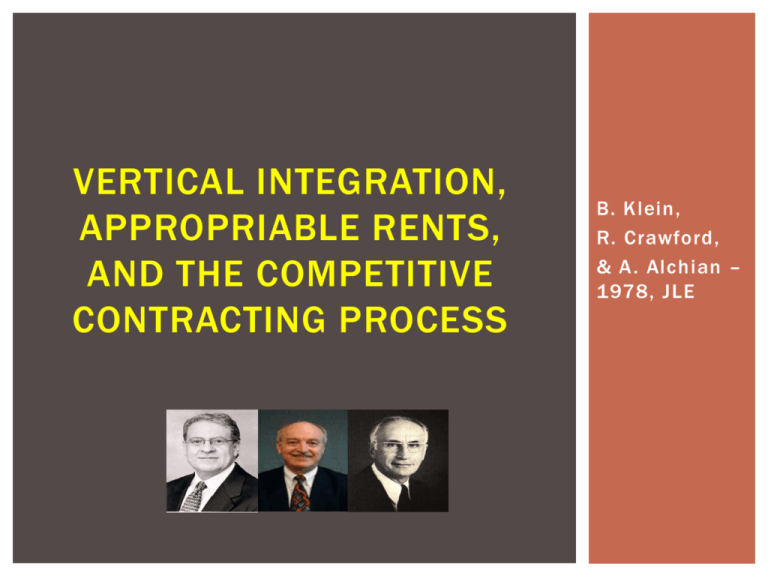

VERTICAL INTEGRATION, APPROPRIABLE RENTS, AND THE COMPETITIVE CONTRACTING PROCESS B. Klein, R. Crawford, & A. Alchian – 1978, JLE PAPER OVERVIEW A Key Question: Given the theories presented in Coase (1937), what possibilities for post -contractual opportunistic behavior exist and how can they be dealt with? What is “Opportunistic Behavior”? “Unanticipated non-fulfillment of a contract or agreement” When some party A reneges in some form on some agreement with some party B OPPORTUNISM AND RENTS Opportunism occurs in the form of appropriation of quasi-rents Specifically, after an investment is made, the presence of appropriable quasi-rents leads to the risk of opportunism What are “Quasi-rents”? “The value of an asset above the next best use” What are “Appropriable Quasi-rents” (AQR)? “The portion of quasi-rents in excess of an assets value to the next highest-valuing user” EXAMPLES OF QUASI-RENTS Party Party Party Party B C A A pays Party A $5,500 to use some equipment will pay Party A $3,500 to use the same equipment incurs $1 ,500 maintenance cost for the equipment could “salvage” the equipment for $1 ,000 Quasi-rents = Revenue – Maintenance – Salvage = $5,500 - $1 ,500 - $1 ,000 = $3,000 AQR = Rate of Party B – Rate of Party C = $5,500 - $3,500 = $2,000 DEALING WITH OPPORTUNISM Vertical Integration Examples – Paper company owns forest, paper mill, and retail stores Newspaper publisher typically own their printing press, but book publishers do not; WHY? Economically Enforceable Long-term Contracts Explicitly enforceable by an outside institution (i.e. government) Solutions can by prohibitively costly Implicitly enforced by market mechanisms (i.e., higher future rates) Effective under specific situations Self-enforcing agreements 1. AUTOMOBILE MANUFACTURING 1919 – GM and Fisher Body entered into 10 year contractual agreement for the supply of closed auto bodies (GM agreed to buy all bodies from Fisher) Price of bodies were set at “17.6% + production cost” and price charged could not exceed what Fisher charges other manufacturers nor greater than the average market price of similar bodies produced by others. 1924 – 65% of GM’s automobiles were of closed body type (all of which came from Fisher Body) GM very unhappy. Fisher also refuses to relocate its plant near the GM assembly plant (mobility cost too high). 1926 – Vertical merger between Fisher Body and GM. 6 2. PETROLEUM INDUSTRY A’s OIL WELL B’s OIL WELL Installed oil producing equipment of A and B + Refinery installation of D and E are specialized to C’s pipe line (very high asset specificity). The portion of their value above the value to the next best user becomes appropriable quasi rent. Pipeline owner C could potentially…. D’s REFINERY E’s REFINERY a. Purchase oil at marginal cost of extracting oil b. Sell the oil to the refineries to the price of alternative sources of supply to refineries (e.g., train) 7 2. PETROLEUM INDUSTRY B’s OIL WELL A’s OIL WELL Therefore.. A, B, D and E forms a jointly owned company which “owns” the pipeline. JOINTLY OWNED D’s REFINERY E’s REFINERY e.g., Rockefeller obtained price reduction from railroad companies (that ship oil) by threatening to build a pipeline. He appropriated quasi rents from the railroad companies. INTEGRATION OR CONTRACT? All other things equal, the lower the appropriable specialized quasi-rents, the more likely the transaction parties will rely on contractual relationships rather than common ownership If an asset offers a substantial portion of quasi -rent, which is strongly dependent upon some other particular asset, both assets will tend to be owned by one party. FINAL THOUGHTS What kind of assets have quasi -rents? Almost anything – physical assets, human capital, social constructs, etc. Kessler and Stern (1959) argue that long -term contracts are a form of vertical integration What continuum exists here? What major thresholds occur between integration and contracting? The issues surrounding ownership relationships and ef ficiency quickly become complex and dif ficult to predict